Ethereum (ETH) has recently reached its highest point in 7 months, but has not yet broken through the psychological resistance level of $4,000.

Altcoins showed impressive growth, but breaking through this important barrier may be difficult. As investors watch carefully, Ethereum's next move could determine the future price direction.

Ethereum Reaches Market Peak

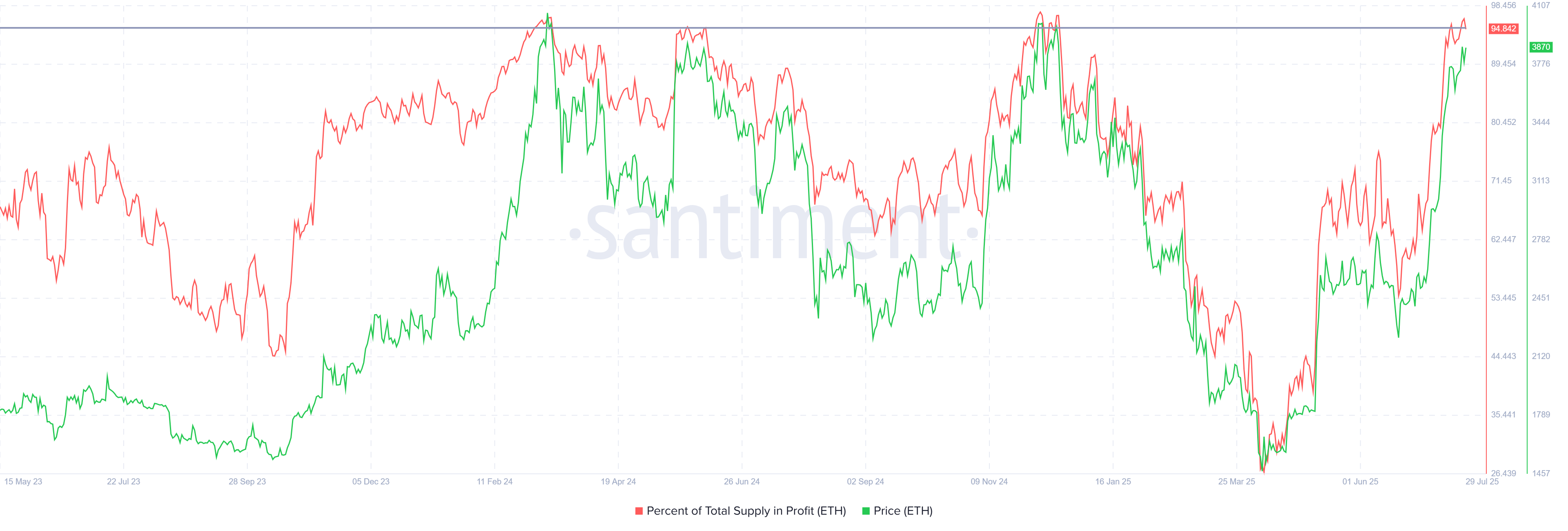

Currently, 94% of Ethereum's total supply is profitable. Historically, a profitable supply exceeding 95% indicates a market peak. This was followed by a price adjustment as investors began to secure profits. Therefore, Ethereum's price may experience an adjustment that could reverse its recent rise if this trend continues.

Market peaks often indicate that bullish momentum has reached saturation, with many investors starting to sell their holdings. This change could slow Ethereum's upward movement as the market reacts to potential saturation.

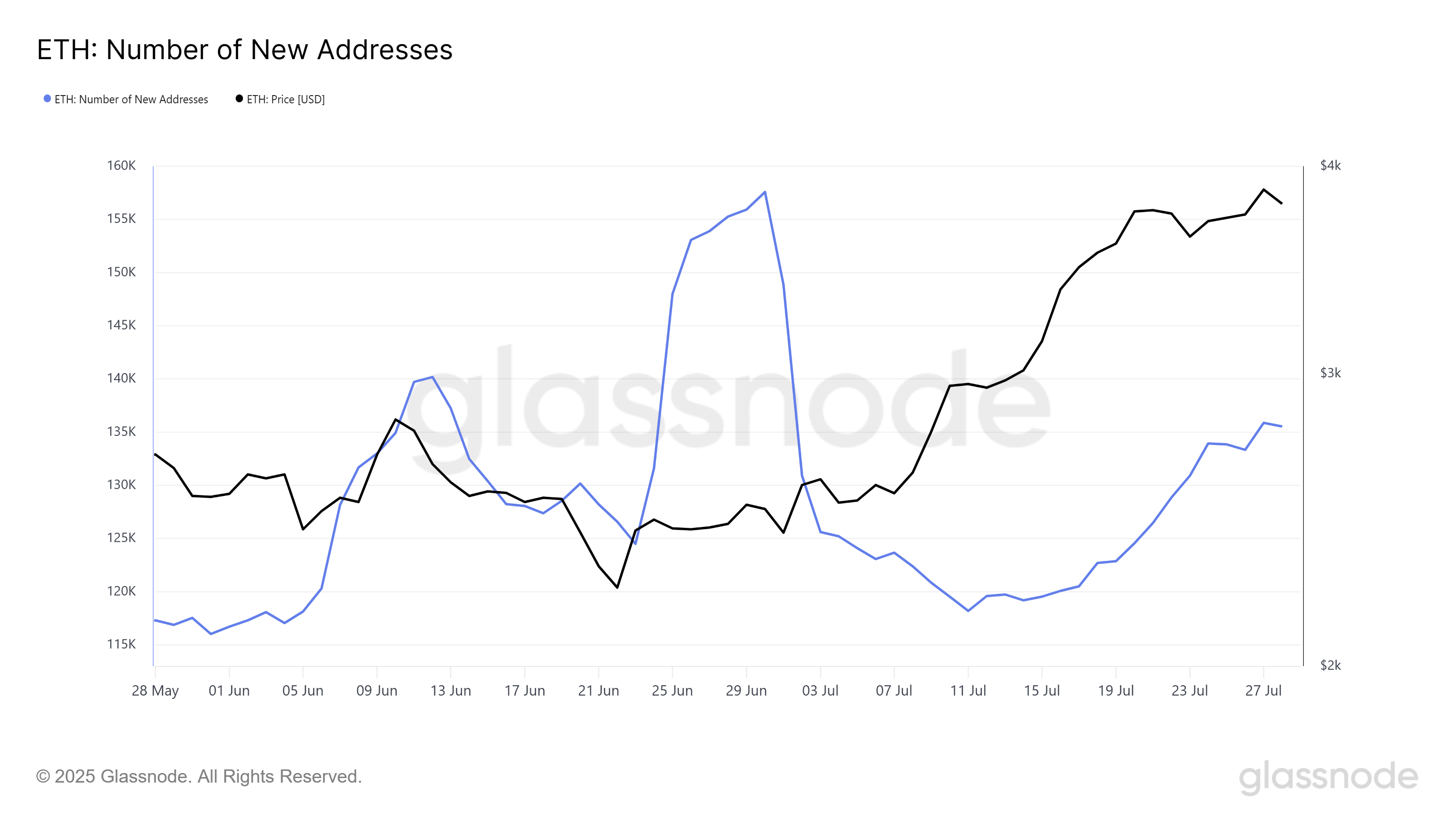

Ethereum's macro momentum showed mixed trends, focusing on new address activity. Early this month, the number of new addresses surged and then sharply decreased. However, recent data shows that new addresses increased by 13% over the past 10 days, rising from 119,184 to 135,532.

If this growth in new addresses continues, it could offset the impact of the market peak and help Ethereum maintain its price increase. New investors could strengthen demand for Ethereum, reducing the risk of market correction.

Ethereum Price Needs Increase

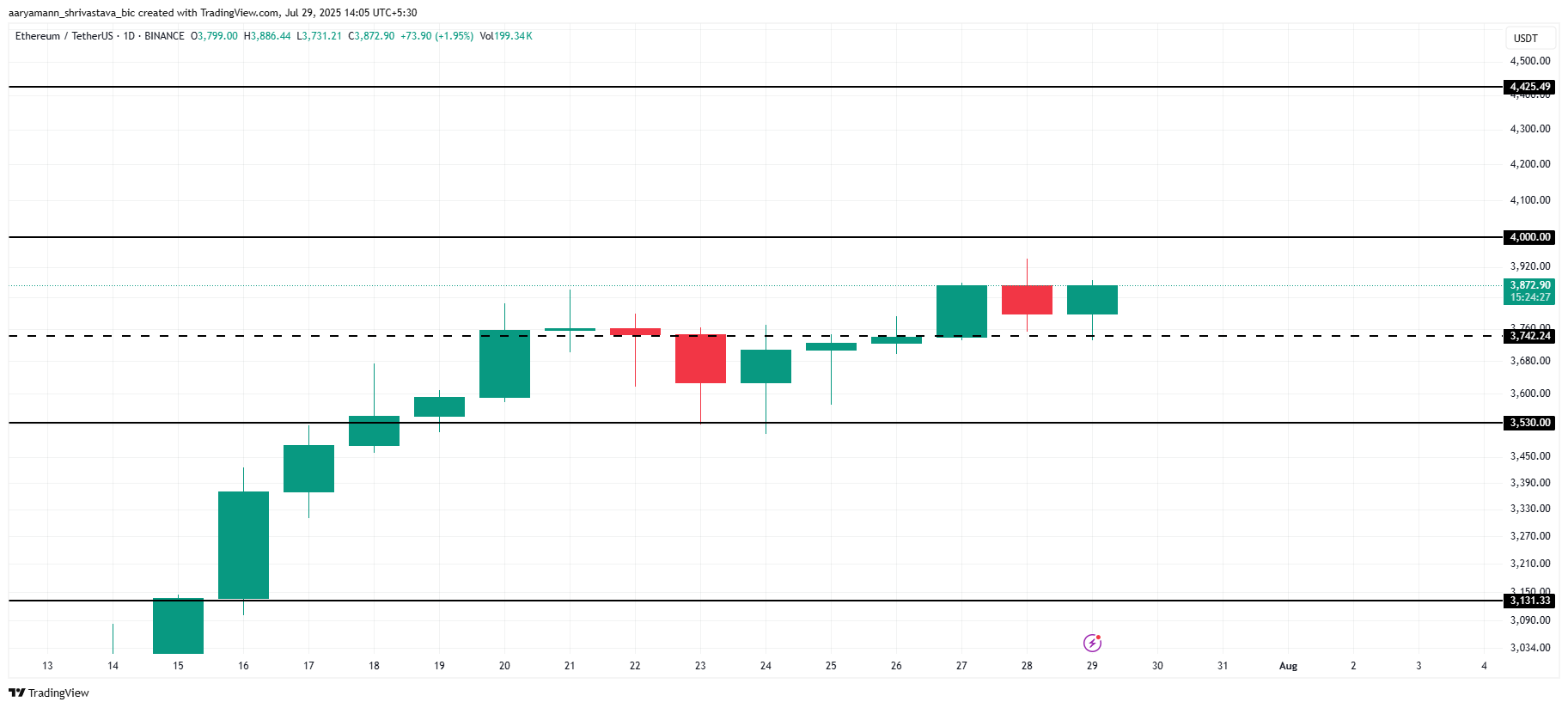

Ethereum's current price is $3,872, above the local support level of $3,742. Ethereum's price is approaching $4,000 but has not yet broken through. This resistance may continue, potentially limiting Ethereum's immediate further rise.

If the market peak signals a reversal, Ethereum's price could fall to $3,530 or lower. A sharp drop to $3,131 is also possible, potentially erasing much of last month's rise. Such a move would invalidate the bullish sentiment that drove Ethereum's growth.

On the other hand, if the influx of new addresses continues and strengthens, Ethereum could finally break through the $4,000 resistance. If this happens, Ethereum could rise to $4,425, with prices surging again. This would invalidate the bearish logic and push Ethereum into a new bullish phase.