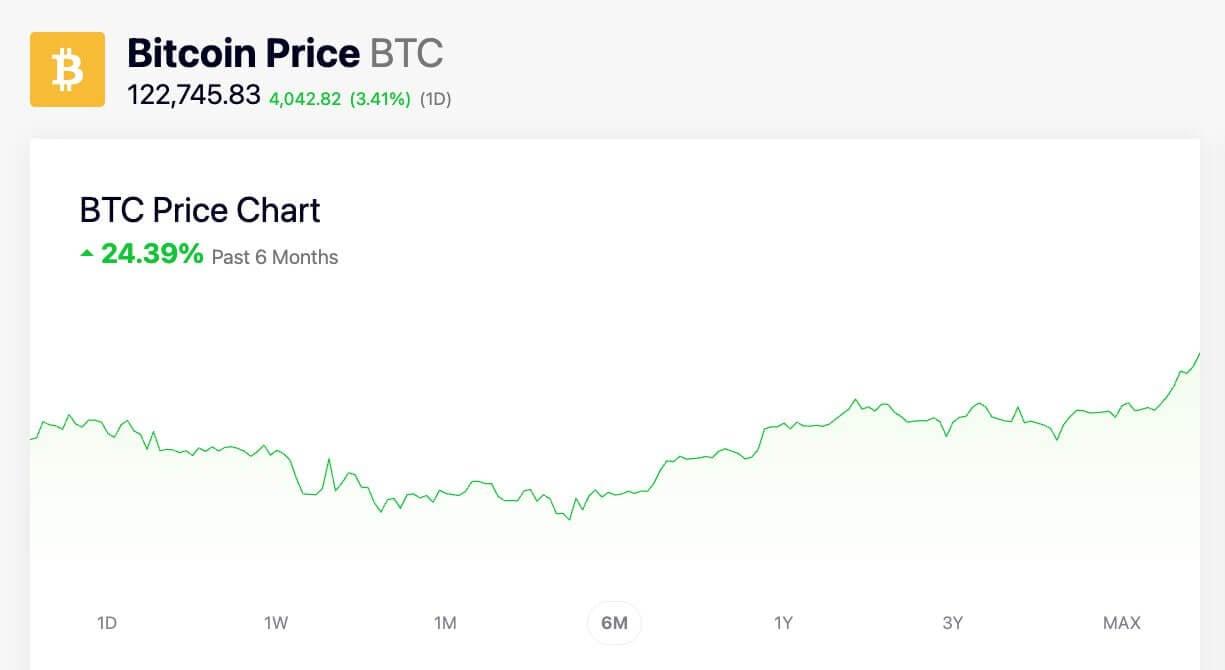

Bitcoin has just established a new historical milestone by surpassing the 123,000 USD threshold, bringing its total market capital to 2,400 billion USD for the first time. The strong surge of the leading digital currency has pulled the entire cryptocurrency market up simultaneously, creating a widespread FOMO wave.

In this excited market context, investors are actively seeking the most potential coins to take advantage of profit opportunities from the current growth cycle. Currently, there are 5 outstanding projects - including both veteran and newcomer names - ready to break through strongly thanks to Bitcoin's momentum.

The article will review the key factors driving Bitcoin to a new peak, while analyzing names with potential for extraordinary profits during this acceleration phase.

Why Did Bitcoin Just Reach a New Peak Exceeding 123,000 USD?

Bitcoin did not randomly increase to reach 123,000 USD. The momentum for this breakthrough has been quietly accumulating for weeks, driven by multiple key factors. Most notably, there is strong inflow of funds from major financial institutions, especially through spot Bitcoin ETF funds.

Prominent names like BlackRock and Fidelity are actively increasing Bitcoin's proportion in their portfolios, helping push BTC to record-high levels. Simultaneously, policy factors have also provided a significant boost to the market. The "Cryptocurrency Week" happening in Washington shows that US legislators have finally begun taking specific steps to build a legal framework for digital assets.

Market sentiment has thus clearly shifted - from cautious optimism to strong excitement. Companies like Strategy and Metaplanet continue adding Bitcoin to their reserves, reflecting growing confidence that BTC is gradually being seen as a "digital gold" - a safe value storage asset amid global economic uncertainties.

On a macro level, international trade and geopolitical tensions have also driven capital towards Bitcoin as a safe haven. As a result, this BTC price increase not only surpasses previous peaks but also creates a strong ripple effect across the entire market.

Ethereum has now exceeded 3,000 USD, many altcoins are recording double-digit increases, while short sellers suffered significant losses with total liquidation values reaching 614 million USD in just 24 hours. Facing this surge, analysts are expecting Bitcoin could reach 150,000 USD - or even higher - before 2025 ends.

The question now is: After Bitcoin, where will funds flow? History shows that whenever BTC hits a peak, capital typically quickly circulates to smaller altcoins - and signs of that cycle have begun reappearing.

Which Coin Should You Buy When BTC Exceeds 123,000 USD?

When Bitcoin reaches a new peak, investors immediately seek coins that might follow. Below are 5 notable names to consider at this moment:

1. Bitcoin Hyper (HYPER)

Bitcoin Hyper (HYPER) is attracting investor attention by addressing one of Bitcoin's biggest weaknesses: scalability. As a new Layer-2 solution specifically designed for Bitcoin, HYPER possesses impressive processing speeds comparable to Solana, while maintaining strong connectivity with BTC's legendary blockchain platform.

The project operates on Solana Virtual Machine (SVM), allowing extremely fast transactions with low costs. Users can wrap BTC, transfer to Bitcoin Hyper network and access DeFi, NFT, gaming applications - features that Bitcoin's Layer-1 currently does not support.

The system's core is zero-knowledge proof technology, ensuring absolute security without slowing the system. The HYPER Token is central to all activities: used for transactions, staking (up to 320% APY) and accessing advanced features.

With Bitcoin's record-breaking surge, HYPER's launch timing is considered extremely favorable. Those wanting to leverage BTC's price increase beyond simply holding might rush into HYPER, especially as institutional funds are increasing.

2. Ethereum (ETH)

Everyone knows Ethereum (ETH) is the king of smart contracts and DeFi. However, what particularly attracts investors now is ETH's clear position to benefit from Bitcoin's strong surge.

History shows that whenever BTC peaks, ETH typically increases immediately after. ETH has just surpassed the 3,000 USD mark for the first time since February, and experts are expecting even higher milestones. Recent upgrades like Pectra have also helped reduce transaction fees, paving the way for more users.

Additionally, institutional capital is currently flowing strongly into Bitcoin - and following the typical cycle, Ethereum will likely be the next destination for these funds. With billions of USD locked in Ethereum's DeFi ecosystem, a push from BTC could quickly become a catalyst, propelling ETH into a new acceleration phase.

3. Snorter (SNORT)

Snorter (SNORT) At first glance, it looks like a meme coin, but in reality, it carries more substantial value. The core product is Snorter Bot – a trading tool on Telegram for small investors. This bot helps quickly search for and buy meme coins, place orders, and detect fraudulent projects without extensive market experience.

Since its launch in May, the project has raised 1.9 million USD through presale with the SNORT token price at only 0.0983 USD. Investors are rushing to buy early, believing this price won't last long.

Holding SNORT will unlock benefits: reduced transaction fees, unlimited purchase limits, and staking with an impressive 220% APY. The 99Bitcoins team believes this practical application will create strong demand immediately after SNORT is listed on DEX.

As Bitcoin drives a wave of meme coins, Snorter with its trading bot is timely and could be a promising choice.

4. Usual (USUAL)

Usual (USUAL) is not flashy but focuses on stability and is backed by real assets. The project issues USD0 – a decentralized stablecoin fully guaranteed by US government bonds and assets in tokenized form.

Users mint USD0 by depositing approved collateral and holding USUAL tokens helps participate in voting within the protocol and receive revenue sharing. This design empowers the community instead of relying on banks or centralized organizations.

When BTC rises strongly, investors typically turn to stablecoins to take profits. With its "community-owned" orientation, USUAL becomes an attractive alternative to centralized stablecoins and could potentially cause USUAL token demand to surge.

5. Best Wallet Token (BEST)

Best Wallet Token (BEST) leverages an obvious fact: as crypto becomes more popular, users will need safer and easier-to-use digital wallets. BEST is the platform token for Best Wallet – a decentralized wallet supporting over 60 blockchains, from Bitcoin, Ethereum to Solana, notably without KYC requirements.

Best Wallet's highlight is its built-in launchpad, allowing users to buy presale tokens before listing. Additionally, the application has DeFi exchange, staking aggregation, hundreds of liquidation pools, and an upcoming crypto debit card.

BEST holders will receive fee reductions, increased staking rewards, voting rights, and access to advanced features like AI trading. YouTuber Borch Crypto believes these benefits could help BEST increase in value up to 100 times when listed.

With Bitcoin breaking records and institutional funds flowing into the market, demand for multi-functional digital wallets like Best Wallet will certainly increase strongly. BEST deserves to be on the consideration list right now.

Note: This is an advertising article from a partner in the Press Release section of Bitcoin News, not investment advice. You should thoroughly research before taking action, and we are not responsible for your investment decisions.