Written by: White55, Mars Finance

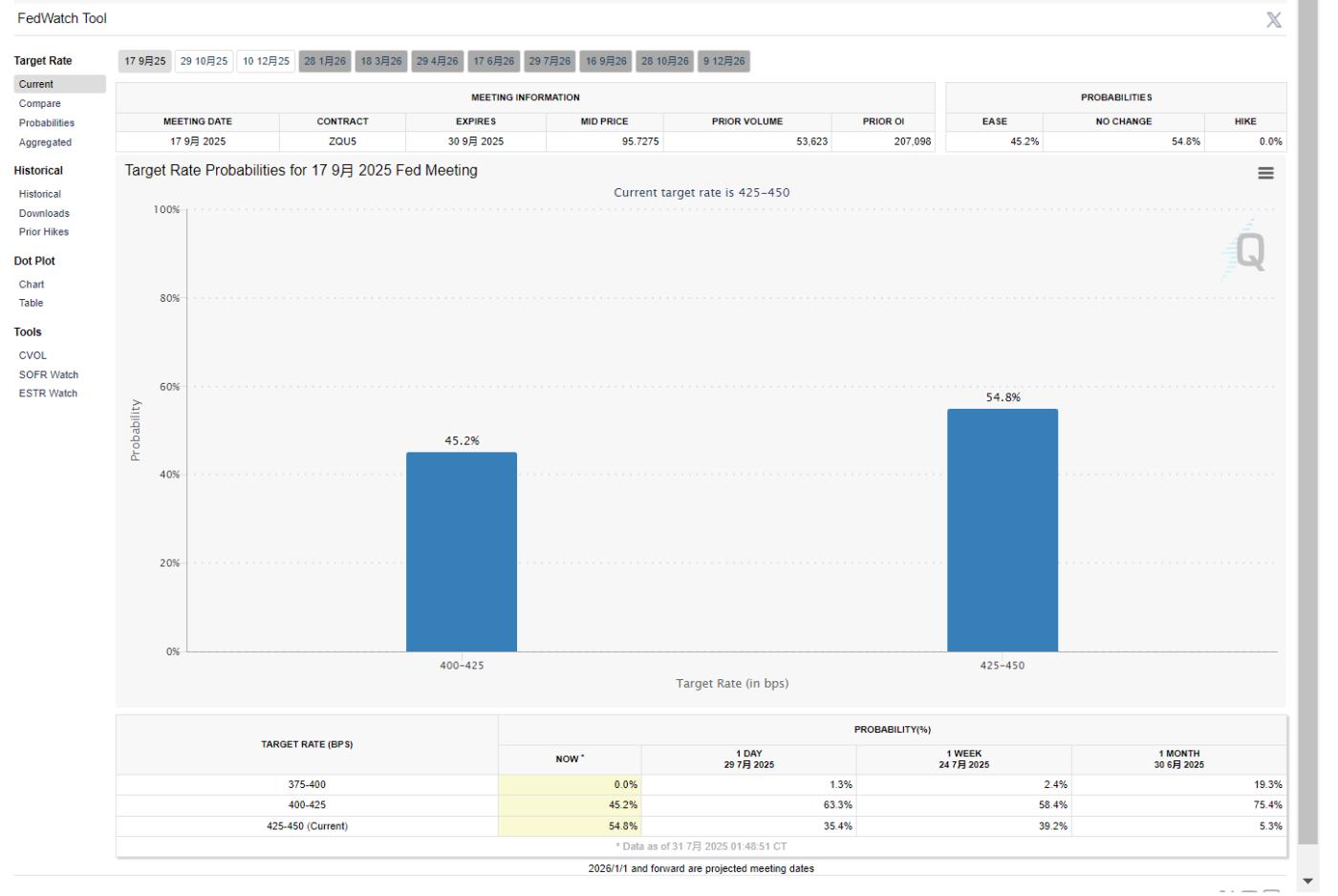

Within 48 hours after the Federal Reserve's July meeting, the market experienced a dramatic restructuring of expectations. When Chairman Powell's hawkish statements pierced through the trading floor during the press conference, the interest rate swap market instantly reacted - the probability of a September rate cut plummeted from 68% before the meeting to 40%, while the October rate cut probability fell from "a done deal" to 80%.

Federal Reserve July Resolution: Hawkish Signals Penetrate the Market

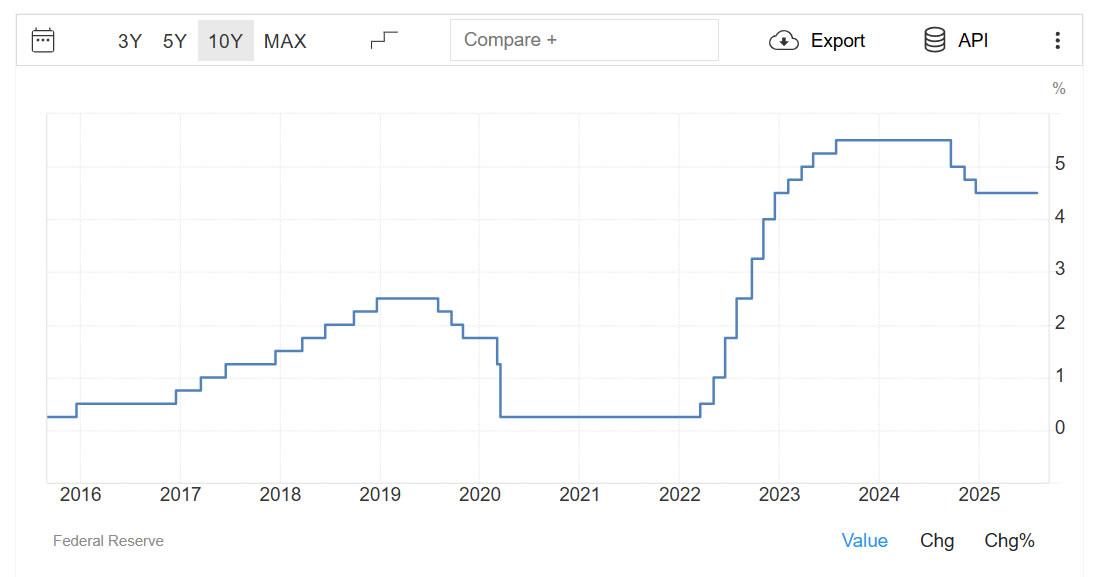

U.S. interest rates remain near their highest level in over a decade. Source: Trading Economics

The decision from the Federal Reserve headquarters in Washington D.C. on July 31 seemingly continued the market's general expectation: the federal funds rate remained unchanged in the 4.25%-4.50% range, maintaining the tightening stance since 2024.

However, beneath the surface, undercurrents were surging - board members Waller and Bowman rarely voted to support an immediate 25 basis point rate cut, breaking the record of no dual dissent in the Federal Reserve for thirty years. This divergence highlights the internal fractures in the Fed's assessment of economic prospects: doves see risks of slowing growth, while hawks closely watch the threat of inflation rebounding.

Powell's statements at the press conference further reinforced the hawkish tone. When reporters asked about a potential September rate cut, he repeatedly emphasized: "We have not made any decisions, which will depend on the overall evidence obtained between now and the September meeting." He specifically pointed out that the surge in furniture and clothing prices has pushed the June CPI to a five-month high, and the impact of Trump's tariff policies "will fully manifest by late summer." This cautious stance directly extinguished market expectations of short-term easing.

Sharp Decline in Rate Cut Probability: A Double Game of Data and Power

The dramatic adjustment of market expectations stems from the superposition of multiple signals:

- Inflation Ghost Reappears: The overall inflation rate in June rose to 2.7%, continuing to rise for four consecutive months, gradually moving away from the Fed's 2% target. The transmission effect of tariffs is fermenting, and the Beige Book shows that businesses are already planning to pass on cost pressures by late summer.

- Labor Market Resilience: Despite a cooling in non-farm employment, over 100,000 new jobs and a 4.1% unemployment rate still remain close to full employment, weakening the urgency for rate cuts.

- Intensified Political Pressure: Trump loudly declared before the resolution that "my impression is Powell is ready to cut rates," attempting to influence the decision. However, Powell's emphasis on the "independence of the Federal Reserve" was seen as a subtle counterattack against political interference.

The CME FedWatch tool captured this massive expectation shift: the probability of maintaining rates in September soared from 32% to 54.8%, while the probability of a 25 basis point rate cut plummeted from 68% to 45.2%. The interest rate market further lowered its expectation of rate cuts by the end of the year to 37 basis points, meaning the promise of two rate cuts has been reduced to an almost "fifty-fifty" game.

Crypto Market Reaction: Short-term Volatility and Structural Support

Within an hour of the resolution's announcement, Bit fell below $116,000, and Ethereum dropped to $3,680. However, this pullback was as brief as a seasonal strong wind - Bit quickly rebounded above $118,600, and Ethereum strongly recovered the $3,870 mark, demonstrating the resilience of crypto assets.

This elasticity is supported by three factors:

- Liquidity Buffer: Despite the delayed rate cut, the Federal Reserve's balance sheet continues to expand, providing bottom-up support for risk assets. Bitfinex analysts note that if there are no signs of economic recession, a 25 basis point rate cut could still be a bull market catalyst.

- Selling Pressure Subsides: The Bitcoin selling waves from Mt.Gox and various government entities have basically ended. Some of the $14.5 billion in FTX creditor distribution funds may flow back into the crypto market.

- Seasonal Patterns: Historical data shows that while September is the weakest month for Bitcoin ("Septembear"), the following October ("Uptober") has an average increase of 1,449% (statistics from 2019 to present).

Bull Market Trajectory Reconstruction: Slowdown or Acceleration?

As the September rate cut expectation collapses, has the fuel for the bull market been exhausted? The market presents divergent judgments:

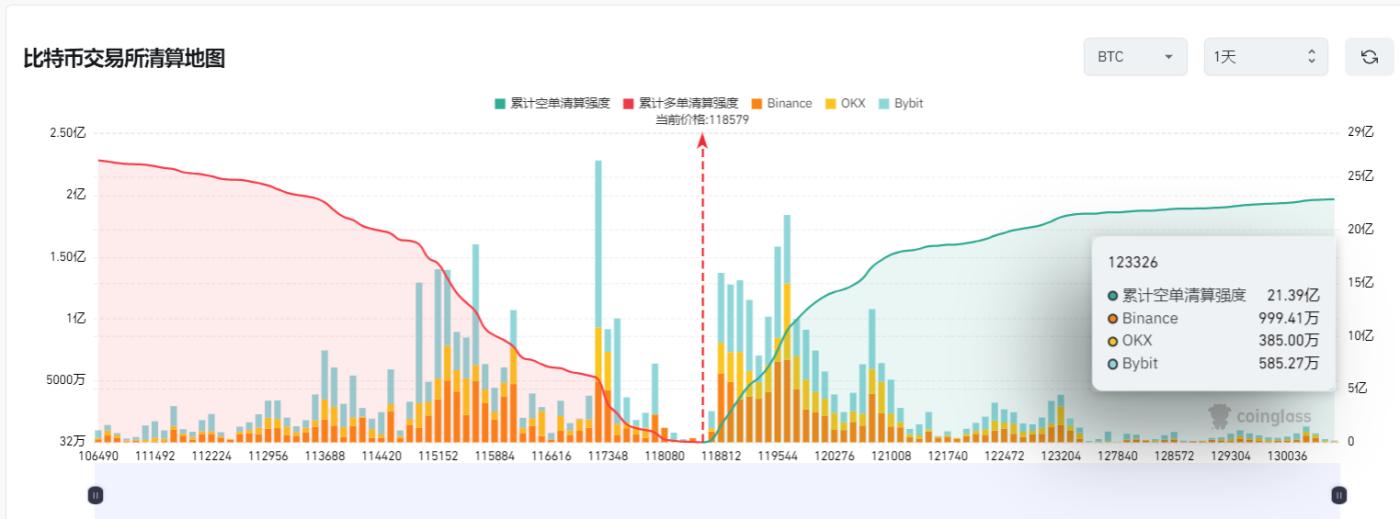

- Short-term Momentum Weakens: LVRG Research Director Nick Ruck candidly says: "If the Federal Reserve remains cautious, the bull market pace may slow down." Leveraged traders are the first to be affected - crypto futures liquidations reached $434 million in the past 24 hours, with 82% being long positions.

- Long-term Narrative Unchanged: Apollo Capital Chief Investment Officer Henrik Andersson emphasizes: "The market has digested the delayed rate cut expectation. The key is whether the recession risk materializes." If there's a soft economic landing, liquidity will eventually flow into risk assets.

The more complex landscape lies in the race between policy and economic data: if employment data deteriorates in the next two months (such as unemployment rate breaking 4.5%), rate cuts might be advanced; but if tariffs push CPI beyond 3%, the Federal Reserve might even restart rate hike discussions. Within Powell's observation window, CPI and employment reports will be released in August and September, and each data point could become a trigger for volatility.

Calm in the Eye of the Storm: Crypto Market's Accumulation Logic

The current market's relative calm precisely reflects investors' strategic patience. Under the impact of the September rate cut probability being halved, the S&P 500 index only slightly dropped 0.4%, and this resilience implies two layers of interpretation:

- Negative News Exhaustion Effect: Some investors view the hawkish statements as the last dip, especially when the Federal Reserve acknowledges that "rate cuts would have been possible without tariffs," making the long-term direction of policy transformation clear.

- Rise of Alternative Narratives: The Trump administration's accelerated tax cuts and regulatory relaxation plans are injecting new expectations for corporate earnings. If fiscal policy takes over from monetary policy, risk assets might get a new engine.

For the crypto market, short-term volatility compression may be brewing a larger breakthrough. CoinGlass's liquidation heat map shows that Bit has accumulated a large number of short liquidation chips near $120,000, and breaking through will trigger a chain reaction. QCP Capital observed that institutional investors are positioning for a fourth-quarter rise through the options market, and the implied volatility premium shows that bullish sentiment remains unchanged.

Crypto Market in Policy Fog: The Art of Balance

As the September FOMC meeting becomes a key battleground for determining monetary policy direction, crypto investors need to find certainty amid multiple uncertainties:

- Enhanced Economic Data Sensitivity: The August 1st non-farm payrolls and August 13th CPI will become market volatility catalysts, requiring vigilance against short-term leverage risks.

- Strategic Value of Seasonal Patterns: If a panic sell-off occurs in September, historical data shows "buying the dip for the fourth quarter" is statistically the optimal strategy.

- Increased Political Variable Weight: Trump threatens to appoint a "more moderate chairman" when Powell's term expires in 2026, and political pressure may force a policy shift.

As Wall Street traders focus on the September FOMC meeting, the cryptocurrency market is experiencing a silent accumulation of energy. The postponement of rate cut expectations may temporarily suppress the bull market's pace, but it is also gathering more powerful momentum for an ultimate breakthrough.

Similar to the script after the emergency rate cut in March 2020 - initial market doubts were ultimately engulfed by a surging liquidity wave, and this time, the institutional funding pipeline brought by the Bit ETF may make the transmission of loose policies faster than at any point in history.

The Federal Reserve's hawkish statements are like sprinkling fine sand into the bull market engine, but true mechanics understand: when the monetary policy shift of the world's largest central bank is inevitable, a brief slowdown is merely a momentary breath before the storm arrives.