Written by: TechFlow

In countless lamentations about the lack of innovation in this cycle, there lies a deep nostalgia for the DeFi Summer that began in 2020.

And this nostalgia has drawn many people's attention to Sonic ecosystem's leading DEX, Shadow Exchange.

In this cycle, with comprehensive performance upgrades and the deep involvement of DeFi's father Andre Cronje, the Sonic blockchain has reignited market expectations and passion for DeFi with the name of "purer DeFi genes". As the DEX with the highest trading volume and revenue in the Sonic ecosystem, Shadow Exchange is undoubtedly a key driving force.

According to the latest report released by Messari, since going online in December 2024, Shadow has averaged 46% of Sonic's total trading volume, peaking at 69%. In terms of revenue, Shadow has distributed $2.04 million to xSHADOW stakers and voters in the past 30 days, not only ranking first in the Sonic ecosystem but also entering the top ten global DeFi revenue rankings.

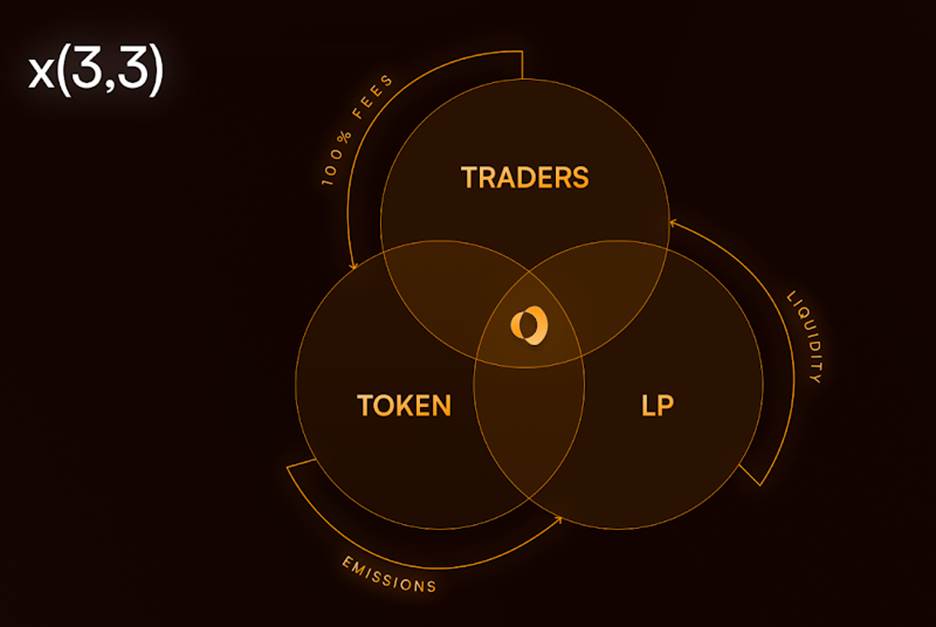

As a core project innovation, x(3,3) evolved from the famous ve(3,3), with mining, staking, and voting seeming like conventional gameplay. How did Shadow "breathe new life into an old tree" by bringing substantive innovation in balancing the interests of traders, liquidity providers, and token holders, thereby attracting a large number of users?

In the recently published roadmap, Shadow has already implemented a lending market based on x33, and upcoming developments like the Memecoin ecosystem and technical infrastructure upgrades - will they trigger a new round of explosive growth?

This article aims to explore this in depth.

[Rest of the translation follows the same professional and accurate approach, maintaining the technical terminology and context.]x33: The liquidity version of xShadow, where users can mint $x33 through xShadow, thereby retaining governance rights and earnings while obtaining token liquidity.

The three tokens are interconnected, forming a solid ecological incentive flywheel of "creating more value → more fully capturing value → more fair value distribution".

ve(3,3) lacks flexibility? x(3,3) supports immediate withdrawal, achieving comprehensive improvement of user participation flexibility.

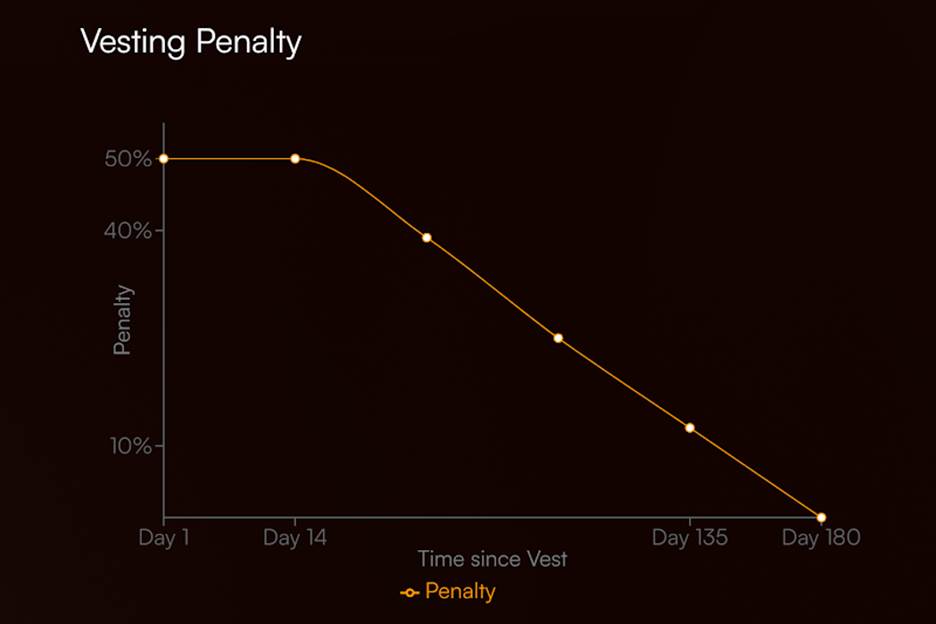

Although users are allowed to withdraw from $xShadow lockup at any time, different withdrawal periods require corresponding penalties: immediate withdrawal forfeits 50%; 90-day phased withdrawal converts at a 1:0.73 ratio; 180-day withdrawal allows 1:1 lossless conversion. This design retains long-term incentives while providing flexible withdrawal options, allowing users to adjust trading strategies according to market fluctuations.

How are early withdrawal penalties handled? x(3,3) introduces a PVP Rebase mechanism, with the protocol capturing value and 100% flowing back to holders.

Early withdrawal penalties are proportionally distributed to other $xShadow stakers, forming an anti-dilution mechanism that protects long-term holders from inflation and provides additional earnings. This mechanism encourages active user participation rather than passive holding.

From a governance perspective, Shadow has designed voting governance and bribery mechanisms to further empower $xShadow holders while ensuring ecosystem rewards flow to truly high-quality liquidity pools.

xShadow stakers vote weekly through Epochs to determine token rewards for different Shadow liquidity pools, and project parties can attract voter support by offering additional rewards, thereby bringing extra income to xShadow holders.

Additionally, to address the non-transferability issue of veTokens in the ve(3,3) model, Shadow innovatively introduced $x33, a liquidity staking version of $xShadow, to further release liquidity.

$x33 can be freely traded on Shadow Exchange or Sonic DEX. When $x33 gains market recognition as an LST token, it can become a utilizable asset, such as collateral in lending markets or being used by other projects to create alternative wealth-generating tools. Silo, Aave, Euler, and Pendle are typical examples of $x33 LST applications.

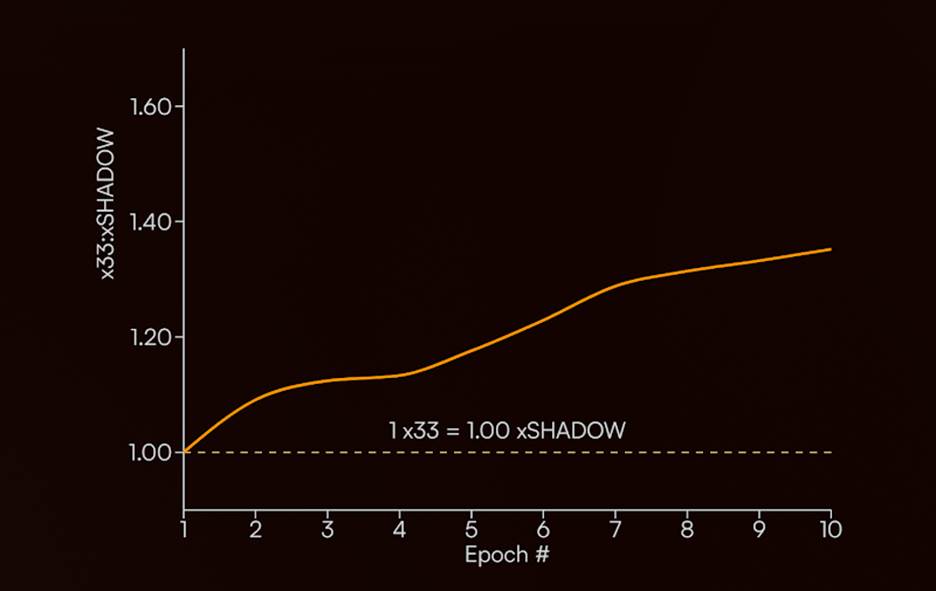

Simultaneously, $x33 has an auto-compounding function, with weekly (per epoch) $xShadow rewards automatically growing through $x33. Although users mint $x33 from $xShadow at a 1:1 ratio, the exchange rate of $x33 to xShadow only increases over time, making it easier for $x33/$Shadow liquidity providers (LP) to set position ranges and attracting numerous arbitrage bots, forming a self-reinforcing liquidity network.

Thus, while safeguarding traders' and LPs' interests, $xShadow holders also enjoy multiple value guarantees:

100% fee distribution: Shadow receives the highest fees (FeeM) from Sonic, fully returned to $xShadow and $x33 holders.

PvP Rebase earnings: Penalties from users exiting $xShadow early flow back to token holders to encourage long-term holding.

Bribery earnings: To gain more voting support, project parties will provide richer rewards to empower $xShadow holders.

x33: With xShadow as the base asset of $x33, its value continuously accumulates through fees and rewards, ensuring $x33's market price never falls below $xShadow's redemption value.

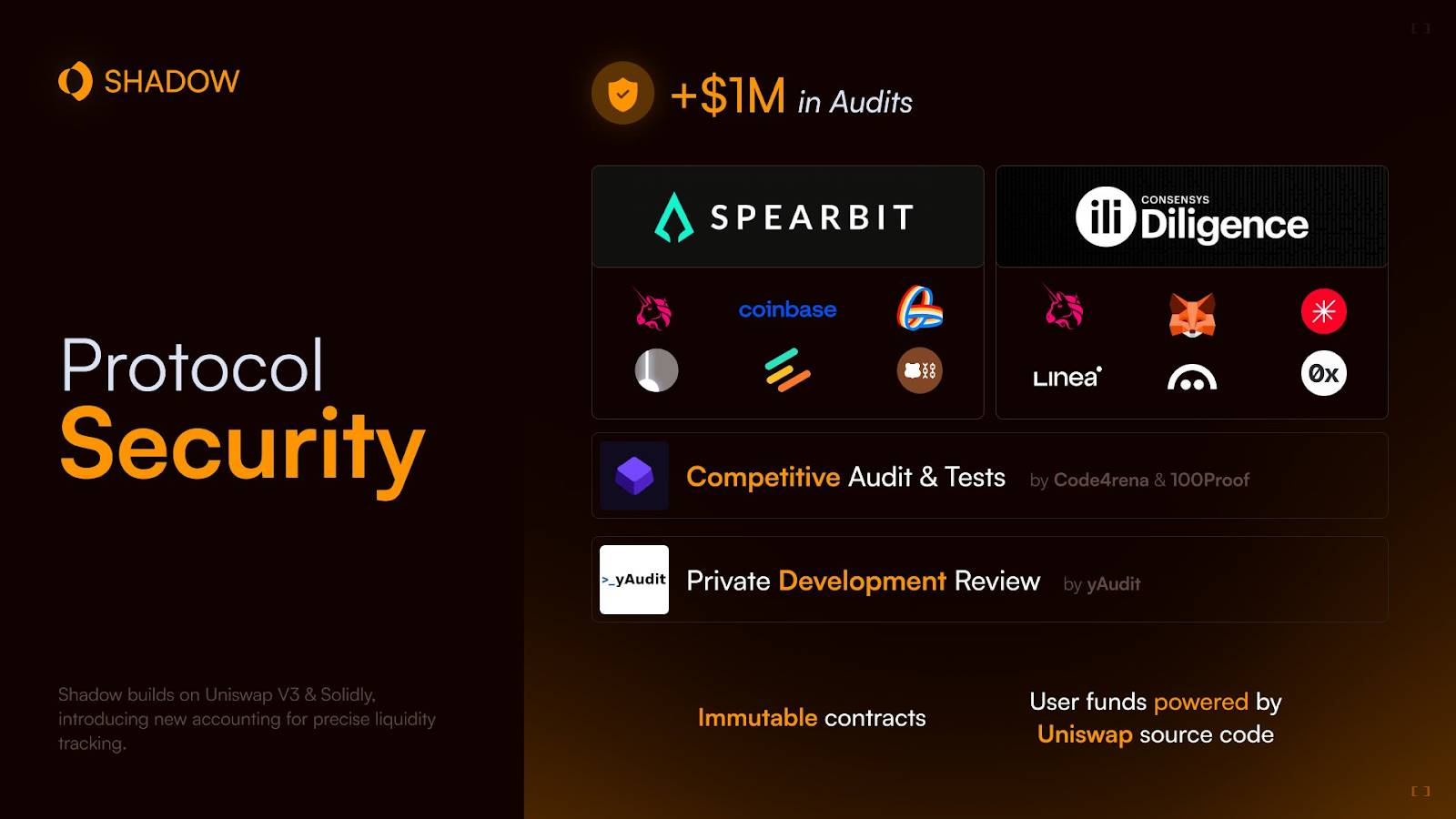

Finally, as a trading platform, security is the premise for all functions and advantages, and through the layered security protection built by Shadow, we also glimpse its commitment to "always prioritizing security".

On one hand, Shadow is built on a robust security foundation: Shadow's core architecture is based on Uniswap V3 and Andre Cronje's Solidly model, and has been optimized with dynamic systems, protocol fee mechanisms, and other enhancements to provide users with more precise liquidity tracking. Additionally, Shadow's immutable smart contract design further strengthens the platform's security.

On the other hand, Shadow has invested up to $1 million in security audits, bringing comprehensive security protection capabilities through rigorous multi-module and multi-stage audits: It is reported that Shadow has passed security audits from multiple institutions including Spearbit, ConsenSys Diligence, Code4rena, Zenith Mitigation, yAudit, and Spearbit, covering core architecture security audits, professional testing, privacy development audits, and other dimensions to build a robust and reliable trading ecosystem.

Participate and Earn Multiple Rewards, Multiple Roadmap Items to be Implemented

Of course, after learning the theory, practice is more important, especially since Shadow is known for its generous rewards.

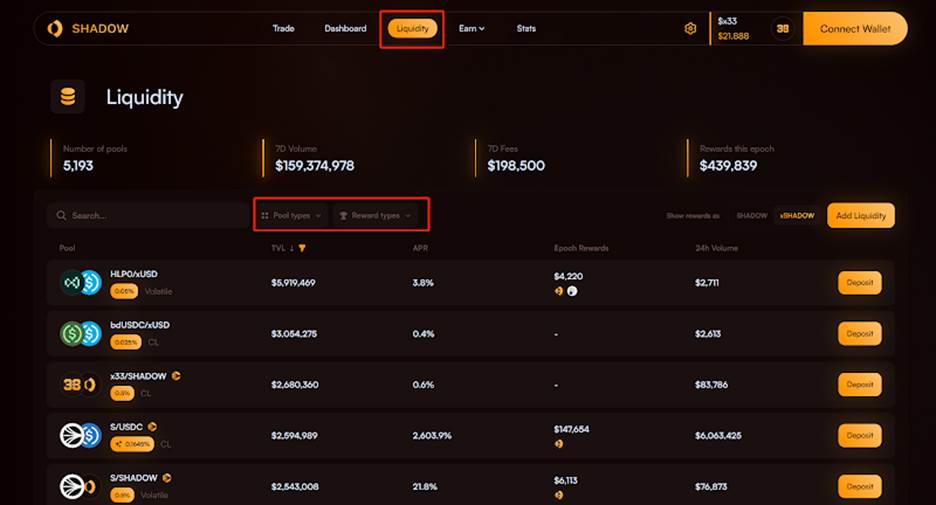

Currently, the most direct way to participate is through liquidity mining, with Shadow's Liquidity page offering multiple liquidity pools for users to choose from based on different risk preferences.

If classified based on liquidity mechanisms, users have four choices:

Stable Pool: Stablecoin trading pairs with low Impermanent Loss, suitable for conservative traders;

Airdrop Pool: Designed specifically for users wanting to earn Sonic airdrop points

Legacy Pool: Uniswap V2 style pool, suitable for conservative traders;

CL Pool: Uniswap V3 style concentrated liquidity pool, suitable for high-risk, high-reward traders.

If classified based on reward types, users have two choices:

Swap Fees Only: Earn trading fees, with stable but lower returns.

Emissions & Incentives: Earn liquidity pool $SHADOW / $xShadow or other token rewards, with higher but more volatile returns.

Users can choose to receive liquidity mining rewards in $Shadow or $xShadow, and then capture more ecosystem value dimensions through operations like minting $x33, achieving a more diverse reward structure.

It's worth noting that with the official launch of Sonic's second airdrop season, as a top DeFi protocol in the Sonic ecosystem, users can earn points by trading whitelisted assets on the Shadow platform, enjoying both loyalty multipliers and yield scoring, with 10x $S airdrop point acceleration for holding $Shadow and $x33.

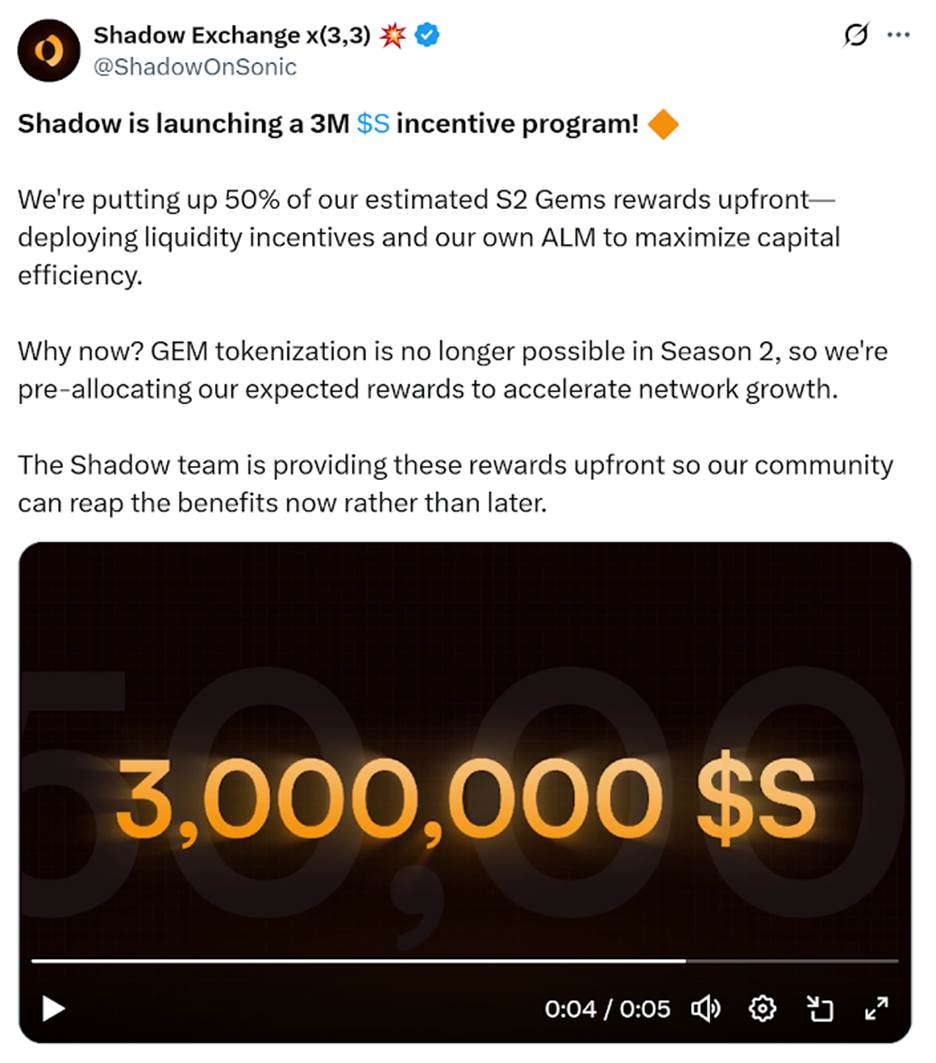

Meanwhile, since the second season airdrop will no longer support GEM tokenization, Shadow has announced a 3 million $S token incentive plan, releasing 50% of the expected second season airdrop rewards in advance, to be used for liquidity incentives and active market-making strategies, further encouraging user participation and ecosystem growth.

Beyond the vigorous ecosystem expansion, the Shadow team has not relaxed in product iteration. According to the official roadmap, Shadow will continue to upgrade its technical infrastructure, including enhancing MEV protection through buyback arbitrage systems and delayed reward mechanisms to ensure rewards flow to genuine market makers, and introducing a new fee tracking system to ensure only efficient liquidity receives rewards.

Meanwhile, multiple innovative features have recently been launched on Shadow, with the most attention-grabbing being the lending market based on $x33, further expanding Shadow's DeFi utility.

In the future, around the Memecoin ecosystem development, Shadow will establish a safer and more incentive-aligned launch process to achieve fair distribution of trading fees among xSHADOW holders, token creators, and liquidity providers.

As the core driving force of the Sonic ecosystem, Shadow Exchange is redefining the development path of DeFi with its unique x(3,3) model, powerful trading performance, and comprehensive reward distribution mechanism.

With the ecosystem's comprehensive layout and gradual implementation of multiple innovative features, we also look forward to Shadow Exchange, as a DeFi newcomer, ushering in its next stage of explosive growth and becoming a key force leading DeFi to greatness once again.