Original | Odaily (@OdailyChina)

Author | Ethan (@ethanzhang_web3)

The 2020 pandemic disrupted many established plans and led William Guo to see the limitations of the traditional financial system during a real estate project. The exploration of combining Web3 with real-world assets thus began to take root.

This same "disruptive gene" has now been integrated into the underlying architecture of PlayEstates. When users receive daily USDC revenue sharing from on-chain properties through PNFT, and when Southeast Asian students can subscribe to high-quality US assets for $10, the William team always exchanges knowing smiles in front of the electronic screen in their San Francisco office. These moments make the near-bankruptcy decision from four years ago seem even more precious.

It is precisely this "turning crisis into an interface" gene that attracted over 10,000 users during the undisclosed marketing phase of PlayEstates. Odaily discovered that the first batch of $350,000 in beta assets sold out in two and a half weeks, behind which lies the shock of many young users experiencing "being a landlord on-chain" for the first time - "It turns out that asset accumulation can be as visualized as a game mission".

In conversations with the founder William Guo, sharp statements like "compliance is a lifeline" and "liquidity is not a technical issue but a human nature issue" frequently emerge. How does this CEO, who is trying to implant a "Pinduoduo-like experience" into real estate, balance the Delaware Series LLC compliance framework with SocialFi gamification design? Can ToC-type RWA truly break through the walls of traditional finance?

Below is the exclusive interview record by Odaily, enjoy~

This structure was jointly designed by our team and the compliance advisory team from a global Top 5 law firm, aiming to provide a secure and efficient entry point for users with different identity statuses and regions.

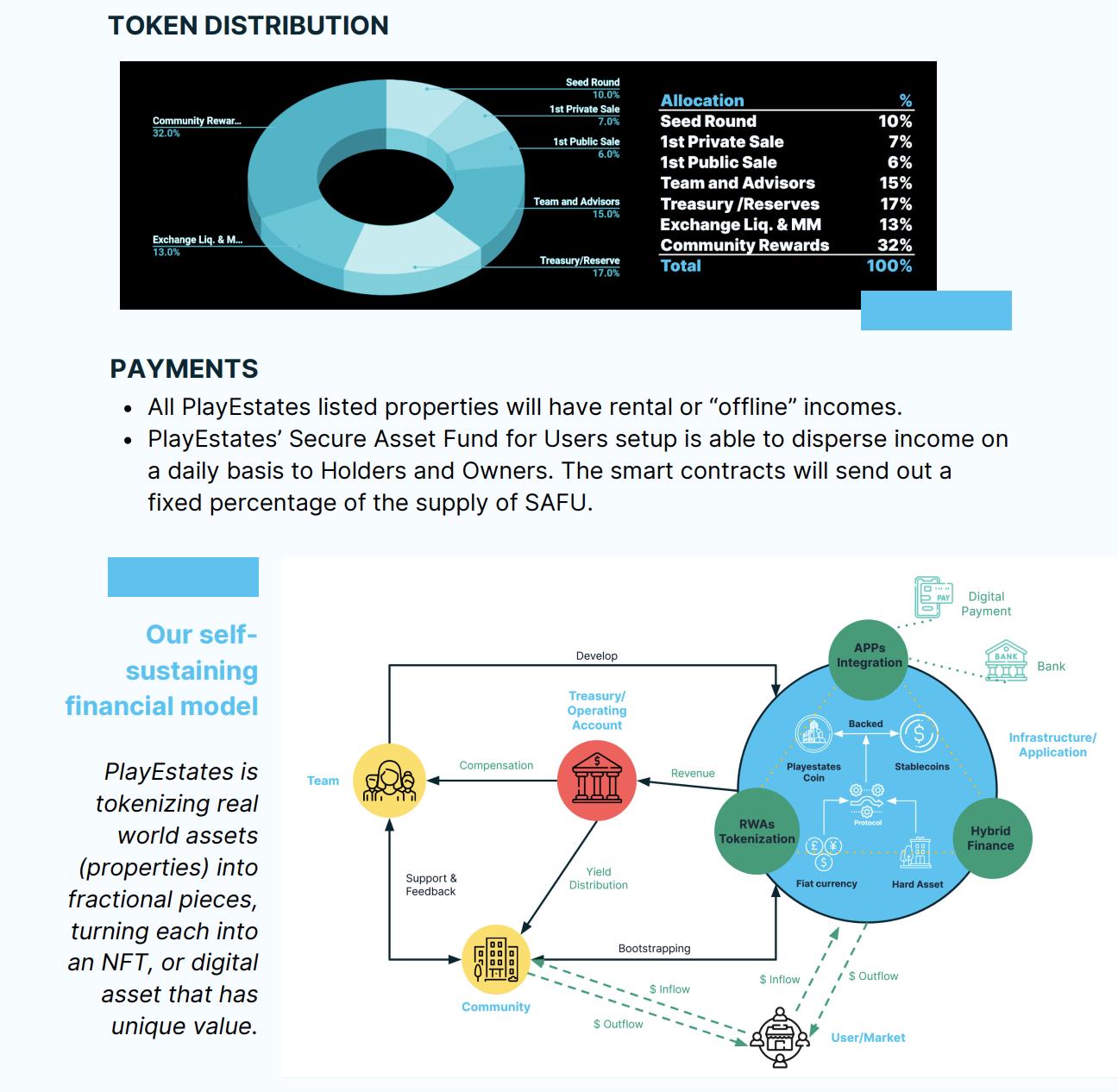

Odaily: What is the operating logic of the daily dividends and SAFU fund mechanism of PlayEstates? How is automatic income distribution coordinated?

William Guo: Our income distribution mechanism is essentially the on-chain monetization of assets. Returns from the asset side will be distributed daily to users holding relevant assets in the form of USDC. This mechanism has dual benefits: on one hand, it enhances platform transparency, with all income records verifiable on-chain; on the other hand, it facilitates future compliance reporting or tax processing.

We view users holding Non-Fungible Tokens as asset "digital shareholders" who receive daily dividends. The entire dividend process is automatically executed, with records publicly verifiable, and can serve as on-chain proof of our platform's performance capabilities. As AUM grows, we hope to strengthen user trust, especially in building confidence among traditional Web2 users.

Odaily: Compared to projects like Ondo and RealT, what are the key differences of PlayEstates? Especially in terms of ToC participation path and product experience?

William Guo: I believe the core challenge in the RWA track is not asset tokenization, but insufficient on-chain liquidity. Technical and compliance pathways have gradually matured, but many projects lack real user participation after tokenization, with tokens being "present in form but absent in spirit".

PlayEstates' strategy is to solve liquidity problems from the source. We are not simply tokenizing assets, but introducing SocialFi and GameFi mechanisms, allowing users to participate in assets through "playing", enhancing interaction experience and transaction frequency. Similar to how Pinduoduo attracts users through gamification, we also hope to provide a sense of achievement and stickiness in small investments, thereby building user trust.

Compared to traditional RWA projects' ToB investment logic, we choose to more resolutely follow the ToC route. Because we believe: where there are users, there is liquidity; with liquidity, asset providers will naturally connect. This model not only reduces intermediary links and improves exit efficiency but also better aligns with Web3's decentralization spirit.

William Guo: These two pain points are actually closely related. Compliance is fundamental. Without proper compliance, assets on the chain lack legal protection, let alone user trust. Liquidity determines users' willingness and experience to participate. Many projects have been put on the chain, but due to complex procedures, difficult exit, or high fees, the final asset value for users is discounted, naturally making it difficult to sustain.

In my view, the next-generation RWA projects with long-term potential must simultaneously solve three things: compliance, liquidity, and asset quality.

The first is localized compliance. Regulatory requirements vary greatly across different countries, and a one-size-fits-all approach won't work. PlayEstates adopts a zoned compliance strategy, such as using Reg D for US users and BVI architecture for overseas users, ensuring that users from different regions can participate within a controllable scope.

The second is liquidity experience. We focus not only on whether assets can be transferred but also on whether the entire path of payment, subscription, and exit is smooth. PlayEstates lowers barriers through GameFi and SocialFi models while optimizing on-chain interaction processes to improve participation efficiency.

The third is asset quality itself. Currently, some projects package poor-quality assets on the chain, which is essentially "shell financing" and harmful to both users and the industry. We always insist on only launching real, high-quality assets with clear return structures and granting users the right to freely enter and exit.

These three points are indispensable and truly constitute the moat of the new generation of RWA projects.