Bitcoin has recently stabilized, with this cryptocurrency maintaining a range between $117,261 and $120,000 over the past two weeks. This price stability has prevented Bitcoin from reaching a new All-Time-High (ATH).

However, signals from investor behavior suggest that next month could lead to a significant change, potentially rewriting Bitcoin's historical price patterns in August.

Bitcoin Investors Are Sending Positive Signals

Bitcoin's current sell-off risk ratio is at 0.24, marking a 6-month high. However, it remains below the neutral threshold of 0.4 and close to the low-value perception threshold of 0.1. This indicates that the market is experiencing a stable phase, with investor behavior showing a pause in large sell-offs.

History shows that periods of low sell-off risk often signal market dips or accumulation phases, where investors wait for a favorable moment to push prices higher. This accumulation is important because it suggests Bitcoin prices may be ready for a change.

For TA and token market updates: Want more information about tokens like this? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

Bitcoin's Sell-Off Risk Ratio. Source: glassnode

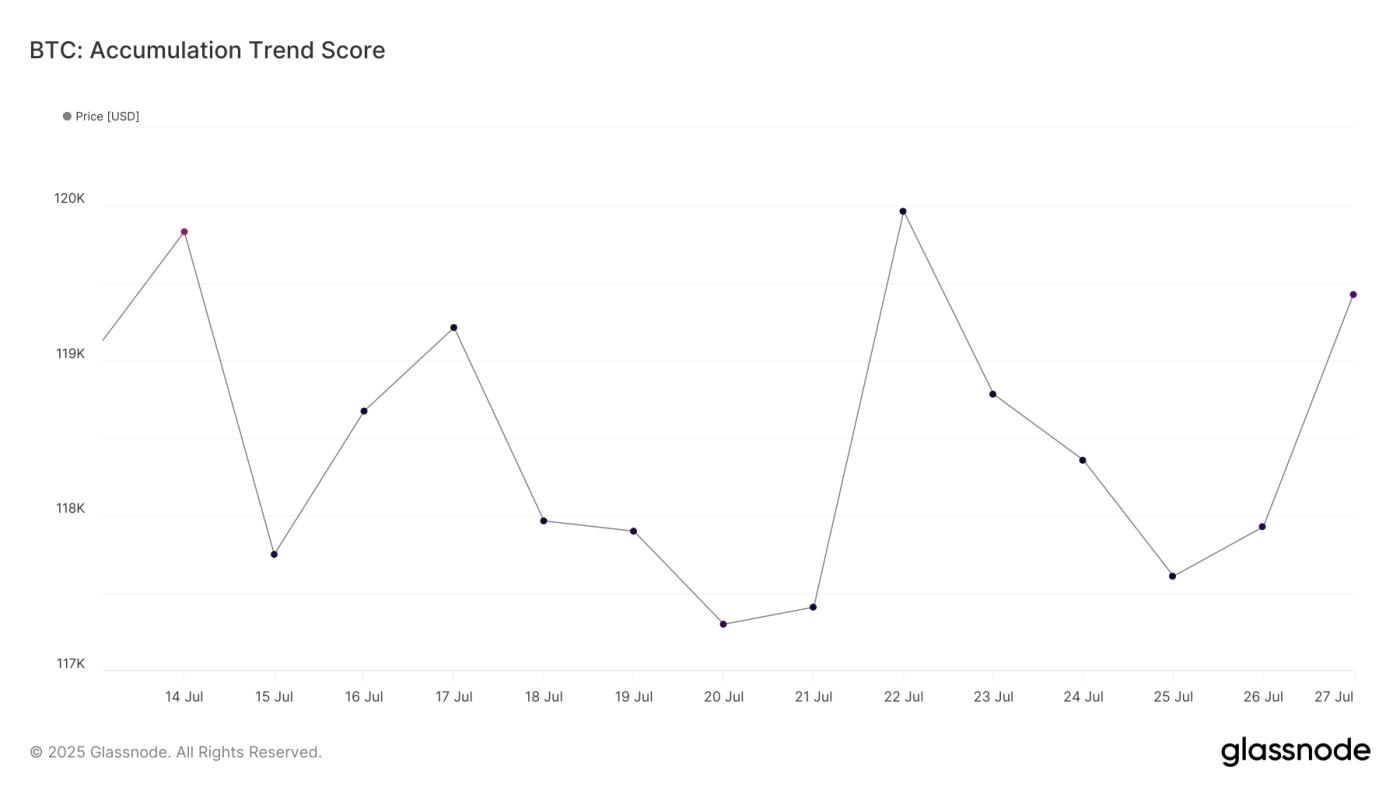

Bitcoin's Sell-Off Risk Ratio. Source: glassnodeBitcoin's accumulation trend score is currently near 1.0 over the past two weeks, indicating that large investors, including whales, are actively accumulating Bitcoin. This trend is crucial because these whales significantly influence the cryptocurrency's price.

An accumulation score near 1 suggests strong price momentum among institutional investors and high-net-worth individuals. This could provide a solid foundation for Bitcoin to overcome resistance levels it has recently struggled with.

The stable accumulation by larger entities implies growing confidence in Bitcoin's long-term value. This could lead to a Bitcoin price increase as more capital is injected into the market by investors.

Bitcoin Accumulation Trend Score. Source: glassnode

Bitcoin Accumulation Trend Score. Source: glassnodeBTC Price May Find Path to ATH

Bitcoin's price is currently fluctuating around $118,938, within a stable range from $117,261 to $120,000. Although this range has held steady, the potential to break above $120,000 is high if investor sentiment remains strong.

Historically, August has been a typically down month for Bitcoin, with average monthly returns at -8.3%. However, with the current accumulation trend and low sell-off risk, Bitcoin might break its historical pattern this year. If Bitcoin can maintain $120,000 as support, it could surpass $122,000 and move towards ATH.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewHowever, there remains a risk that the market could turn bearish if investors change their perspective due to unforeseen market factors. In this scenario, Bitcoin could lose support at $117,261 and slide to $115,000, reversing the bullish argument.