$BONK has the reflexivity of a memecoin, the P/E ratio of a high-growth tech stock, and pays higher dividends than the average company in the S&P 500.

Bonk is the trade.

Unipcs (aka 'Bonk Guy')

@theunipcs

07-16

everyone keeps talking about wanting to re-run the $HYPE trade on $PUMP

when in reality $BONK is the HYPE trade re-run

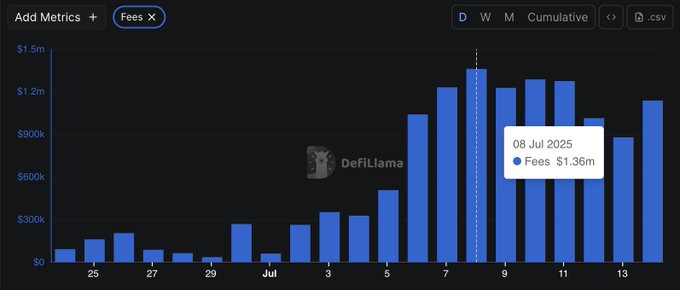

- BonkFun now generates over $1 million in fees every day on average

- 50% of BonkFun fees go towards buying and burning BONK vs the speculated 25% of Pumpfun

A few P/E ratios for comparison:

- $BONK: P/E ratio = 31 *

- $APPL: P/E ratio = 32

- $AMZN: P/E ratio = 37

- $MSFT: P/E ratio = 39

- $NVDA: P/E ratio = 54

- $HYPE: P/E ratio = 61

*based on the annualised 30-day revenue (which is the better metric to look at if you don't plan to hold for a full year)

Regarding dividends:

Token buyback programs are essentially the same as paying dividends.

This is because your share of the total tokens grows proportional to the buybacks.

For example, if you own 10 coins with a total supply of 100 and get paid 10% dividends, you own 11% of the supply.

However, if instead 10% are bought back and burned, you now own 11.1% which is esentially the same.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content