Despite a 15% monthly increase, the price of SHIB is not showing a decisive upward movement. Over the past week, SHIB has only moved about 2%, which is similar to the overall market correction.

Despite the ascending wedge pattern suggesting a breakthrough, new data shows that large holders and weak buying activity are constraining the token.

Large Holders Transferring Tokens to Exchanges… Increasing Selling Pressure

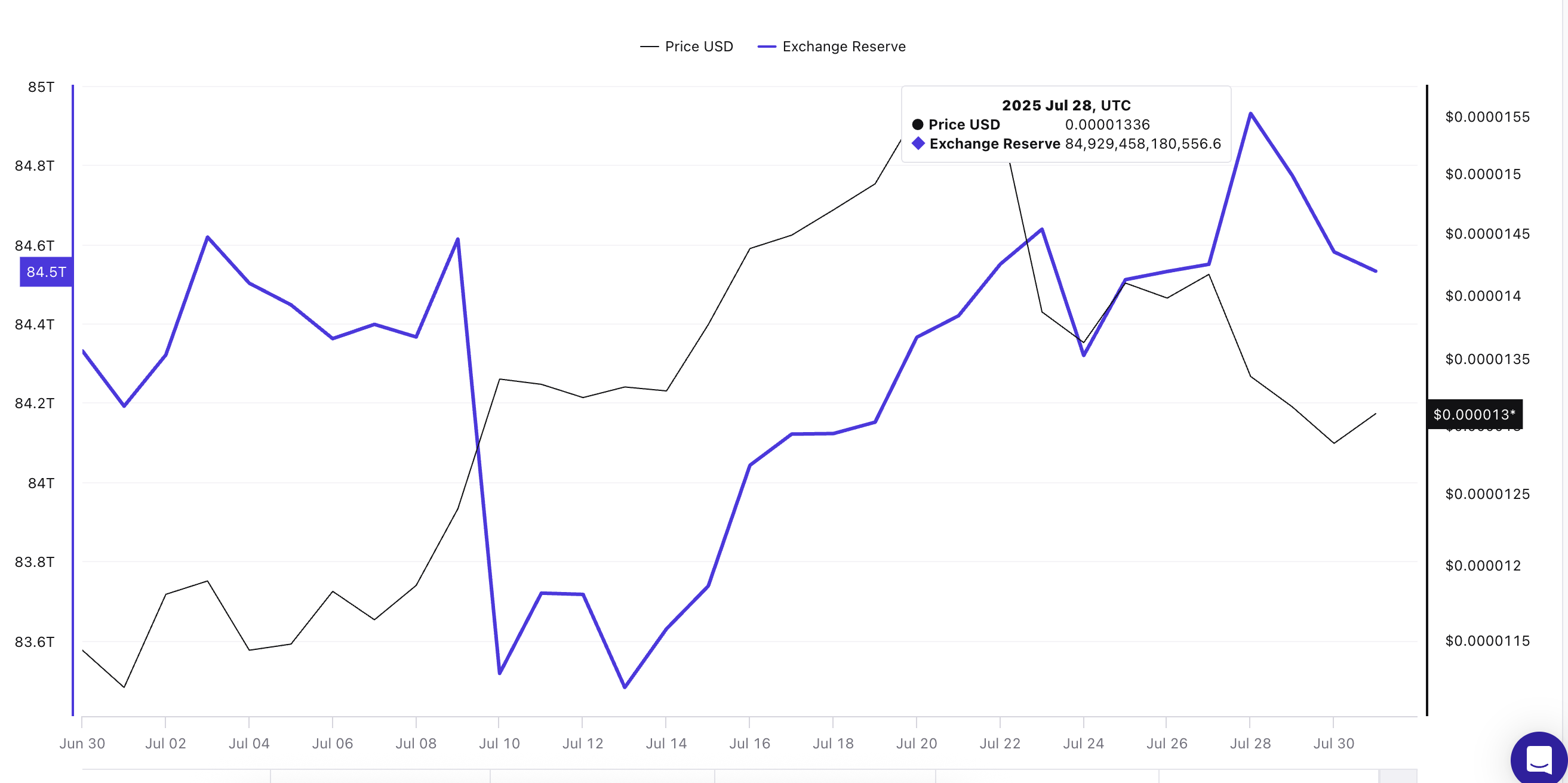

One of the key signals explaining SHIB's difficulties is the surge in exchange reserves. On July 28, exchange wallets recorded a monthly high of 84.9 trillion SHIB. This means large holders are sending more tokens to exchanges, preparing to sell.

At the time of writing, reserves have slightly decreased, but there are still many tokens on exchanges that could trigger a deeper correction.

This is consistent with previous data where large holder net inflows turned negative. Whales are dumping tokens into the market instead of private wallets, creating additional supply and making it difficult for SHIB to rise in price.

Token Technical Analysis and Market Update: Want more of these token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

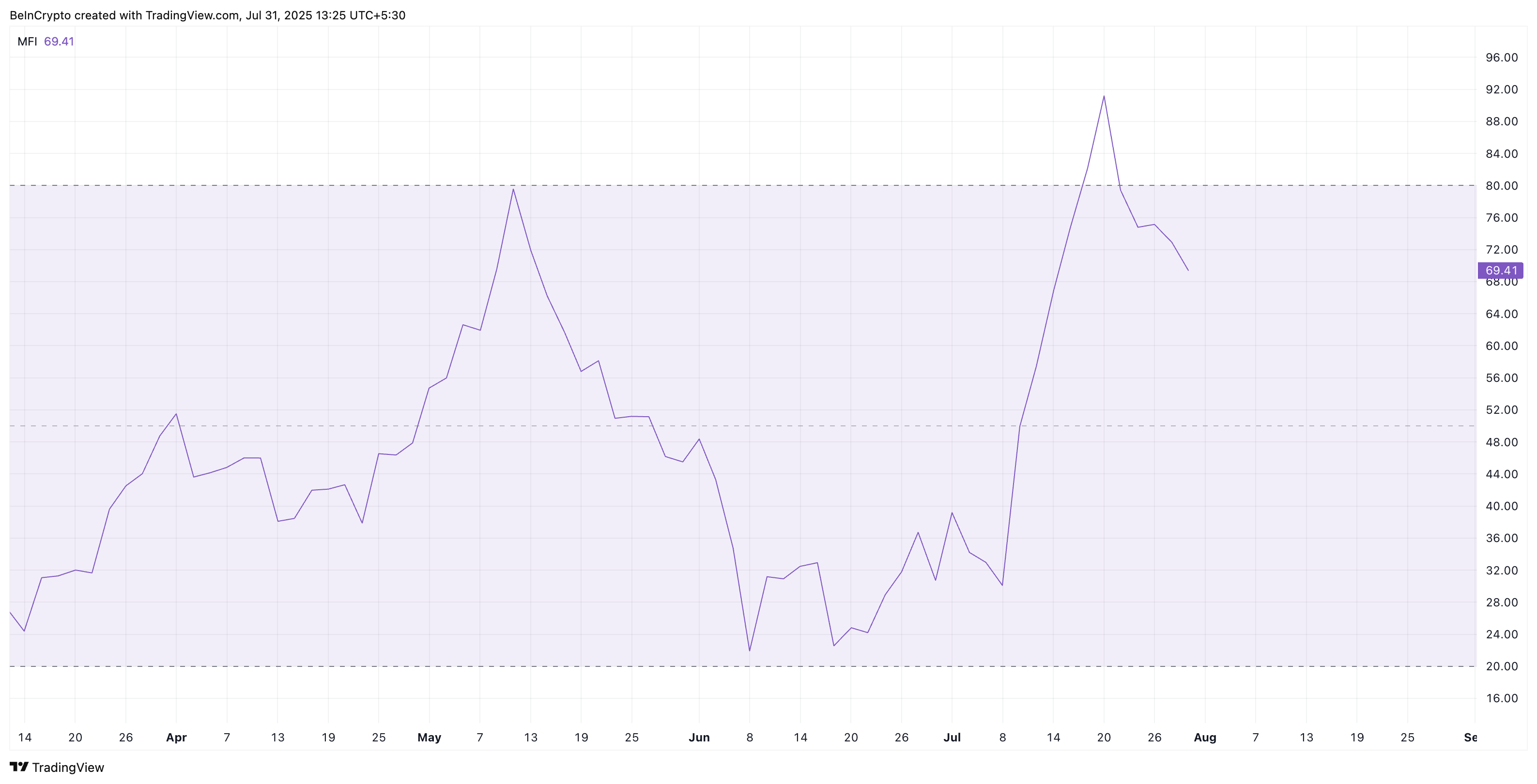

Money Flow Index Shows Weakening Buying Pressure

The Money Flow Index (MFI) indicates how much money is flowing in or out of a token based on price and volume. For SHIB, the MFI has sharply dropped from 91 to 69 in 10 days. This shows buyers are not injecting strong capital despite low prices.

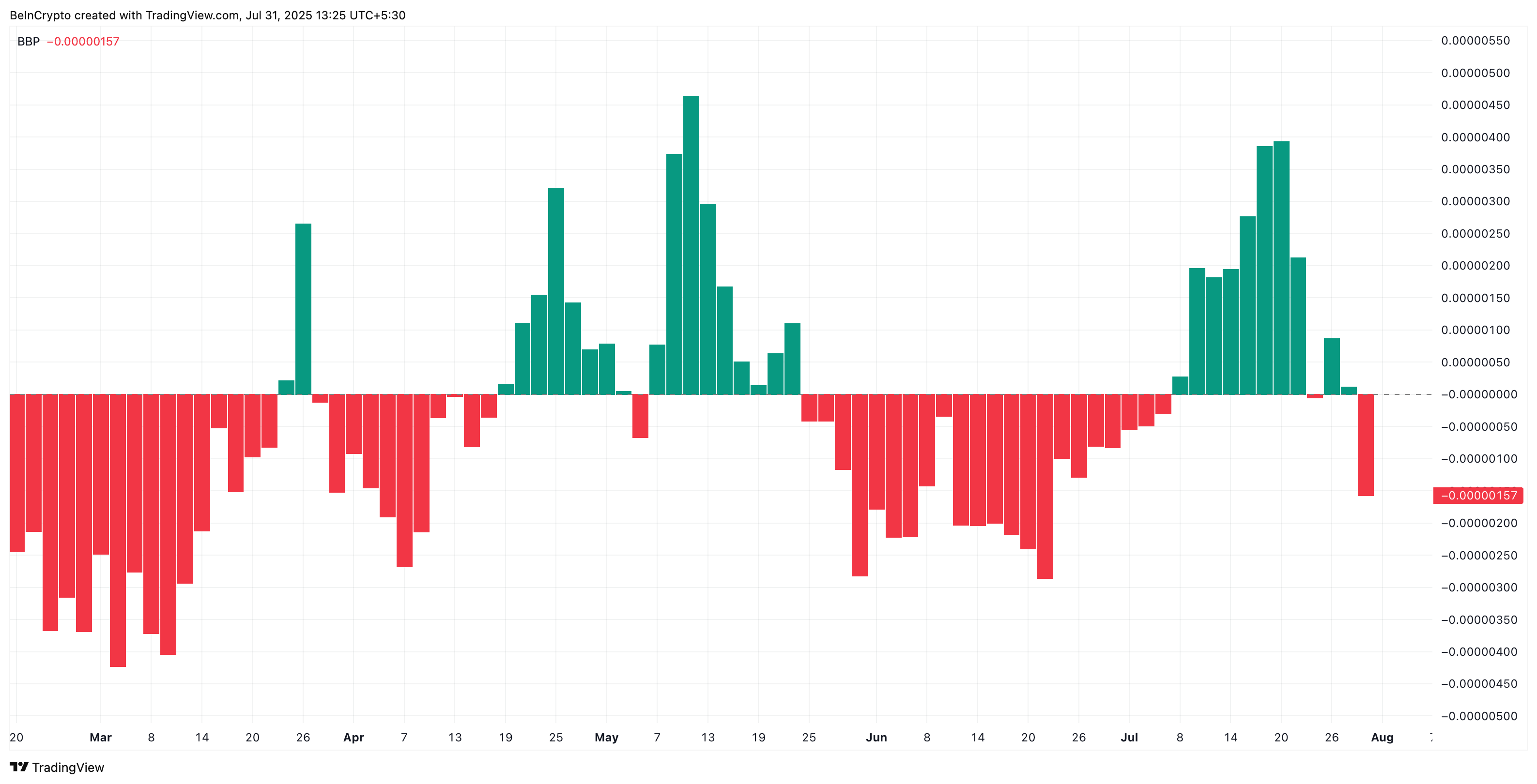

The Bull-Bear Power indicator supports this, showing sellers have taken control in recent price movements. While upward momentum has weakened for some time, the long red bars clearly show who is controlling the current SHIB price movement.

Despite SHIB trading within an ascending wedge, the MFI decline and strong bear signals suggest current buying demand is weak.

The Bull-Bear Power indicator measures the strength of buyers and sellers by comparing price movements to moving averages. Positive values indicate bulls are stronger, while negative values show bears are in control.

SHIB Price Trapped in Wedge Formation

SHIB's price is within a descending wedge pattern on a 2-day timeline. This setup often leads to an upward breakout. However, the token is currently trapped near $0.0000130, with strong support at $0.0000128. If this level breaks, the next downward points are $0.0000122, then $0.000010. Falling below $0.000010 would completely invalidate the bullish setup.

With SHIB's price hovering in recent days, it's reasonable to clear noise through the 2-day chart.

Conversely, breaking above $0.0000158 (but first $0.0000146) could resume the upward trend. This would align with the expected wedge breakout direction and potentially trigger a larger rally.