TL;DR

- MicroStrategy (MSTR) has pioneered a new financial structure: using the equity market to acquire Bitcoin through zero-coupon convertible bonds and preferred shares, monetizing stock volatility rather than relying on operational cash flow.

- When MSTR trades at mNAV > 1, it can issue equity without dilution, buying BTC and increasing BTC per share, creating a self-reinforcing flywheel.

- The company’s capital structure is sustained by hedge funds engaged in gamma trading, who buy the bonds and dynamically hedge with short MSTR stock to profit from volatility, not direction.

- Convertible bond buyers accept 0% interest because the embedded call option is highly valuable in a high-volatility regime (BTC/MSTR).

- Despite Saylor’s “never sell BTC” stance, MicroStrategy could be forced to liquidate some BTC under stress scenarios such as debt maturities, high dividend obligations, or failed capital market access during downturns.

- The broader trend shows public companies using crypto reserves as narrative and capital strategies, offering investors leveraged exposure to crypto assets through equities, but also introducing volatility, financing, and faith-based risks.

1. Introduction

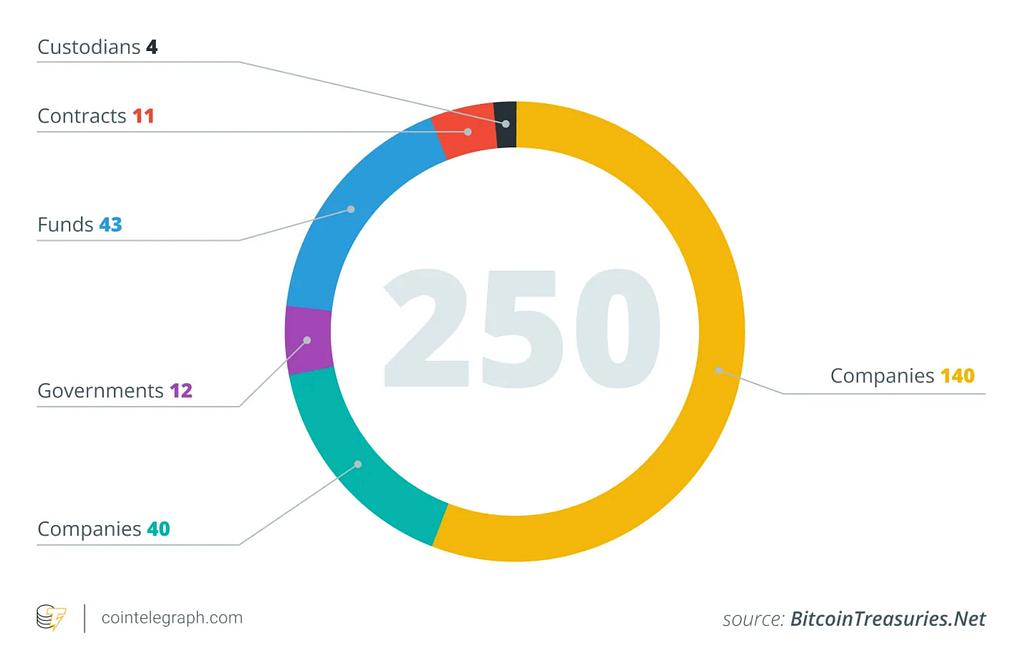

By mid-2025 an increasing number of public companies have begun holding cryptocurrencies, especially Bitcoin, inspired by the success of Strategy, as part of their treasuries. For example, blockchain analytics data show 26 new firms added Bitcoin in June 2025 alone, bringing the total number of companies holding BTC to roughly 250 worldwide.

These firms span diverse industries (tech, energy, finance, education, etc.) and geographies. Many cite Bitcoin’s fixed 21‑million supply as an inflation hedge and a non‑correlated asset. This strategy has quietly become mainstream: by May 2025, 64 SEC-registered companies already held about 688,000 BTC, around 3–4% of the total Bitcoin supply, and analysts estimate well over 100–200 companies globally now have crypto on their book.

2. What is the model of crypto reserve

When a public company allocates part of its balance sheet to crypto, the immediate question arises: how do they fund these purchases? Unlike traditional financial institutions, most crypto treasury companies, in the following I will use $MSTR as an example as most other companies follow the same way it did, do not rely on cash-rich operations.

Operating Cash Flow from Core Business

While theoretically the most organic and least dilutive approach, funding crypto purchases from core business cash flow is rarely feasible, and this fact is by now well understood across the industry. Most crypto treasury companies simply lack the consistent, large-scale cash flows needed to acquire substantial reserves of BTC, ETH, or SOL without tapping external financing.

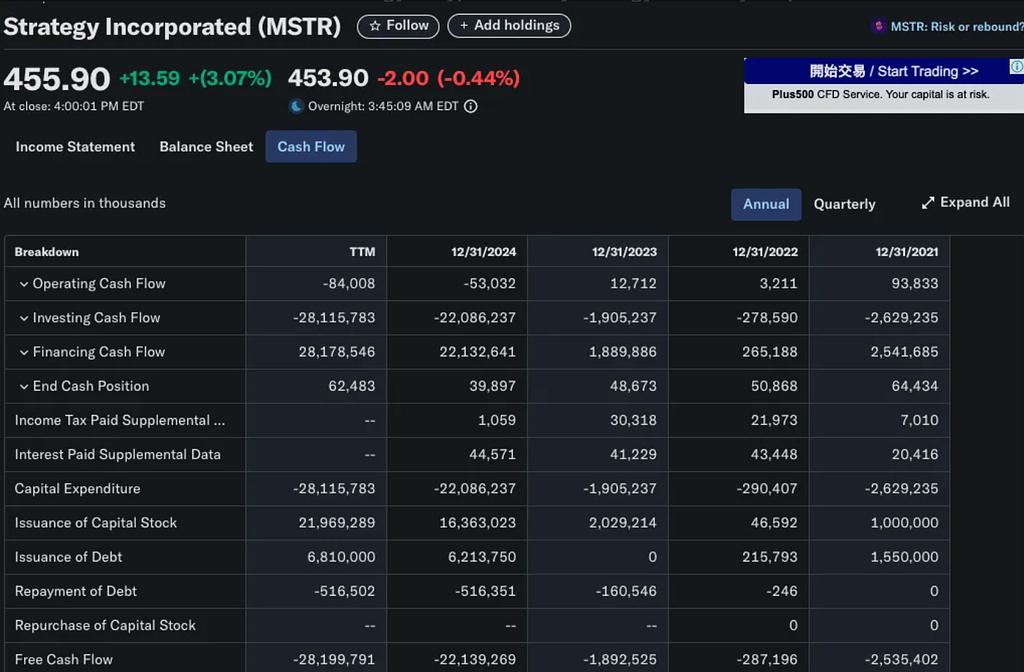

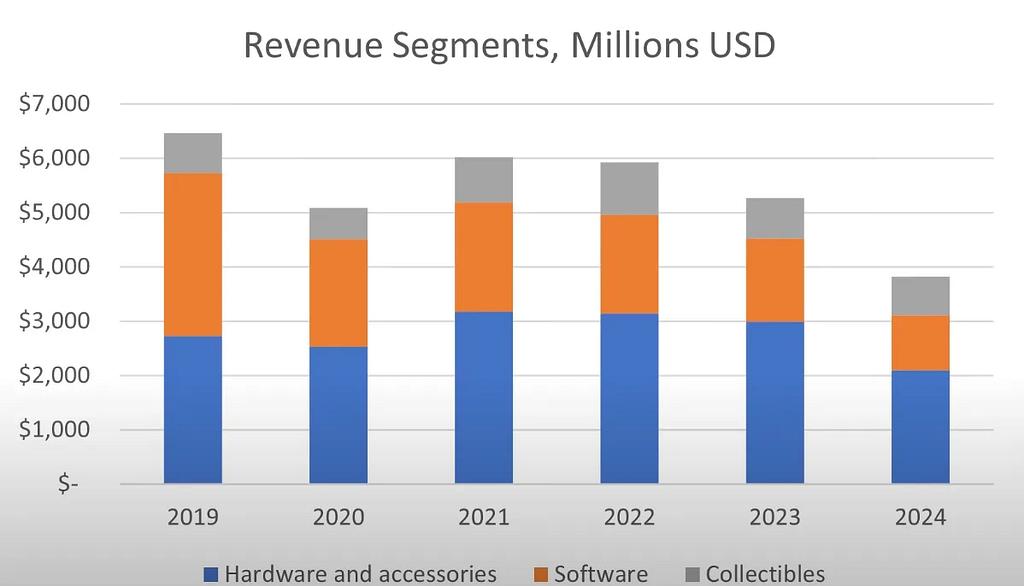

Take MicroStrategy (MSTR) as the canonical example: founded in 1989 as a business intelligence software firm, it still generates only modest revenue from tools like HyperIntelligence and AI dashboards. In fact, its operating cash flow is negative on an annual basis, far short of the tens of billions it has invested into Bitcoin. This underscores that MicroStrategy’s crypto treasury strategy has always depended on external capital formation, not internal profitability.

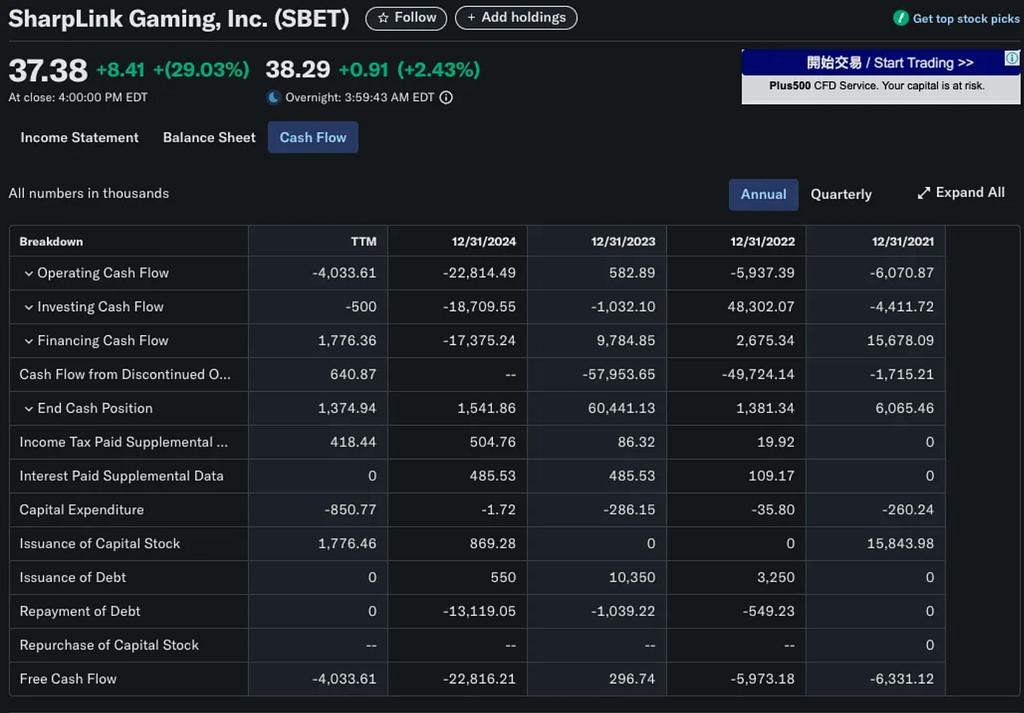

Similarly, SharpLink Gaming (SBET), which pivoted in 2025 to become an Ethereum treasury vehicle by acquiring over 280,706 ETH (~$840M), could not have possibly financed such a move through its B2B gaming revenue base alone. Its capital formation strategy centered instead on PIPE financing and direct equity issuance, not operating income.

b. Capital Markets Financing

Among public companies adopting a crypto treasury strategy, the most prevalent and scalable model is to raise capital through the public markets, either via equity or debt issuance, and use the proceeds to accumulate crypto assets such as Bitcoin. This approach allows companies to build large crypto treasuries without using retained earnings, and it draws heavily from the financial engineering playbooks of traditional capital markets.

Issuing Shares: The Traditional Case of Dilution

In most scenarios, issuing new shares comes at a cost. When a company raises equity capital by issuing more shares, two things typically happen:

- Dilution of ownership, Existing shareholders own a smaller piece of the company.

- Decline in EPS, With net income unchanged but more shares outstanding, earnings per share fall.

These effects usually lead to a decline in stock price, for two main reasons:

- Valuation math: If P/E stays constant, but EPS drops, share price must fall.

- Market psychology: Investors often interpret capital raises as a sign of weakness or desperation, especially if proceeds are used to fund unproven growth plans.

Additionally, the sudden influx of supply from new shares can pressure the market price downward, as shown below:

The Exception: MicroStrategy’s Anti-Dilutive Equity Model

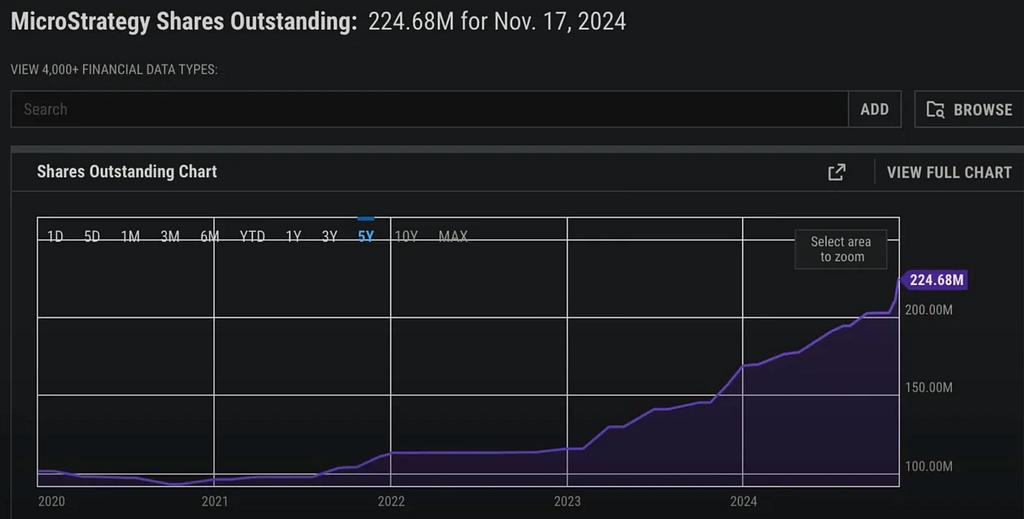

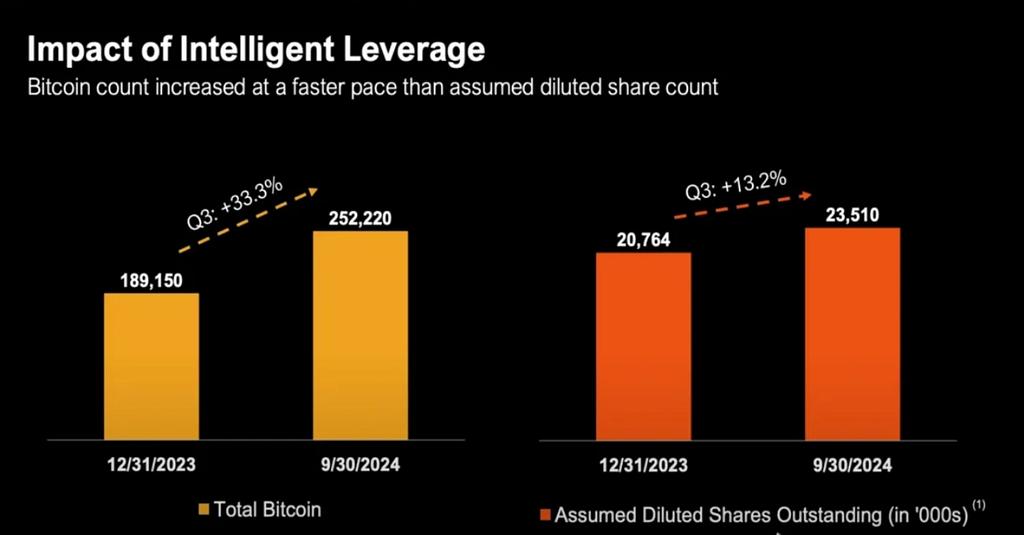

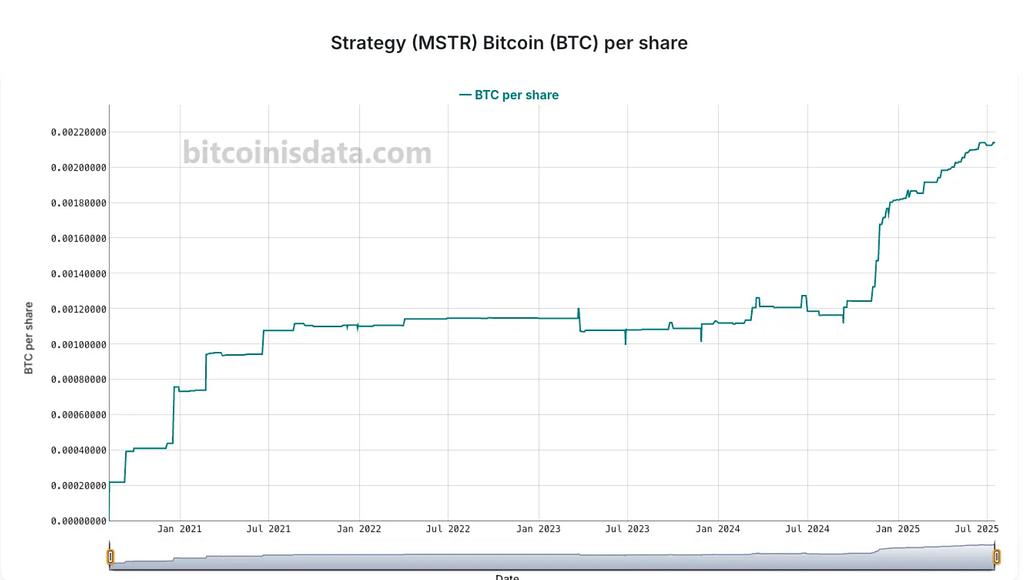

MicroStrategy (MSTR) represents a notable deviation from the traditional equity dilution narrative. Since 2020, the company has aggressively issued equity to fund its Bitcoin purchases, more than doubling its outstanding shares from under 100 million to over 224 million by late 2024:

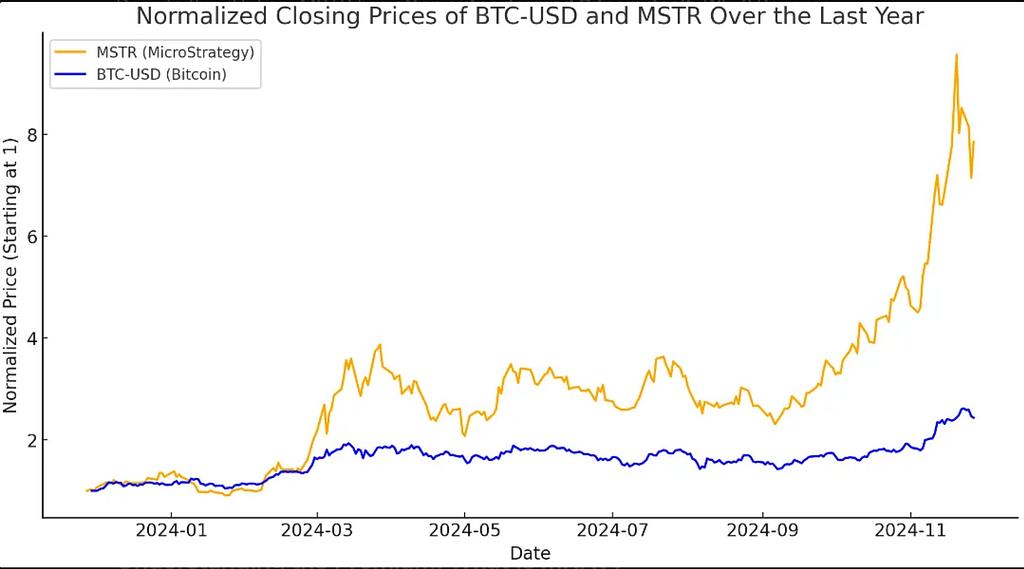

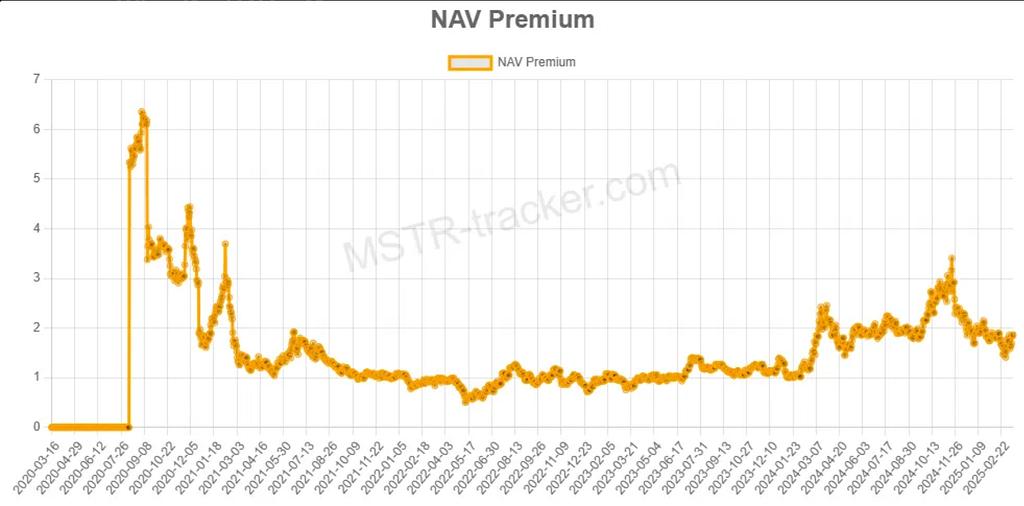

Despite this dilution, MSTR has often outperformed Bitcoin itself. Why? Because MicroStrategy has consistently traded at a premium to its underlying Bitcoin holdings, a condition we refer to as mNAV > 1.

Understanding the Premium: What Is mNAV?

- When mNAV > 1, the market is assigning a valuation to MSTR that is greater than the fair market value of the Bitcoin it holds.

In other words, investors are paying more per unit of Bitcoin exposure via MSTR than if they bought BTC directly. This premium reflects market confidence in Michael Saylor’s capital strategy, and perhaps a belief that MSTR offers leveraged, actively managed BTC exposure.

Backed by Traditional Finance Logic

While mNAV is a crypto-native valuation metric, the concept of trading at a premium to underlying assets is well established in traditional finance.

Companies routinely trade above book value or net assets because of:

1. Discounted Cash Flow (DCF) Valuation

Investors price in the present value of future cash flows, not just current asset holdings. This often results in a company trading far above book value, especially when:

- Revenue and margins are expected to grow

- The company has pricing power or an innovation moat

📌 Example: Microsoft is valued not on cash or hardware, but on recurring software cash flows projected far into the future.

2. Earnings and Revenue Multiples

In many high-growth sectors, companies are valued using multiples of earnings (P/E) or revenue:

- Fast-growing software companies may trade at 20–30× EBITDA

- Early-stage firms with no profits may trade at 50× revenue or higher

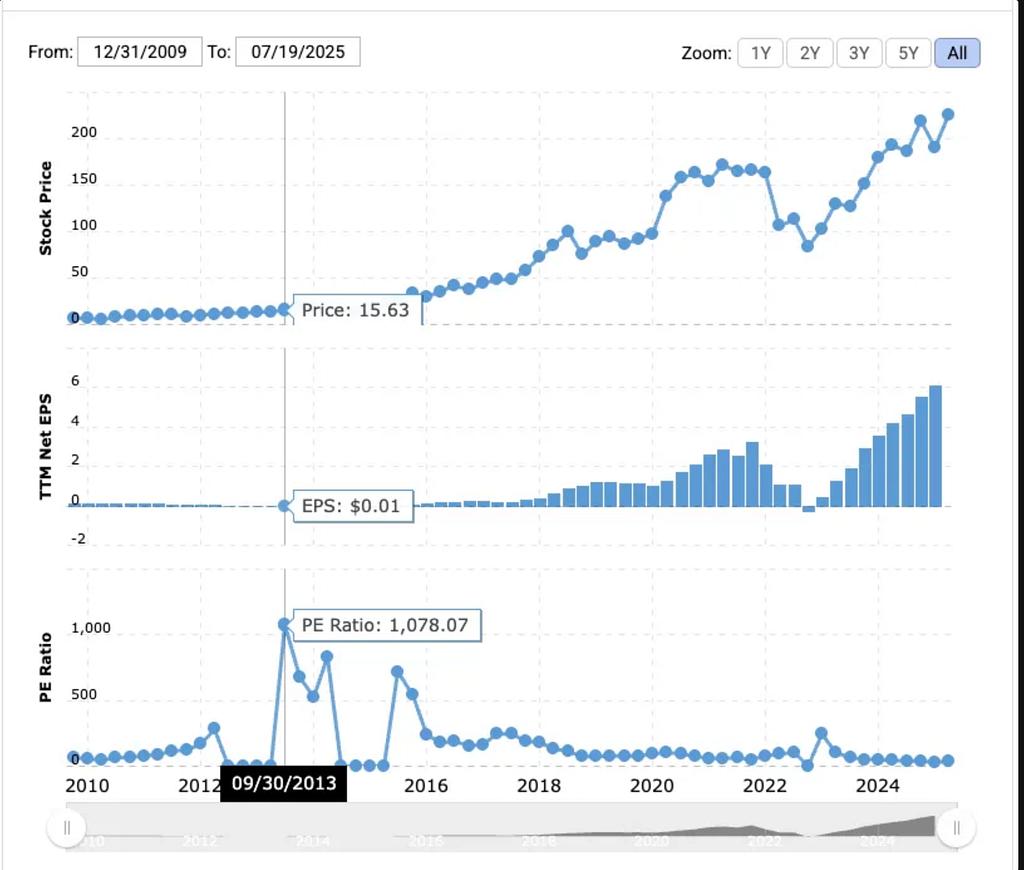

📌 Example: Amazon traded at a P/E of 1,078× in 2013.

Despite thin profits, investors bet on future dominance in ecommerce and AWS.

MicroStrategy has something that Bitcoin itself doesn’t, a corporate wrapper that taps traditional financing channels. As a U.S. public company, it can issue stock, bonds, and now preferred equity to raise cash, and it has done so spectacularly. Michael Saylor effectively arbitraged the system: he raised billions through zero-percent convertible bonds and, more recently, through innovative preferred stock offerings, and funneled all that money into Bitcoin. Investors recognize that MicroStrategy can acquire Bitcoin at scale using other people’s money, an opportunity individuals don’t have so readily. MicroStrategy’s premium “has nothing to do with short-term NAV arbitrage” and everything to do with the market’s trust in the company’s capital access and allocation. Wall Street is betting that Saylor’s team will continue to deftly leverage equity and debt to grow their Bitcoin hoard, so you’re paying a premium for Saylor’s financial engineering.

How mNAV > 1 Enables Anti-Dilution

When MicroStrategy trades at mNAV > 1, it can:

- Issue new shares at a premium

- Use proceeds to buy more BTC

- Increase its total BTC holdings

- Drive up both NAV and enterprise value.

Even with more shares outstanding, BTC per share may stay flat or even rise, making the issuance anti-dilutive. The premium in mNAV reflects investor confidence that MicroStrategy will continue to acquire more Bitcoin in a way that grows or maintains BTC per share, effectively functioning like a Bitcoin growth vehicle.

What if mNAV < 1?

When mNAV < 1, it means each dollar of MSTR stock buys you more than $1 worth of BTC, at least on paper. In traditional finance terms, MSTR is trading at a discount to NAV, which introduces capital allocation challenges. If it uses that $1 of equity proceeds to buy BTC, it’s essentially overpaying in shareholder terms. This dilutes BTC/share, and therefore destroys value for existing shareholders.

If MicroStrategy finds itself with mNAV < 1, it cannot continue the share issuance → BTC buy → BTC/share growth flywheel.

So what options remain?

Buy Back Shares Instead of Buying BTC

Buying back MSTR shares when mNAV < 1 is value-accretive, because:

- You’re buying shares at a discount to the BTC they represent.

- BTC/share increases as the float shrinks.

Saylor has alluded to this explicitly: if mNAV falls below 1, the better move is to repurchase stock, not buy more BTC.

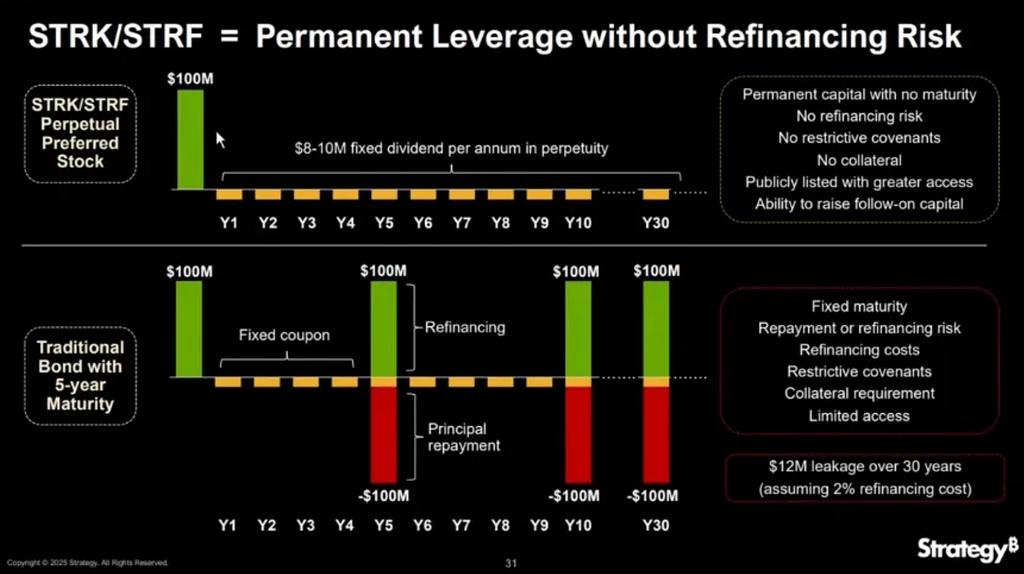

Issue Preferred Stock

Preferred stock is a hybrid security that sits between debt and common equity in a company’s capital structure. It typically offers fixed dividends, has no voting rights, and carries priority over common stock in receiving payouts and liquidation proceeds. Unlike debt, it doesn’t require principal repayment, and unlike common equity, it provides more predictable income.

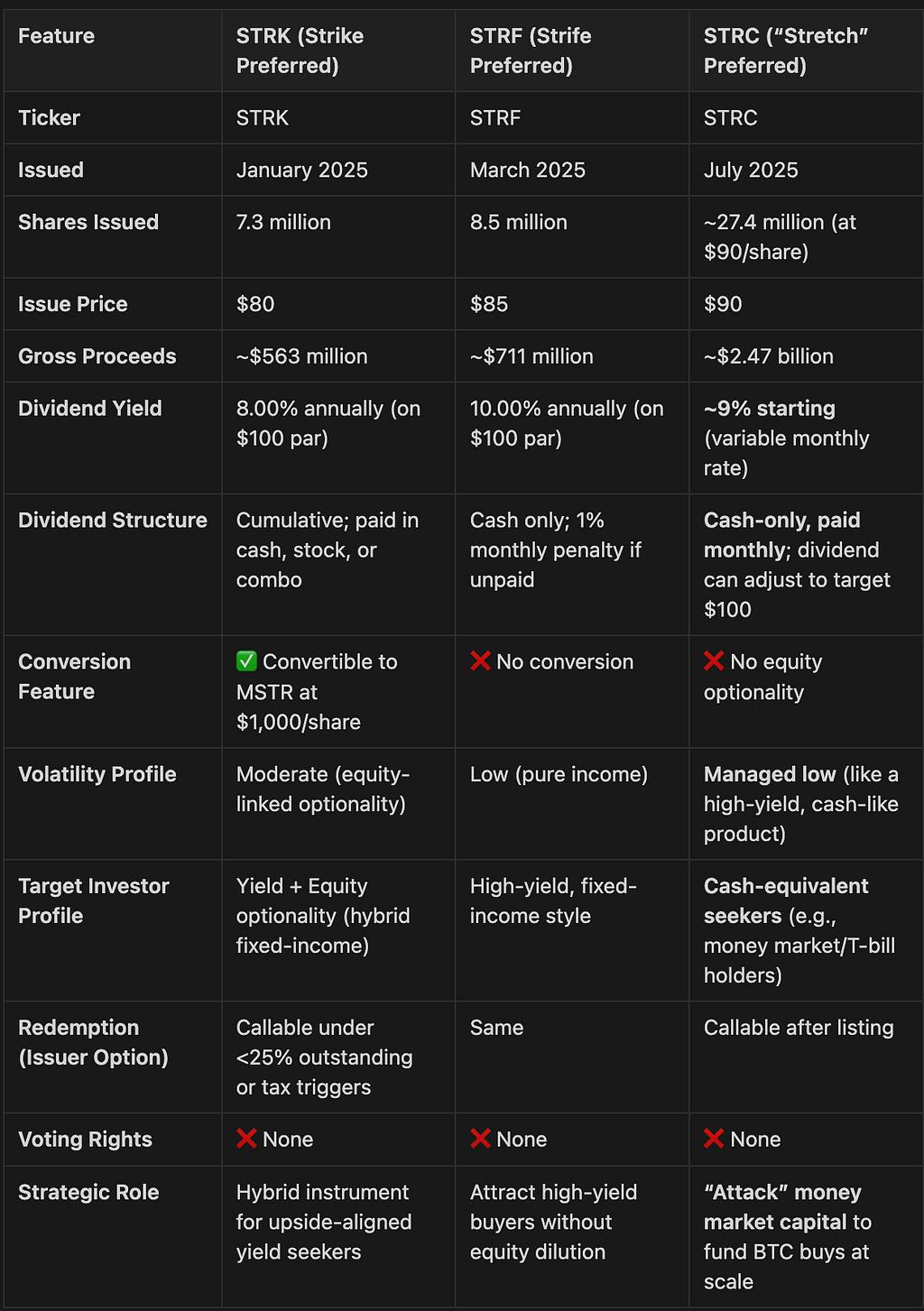

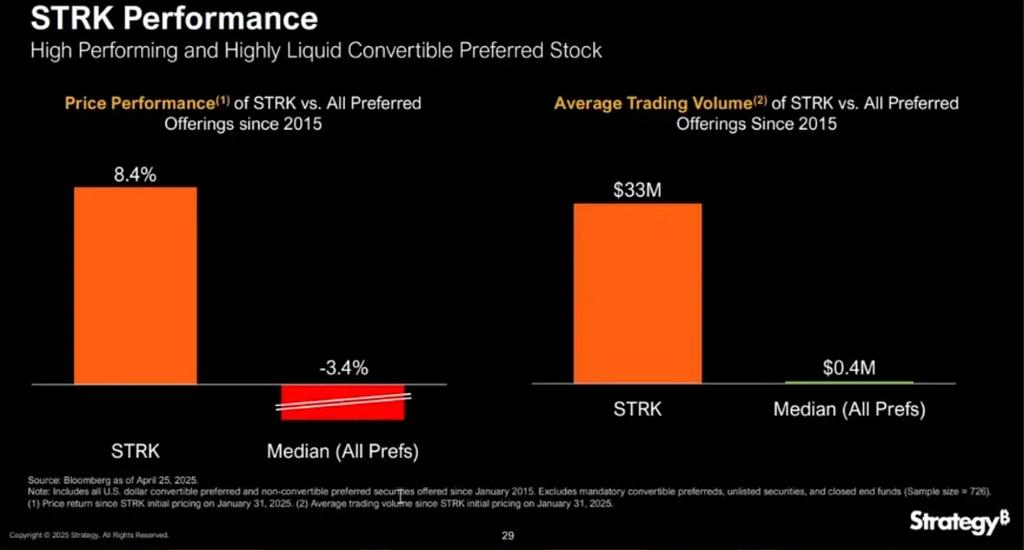

MicroStrategy has issued three types of preferred stock: STRK, STRF and STRC.

STRF is the most straightforward instrument: a non-convertible, perpetual preferred share that pays a fixed 10% annual cash dividend on a $100 par. There is no conversion feature, no upside exposure to MSTR equity, just yield. STRF’s market price floats to balance investor demand for yield and MicroStrategy’s appetite for funding:

- When MicroStrategy wants to raise cash, it can issue more STRF, increasing supply and nudging prices down.

- If investor demand for yield spikes (e.g., during low-rate periods), STRF’s price can rise, lowering its effective yield.

- This dynamic creates a self-adjusting instrument with relatively narrow price ranges (e.g., $80–$100), driven mainly by yield appetite and issuance volume.

Example: If market rates require 15% yield, STRF might fall to $66.67. If only 5% yield is sufficient, it could rise to $200.

Because STRF is non-convertible and non-callable (except under special tax/capital conditions), it functions much like a perpetual bond, one that MicroStrategy can use repeatedly to “buy the dip” on BTC without ever needing to refinance.

STRK resembles STRF in its 8% fixed dividend, but adds a 10:1 equity conversion feature if MSTR stock trades above $1,000. This embeds a deep out-of-the-money call option, giving holders long-term upside if MSTR performs.

Here’s why STRK is such a powerful instrument for MicroStrategy and its investors:

- Asymmetric Upside for MSTR Shareholders:

- Each STRK share is sold at ~$85, meaning 10 STRK raise $850 in BTC-purchasing power.

- If later converted into 1 MSTR share, this effectively lets MicroStrategy acquire BTC now by giving up equity only if its stock has tripled.

- That means STRK is non-dilutive until MSTR trades >$1,000, and even then, it reflects prior BTC accretion.

2. Self-Healing Yield Dynamics:

- STRK pays $2/quarter, or $8/year, per share.

- If STRK falls to $50, its yield rises to 16%, attracting buyers and stabilizing the price.

- This downside-resilient structure makes STRK behave like a “bond with optionality”: it protects in downturns and participates in the upside when the cycle turns.

3. Investor Strategy and Conversion Incentives:

- When MSTR eventually exceeds $1,000, STRK holders are incentivized to convert, locking in capital appreciation.

- Over time, as MSTR climbs further (e.g., to $5,000 or $10,000), STRK’s dividend becomes trivial (~0.8% yield), accelerating conversion.

- This creates a natural exit funnel for STRK and transforms temporary leverage into equity-based ownership.

MicroStrategy also retains the right to redeem all outstanding $STRK under certain conditions, such as when less than 25% of the original issuance remains outstanding or in response to tax events. In liquidation, $STRF ranks senior to common equity but junior to all debt.

These instruments are particularly powerful when mNAV < 1, because issuing common equity at a discount to Bitcoin NAV is value-destructive (it lowers BTC/share). However, preferred stock allows MicroStrategy to raise capital without diluting common shareholders, enabling continued Bitcoin accumulation or even share buybacks, preserving BTC/share while still expanding the balance sheet.

How they pay back their interest?

In 2025 YTD alone, MicroStrategy raised $6.6B through ATM (At-The-Market) equity offerings. This more than covers the $185M needed for annual coupon/dividend payouts. Paying fixed preferred returns via equity proceeds is non-dilutive to BTC per share if mNAV > 1, because more capital is raised than intrinsic dilution per BTC unit.

Also, Preferred stock lets MicroStrategy fund Bitcoin purchases without impacting its net debt ratios, which is critical for maintaining market confidence in its capital structure.

When mNAV > 1

Convertible Bond

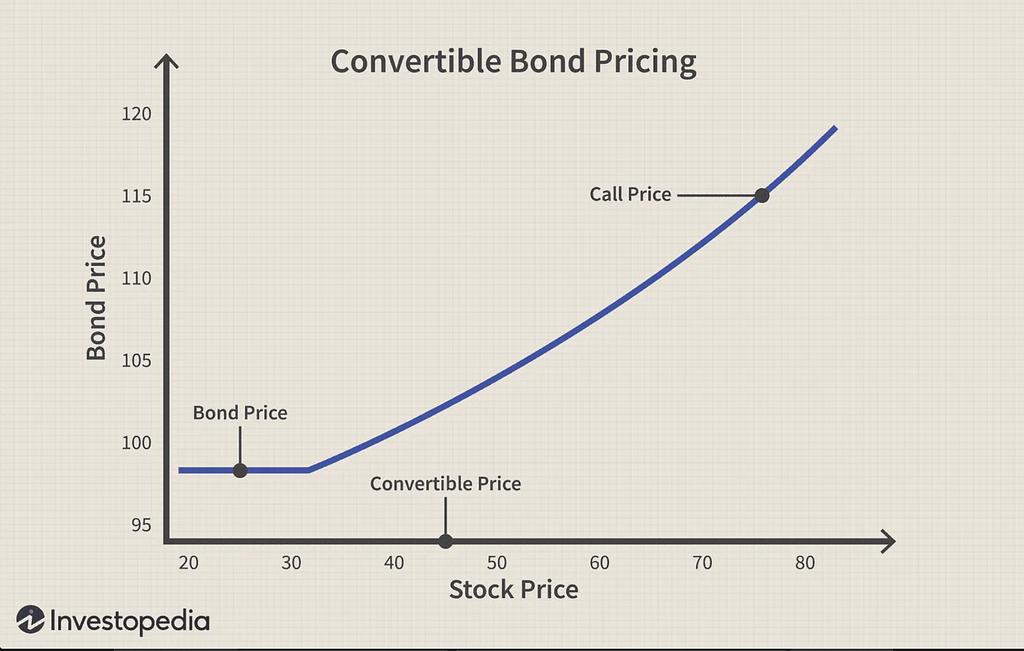

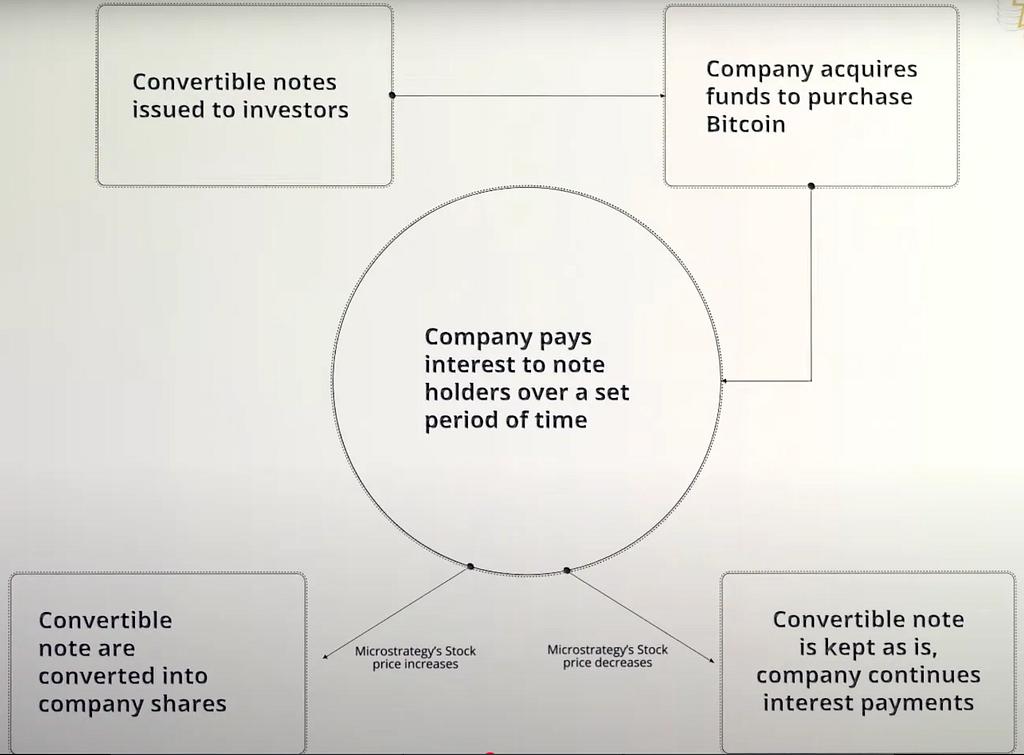

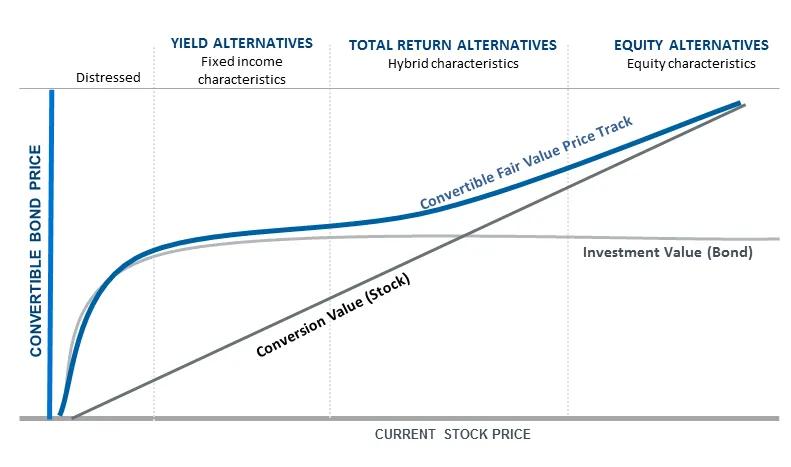

A convertible bond is a type of corporate debt that gives the bondholder the right, but not the obligation, to convert the bond into a predetermined number of shares of the issuing company, usually at a fixed price (called the conversion price), so it is like bond + call option. It usually used in mNAV>1 as convertible bonds are structured for BTC accumulation.

with MicroStrategy’s 0% convertible bonds:

- There are no interest payments during the bond’s life.

- Only the principal is due at maturity, unless investors choose to convert to shares.

- For MSTR, this is a capital-efficient way to raise billions to buy Bitcoin with no immediate dilution and no interest burden, only long-term risk if the stock price underperforms.

Case 1: Outperform Scenario, Stock Price Increases

- MicroStrategy issues convertible notes to investors.

- It receives $3B in capital now, and uses it to purchase Bitcoin.

- Since the notes carry 0% interest, MicroStrategy pays no interest during the life of the bond.

- MSTR stock outperforms → price exceeds the threshold.

- Investors convert their bonds or get principal.

- MicroStrategy does not repay principal in cash. Instead, it issues new shares.

Case 2: Underperform Scenario, Stock Price Declines

- MicroStrategy issues convertible bonds to raise capital and buys Bitcoin.

- Since the notes carry 0% interest, MicroStrategy pays no interest during the life of the bond.

- MSTR’s stock price declines, remaining below the conversion price throughout the bond’s life.

- Investors do not convert, conversion would be a loss.

- Upon maturity, MicroStrategy repay the full principal.

- If cash reserves are low, it may need to raise capital again to repay.

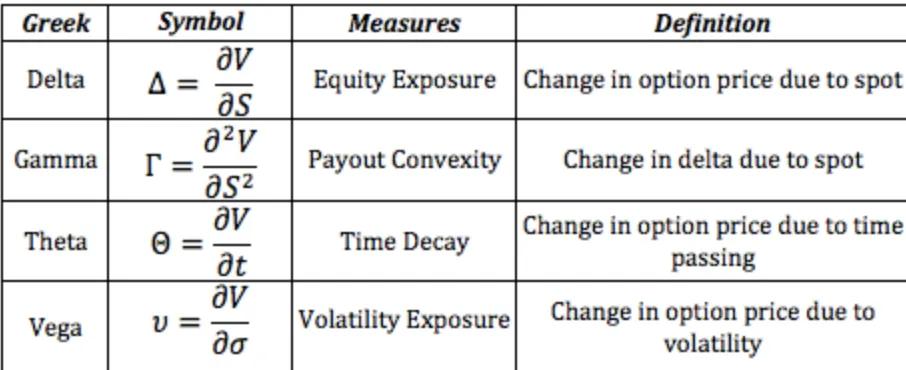

Quick review on option theory 101:

One thing worth emphasizing is that convertible bonds are fundamentally a combination of a straight bond and a call option on the issuer’s stock. In the case of MicroStrategy (MSTR), the company has consistently issued convertible bonds with 0% coupon rates, meaning investors receive no annual interest income.

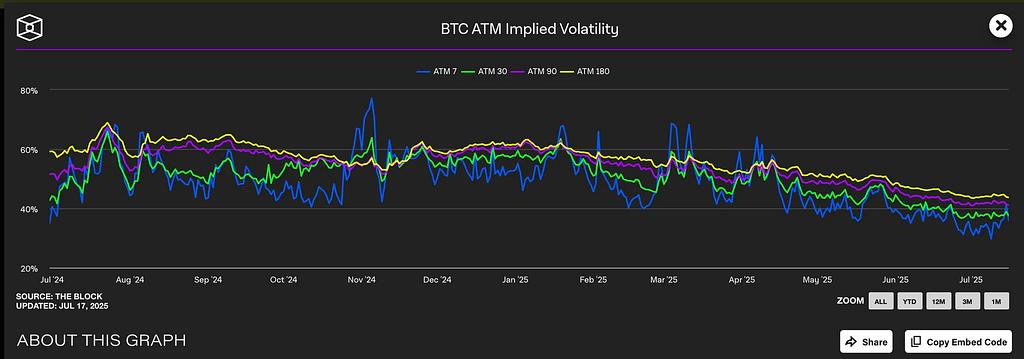

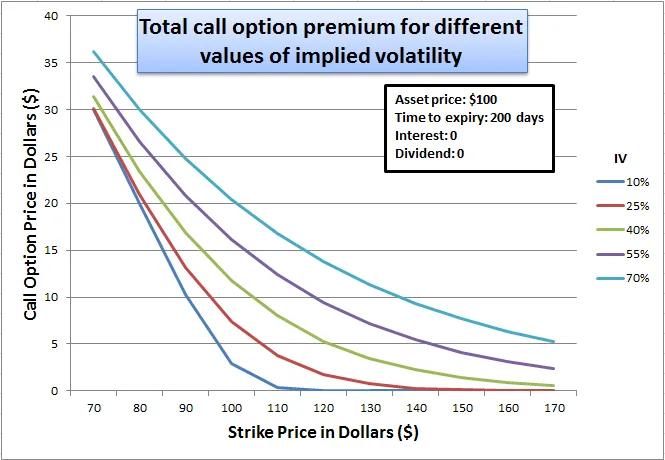

Why would sophisticated investors accept such unattractive terms? The answer lies in the embedded call option, the right to convert the bond into equity if MSTR’s stock rises above a predefined threshold. This option holds significant value, especially when implied volatility, because the greater the expected price swings, the more valuable the chance to capture upside.

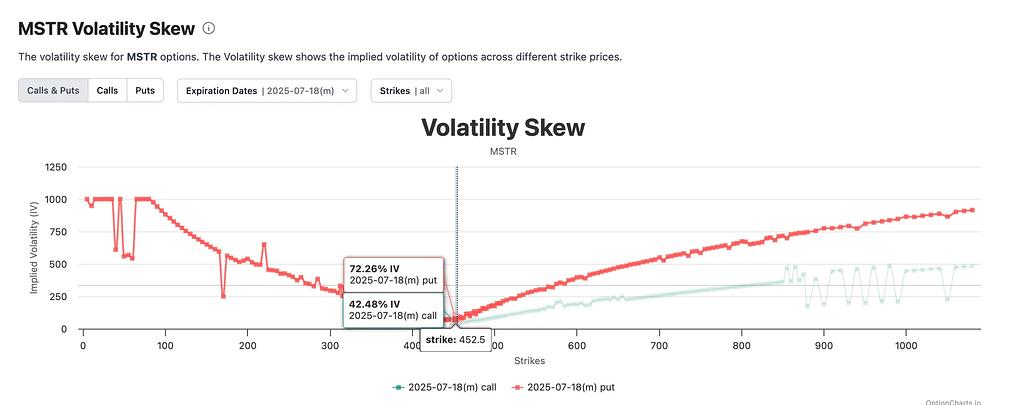

We observe that Bitcoin’s IV ranges from 40% — 60% across different tenors. Since MicroStrategy’s stock price is highly correlated with Bitcoin, this elevated BTC IV indirectly inflates the value of MSTR’s equity options.

At-the-money calls (strike ~$455) are trading at 45% IV, while corresponding puts are even higher, showing intense market expectation for volatility. Such a volatility regime amplifies the value of the embedded call option within MSTR’s convertible bonds.

In effect, MicroStrategy is able to “sell” this call option to investors at an expensive price. The more a stock (or underlying asset) moves, the greater the chance an option will end up “in the money”. That can make calls more expensive when volatility is high.

From the investor’s perspective, this is acceptable because they are essentially buying a leveraged volatility bet, if the stock soars, they convert into equity and benefit massively; if it doesn’t, they still recover principal at maturity. For MSTR, this is a win-win: it raises capital without paying interest or immediately diluting shareholders, and if its Bitcoin strategy succeeds, it can service or refinance the debt through stock appreciation alone. In this context, MSTR isn’t just issuing debt, it’s monetizing volatility and trading future upside for cheap capital today.

Gamma trading plays a central role in the functioning and sustainability of MicroStrategy’s capital structure, especially in the context of its repeated convertible bond issuances. The company has issued billions of dollars worth of convertible debt at 0 rates, relying on the embedded call options to make these bonds attractive. But the buyers of these instruments are not typical long-term bondholders. Instead, they are often market-neutral hedge funds who engage in gamma trading.

Short float refers to the percentage of a company’s total publicly tradable shares (the float) that are currently sold short.

Only SBET does not issue convertibles, but only do large PIPE (Private Investment in the Public Market) and ATM equity mechanism, which shows a lower short float.

Mechanics of Gamma Trading in MSTR:

- The Basic Trade:

- A hedge fund buys MicroStrategy’s convertible bonds (which are bonds + call options).

- Simultaneously, it shorts an appropriate number of MSTR shares to remain delta-neutral

2. Why It Works:

- If MSTR stock goes up, the embedded call option in the convertible bond becomes more valuable faster than the short loses money.

- If MSTR stock goes down, the short position gains value faster than the bond (including its call option) loses value.

- This convex payoff profile enables hedge funds to profit from volatility, not the direction, of MSTR stock.

3. Gamma and Rebalancing:

- As MSTR stock moves, the hedge fund must constantly rebalance its short position to remain delta-neutral.

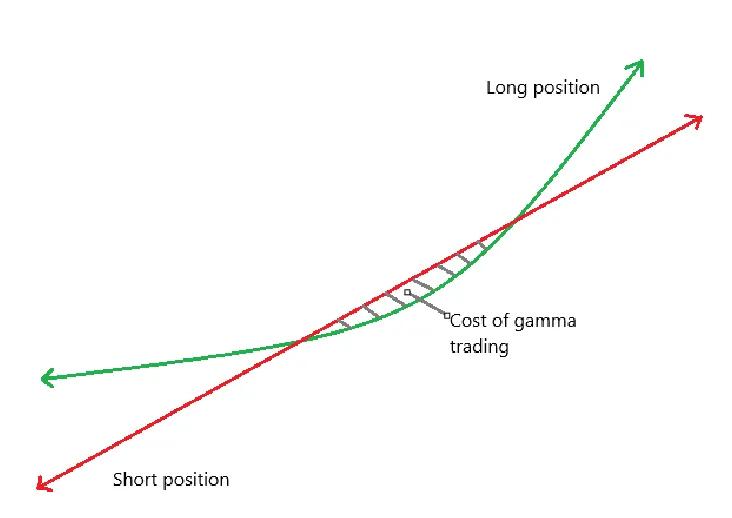

- In a gamma trading approach, the initial hedge is set proportional to the bond’s delta, neutralizing immediate stock exposure. For example, if a convertible bond has a delta of 0.5, the arb fund will short $50 of MSTR stock for every $100 of bond purchased. This creates a position whose value is insensitive to small stock moves, if MSTR’s share price rises $1, the bond might gain ~$0.50 while the short stock loses ~$0.50, roughly canceling out. However, as the stock moves more, the bond’s delta itself changes (this rate of change is the gamma). If MSTR’s stock rises significantly, the bond behaves more like stock and its delta increases; the trader must short additional shares to remain delta-neutral. Conversely, if the stock falls, the bond’s delta drops (becoming more bond-like), and the trader buys back some shares to maintain neutrality.

- This process of frequent rebalancing, selling shares on rallies and buying on dips, is known as gamma trading.

- Yet, when the stock price moves, the bond’s delta changes non-linearly. You constantly rebalance your short stock position to stay delta-neutral.

- Green: Payoff of holding the convertible bond.

- Red: Payoff of shorting the underlying stock.

- Net P&L = green curve − red line, if the stock trades sideways, near the conversion zone, the frequent rebalancing to maintain delta neutrality causes you to lose money, represented by the shaded “Cost of Gamma Trading” area.

4. Implication for MSTR’s Premium:

- These gamma hedgers are not long-term holders. They are not betting on Bitcoin or Saylor’s vision. If the conversion bond meets the target price, delta becomes 1, then there will be low gamma.

- If gamma trading becomes unprofitable (e.g., due to falling realized volatility or tightening spreads), these funds will exit, removing a key source of demand for MSTR’s convertibles.

5. Second-Order Effects:

- MicroStrategy’s convertible bonds tend to have low/zero coupons, but long durations → low theta

- When volatility drops too low, gamma traders exit, convertible bond sales become harder, Gamma PnL≪ Theta Drag, where value of short options drop over time.

3. Performance

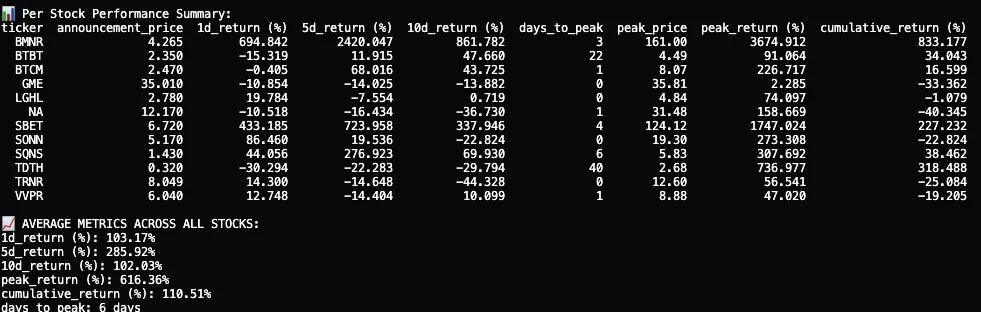

We tracked and analyzed the stock price reactions of react 12 public companies following their first-ever crypto treasury announcements or major change in their crypto treasury in 2025. Our dataset includes price data surrounding the announcement date, candlestick visualizations, and performance metrics.

The stock price response to first-time crypto treasury announcements in 2025 was, on average, explosive, short-lived, but still had positive cumulative return to the stock.

Across 12 public companies, the average 1-day return was +103.17%, indicating strong immediate investor reaction. The 5-day return surged further to +285.92%, with a tapering effect by day 10, settling at +102.03%. While some companies posted mild or negative returns, several experienced extreme spikes.

Example

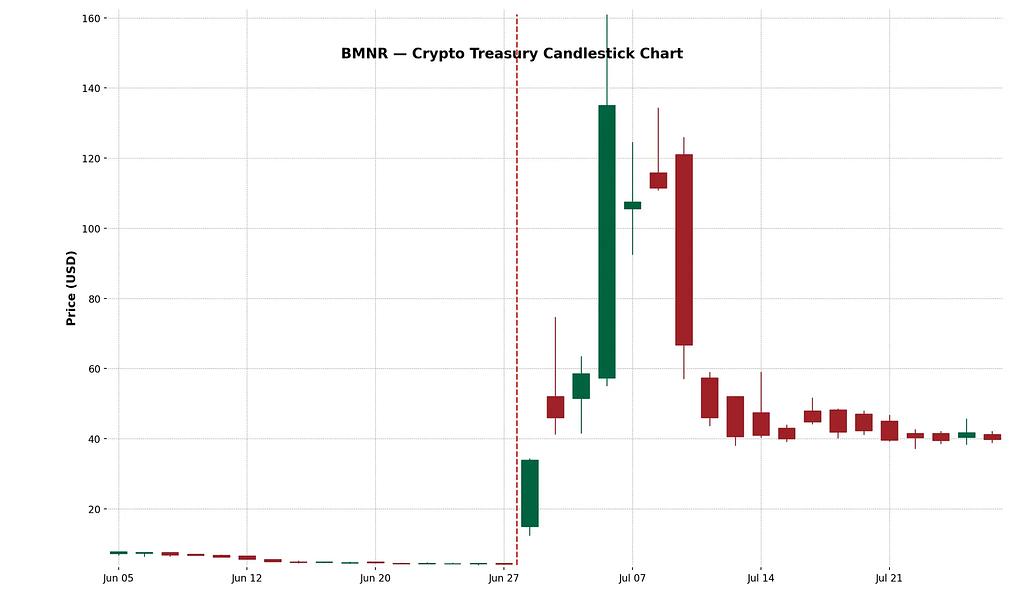

BitMine Immersion Technologies Inc. (NYSE-American: BMNR) is a Las Vegas-based blockchain infrastructure company that operates industrial-scale Bitcoin mining sites, sells immersion cooling hardware, and hosts third-party mining equipment in low-cost energy regions such as Texas and Trinidad. On June 30, the firm raised roughly $250 million via a private placement of 55.6 million shares priced at $4.50 each to scale its Ethereum treasury.

The stock surged from $4.27 to a peak of $161 within three days, representing a +3,674.9% return from announcement price to intraday high. This extraordinary rally, likely fueled by thin float, high retail interest, and FOMO-driven momentum, corrected sharply after, ending with a +882.4% cumulative return over 2 weeks. Despite a steep drawdown, the initial gains highlighted how markets reward bold treasury shifts, especially when they resemble MicroStrategy-style conviction.

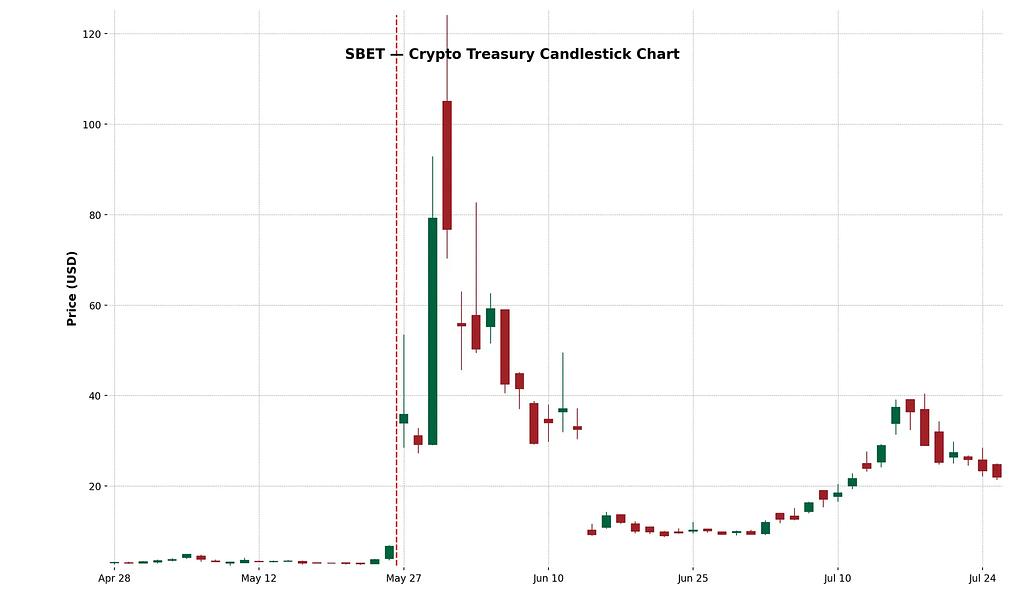

Founded in 2019, SharkLink Gaming Ltd. (Nasdaq: SBET) is an online technology company that converts sports fans into bettors by pairing them with timely sports betting and interactive gaming offers through its proprietary platform. SharpLink began amassing ETH on its balance sheet, financing these purchases through a combination of private investments in public equity (PIPEs) and at-the-market (ATM) offerings.

The stock initially responded with euphoria: SBET surged +433.2% on day one, peaking at +1,747% within four trading days. This dramatic rally was fueled by both the size of the crypto allocation and the high-profile names backing the deal. Retail investors, crypto-aligned funds, and speculative traders piled in, pushing the stock above $120.

However, the rally was short-lived. On June 17, SharpLink filed an S-3 registration statement with the SEC, which allows PIPE investors to potentially resell their shares. This sparked widespread confusion. Many interpreted the filing as evidence that major backers were dumping their positions. While Consensys co-founder and SBET board chair Joseph Lubin clarified that no shares had actually been sold, the clarification came too late: SBET stock crashed nearly 70%, erasing a majority of the post-announcement gains.

Despite this sharp correction, SBET’s cumulative return remained at +441.7%, indicating the market still assigns substantial long-term value to the ETH treasury move. The drawdown from peak was 33.9%, but the resilience in later weeks shows continued belief in the firm’s thesis. Notably, the stock saw renewed accumulation in July, suggesting that investor confidence in the Ethereum-as-reserve model is regaining strength.

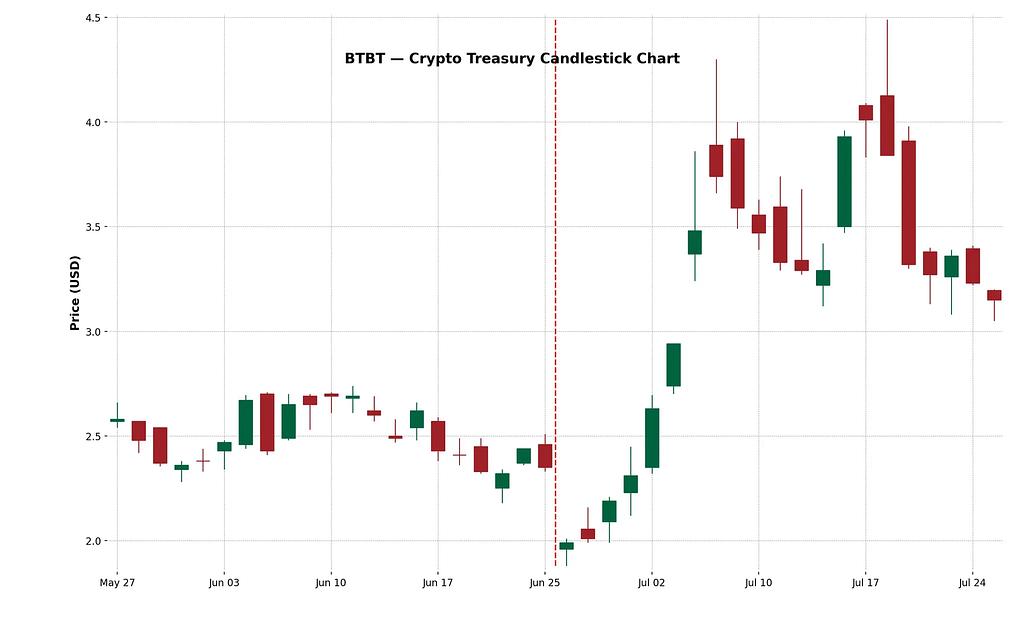

Bit Digital Inc. (Nasdaq: BTBT) is a New York-based digital asset platform founded in 2015 that originally operated industrial bitcoin mining farms in the United States, Canada and Iceland.

In June 2025, the company executed a fully underwritten public follow-on offering that raised roughly $172 million and, together with proceeds from selling 280 BTC, redeployed the capital into Ethereum, amassing about 100,603 ETH and completing its pivot to an Ethereum staking and treasury model under CEO and crypto veteran Sam Tabar.

Initial response was weak (–15% on day 1), but the price began a steady rise over the next two weeks, ultimately gaining +83% at peak. The measured reaction could reflect the market’s awareness that Bit Digital already operated in crypto mining. Nonetheless, a +70.6% cumulative return suggests that broadening crypto exposure still positively impacts perception, even for seasoned players.

Yet, GameStop (GME), which in May 2025 announced its first-ever Bitcoin purchase, following a broader pivot into crypto-aligned consumer gaming infrastructure. Despite massive retail interest and the symbolic weight of a Bitcoin treasury move by a cultural meme stock icon, GME posted negative 5-day and 10-day returns following the announcement. This disparity underscores a core insight: positive crypto news alone is not enough to sustain price appreciation.

GameStop’s Bitcoin move drew doubt because its retail business remains floundering and the pivot arrived amid repeated strategy changes.

It failed to sustain an uptrend appears tied to skeptical markets and lack of clear operational change. The company’s core revenue base was still shrinking, and executives offered little beyond the crypto bet. Messaging was mixed, GME leapt from one focus to another (stores, NFTs, metaverse, now crypto), which undermined confidence.

Crypto Performance

Beyond Bitcoin, a growing number of companies have begun favoring Ethereum (ETH) as their primary crypto treasury asset. The rationale is multifaceted. First, Ethereum is widely viewed as the foundational layer for real-world asset (RWA) tokenization platforms, including protocols like Ondo, Backed Finance, and Centrifuge, all of which are building institutional-grade financial products atop Ethereum’s settlement layer. This makes ETH a strategic reserve for firms betting on the tokenization of traditional finance.

Second, unlike Bitcoin, Ethereum is yield-bearing through staking, defi composable, offering 3–4% annualized rewards directly to holders who participate in securing the network. This transforms ETH into a form of programmable, income-generating capital, a compelling narrative for CFOs seeking returns on idle treasury funds.

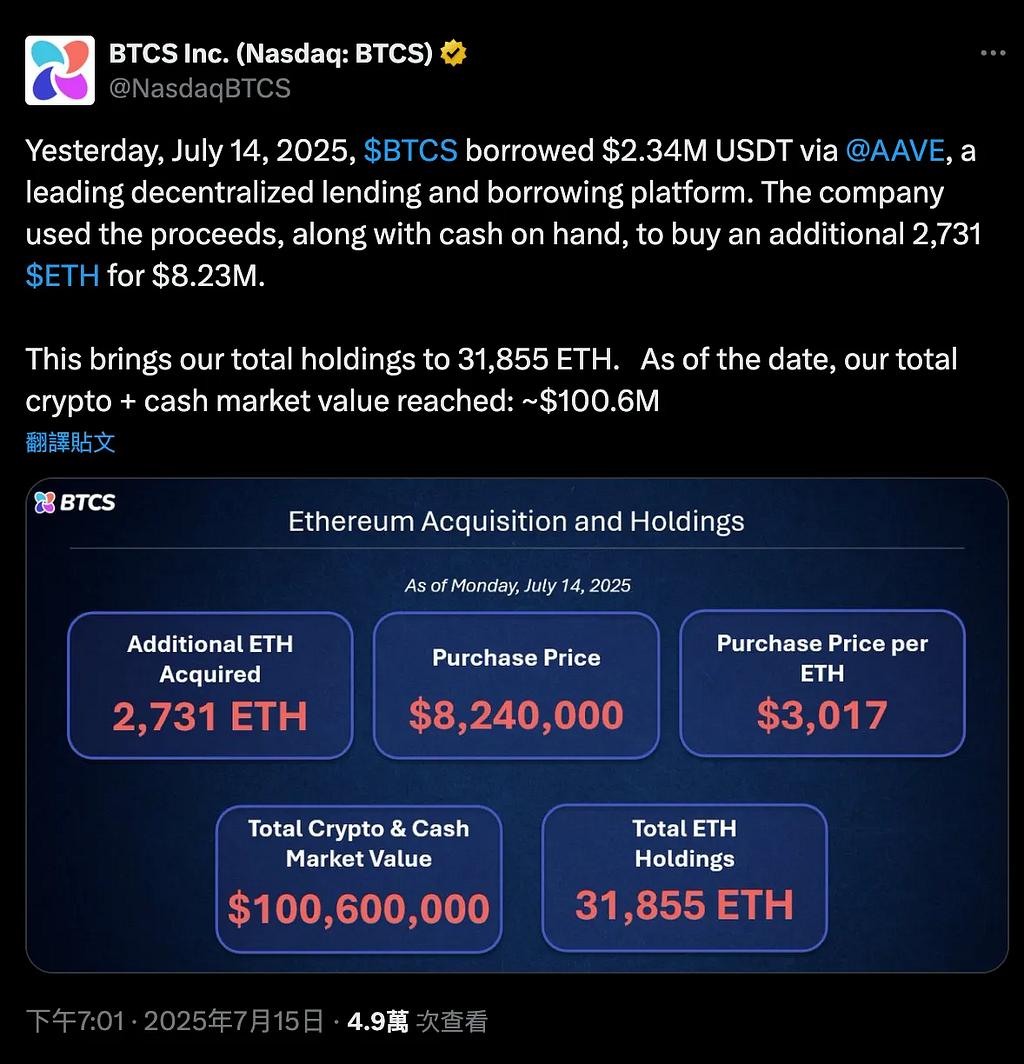

On July 14, 2025, BTCS borrowed $2.34M USDT via Aave, a decentralized lending protocol, and combined it with cash to purchase 2,731 ETH for $8.24M, adding to its growing Ethereum balance sheet. This leveraged transaction increased BTCS’s total ETH holdings to 31,855 ETH, pushing its crypto + cash market value to $100.6M.

This move exemplifies how ETH uniquely serves as both collateral and capital in the DeFi ecosystem. While Bitcoin is largely inert and custodial in nature, held in cold wallets or wrapped for limited DeFi exposure, Ethereum is natively composable, allowing companies to borrow, stake, or deploy it across yield-generating protocols without exiting their position.

Third, the emergence of Ethereum ETFs has bolstered institutional confidence and liquidity, with net inflows signaling mainstream acceptance. As a result, companies like SharpLink (SBET), Bit Digital (BTBT), and even private market players are increasingly aligning their balance sheets with ETH, not just for speculative upside, but to express a long-term thesis on Ethereum as the infrastructure of decentralized capital markets. This shift marks a key evolution in the crypto treasury trend: from Bitcoin as digital gold to Ethereum as digital rails.

A few notable examples of this trend:

- XRP Treasuries: VivoPower International (NASDAQ: VVPR) raised $121 million in May 2025, led by a Saudi prince, to become the first public company pursuing an XRP reserve strategy. Not long after, Trident Digital Holdings (NASDAQ: TDTH) in Singapore announced plans for up to $500 million in stock issuance to fund an XRP treasury reserve. And in China, Webus International (NASDAQ: WETO) filed to allocate $300 million to XRP holdings, aiming to integrate Ripple’s payment network into its business. These moves were inspired by Ripple’s legal clarity in the U.S. and the idea that XRP could serve as a cross-border settlement asset. The market reactions were mixed, XRP itself was on an upswing in mid-2025, so these stocks saw trading spikes, though not all sustained. But they signaled a diversification of the treasury narrative beyond Bitcoin/Ethereum.

- Litecoin Treasury: MEI Pharma (MEIP), a small-cap biotech, pulled an eyebrow-raising pivot in July 2025 by raising $100 million (with participation from Litecoin’s founder Charlie Lee and the Litecoin Foundation) to launch the first institutional Litecoin treasury reserve. MEIP’s move was packaged with leadership changes (Lee joining the board) and was seen as a play to apply crypto capital to a struggling sector (biotech). The stock initially popped on the news of “Litecoin in a pharma company,” though it remained volatile as investors tried to grasp the endgame. It’s an example of how even lesser-known coins like LTC found their way into corporate treasuries.

- Hyperliquid (HYPE) Token: In one of the more exotic pivots, Sonnet BioTherapeutics (SONN) announced an $888 million reverse merger in July 2025 to form Hyperliquid Strategies Inc., which would hold about $583 million worth of HYPE tokens (a DeFi “hyperliquidity” token) on its balance sheet. This deal, backed by major crypto VCs like Paradigm and Pantera, aimed to create the largest public company holding the HYPE token. SONN’s stock soared on the announcement (HYPE was a hot new thing), though skeptics noted the complex structure and the fact that much of the valuation was tied to a very young token. Similarly, Lion Group (LGHL), a fintech firm, secured a $600 million facility to accumulate HYPE as well as Solana (SOL) and Sui tokens as reserves — a multifaceted approach to building a crypto war chest.

4. When Would Saylor Sell?

Michael Saylor has famously claimed that MicroStrategy will “HODL” its Bitcoin forever, that is, the company has no intention to sell its BTC holdings, ever. In fact, MicroStrategy even updated its corporate policy to state Bitcoin is its primary treasury reserve asset, implicitly meant for the very long term. However, in the pragmatic world of corporate finance, never say never. There are conceivable scenarios where MicroStrategy could be forced to liquidate some Bitcoin, despite its long-term conviction. Understanding these scenarios is crucial, because they represent risk factors to the whole thesis of MicroStrategy as an unshakeable Bitcoin proxy.

Here are some situations that might test MicroStrategy’s resolve and potentially compel a Bitcoin sale:

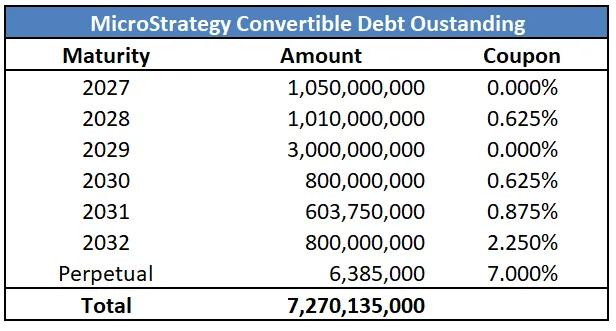

Major Debt or Bond Maturities in a Tight Credit Market: MicroStrategy has several tranches of debt outstanding, including convertible bonds (due 2028 and 2030, after it redeemed its 2025 and 2027 notes in equity) and potentially other loans. Normally, companies refinance debt by issuing new debt or equity. MicroStrategy successfully did this in early 2025, redeeming a 2027 convert by converting it to shares, thus avoiding a cash payout. But imagine a scenario where a big maturity is looming and market conditions are poor: say in 2028, Bitcoin is in a deep bear market, MicroStrategy’s stock is down, and interest rates are high (so new borrowing is very expensive). If a $500 million–$1 billion debt came due then, MicroStrategy could face a cash crunch.

- In this scenario, traditional capital markets may shut off, especially if IV is too low to attract convertible bond buyers who rely on the value of the embedded option. This eliminates one of MicroStrategy’s most effective financing tools.

- In such a credit crunch scenario, selling some Bitcoin to raise cash might be the only feasible way to retire or service debt without default. Essentially, the company would have to liquidate some of its reserve to pay the bills, akin to a margin call. The scale of MicroStrategy’s BTC holdings (over $70B worth in 2025) provides some solace that they could sell a few thousand BTC and cover a lot of obligations. But it would be a drastic step and probably only undertaken if refinancing options completely dried up.

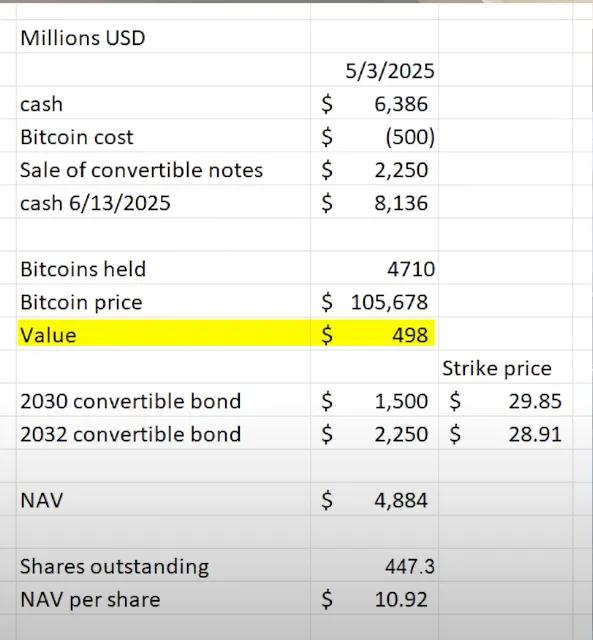

Soaring Interest Burden or Preferred Dividends: MicroStrategy’s financing model provides flexibility, but it isn’t free. As of 2025, the company is on the hook for:

- 8% dividend on STRK (can be paid in stock or cash)

- 10% cash dividend on STRF (non-deferrable without penalty)

- 9–10% on STRC, paid monthly in cash, with board-adjustable rates

- Interest on convertible bonds (albeit low-rate legacy notes like the 0.625% 2030s)

Combined, these annual fixed obligations exceed $180M, as shown in their investor presentation, and will likely rise as new capital is raised.

- But in a crypto winter scenario, MicroStrategy might find itself burning cash to meet these obligations, especially STRF and STRC which demand cash dividends. If Bitcoin’s price plunged and stayed low for years, the company’s leverage becomes dangerous. The board could decide to sell a chunk of BTC to fund a year or two of interest/dividends, essentially to buy time in hopes of a recovery. It would be a reluctant move, but less harmful than failing to pay and defaulting on preferred dividends (STRF is cumulative, so missed payments compound and could eventually trigger defaults or other restrictions).

What Happens if Interest Rates Rise? If the Fed continues to raise rates, all of MicroStrategy’s future capital raises become more expensive:

- New preferred issuances will require even higher dividend yields to attract investors (e.g., >10%)

- Convertible bonds become harder to sell unless IV is high (which often isn’t the case in bear markets)

- Equity dilution becomes more painful if MSTR’s stock price is suppressed

In other words, the cost of capital surges, but revenue remains flat and BTC may be trading down.

In summary, MicroStrategy would only sell its Bitcoin under duress or fundamental strategic shift. The scenarios are mostly around financial stress: inability to roll debt, an untenable cost of capital, or a market discount that threatens the company’s value. In normal conditions, Saylor’s strategy is to keep buying or at least holding, not selling. In fact, the company has demonstrated this commitment; for example, during the crypto market dip of 2022–2023, MicroStrategy did not sell any Bitcoin (even as some other corporates like Tesla sold a portion). That said, the company did do one subtle thing: it sold a small amount of equity and used the cash to buy back some of its own convertible bonds at a discount in 2022, effectively retiring debt cheaply rather than selling BTC. That shows management’s preference to avoid ever selling Bitcoin, they’ll try all other levers first.

5. Summary

MicroStrategy (MSTR) has pioneered a new corporate finance model, one in which a publicly traded operating company functions simultaneously as a leveraged Bitcoin holding vehicle. Through aggressive use of capital markets tools, particularly zero-coupon convertible bonds, MSTR has effectively monetized its equity volatility to accumulate over 600**,000 BTC** without relying on cash flow from operations. The core mechanism is simple yet powerful: issue equity or convertibles (21/21 plan or now 42/42 plan) when the stock trades at a premium to Bitcoin NAV (mNAV > 1), and deploy the proceeds into BTC. This cycle has proven sustainable because MicroStrategy’s stock consistently trades well above the mark-to-market value of its treasury, allowing it to add Bitcoin per share even while issuing new shares.

At the heart of this strategy lies the convertible bond, a hybrid security combining downside protection (bond floor) with equity upside (embedded call option). Investors accept 0% interest rates because the embedded call option is highly valuable in high-volatility regimes. In fact, MSTR is not just issuing debt, it is selling volatility, and doing so at a premium. In periods where implied volatility on BTC and MSTR is elevated (as seen in 2025), investors are willing to finance the company at zero yield in exchange for the right to participate in the next leg of crypto upside. This model transforms volatility into a financial asset, capital raised without interest, dilution delayed until stock outperformance.

However, the model is not without limitations. If implied volatility compresses, either due to market maturation or declining BTC momentum, the value of the embedded call option falls. This makes future convertible bond issuance less attractive and may force MSTR to either raise capital through traditional means or repay bonds in cash at maturity. Moreover, the ecosystem of gamma traders and volatility arbitrageurs that supports MSTR issuance is opportunistic; should volatility drop or sentiment turn, demand for its securities may dry up. While this isn’t a delta risk — since MSTR’s underlying exposure to BTC is well known, it is a low-gamma risk, where small changes in volatility expectations can sharply reduce the appeal of MSTR’s capital strategy.

Nonetheless, betting on companies like MSTR has become a favored strategy not only for institutional funds but also among retail investors who treat them as tradable proxies for Bitcoin upside. This speculative instinct echoes similar behavior on-chain, where crypto-native users are increasingly buying memecoins linked to crypto treasury firms or trading stocks like MSTR and SBET as narrative vehicles. Whether in traditional markets or DeFi, the thesis is similar: exposure to crypto-treasury companies offers leveraged, high-volatility bets on digital asset appreciation, and when timed well, delivers returns that rival the assets they hold.

In short, MicroStrategy has not merely adopted Bitcoin as a treasury reserve, it has invented a new financial structure around it. It is the first successful crypto treasury company, and its capital model may define how future firms approach treasury assetization, volatility capture, and shareholder value creation in a Bitcoin-centric financial world.

Sources:

Website:

- StrategyTracker - Real-Time Bitcoin Treasury Tracker

- An Introduction to Convertible Bonds

- A CFA Level 2 Discussion About Convertible Bonds Formulas Explained

https://www.theblock.co/data/crypto-markets/options/btc-atm-implied-volatility

https://finance.yahoo.com/quote/MSTR/financials/

https://finance.yahoo.com/quote/SBET/financials/

Video:

https://medium.com/media/aff55a2b8af1a2aec6c9ecf042f8a288/hrefhttps://medium.com/media/90a742338601b106e6e185b1d15753be/hrefhttps://medium.com/media/f22d483d397d2bbf7fcef802ed9470dd/hrefhttps://medium.com/media/d7c610bdf2e98e95c28fe29cc5773e1c/hrefhttps://medium.com/media/c694a6a29954396e9298cb024e046de9/hrefhttps://medium.com/media/80313e68c0be6fd03f206334effc31d6/hrefhttps://medium.com/media/35d9b3b7ac5b66d51aafd074ac11c2ff/hrefhttps://medium.com/media/091bf31858240f89255d7adbb0b975d5/hrefPerformance data from:

https://polygon.io/

The First Crypto Treasury Company: Inside MicroStrategy’s Leverage Flywheel was originally published in IOSG Ventures on Medium, where people are continuing the conversation by highlighting and responding to this story.