A physics genius builds the quietest giant in the crypto world.

Written by: Thejaswini MA

Compiled by: Luffy, Foresight News

Jeff Yan is fascinated by chameleons. Not in the metaphorical sense of "blending into the environment," but a genuine love for the animal itself. His Twitter handle is @chameleon_jeff, and in a recent podcast, he explained his obsession: chameleons can independently move their eyes in different directions, "two claws forward, three claws backward, which shows a very interesting evolutionary trajectory," and possess a powerful tongue projection ability. "They're somewhat like aliens on Earth," he says.

This strange opening helps you understand the man. With just a 10-person team and zero venture capital funding, he has built one of the world's largest trading platforms.

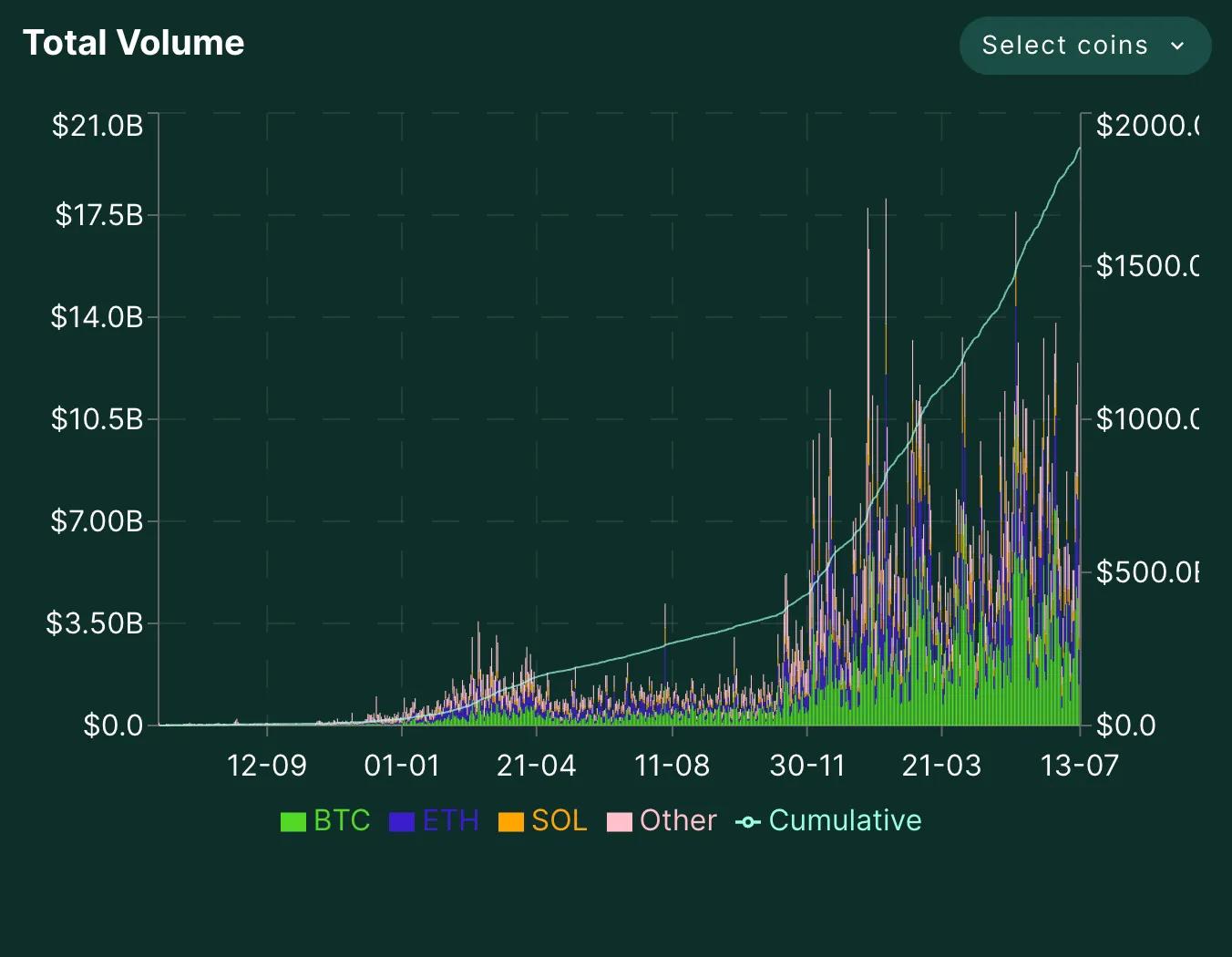

In the past 12 months, Hyperliquid's trading volume has reached $1.8 trillion. The platform occupies over 10% of global perpetual futures trading and over 70% of decentralized exchange (DEX) perpetual contract trading volume. More than 200,000 active users trade on the platform daily, generating hundreds of millions in revenue.

Jeff Yan initially did not intend to build one of the world's largest decentralized exchanges. However, in less than two years, he achieved just that. Jeff discovered and solved problems that others overlooked.

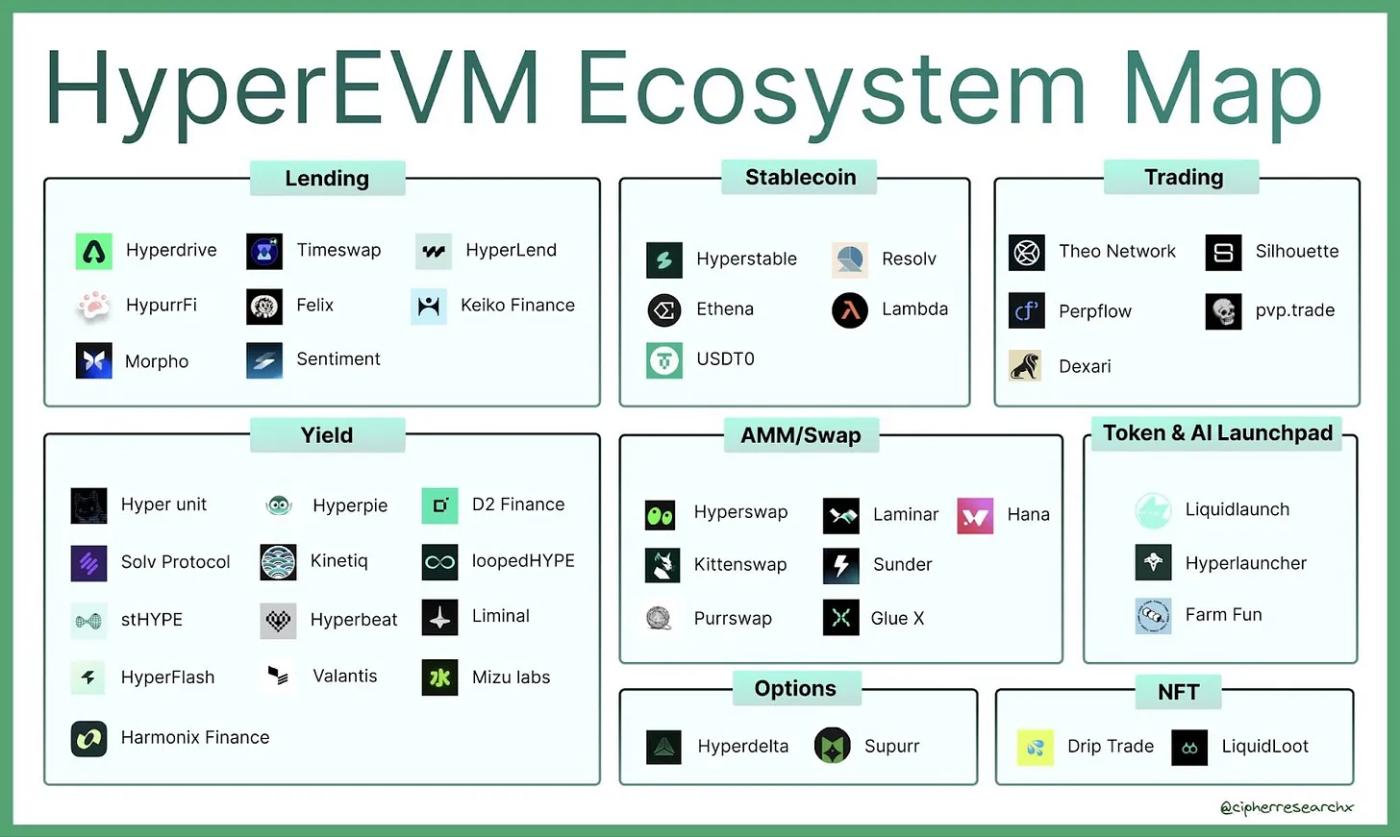

Rapid ecosystem development: The collateralized debt position protocol Felix currently manages over $400 million in assets, and the lending protocol HyperLend manages $380 million. Jeff says the ultimate vision is to centralize all financial services on one platform.

The problem Jeff discovered is common across all crypto exchanges: experienced high-frequency traders use bots to quickly buy or sell before market makers update quotes after publishing prices. As a result, market makers are forced to widen spreads to protect themselves, ultimately causing ordinary traders to pay higher fees.

Hyperliquid solved this issue by lowering the priority of rapid "market-taking" orders. Instead, the platform provides market makers a fair opportunity to update prices, meaning lower spreads and better prices will benefit all users.

The platform's order matching engine uses a price-time priority mechanism with additional smoothing execution rules. Under specific conditions, special orders like canceling orders or post-only orders can have higher priority than standard orders, allowing market makers to respond to new information and adjust quotes while avoiding being targeted by quick traders.

This subtle change encourages market makers to quote lower spreads, as they are less likely to suffer losses from delayed arbitrage. Ultimately, everyone on the platform can obtain more favorable prices and higher liquidity. All of this occurs on-chain, making the entire process transparent, enabling users to see fairer and more consistent results.

This technical depth might explain why professional traders (the most sensitive to execution quality) choose Hyperliquid despite having access to every centralized crypto exchange.

What Happens Next

However, Jeff faces an interesting challenge: how to scale a 10-person company handling trillions in trading volume?

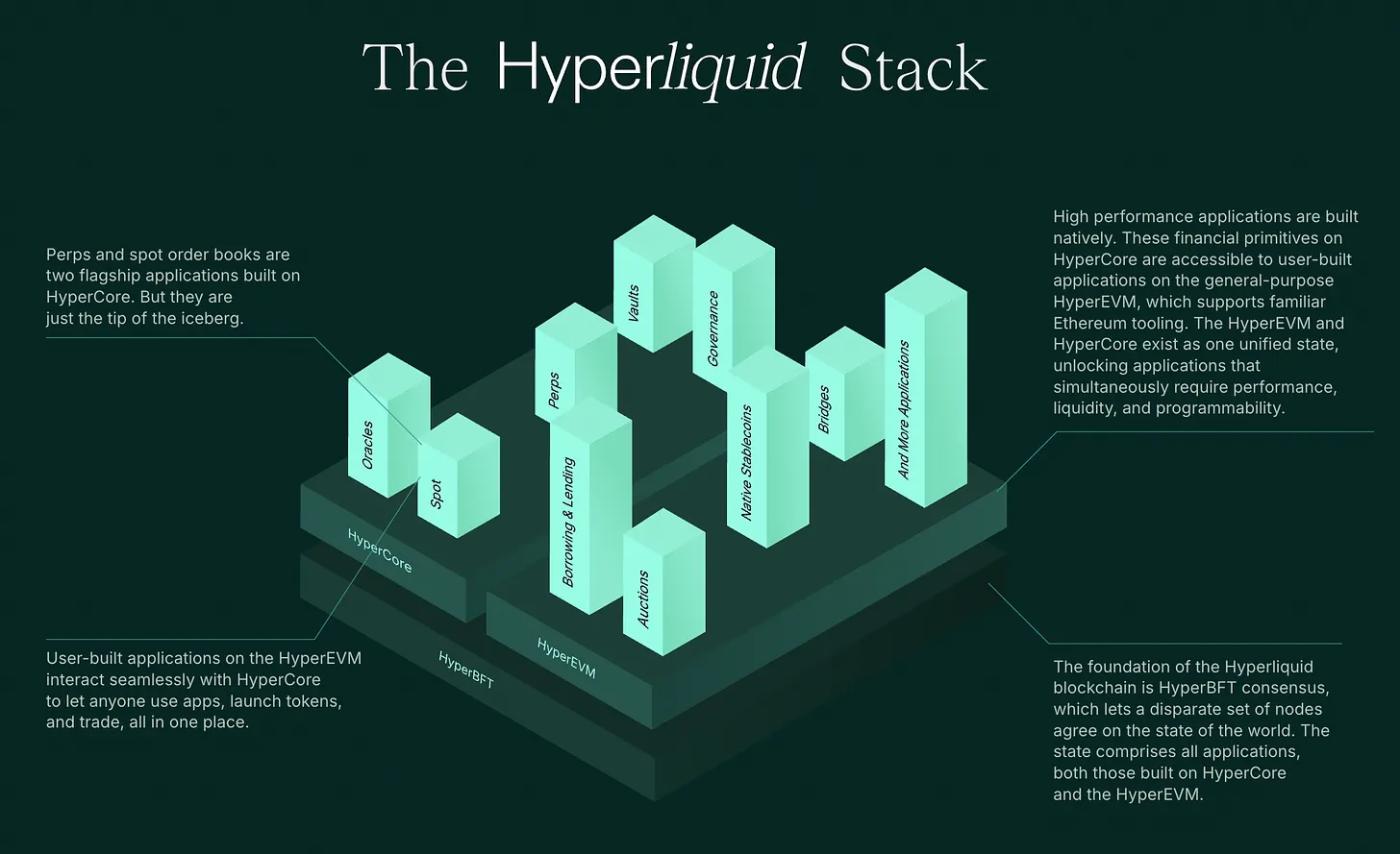

His counterintuitive solution: instead of hiring more people, build tools that allow others to construct applications on Hyperliquid.

"If something can be done by someone else, it should be done by someone else," Jeff says. "We can hardly do anything. I think this is actually a blessing in disguise."

The platform recently launched permissionless market creation, allowing anyone to create new trading markets by staking HYPE tokens. However, the threshold of 1 million HYPE tokens (worth tens of millions of dollars) means not everyone can access this service. For users meeting the threshold, developers can retain 100% of fees from markets they create, an offering unavailable in traditional exchanges.

Jeff is also discussing infrastructure development with sovereign wealth funds, though he's reluctant to specify countries. The goal is to demonstrate that decentralized systems can handle the scale and complexity of national financial systems.

In July 2025, Nasdaq-listed biotech company Sonnet BioTherapeutics announced entry into the crypto domain, establishing an entity worth $888 million focused on holding HYPE tokens. This transaction will make the newly renamed Hyperliquid Strategies Inc. the US-listed company holding the most HYPE.

In an industry filled with grand promises to revolutionize everything, Jeff has built something simple yet effective. Without loud claims of "banking the unbanked" or grandiose "Web3 will change the world" visions, just a platform traders genuinely enjoy using.

"We focus on building a product users love," Jeff explains, "everything else is secondary."

This approach seems effective. Hyperliquid currently processes over 10% of global crypto derivatives trading, operated by a 10-person team with no marketing budget. For Jeff, it's just another engineering problem to solve.