Compiled by: TechFlow

Abstract: In the vast blockchain universe, Arbitrum is ambitiously building a "Digital Sovereign Nation." By driving DAO fiscal growth through high-profit block space and innovative revenue streams, it is weaving an ecosystem interwoven with technology, governance, and economic incentives. Let us witness the rapid development of this blockchain empire.

Key insights

Arbitrum’s development is guided by the vision of building a “ Digital Sovereign Nation, ” pioneering a model for how decentralized, on-chain entities can leverage their resources to increase demand for their products and grow their wealth.

Arbitrum offers a dual product : Arbitrum One, one of the most active and liquid networks, with $6.6 billion in stablecoin supply and $2.59 billion in DeFi TVL; and Arbitrum Orbit, a diverse ecosystem of 48 custom Arbitrum Chains running on the mainnet.

This dual offering executes the “Arbitrum Everywhere” strategy , giving developers the flexibility to leverage shared liquidity on Arbitrum One or custom create rollups with an “open and neutral blockspace” to meet the needs of a variety of emerging use cases.

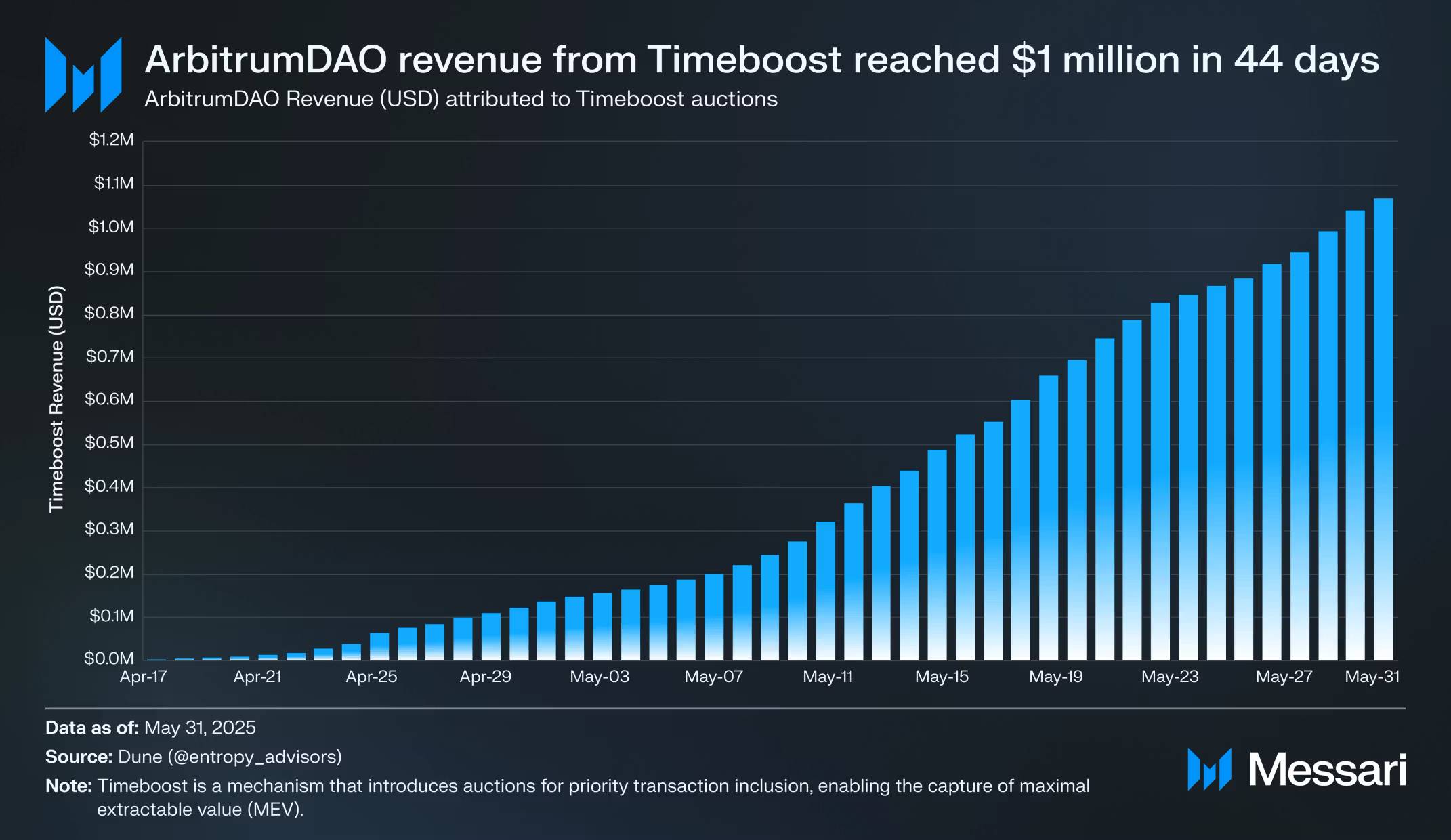

Arbitrum’s economic engine is driven by multiple on-chain revenue streams , including core protocol revenue and the Timeboost auction, which captures MEV and generated over $1 million in revenue for the DAO in the first 44 days after launch.

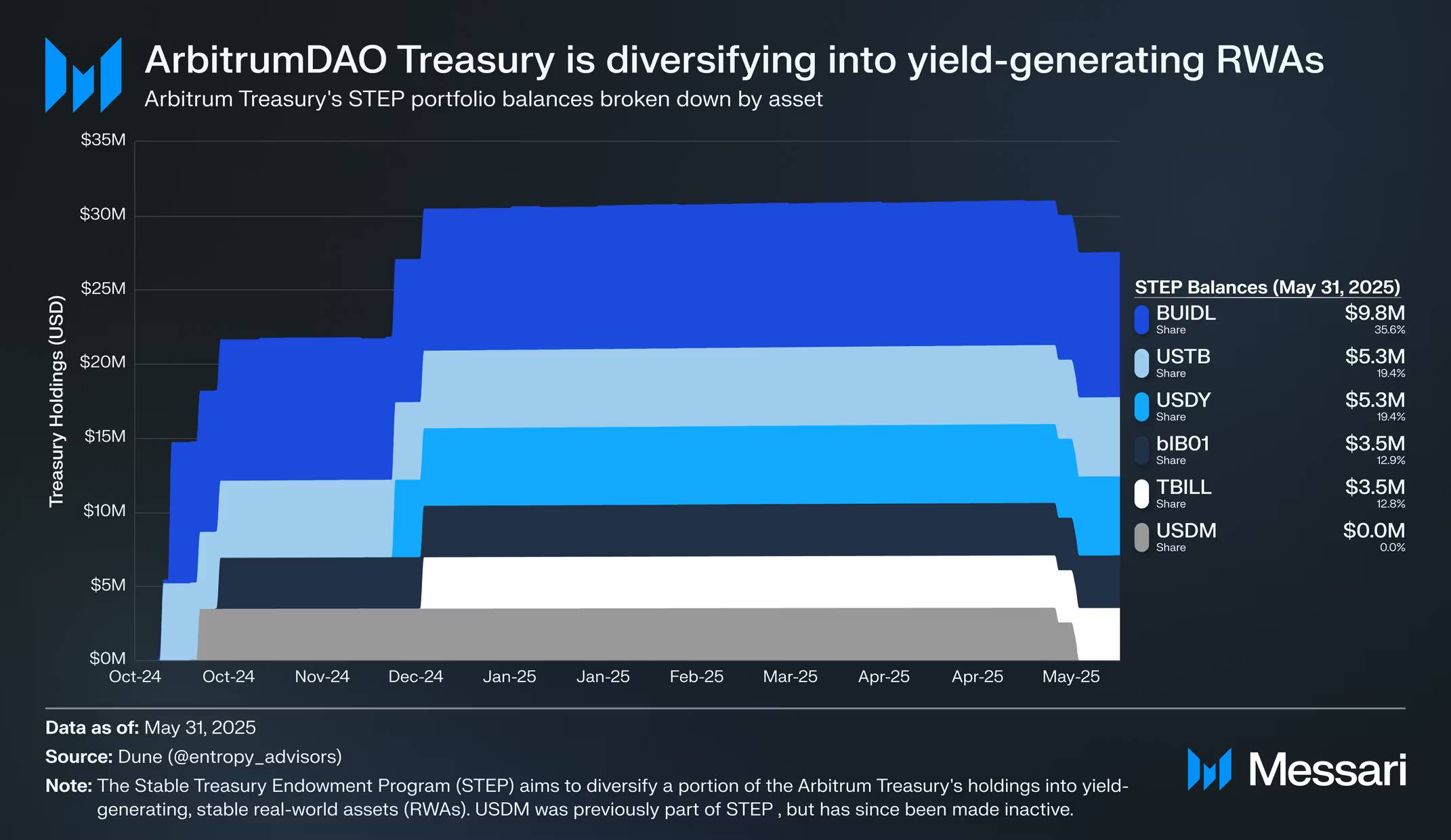

ArbitrumDAO leads the growth flywheel by deploying treasury assets to fund ecosystem investment initiatives and support economic pilot zones through initiatives such as the Stable Treasury Endowment Program (STEP) and Arbitrum Gaming Ventures (AGV).

Arbitrum Today

Arbitrum ( ARB ) is best known for its Arbitrum One , a Layer-2 blockchain that has become one of the most active , liquid , and high-performing blockchains in the cryptocurrency space. However, this only covers a portion of Arbitrum's offerings, which has evolved into a comprehensive, multi-product technology platform. Arbitrum's proposition consists of two distinct yet interrelated products, serving different market segments.

Arbitrum One: A flagship L2 Rollup with a shared execution environment offering EVM -like functionality. Its success is reflected in its year-to-date on-chain GDP of $214.9 million, TVL of $2.59 billion, and stablecoin supply of $6.6 billion, the highest values among L2s as of May 31, 2025.

Arbitrum Orbit: The Arbitrum Nitro technology framework enables projects to deploy customized L2 or L3 networks using the same underlying infrastructure as Arbitrum One. These Arbitrum Chains can be tailored to specific use cases while maintaining interoperability with the broader Arbitrum Orbit ecosystem.

This dual-product strategy enables Arbitrum to capture value from both shared infrastructure and custom deployment needs, addressing market segments that have historically been viewed as competing. Together, Arbitrum One and Arbitrum Orbit support the vision of “ Arbitrum Everywhere ,” positioning Arbitrum as the infrastructure layer for widespread adoption.

The "Arbitrum Everywhere" vision embodies a strategy to support the full application development lifecycle, from initial deployment on a shared liquidity layer to future migration to dedicated, custom networks as needs evolve. This vision is guided by three core pillars: performance, unification, and decentralization. The stated goal is to advance all three pillars simultaneously, rather than creating trade-offs between them.

Achieving this vision requires not only technological innovation but also a fundamental shift in project governance with the creation of the ArbitrumDAO in March 2023. This marks Arbitrum's transition from a project led by a single company under Offchain Labs to a decentralized protocol governed by ARB token holders. This move, designed to empower the community, reflects Arbitrum's core belief: Arbitrum's story goes beyond scaling Ethereum to redefine the decentralized spirit that embodied the original crypto dream.

With the ArbitrumDAO initialized and on-chain governance deployed, Arbitrum is poised for expansion. Specifically, Arbitrum will become a shared rollup ecosystem custom-built using Arbitrum Nitro and governed by the ArbitrumDAO. Arbitrum Orbit launched in October 2023, and has grown to 48 publicly announced Arbitrum Chains live on mainnet, lending credibility to the "Arbitrum Everywhere" slogan.

In 2025, Arbitrum embarked on a new phase of development , shifting its focus to building a vibrant on-chain economy. With the foundation of a " Digital Sovereign Nation " now laid, Arbitrum aims to be a model for how decentralized protocols can achieve long-term economic prosperity.

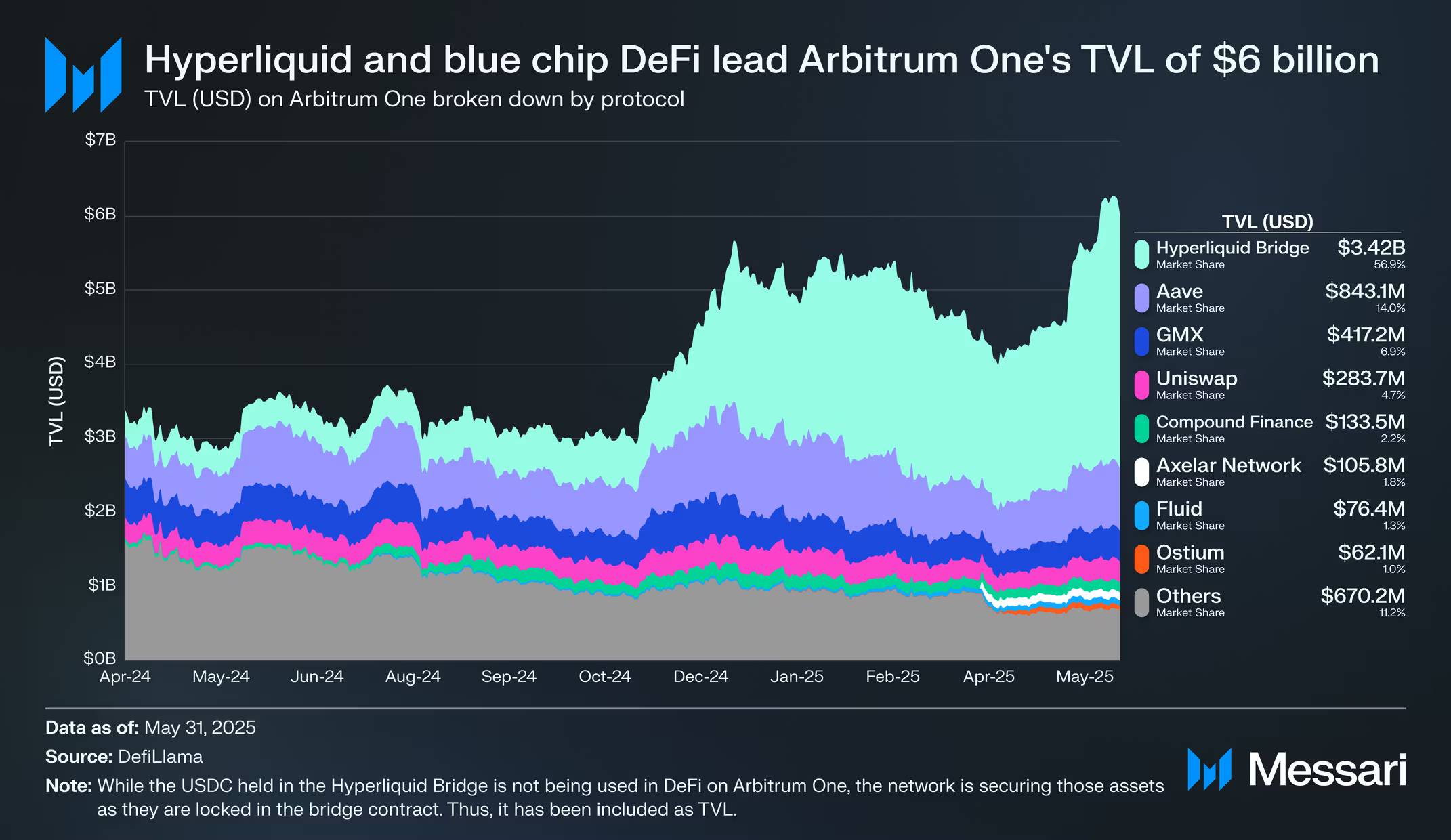

Arbitrum One

Arbitrum One's expertise stems from its focus on DeFi . It is the most liquid DeFi platform in the Arbitrum Orbit ecosystem, with a total value locked (TVL) of $2.59 billion in DeFi as of May 31, 2025. However, if Hyperliquid and Hyperliquid Bridge are included, Arbitrum One's TVL jumps to $6 billion. All of Hyperliquid Bridge's USDC liquidity comes from Arbitrum One, representing 56.9% of the TVL, or $3.42 billion.

Arbitrum One also boasts the largest L2 deployments of blue-chip DeFi protocols such as Aave ($843.1 million), Uniswap ($283.7 million), Compound ($133.5 million), and Arbitrum’s native GMX ($417.2 million). Additionally, Arbitrum includes emerging protocols such as:

Fluid : A lending protocol where deposited assets also power its decentralized exchange (DEX). For a comprehensive overview of Fluid, see Messari’s Initiation of Coverage report .

Ostium : A perpetual futures exchange for real-world assets (RWAs) . For an overview of the real-world perpetual futures market, including Ostium, see Messari’s report on “ Decentralization of Real-World Assets .”

Renegade : An on-chain dark pool that provides spot token trading while maintaining privacy and eliminating maximum extractable value (MEV) .

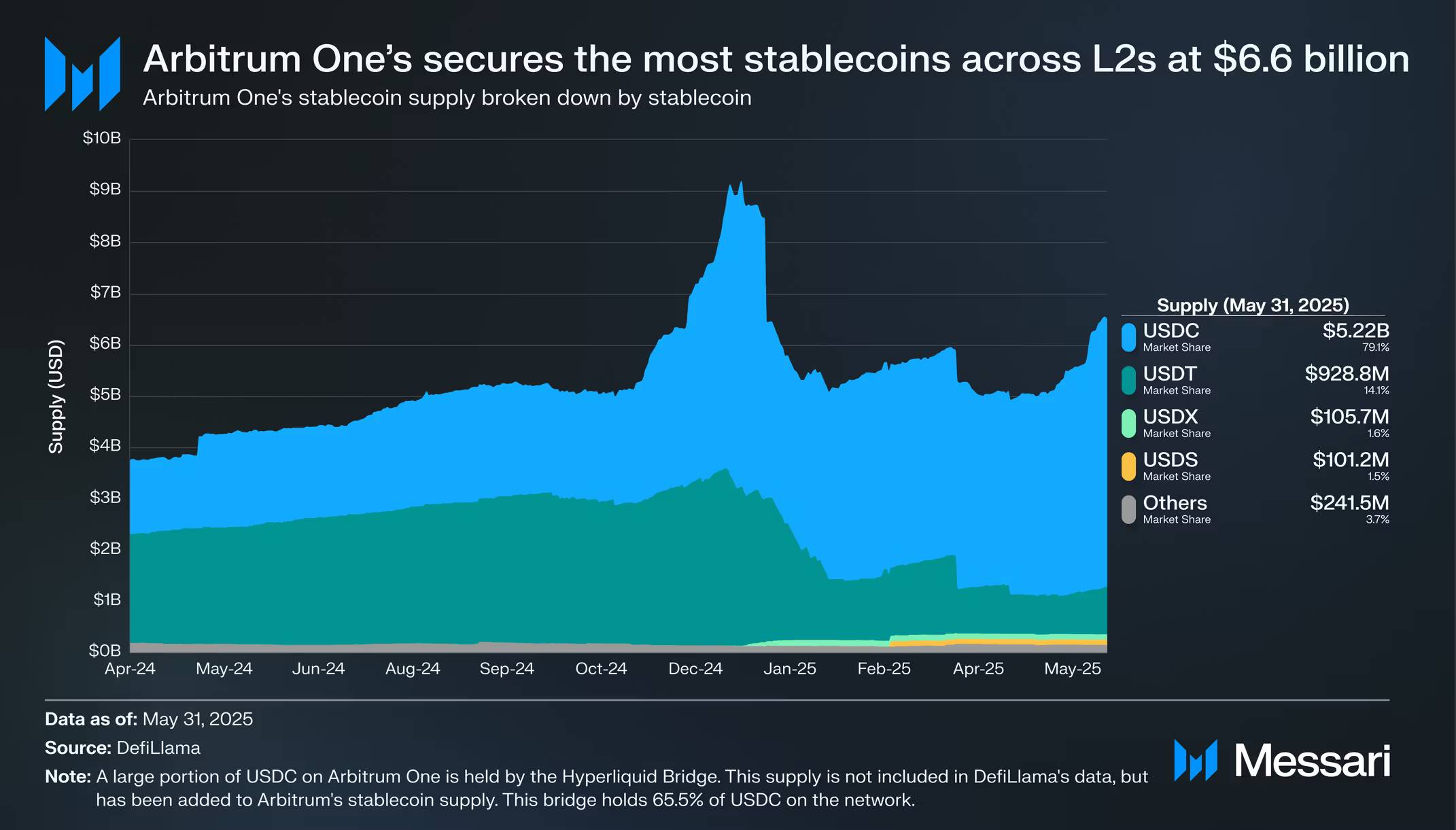

As of May 31, 2025, Arbitrum One's stablecoin supply was $600 million, the highest of all L2s. Hyperliquid Bridge held 51.8% ($3.42 billion) of all stablecoins on Arbitrum One ($6.6 billion). This made Circle the leading revenue-generating protocol on Arbitrum One year-to-date, generating $62.1 million in revenue from the network's stablecoin supply. USDT was the second-largest stablecoin on Arbitrum One, accounting for 14.1% of all stablecoins, or $928.8 million. In January 2025, USDT0 launched as a full-chain implementation of USDT, using Arbitrum One as its central liquidity hub .

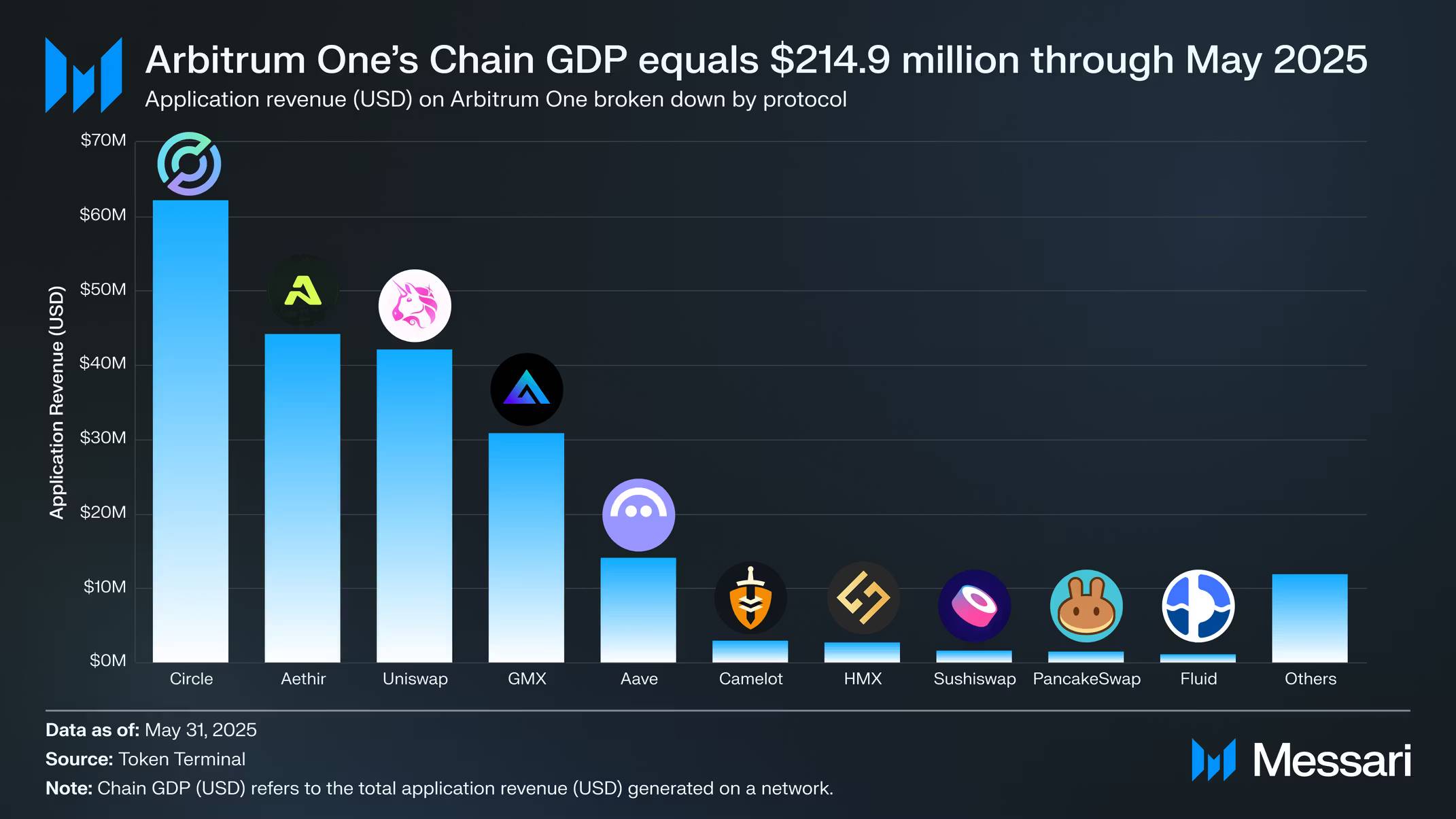

Arbitrum One’s on-chain GDP , or the total revenue generated by applications on the network, has reached $214.9 million from the beginning of 2025 to May 31, 2025. Uniswap, GMX, and Aave account for 40.5% of Arbitrum One’s on-chain GDP.

A network's Application Revenue Capture Rate (App RCR) is the ratio of revenue generated by its applications to their Real Economic Value (REV). For example, on Arbitrum One, REV is defined as the sum of base transaction fees, priority fees, and Timeboost auction revenue. As of May 31, 2025, the network's total REV reached $7.4 million, with a year-to-date App RCR of 2,904%. This means that for every $100 spent on fees and auctions on Arbitrum One, applications earn $2,904 in revenue.

A network's Application Revenue Capture Ratio (App RCR) can be greater than 1 if applications on the network successfully monetize their activity and/or transaction costs are low. In the case of Arbitrum One, both are achieved. A project's revenue stream can even flow to project token holders. For example, application revenue generated on GMX is partially shared with GMX stakers.

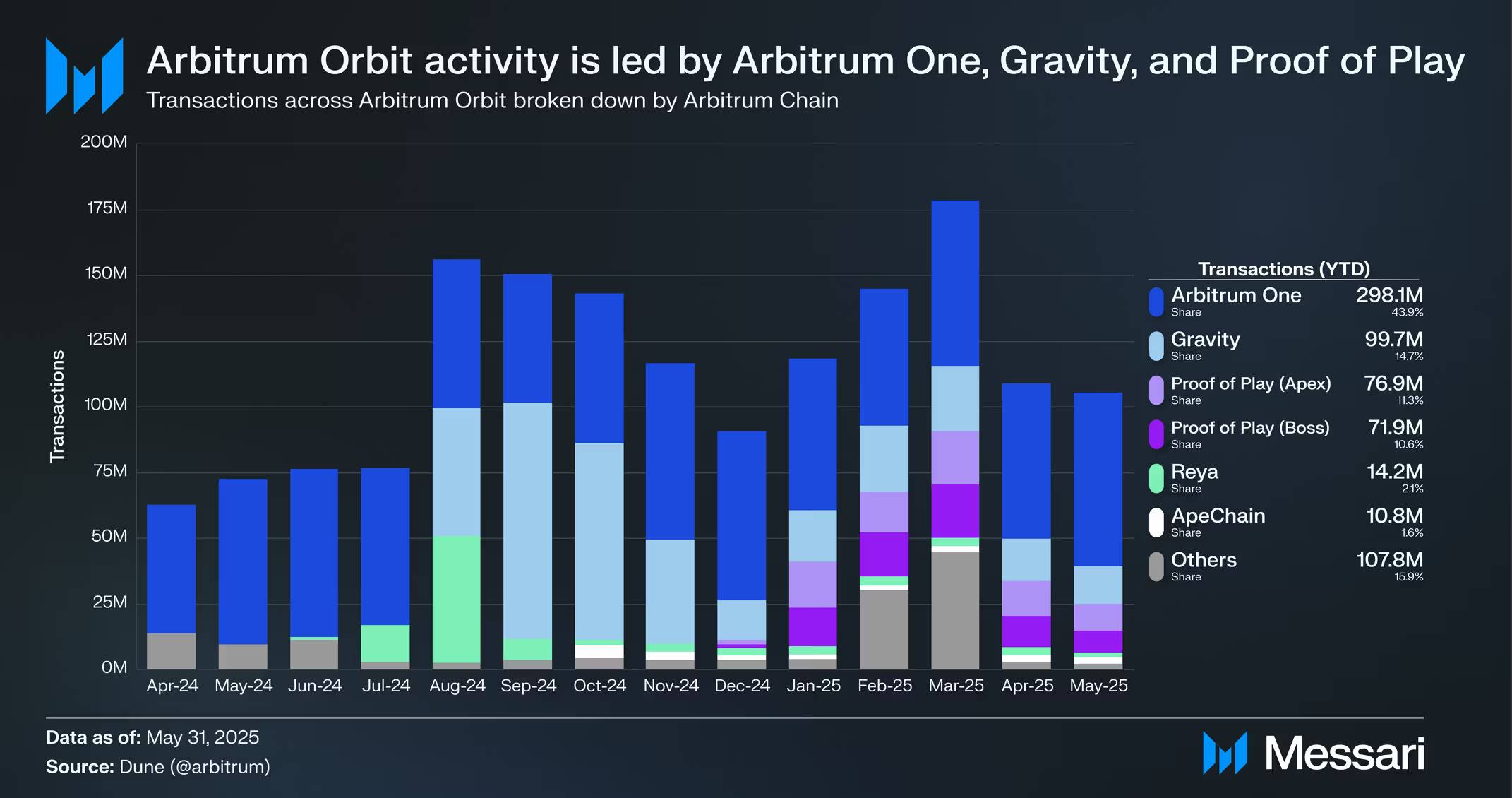

Arbitrum Orbit

Arbitrum Orbit launched its mainnet in October 2023, allowing anyone to launch their own Arbitrum Chains . Rollup-as-a-Service (RaaS) providers like Caldera, Gelato, Conduit, Alchemy, and AltLayer offer simplified rollup support for Arbitrum Chains like ApeChain , Proof of Play , and ReyaChain .

A key driver of Arbitrum Orbit's growth is its technical flexibility. The technology stack allows developers to customize the network at the network level, creating dedicated blockspaces for specific use cases. Customization capabilities include:

Custom Gas Tokens : Arbitrum allows Arbitrum Chains to use any ERC-20 token (usually the project's own token) as payment for network transaction fees .

AnyTrust Protocol : Arbitrum’s alternative data availability (DA) solution that optimizes performance by trusting the off-chain actions of the Data Availability Committee ( DAC). Notably, Arbitrum Nitro also supports external DA providers such as Celestia and EigenDA .

Layer-3s: Arbitrum allows Arbitrum Chains to act as L3s, which aggregate to L2s like Arbitrum One, rather than L1s like Ethereum.

Arbitrum Chains can settle on L1 chains like Ethereum, similar to L2 chains, or on L2 chains like Arbitrum One, similar to L3 chains. As of May 31, 2025, the Arbitrum Orbit ecosystem includes 48 officially announced Arbitrum Chains live on mainnet, with an additional 38 currently in testnet or development. Arbitrum Orbit has over 1.1 million weekly active addresses, a total value locked (TVL) of $13.7 billion, and 1.89 billion transactions, accounting for 31.8% of all L2 transactions.

Arbitrum's Economic Engine

Digital Sovereign Nation

Arbitrum's next step in development stems from its vision of becoming a self-sustaining " Digital Sovereign Nation ." The " Arbitrum Everywhere " strategy fosters an economic and governance model that can be understood through three core elements: a diverse set of actors and stakeholders, valuable digital resources, and an economic pilot zone generated by fiscal deployment.

Diverse Participants and Stakeholders: The first pillar comprises Arbitrum's participants and stakeholders, including developers, users, and investors, all represented by the ArbitrumDAO. Arbitrum's model is unique in that it empowers the ArbitrumDAO with full on-chain control over protocol upgrades and treasury holdings. This control is fundamental to achieving a Digital Sovereign Nation.

Valuable Digital Resources: The second pillar is Arbitrum's valuable digital resources. In this context, these resources refer to Arbitrum's blockspace and execution environment, which act as high-margin digital commodities. The economics of Layer 2 allow it to retain a significant portion of network revenue, unlike Layer 1, which distributes a significant portion of network revenue and issues new tokens to incentivize validators to maintain network security. With an average gross margin exceeding 95% on Arbitrum One transactions, and additional revenue generated by projects like Timeboost and the Arbitrum Extension Program (AEP), the value generated by Arbitrum's on-chain activities accrues directly to the ArbitrumDAO treasury.

Economic Experimentation Zones Generated by Fiscal Deployment: The third pillar is Economic Experimentation Zones, which power the growth flywheel. The ability to generate and retain revenue enables the ArbitrumDAO to reinvest assets in new projects. These projects, in turn, drive demand for Arbitrum blockspace and activity, further fueling the flywheel and strengthening the long-term vision of the Digital Sovereign Nation.

Growth Flywheel

At the heart of Arbitrum's transformation into a Digital Sovereign Nation lies a growth flywheel that returns value to its members and stakeholders. Primarily, revenue is generated from digital resources such as blockspace and the execution environment. This revenue is distributed to a treasury managed solely by the ArbitrumDAO. The DAO invests in ecosystem investment projects and economic pilot zones, driving compounding demand for its products and expanding its asset base.

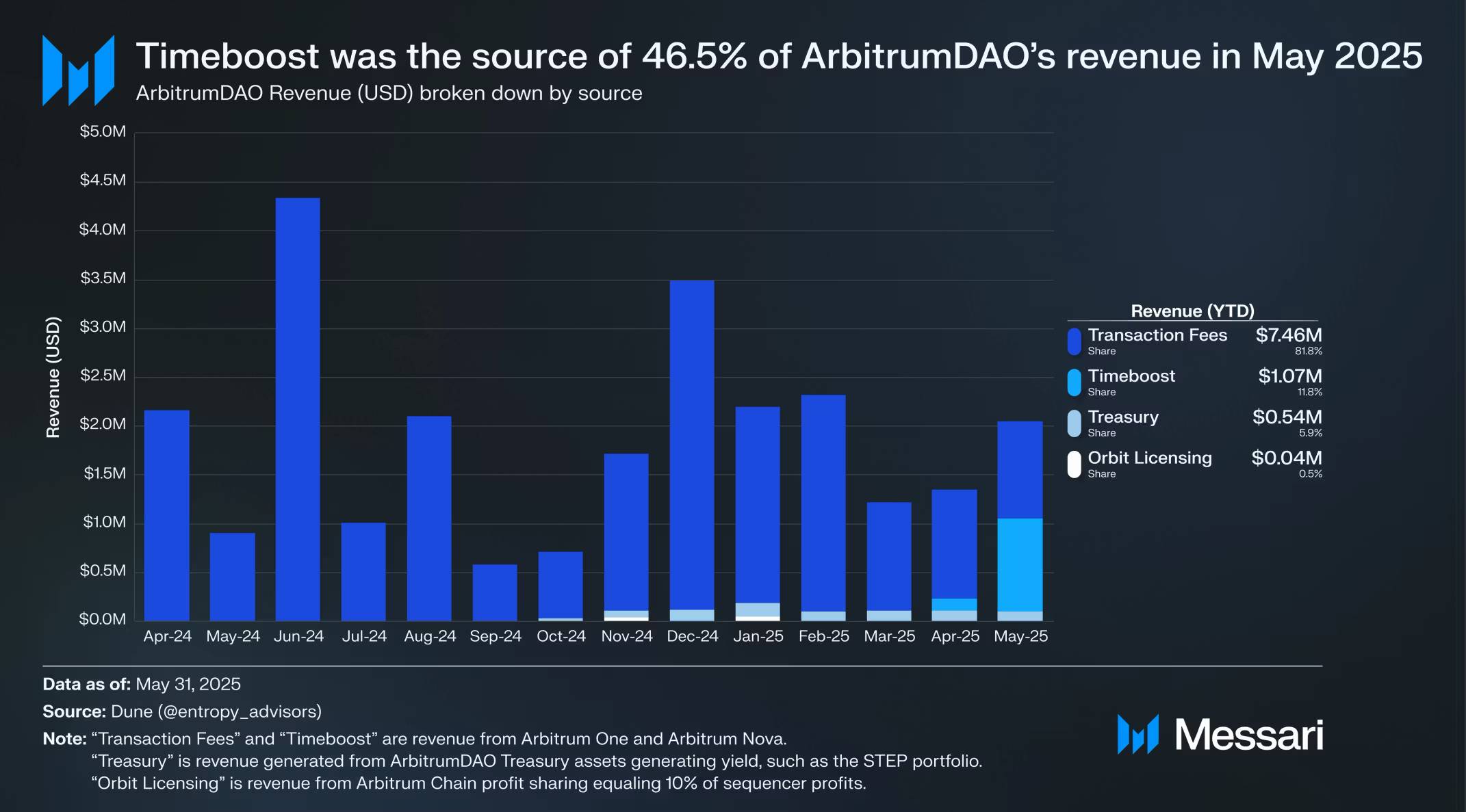

Core protocol revenue

The ArbitrumDAO derives value directly from the usage of Arbitrum's core products, including Arbitrum One and Arbitrum Orbit. This model of accruing value directly to a DAO-controlled treasury is a key differentiator for Arbitrum. Arbitrum One and Arbitrum Nova contribute 100% of their collator profits to the ArbitrumDAO. All other Arbitrum Chains are required to share 10% of their collator profits as part of the Arbitrum Expansion Program (AEP) licensing fee, with 8% going to the ArbitrumDAO and 2% to the Arbitrum Developer Association . Notably, L3s that settle to Arbitrum Chains like Arbitrum One are exempt from profit sharing. From the beginning of the year to May 31, 2025, the ArbitrumDAO has generated $7.5 million in revenue from these revenue sources.

Timeboost

In March 2023, Offchain Labs announced the development of the Timeboost protocol , which modifies the sequencer's transaction ordering. This modification aims to preserve Arbitrum's traditionally fair first-come, first-served model while creating a new revenue stream for the ArbitrumDAO through an auction-based priority transaction model. Timeboost adds approximately 250 milliseconds of latency and introduces a fast lane for auctionable transactions, enabling maximum extractable value (MEV) from strategies such as atomic arbitrage and liquidations .

Timeboost launched on April 17, 2025, initially on Arbitrum One and Arbitrum Nova. 44 days after launch, Timeboost surpassed $1 million in gross revenue . As of May 31, 2025, Timeboost achieved annualized revenue of $11.3 million (based on a 30-day moving average ), on track. Of this, the majority, 97%, was distributed to the ArbitrumDAO, with the remaining 3% going to the Arbitrum Developer Association .

Timeboost auctions consistently account for over 50% of the network REV (Real Economic Value) generated by Arbitrum One, with over 99% of auctions having active bidders . Other Arbitrum chains may also choose to incorporate Timeboost as part of their Arbitrum Nitro implementations. As Timeboost is adopted by other Arbitrum chains, its importance is likely to grow.

Ecosystem Investment Plan

Any application built on Arbitrum One and all Arbitrum Chains is eligible for support from the Arbitrum Ecosystem Investment Program . Throughout the life of the ArbitrumDAO, the Ecosystem Investment Program will continue to issue ARB tokens to fuel Arbitrum's long-term growth and drive demand for the Arbitrum platform. This is a key component of Arbitrum's vision of "making Arbitrum everywhere" and becoming a self-sufficient digital sovereign nation.

DeFi Revival Incentive Program (DRIP)

The DeFi Renaissance Incentive Program (DRIP), approved on June 23, 2025, aims to incentivize DeFi activity on Arbitrum One to achieve specific goals, such as becoming the "best platform for borrowing USDT, USDC, and ETH against wstETH." The DRIP will be rolled out over up to four three-month quarters, distributing up to 20 million ARB (0.2% of the total token supply) each quarter. Entropy Advisors, the Arbitrum Foundation, and Offchain Labs will serve as administrators of the program, which is scheduled to launch in July 2025.

Onchain Labs

In March 2025, the Arbitrum Foundation and Offchain Labs established Onchain Labs to "accelerate innovative on-chain experiences on Arbitrum." Talos , the first project incubated by Onchain Labs, was released in July 2025. Talos is an upcoming protocol controlled by an artificially intelligent agent that autonomously manages treasury assets, token economics, and protocol mechanisms. However, this agent will be governed by its future token holders , who will propose upgrades through GitHub after a public community vote.

Other ecosystem funding programs

The Arbitrum Foundation and ArbitrumDAO also support grant programs . In the past, these programs have included the Trailblazer AI Grant Program , Stylus Sprint , the Arbitrum x Farcaster Buildathon , the Uniswap-Arbitrum Grant Program , the Pluralistic Grants Grant Program , and ArbiFuel .

The third season of the Arbitrum DAO (Domain Allocator Product) Rewards Program was approved in February 2025 and will run for two quarters starting in October 2023 and lasting for one year until March 2026. 23.4 million ARB (0.23% of the total token supply) will be distributed to five categories of projects through Questbook .

Previously, ArbitrumDAO also approved several incentive programs that distribute ARB tokens within the Arbitrum Orbit ecosystem:

Short-Term Incentive Program (STIP): STIP was approved in October 2023 and allocated 50 million ARB (0.5% of the total token supply) to 30 Arbitrum Orbit projects to be distributed as incentives to their users.

STIP Backfund: The STIP Backfund was approved in November 2023, distributing 21.5 million ARB (0.22% of the total token supply) to 26 Arbitrum Orbit projects that were approved for STIP but did not receive funding because they were not among the top 30 projects that received "yes" votes.

STIP Bridge: The STIP Bridge was approved in May 2024, distributing an additional 37.5 million ARB (0.37% of the total token supply) to previous recipients of STIP or the STIP Backfund.

Long-Term Incentive Plan (LTIP): The LTIP was approved in February 2024 and distributes up to 45 million ARB (0.45% of the total token supply) to projects that receive the STIP.

Economic Experimental Zone

As of May 31, 2025, the ArbitrumDAO treasury holds assets valued at $1.21 billion, which continues to grow from core protocol revenue. ArbitrumDAO uses these assets to invest in emerging economic opportunities, generating new revenue streams. This active capital allocation strategy is a core component of the growth flywheel, enabling the DAO to continuously invest in Arbitrum's growth.

Stabilizing Endowment Program (STEP)

In December 2023, a proposal was approved to establish a Finance and Sustainability Working Group to support the financial operations of the ArbitrumDAO. In January 2024, KPK published the Arbitrum Finance and Sustainability Research Report , which assessed the impact of a potential ARB token sale, explored potential uses of ETH-denominated sequencer revenue, and developed guidelines for effective financial management.

The effort to diversify the treasury’s holdings and generate income began with the Stable Treasury Endowment Program (STEP), which aims to diversify a portion of the treasury’s holdings into stable real-world assets (RWAs) that generate income and drive significant growth in the adoption of RWAs on Arbitrum One.

Step 1: Proposed by the Finance and Sustainability Working Group and approved in April 2024, Step 1 converts 35 million ARB (0.35% of the total token supply) into RWAs. A total of 33 applications were received, of which 6 were approved via an off-chain vote on Snapshot. The proceeds from the sale of ARB were $29.3 million, which were subsequently converted into Securitize's BUIDL ($9.6 million), Ondo's USDY ($5.2 million), Superstate's USTB ($5.2 million), Mountain's USDM ($3.5 million), OpenEden's TBILL ($3.5 million), and Backed Finance's bIB01 ($3.5 million).

Step 2: Proposed by the Finance and Sustainability Working Group and approved in February 2025, Step 2 will convert 35 million ARB (0.35% of the total token supply) into RWAs, specifically WisdomTree’s WTGXX, Spiko’s USTBL, and Franklin Templeton’s BENJI.

As of May 31, 2025, the ArbitrumDAO Treasury’s RWA holdings totaled $27.6 million. Since its inception, STEP has generated a total of $745,000 in interest income .

Arbitrum Gaming Ventures (AGV)

Arbitrum Gaming Ventures (AGV, formerly the Gaming Catalyst Program (GCP)), approved in June 2024, will allocate up to 200 million ARB (2% of the total token supply) to invest in Arbitrum Orbit game studios, applications, and chains. AGV's goal is to "introduce outstanding developers and help them accelerate development at all stages of the game lifecycle." Funding is divided into three categories:

Construction Grant: 25 million ARB (0.25% of the total token supply) to “accelerate the early development of Arbitrum, or incentivize users to join.”

Investment: 135 million ARB (1.35% of the total token supply) for “teams seeking more than 500,000 ARB or additional development funding beyond initial development.”

Infrastructure Bounty: 40 million ARB (0.40% of the total token supply) to “create gaming-specific technology that will make Arbitrum the best choice for game developers.”

AGV has also issued 25 million ARB (0.25% of the total token supply) for operations. AGV is an entity aligned with Arbitrum, led according to its charter and key performance indicators (KPIs), and overseen by the five-member CGP Council.

The vast majority of ARB allocated to GCP is intended for venture capital investments, which will generate multiple-fold returns for ArbitrumDAO. AGV announced its first investment of $10 million on May 8, 2025, in Wildcard , Hyve Labs , T-Rex , Xai , and Proof of Play . AGV's latest update , published on May 31, 2025, highlighted over 70 projects in its pipeline. Arbitrum Gaming Ventures' full list of investments is available on Messari Fundraising .

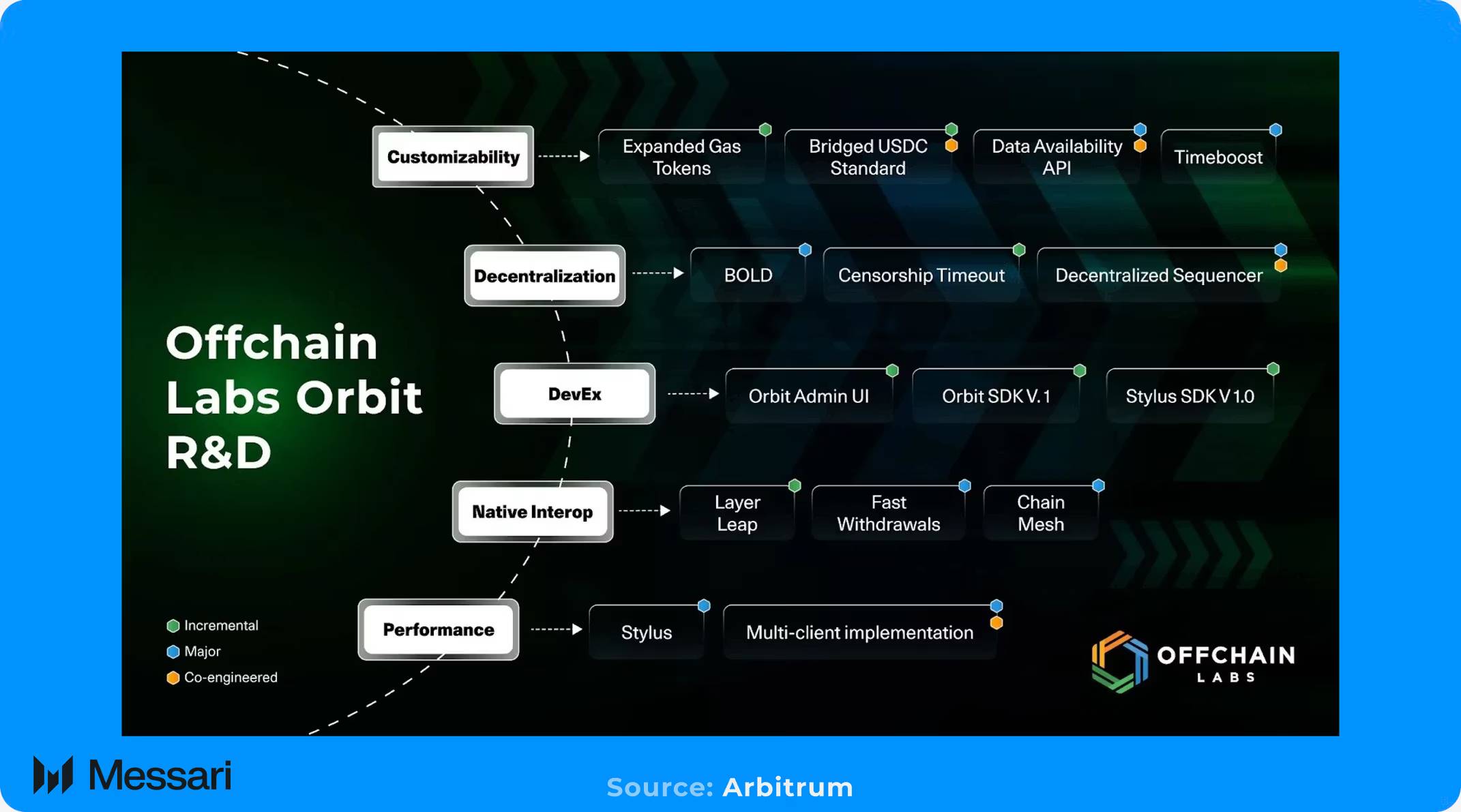

Arbitrum Technology

The Arbitrum technology stack powers the Arbitrum Chains that comprise the Arbitrum Orbit ecosystem. At the core of Arbitrum technology is Arbitrum Nitro , a technology stack developed by Offchain Labs . Arbitrum Nitro has become an evolving technology stack capable of meeting the needs of a wide range of emerging use cases. A key tenet of Arbitrum Nitro is its emphasis on customizability and autonomous blockspace, enabling developers to tailor the network to their protocol's needs, supporting the vision of " Arbitrum Everywhere ."

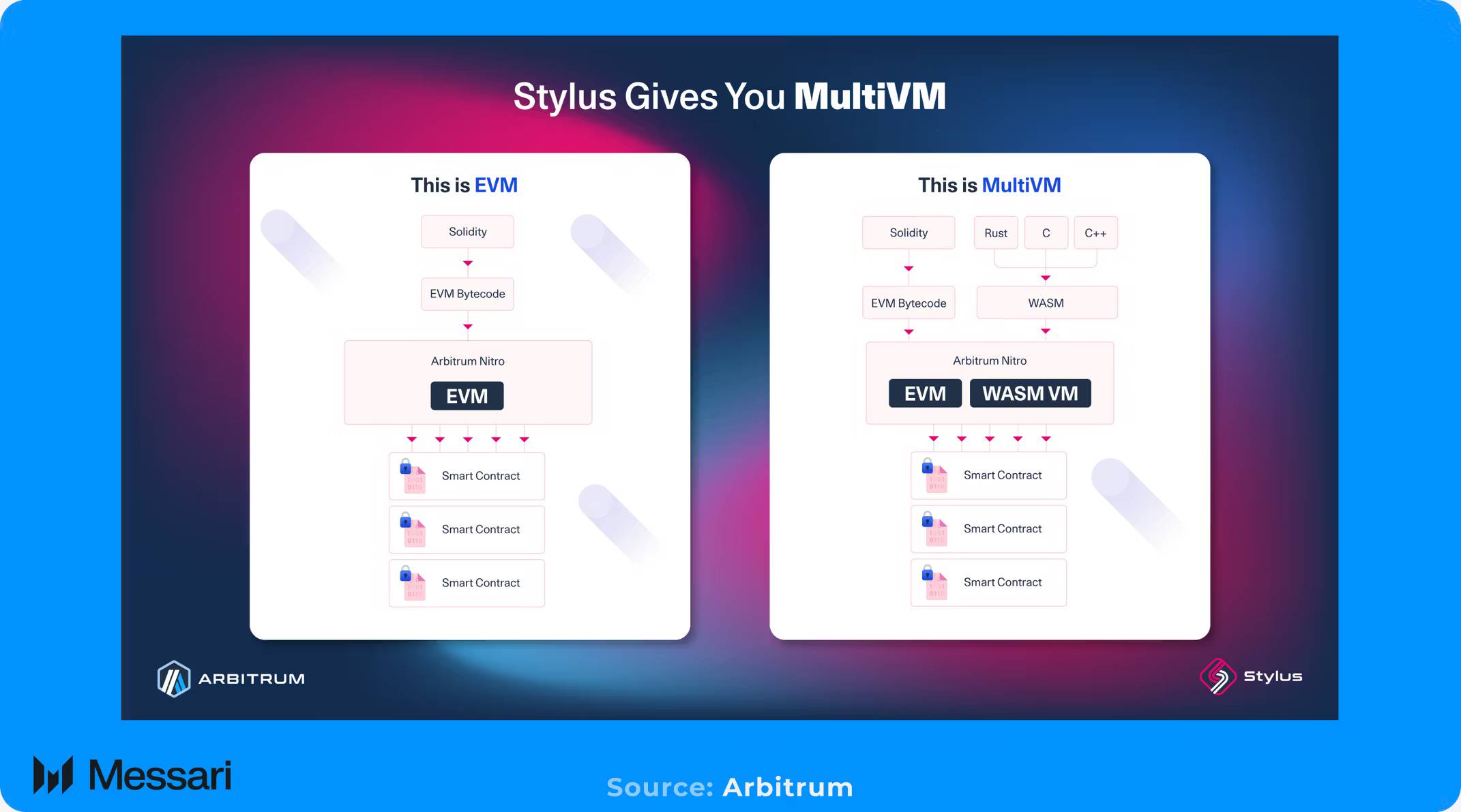

Stylus

In February 2023, Offchain Labs announced the development of Stylus , an upgraded virtual machine that runs in parallel with the EVM . Stylus launched in September 2024, initially running on Arbitrum One and Arbitrum Nova. It allows developers to compile non-EVM programming languages such as Rust , C/C++ , Zig , and Bf to WebAssembly (WASM), maintaining interoperability with the EVM. As a result, smart contracts written in different languages can interact with each other (for example, a smart contract written in Solidity can call a smart contract written in Rust). Protocols currently using Stylus include Renegade Finance , Superposition , Uniswap , and Fairblock .

Limited Liquidity Delay (BoLD)

In August 2023, Offchain Labs announced the development of the Limited Liquidity Delay (BoLD) protocol, which introduces a permissionless, fraud-proof system that enables a single, honest validator to protect rollups from malicious sorters. BoLD's dispute protocol allows anyone to publish a claim about the state of an Arbitrum Chain on its parent chain (such as Ethereum for Layer 2 or Arbitrum One for Layer 3). If the challenge is successful, the security deposit submitted by the malicious party is forfeited. For a deeper understanding of BoLD, Offchain Labs has developed a protocol whitepaper , a technical whitepaper , and an economic whitepaper on BoLD.

After ten months of testnet testing and approval from the ArbitrumDAO, BoLD officially launched in February 2025. Arbitrum's BoLD met one of the five necessary conditions for Phase 1 decentralization, as defined in Vitalik Buterin's " The First Milestone of Rollup ." As of May 31, 2025, only two Arbitrum Chains, Arbitrum One and Kinto, had reached Phase 1 decentralization, which requires:

Functional fail-safe systems like BoLD.

At least five participants were able to submit bug proofs.

A permissionless bridge to the Ethereum mainnet.

A functioning Security Council .

The implementation of the escalating measures approved by the Security Council will be delayed for at least seven days.

BoLD also meets one of the three necessary requirements to be classified as Phase 2. The other two are that users should have at least 30 days to exit the network in the event of an unwanted upgrade, and that the Security Council should have the power to intervene only in the event of a serious protocol flaw that could cause significant harm if not addressed.

Research and Development

Offchain Labs, founded by Ed Felten , Steven Goldfeder , and Harry Kalodner , has raised over $120 million for development. As a core technology developer, the company invested in the development of Arbitrum Nitro. Currently, Offchain Labs is developing a Universal Intents Engine to enhance the interoperability of Arbitrum Orbit and strengthen the Arbitrum Everywhere value proposition:

Intent-based interoperability is planned for the first half of 2025 and will enable cross-chain token swaps and token transfers in “less than three seconds.”

Cross-chain operations are scheduled to launch in the second half of 2025 and will achieve interoperability at the protocol level, enabling cross-chain operations in a "fast, cheap and trustless manner."

Additionally, Offchain Labs is working to add support for a set of decentralized orderers and introduce native interoperability with Arbitrum Orbit. Offchain Labs also plans to add support for other EVM clients, such as Reth , Erigon , and Nethermind , in the future to continue improving Arbitrum Chain's performance. In May 2025, Erigon and Nethermind formally committed to supporting Arbitrum Nitro while developing their execution clients.

Other major Arbitrum Nitro upgrades include those affecting the state transition function (STF) and the subsequent execution environment, ArbOS . These upgrades typically occur in conjunction with Ethereum mainnet hard forks and must be approved by the ArbitrumDAO before implementation. Historically , ArbOS has had three major upgrades: ArbOS 11 , ArbOS 20 Atlas , ArbOS 32 Bianca , and ArbOS 40 Callisto .

Arbitrum Ecosystem

Arbitrum's economic engine and "Digital Sovereign Nation" strategy have been widely recognized by platform participants. The combination of its technology, ecosystem investment program, and economic opportunity zones has already achieved tangible applications across multiple key verticals.

Institutional and Real World Asset (RWA) adoption

A major growth area is the tokenization of RWAs, with several major traditional financial institutions deploying products on Arbitrum One:

BlackRock : The USD Institutional Digital Liquidity Fund (BUIDL) launched on Arbitrum One in November 2024, with a network supply of $31.1 million as of May 31, 2025. BUIDL is a tokenized USD money market fund developed by BlackRock and is held in the ArbitrumDAO Treasury as the largest portion of the STEP portfolio .

Franklin Templeton : The on-chain U.S. Government Money Fund ( FOBXX ) invests in U.S. government securities, cash, and repurchase agreements. The fund was tokenized by Franklin Templeton as BENJI on Arbitrum One. BENJI has a supply of $92 million on Arbitrum and was selected as the largest allocation recipient in Phase 2 .

WisdomTree : WisdomTree Connect launched on Arbitrum One in April 2025. It provides access to 13 tokenized funds across money market instruments, equities, fixed income, and asset allocation strategies, expanding institutional access to tokenized assets.

Tokenized asset platform

The ecosystem of crypto-native platforms offering yield-generating RWA products has expanded to Arbitrum One:

Ondo Finance: Operated by Ondo Finance , USDY is deployed on Arbitrum One and is backed by U.S. Treasuries and bank deposits. It aims to be a widely accessible, yield-generating stablecoin. As of May 31, 2025, the supply of USDY on Arbitrum One was $6.3 million.

Spiko: The Euro Treasury Bill ( EUTBL ) and US Treasury Bond ( USTBL ) operated by Spiko are tokenized money market funds deployed on Arbitrum One. As of May 31, 2025, Spiko's TVL on Arbitrum One was $94 million.

OpenEden: Provided by OpenEden , U.S. Treasuries are tokenized via TBILL on Arbitrum One and include real-time proof of reserves and custody via authorized third parties. As of May 31, 2025, the supply of TBILL on Arbitrum One is $5.7 million.

Enterprise and FinTech Integration

Arbitrum One can also serve as a critical infrastructure layer for other established companies and protocols:

Robinhood: In February 2024, Robinhood integrated Arbitrum One- based exchange functionality into its self-custodial wallet, enabling its users to access Arbitrum One's DeFi ecosystem. In June 2025, the partnership expanded further when Robinhood announced it would launch equity tokens on Arbitrum One . These equity tokens include investment opportunities in private companies such as OpenAI and SpaceX, with plans to introduce this product to the upcoming Robinhood Chain .

Hyperliquid, a highly successful L1 platform focused on perpetual contract trading, uses Arbitrum One as its primary USDC onramp. As of May 31, 2025, Hyperliquid Bridge had secured $3.42 billion in USDC liquidity from Arbitrum One.

Arbitrum Orbit

As of May 31, 2025, the 48 publicly announced Arbitrum Chains that have launched on mainnet have an average monthly transaction volume of 135.8 million. Besides Arbitrum One, the most active Arbitrum Chains include:

Gravity : Launched by Galxe in August 2024, Gravity is a Layer 2 backed by Conduit and the G token . Gravity is powered by an ecosystem of digital identity, community engagement, and on-chain credential verification. Initially launched as part of Arbitrum Orbit, Gravity is scheduled to transition to a high-performance Layer 1 in Q4 2025.

In 2025, the network accounted for 14.7% of Arbitrum Orbit’s transaction volume, with a total transaction volume of 99.7 million and a total value locked (TVL) of $2.7 million. For more information, see Messari’s recent report on Gravity .

Proof of Play : Proof of Play is a gaming studio behind the hit Pirate Nation , a pirate -themed role-playing game (RPG). Proof of Play owns two L3 chains, Apex ( launched in March 2024) and Boss ( launched in August 2024), powered by Conduit. The studio also provides various on-chain services , such as verifiable randomness and mirroring .

The network accounted for 21.9% of Arbitrum Orbit’s transaction volume in 2025, reaching 148.9 million.

ReyaChain : Launched in April 2024, Reya is a Gelato-powered L2 chain whose protocol offers perpetual futures trading and the rUSD stablecoin. Recently, Reya launched rUSD staking services and plans to release an updated vision for building a decentralized Nasdaq .

The network accounted for 2.1% of Arbitrum Orbit transactions in 2025, with a TVL of $10.8 million and $16.1 million.

ApeChain : Launched in October 2024, ApeChain is a Layer 3 blockchain powered by Caldera and the APE token . ApeChain, the parent company of ApeCoin and Bored Ape Yacht Club (BAYC), focuses on three pillars : content, tools, and distribution. Users can stake assets and earn returns , and access games and metaverse applications.

In 2025, the network accounted for 1.6% of Arbitrum Orbit’s transaction volume, reaching 148.9 million transactions and a TVL of $10 million. For more information, see Messari’s recent report on ApeChain .

Several new Arbitrum Chains are also being launched during 2025 and are still under development, including:

Superposition : Launched in January 2025, Superposition is an L3 platform powered