This article is machine translated

Show original

It has been a long time since we discussed interest rate hikes and cuts, and you can find numerous articles exploring this topic on Douyin or Zhihu. So, what is the core impact of interest rate changes on the market? Or in other words, under what circumstances do they have a positively correlated influence on financial markets? And when do they have little impact? In fact, it mainly depends on the stage of the market trend. For example, the previous previous round saw a so-called "rate hike" bull market, while the last round was a so-called "rate cut" bull market.

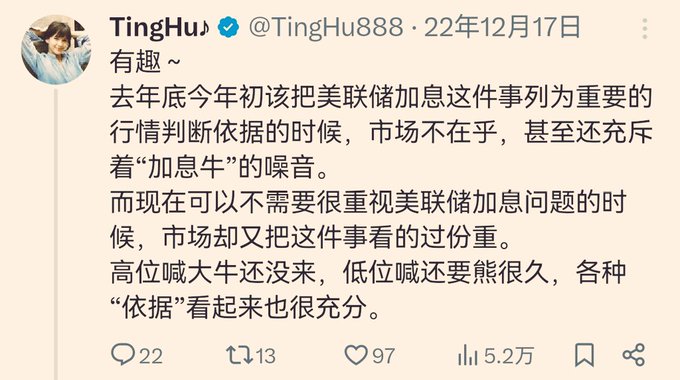

TingHu♪

@TingHu888

12-17

有趣~

去年底今年初该把美联储加息这件事列为重要的行情判断依据的时候,市场不在乎,甚至还充斥着“加息牛”的噪音。

而现在可以不需要很重视美联储加息问题的时候,市场却又把这件事看的过份重。

高位喊大牛还没来,低位喊还要熊很久,各种“依据”看起来也很充分。

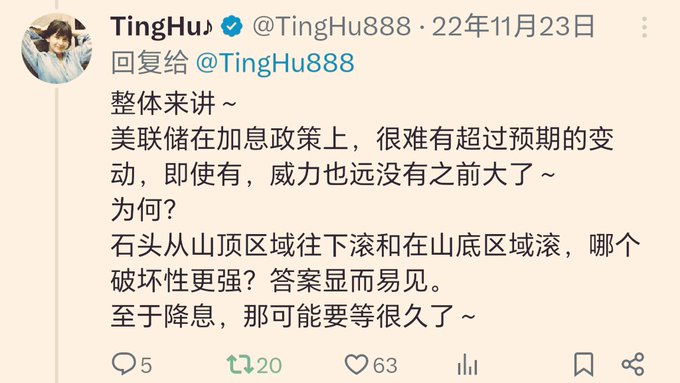

② Isn't the popular science article saying that the dollar interest rate hike cycle is "draining water" and the interest rate cut cycle is "releasing water"? So one should invest according to the dollar cycle. How can there be bull markets during rate hikes and bull markets during rate cuts? Since there can be bull markets during rate hikes, based on historical experience, 2022 could also see a "rate hike" bull market (of course, market factors for the 2022 bull market are not limited to this). As a result, when it hit rock bottom and could ignore the rate hike issue, it started to focus on it again, and was scared by the market.

③ Therefore, how can one judge the impact of interest rate hikes and cuts? Essentially, it depends on the market's state. For example, as previously mentioned, the overall market in 2021 rose too much, and at this point, a rate hike would definitely cause an outflow, thereby leading to deteriorating liquidity, so the overall market was bound to decline in 2022. However, at the bottom of the market, the destructive power of stones rolling is generally less significant. During the process of moving up from the bottom, rate hikes become less important, and rate cuts during this process can be used for speculation.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content