On July 22, CertiK released the "Skynet Stablecoin Panoramic Report for the First Half of 2025", which sparked widespread attention. Mainstream media such as the International Financial News of People's Daily, Xinhua Finance, and Shanghai Securities News promptly conducted in-depth reporting, focusing on the core trends and risk insights revealed in the report.

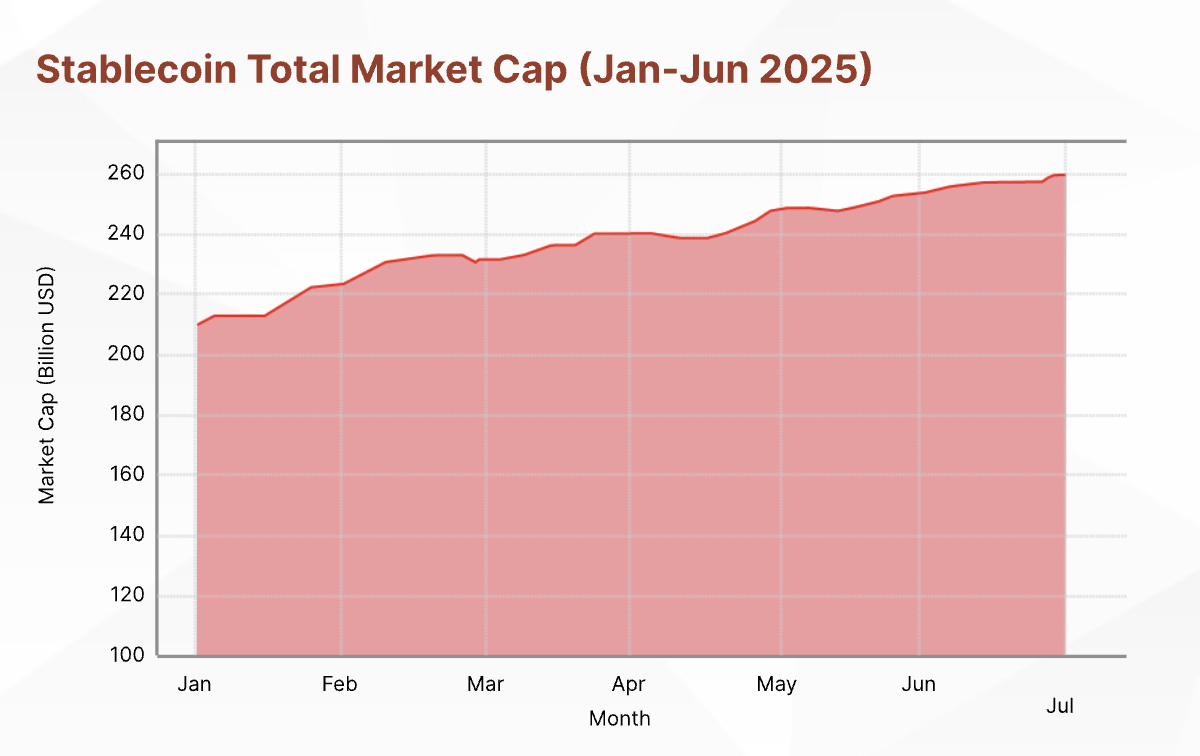

The report points out that stablecoins are accelerating their integration into the mainstream financial system, with a total market supply exceeding $250 billion and a monthly settlement amount reaching $1.4 trillion, showing a strong growth trend. Meanwhile, frequent security incidents and rising compliance risks have become the main challenges facing the industry. The report emphasizes that rigorous risk management, transparent operational mechanisms, and proactive compliance strategies will be key to achieving long-term sustainable development for stablecoin projects.

The concentrated media coverage reflects the market's high level of attention to stablecoin security and regulatory issues, and highlights the critical role of security institutions in promoting industry transparency and compliance. CertiK will continue to establish a more comprehensive risk identification system for the stablecoin industry through technological research and security practices, promoting orderly development along a secure and controllable path.

Here is the full report:

Stablecoins Accelerate Integration into Mainstream Financial System, Total Supply Exceeds $250 Billion in First Half

Recently, CertiK, the world's largest Web3.0 security company, released the "Skynet Stablecoin Panoramic Report for 2025", systematically reviewing and analyzing the market performance, risk landscape, regulatory progress, and development trends of the stablecoin industry.

The report shows that the stablecoin market continued to expand in the first half of 2025, with a total supply reaching $252 billion and monthly settlement volume growing by 43%. User activity significantly improved, with the total number of holding addresses exceeding 120 million (as of the third quarter of 2024). USDT remains the most widely held stablecoin, with over 5.8 million addresses, approximately 2.6 times that of USDC.

Based on the CertiK Skynet Stablecoin Scoring Framework, the report systematically evaluated multiple mainstream stablecoins across six dimensions, including "operational resilience", "governance capabilities", and "code security". USDT, USDC, PYUSD, and RLUSD stood out in terms of security, market dynamics, and compliance adaptation, ranking at the top of the scoring list. Among them, USDC, with its MiCA license and successful listing, saw its market value rise to $61 billion, becoming the fastest-growing mainstream stablecoin. PayPal's PYUSD, by integrating the Solana network and launching a token holding reward program, doubled its market value in a short period. RLUSD, with its safety and reliability in institutional-level application scenarios, has maintained zero security incidents since its launch, successfully establishing its market positioning.

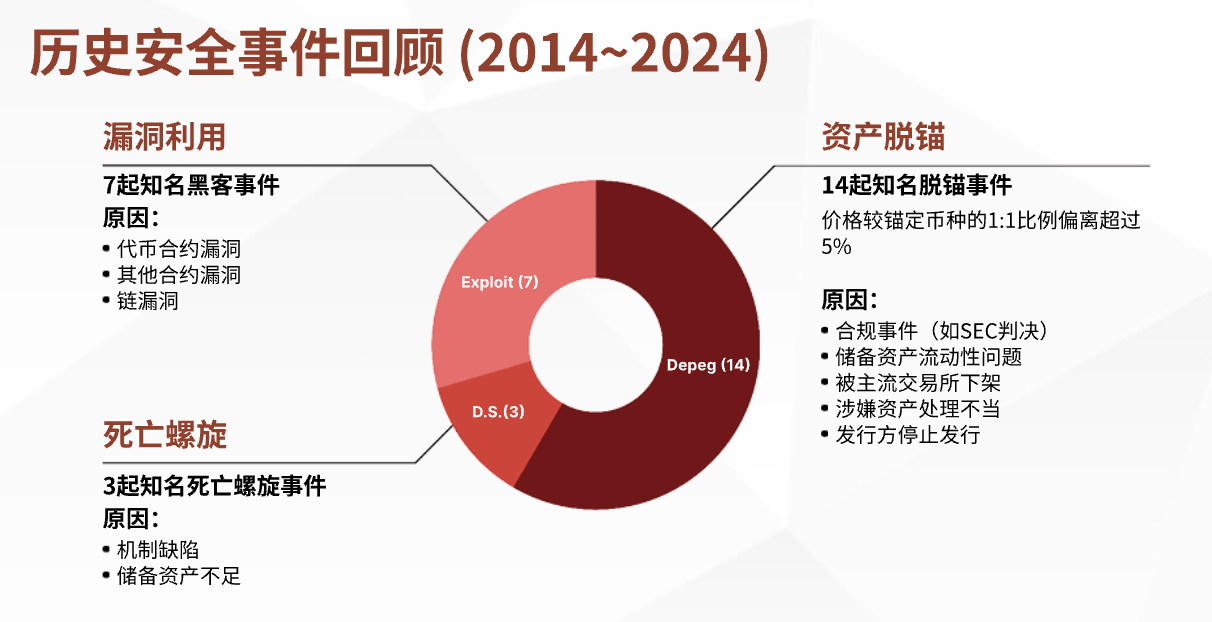

While the market expands rapidly, the report reveals that stablecoins are facing increasingly severe security and compliance challenges. In the first half of 2025, the risk landscape of the stablecoin industry is undergoing significant transformation. The overall crypto market experienced 344 security incidents, with cumulative losses reaching $2.47 billion, a historical high. Operational errors, exemplified by Bybit's private key leakage, became the primary source of losses, with a single incident causing losses of $1.5 billion. Compared to traditional smart contract vulnerabilities, attackers are gradually shifting their focus to the operational infrastructure of centralized platforms.

The report warns that stablecoins are becoming a primary tool for money laundering by some hackers, with networks like TRON being the preferred choice due to their low transaction fees and high liquidity. Although such transactions have decreased in proportion to total transaction volume, the absolute amount still reaches tens of billions of dollars, posing significant compliance risks. The closure of Garantex exchange in March 2025 is a landmark event signaling stricter compliance reviews.

Regulatory implementation is also reshaping the market landscape, with stablecoins accelerating their integration into the mainstream financial system. As the STABLE Act and GENIUS Act make progress in the US Congress and the EU's MiCA regulations are fully implemented, regulation becomes a key force in reshaping the stablecoin landscape. Compliance pressure is driving market differentiation: institutional-level projects with licenses and transparent reserves are gaining higher market trust, while issuers who have not completed compliance are being marginalized by mainstream trading platforms.

Additionally, traditional financial institutions and large enterprises have been actively piloting stablecoin businesses in the first half of the year. Societe Generale launched USDCV, a dollar stablecoin based on Ethereum and Solana, becoming the first major bank to introduce a compliant dollar stablecoin. Institutions like Bank of America and Santander Bank are also promoting related project development, with some already in the regulatory approval stage.

Looking ahead to the second half of the year, the report predicts that RWA (Real World Asset) backed and yield-generating stablecoins will become the innovation mainline, potentially occupying 8% to 10% of the market expected to exceed $300 billion by year-end. RWA-backed stablecoins, by anchoring off-chain assets like government bonds, highly align with the current regulatory trend of stablecoin compliance in major global economies. Yield-generating stablecoins, with their "on-chain money market fund" attributes, are attracting investor groups seeking stable returns, particularly catching the attention of institutional and high-net-worth investors.

However, such models introduce more complex counterparty and strategic risks while bringing new application value. On this, the report emphasizes that rigorous risk management, transparent operational mechanisms, and proactive compliance attitudes will be key to achieving long-term sustainable development for stablecoin projects.