Gavin Wood Drops Another Bombshell Idea: Does JAM Need a "Three-Token Model"?

This week, Gavin and the JAM developers delved into the token economic design of JAM, discussing not just "which token to use," but also redefining the resource pricing method in Web3 - from security to computing power to storage.

Key Highlights:

PoS Logic is Collapsing - The old narrative from 2019 that "staking tokens = buying security" is becoming ineffective, with the model of subsidizing staking rewards through inflation failing.

Functions Must Be Separated - JAM envisions allocating Staking (security) / Core (computing power) / Storage to different tokens to avoid price distortion and resource inefficiency caused by "one token doing everything".

Three-Tier Economic Model - Staking Economy, Core Allocation, and Storage Deposits. Especially, storage must be priced using a fixed-supply independent token.

PoP Introduces Dramatically Lower Security Costs - If validator identity can be proven + cheaper layer-2 nodes, security costs could drop from $500 million/year to almost zero, no longer sustained by inflation.

Multi-Chain Shared Security - JAM allows Polkadot, Kusama, etc. to buy cores using DOT/KSM, potentially even sharing the same JAM in the future, like multiple countries sharing a "Web3 cloud computer".

But Fairness Must Be Considered - Gavin warns: DOT holders won't join a JAM that's "obviously biased towards KSM". It must ensure no chain receives "special treatment" and that everyone is "better together".

This isn't just about "which token JAM will use" - it's a "system reboot" of Web3 token economics. http://x.com/polkaworld_pro/status/1948724766128701536

Second Postponement: June 24 → July 26 (Tentative)

Final Decision Deadline: November 8, 2025

Additional Message: Bloomberg analysts predict over 90% approval probability for 21Shares' DOT ETF. https://x.com/polkaworld_org/status/1947848679131648270

Some say DOT is falling due to treasury selling? Community member Leemo responds: The real culprit is someone else.

Truth 1: The big holders I know are selling much more than the treasury

Truth 2: On-chain staking rewards are the biggest selling pressure (check the data on Dune)

Truth 3: Treasury selling DOT is for service exchange and construction, not for dumping

"What the treasury should really manage is whether the money is spent where it should be."

Learn more about Leemo's perspective in PolkaWorld's latest article 《Who is the Real Culprit Behind DOT's Selling Pressure? An On-site Analysis by a Governance "Troublemaker"!》

In the latest Space Monkeys podcast, host Jay asked: "Why would projects still choose to deploy on Polkadot today?"

Santi Balaguer from Parity ecosystem development answered: "Polkadot is the only system designed from the beginning for native rollups."

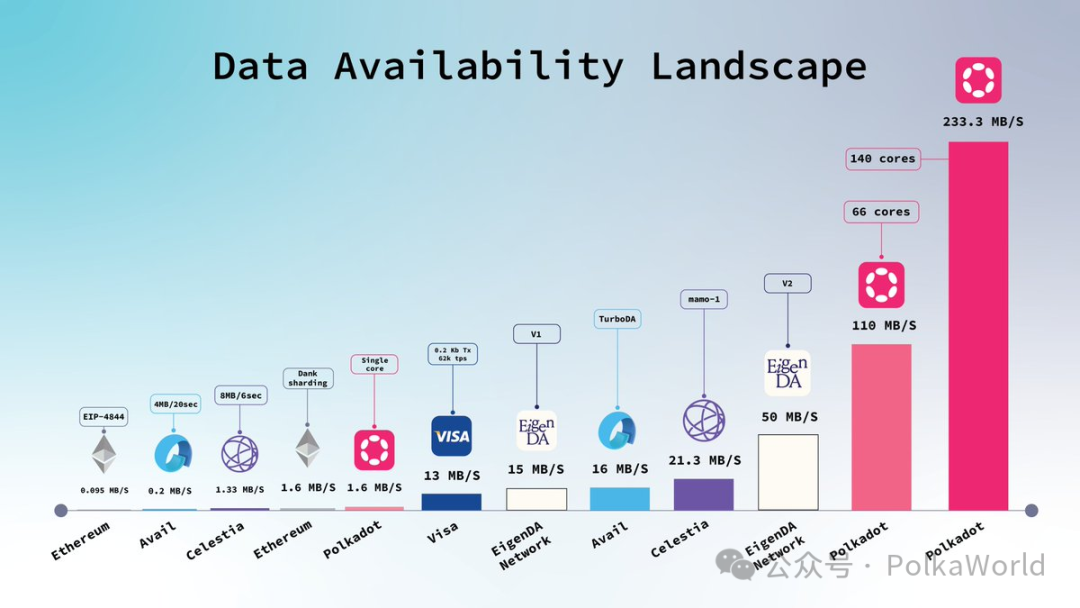

Extremely High DA Throughput: Polkadot provides 110 MB/s, giving applications more bandwidth.

Native Cross-chain Interoperability: Trustless collaboration between parallel chains, ready out of the box.

143K TPS Record: Spammening test reveals rollups' parallel processing potential.

Elastic Scaling: Start/stop cores on-demand, scale up or save costs as needed.

Shared Security: Each chain automatically inherits relay chain security, no need to build validator network.

Check more information: https://x.com/TheKusamarian/status/1946963318088024317

In the Web3 world, bridges are the blood vessels connecting ecosystems, but a fragile bridge can bring down an entire network. However, PDP makes bridging on Polkadot a "secure default option".

Trustless: Messages are relayed by Polkadot itself, not third-party multisig custody

Native: Deploy a Polkadot Rollup, and bridging capabilities are ready out of the box

True Bidirectional Bridge: Rollup A initiates request → Rollup B decides whether to connect, with final decision power given to each chain's governance, returning power to token holders

Cross-chain? Still Trustless: Snowbridge connecting Ethereum, Hyperbridge for multi-chain Proof-based interoperability, all bridges run on Polkadot Rollups and can be connected at any time

Come experience the "one-click bridging" at PDP~

Dashboard Operation → Open, manage any Rollup channel

Automatic Bridging → Direct connection to The Hub, Coretime Chain, and other key systems

PDP makes Polkadot's bridging infrastructure not just secure, but also user-friendly. https://x.com/PolkadotDeploy/status/1948069121595428925

Alice und Bob share news from Web3 Summit —— At this year's Web3 Summit, Kusama became the most "cool" keyword on-site. Web3 Foundation announced injecting 10 million DOT for privacy technologies & zero-knowledge (ZK) experiments on Kusama.

Additionally, the atmosphere at the Kusama Hackathon was also explosive:

Over $100,000 in prizes attracted big names like Hyperbridge, Incubation Kusama, Polkadot teams

Developers created anonymous voting, ZK reporting tools, and privacy transfer apps within 48 hours using the Noir framework

Rumor has it that someone developed Kusama Hub and Kusama App to help new users easily discover Kusama's ecosystem applications.

In short, Kusama is ushering in a new "Chaos Experiment Season" —— focusing on ZK, privacy technologies, and hacker culture, becoming an innovation engine in the crypto field again. https://x.com/alice_und_bob/status/1948731043508339183

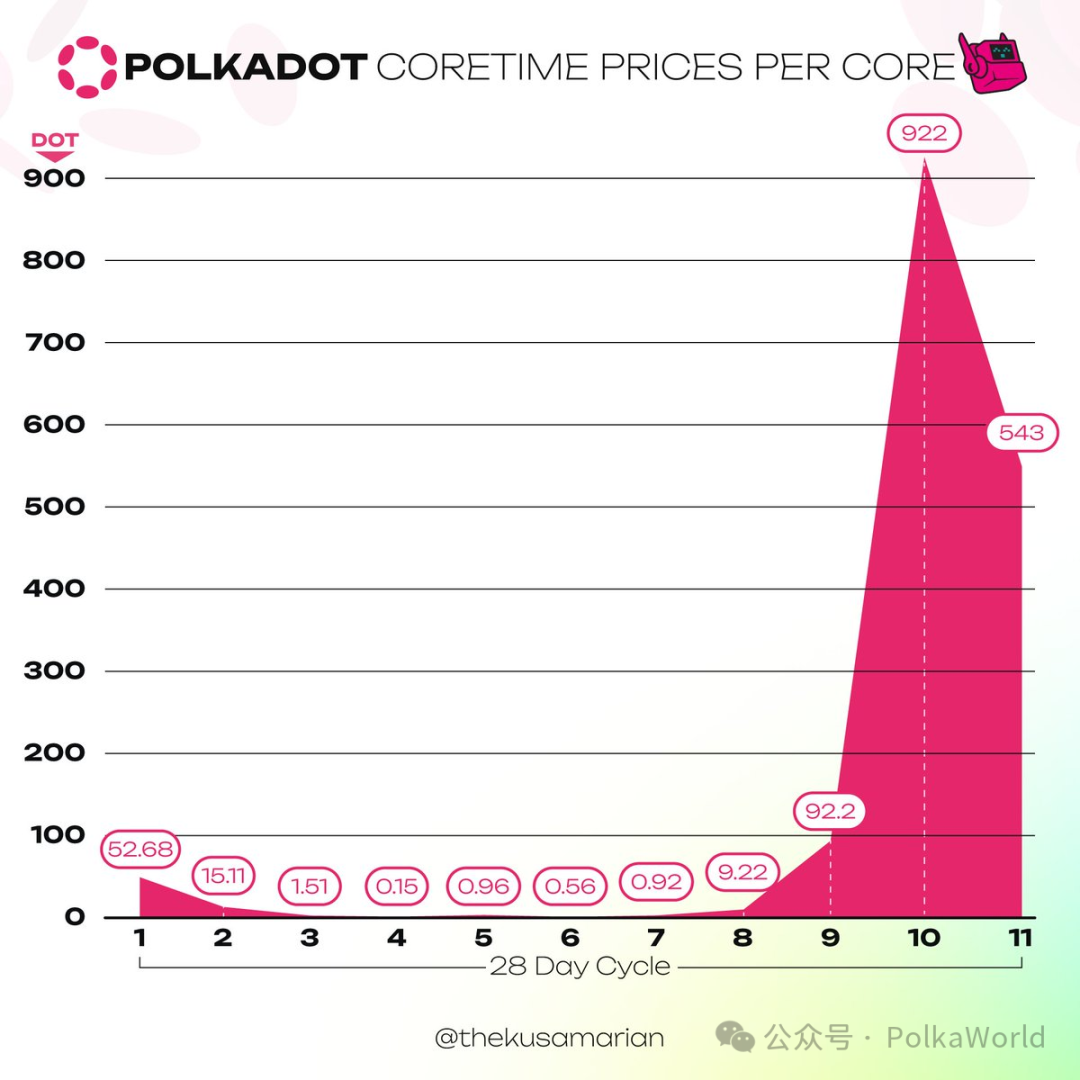

Latest Polkadot Coretime Sales Dynamics! After a 10x surge, prices show a slight pullback!

Coretime is the "ticket" for Rollups to access Polkadot's security and cross-chain interoperability——every 28 days, projects must burn DOT to gain network access.

From the latest chart, Coretime suddenly surged to 92.2 DOT in Round 9, then peaked at 922 DOT in Round 10, and subsequently fell back to 543 DOT in Round 11, still remaining at a high level. https://x.com/TheKusamarian/status/1948473259076284809

What does this mean?

Polkadot network demand has clearly increased, with Coretime competition intensifying

The amount of DOT burned monthly will continue to increase, long-term affecting DOT's supply structure

To learn more about how Coretime ignites DOT's economic model, check PolkaWorld's article 《Coretime + Elastic Scaling: Building a Productized, Sustainable Web3 Business Logic for Polkadot!》

Ecosystem Projects

On July 25, Bifrost launched a vDOT/ETH liquidity incentive activity on Uniswap! As part of the Polkadot DeFi Singularity event! In this activity, users only need to provide liquidity for the vDOT/ETH trading pair on Uniswap to participate in rewards! As long as the wallet holds the corresponding LP tokens, rewards can be claimed directly through the https://merkl.xyz page!

What needs to be prepared in advance? Users are advised to prepare sufficient vDOT and ETH on Base, Ethereum, and other relevant networks in advance, to seize the liquidity pool advantage at the first opportunity when the incentive opens!

What about users who don't have vDOT assets yet? Quick vDOT minting channel http://app.bifrost.io

Tips:

Be sure to retain LP tokens after submitting liquidity, rewards can be claimed at any time.

Users are advised to assess slippage and risks when providing liquidity.

Remember to regularly check https://merkl.xyz and claim rewards in time!