Original | Odaily Planet Daily (Translated from @OdailyChina)

Author | Ethan (Translated from @ethanzhang_web 3)

Original Title: Bringing LST to Wall Street: Solana ETF's "Staking Add-on" Battle

On May 20th this year, the SEC first pressed pause, asking 21 Shares, Bitwise, VanEck, and Canary Capital to wait a bit longer for the spot Solana ETF—reasoning that they "need more time to evaluate legal and policy issues".

Less than a month later, the wind changed direction. On June 11th, multiple informed sources revealed: the SEC had verbally notified all potential issuers to "submit a revised S-1 within next week, with 30 days for comments", specifically requesting additional descriptions of "physical redemption" and "Staking"—clearly implying that "Staking can be discussed";

Soon, major asset managers collectively responded: Franklin Templeton, Galaxy, Grayscale, VanEck, Fidelity, and 5 other institutions submitted updated S-1s on June 13-14; The SEC's traced documents first featured the term "Staked ETP", with Staking becoming a chapter heading.

On June 16th, CoinShares joined the battle, becoming the eighth applicant; On June 24th, Grayscale wrote a 2.5% management fee rate in their new S-1, betting on "high fees + high brand" to be the first to pass.

Entering July, the SOL ETF pace clearly accelerated:

July 7th—CoinDesk disclosed: SEC set a hard deadline of "submit by end of July", aiming to approve the first batch of spot SOL ETFs before October 10th;

July 8th—Fidelity's application was delayed by 35 days, "waiting to supplement materials";

July 28th—Grayscale's application was again postponed, with the new final deadline falling on October 10th;

July 29th—Cboe BZX submitted two 19b-4s at once: ①Canary Staked INJ ETF; ②Invesco × Galaxy spot Solana ETF, clearly offering "spot + Staking" double insurance;

July 31st—①Jito Labs + Bitwise + Multicoin + VanEck + Solana Institute submitted an LST open letter to SEC's crypto asset special working group, officially endorsing "Staked ETP"; ②21 Shares simultaneously submitted a revised S-1, rushing to complete Staking terms at the last minute (seen in SEC filing).

Thus, within two months, they completed a back-and-forth of "two delays + three revisions + four new applications"—pushing our core discussion topic to the forefront: Can Liquid Staking Token (LST) be put into an ETF?

Why: Why are LSTs desperately trying to enter ETFs?

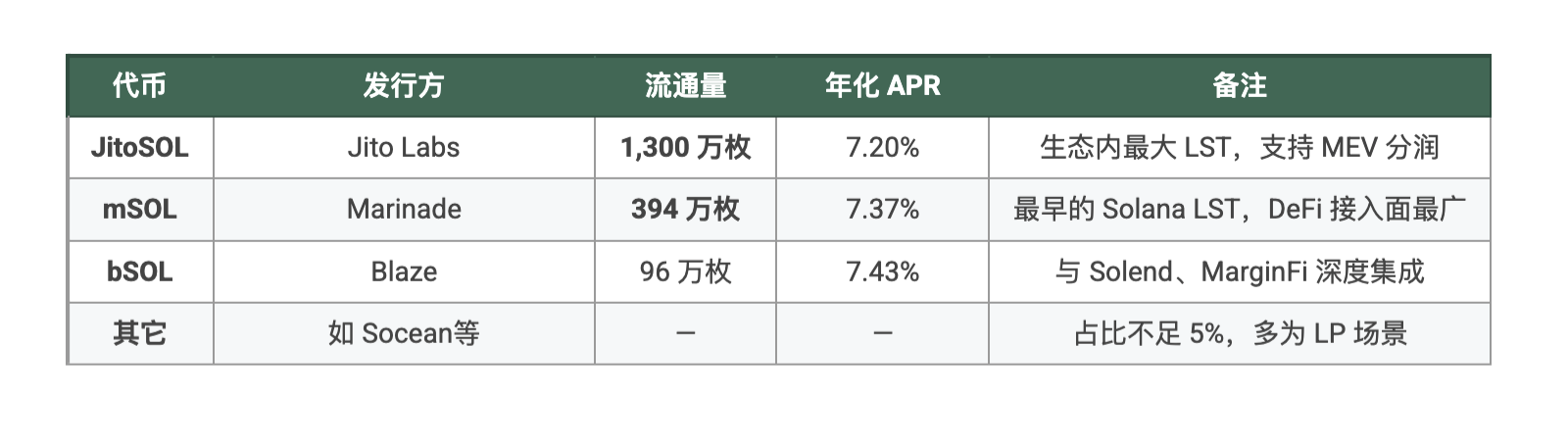

LST List and Current Status

Note: APR is from each LST issuer's official website on August 1st, with data subject to real-time changes.

Triple Benefits

Passive Funds = Long-term Lockup

The larger the ETF scale, the more it can turn LST into a "fund pool that won't actively reduce positions but continues to earn returns". For Jito and Marinade, this directly adds "billions-level" long-term Staking volume, allowing stable protocol commissions, and naturally boosting TVL.

Liquidity Depth Leap

ETFs will continuously trade in the secondary market, and fund shares corresponding to LST need daily market-making—market makers will simultaneously set up LST/SOL and LST/USDC depths, providing a thicker bottom than DeFi pools.

Brand Credit Spillover

Entering the SEC compliance framework means "endorsed by Wall Street". Once 10K, N-CSR, and other public documents start mentioning JitoSOL / mSOL, the due diligence cost for ordinary institutions will plummet, upgrading LST from "niche DeFi certificate" to "accountable financial asset".

Impact: Breakdown along three lines

For Solana: Dual Improvement in Security + Valuation

Staking Rate Elevation—Based on 2025 H1 data, if the first batch of spot SOL ETFs collectively raises $5 billion, with 80% allocated to LST, the chain will instantly add about 24 million staked SOL (calculated at $167 USD/SOL), raising the Staking rate from 66% to nearly 71%, simultaneously elevating the network's Nakamoto coefficient.

Valuation Anchor "Yield Rate"—Staking APR ≈ 7% becomes a segment of DeFi's risk-free yield curve. Buyers can simplify discounting with "SOL current price / 7%", rather than pure Beta parabola, making sector valuation more friendly.

For Other ETFs:

Conclusion: If SOL LST ETF passes first, the ETH camp will be forced to write "native Staking" terms more precisely, while BTC ETF can only continue relying on lowering fees to maintain attractiveness.

For ETF Buyers:

Three-in-One—Spot Beta + over 7% annual yield + secondary market liquidity; For Family Offices / pension funds with strict compliance constraints, this is the first "buyable high-yield PoS" ticket.

Tax & Settlement Friendly—Staking returns in 40 Act/33 Act structures are often taxed as capital gains rather than operating income, more advantageous than personal on-chain Staking.

Fee Game—Currently disclosed fees range from Grayscale's 2.5% to expected 0.9% (industry speculation of VanEck framework), whoever returns more revenue will attract orders. BTC ETF has already been drawn to 0.19-0.25%, and the fee war is destined to spread.

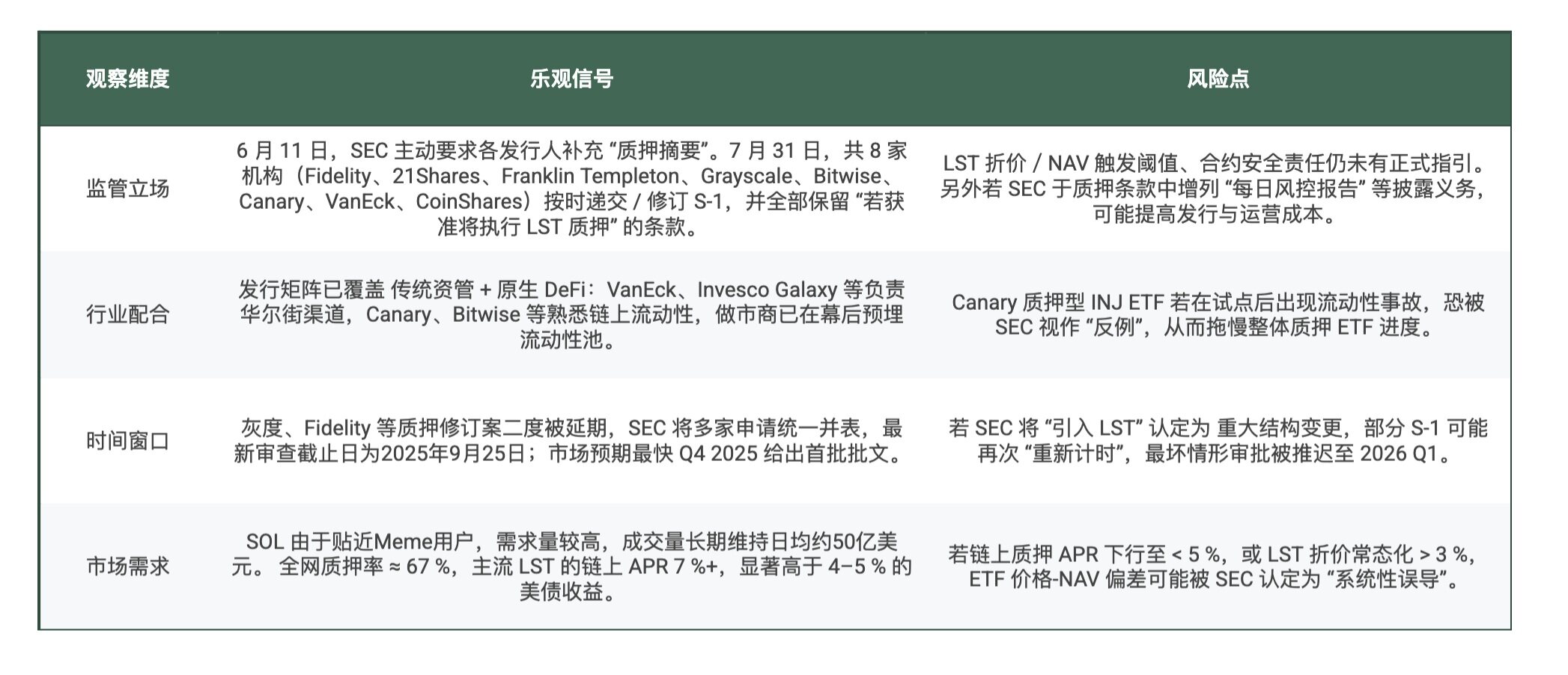

Call for Intensity: Will it pass? What are the risks?

Based on the above data, the probability of approval is around 60-70%. The author believes that to pass smoothly, issuers should at least supplement three types of solutions in the S-1:

Solution One: Discount Circuit Breaker Threshold

Suggest setting a deviation limit for LST market price against reference NAV (example: ± 5%); Once the threshold is triggered, pause primary market subscription/redemption, and activate "price difference adjustment" or cash creation backup process to ensure fund share alignment with underlying asset value.

Solution Two: NAV Calculation and Calibration

Introduce at least two independent data sources: one on-chain oracle (like Chainlink) + one compliant custody/market-making quotation (like Coinbase Prime, Cumberland, etc.); Recommend 10-second updates, and disclose redundancy and fault-switching plans for regulators to assess price distortion risks.

Solution Three: Contract Risk Coverage

At the smart contract level, besides annual third-party audits, consider purchasing Lloyd's of London, Nexus Mutual, or equivalent policies covering extreme scenarios like hacker attacks and Staking slashing; Clearly specify claim processes, coverage limits, and trigger conditions in the prospectus to give investors and regulators a quantitative expectation of potential losses.

(Note: The above measures are a "reference framework" proposed by the author based on public cases and industry best practices, with specific thresholds and technical routes still requiring further communication between issuers and the SEC.)

Conclusion

From "blacklisting" in May to "nurturing" in July, the SEC completed an attitude reversal in just 70 days: It no longer hesitates about "whether to list" but starts discussing "how to list"—the first time "Staking and LST" are written in the footnotes of "Crypto ETF 2.0". Standing on the other side of the table, crypto players told Wall Street through "an open letter + a revised S-1": "We know how to maximize fund efficiency better than you." The next step depends on whether regulators are willing to let this "high-yield, low-maintenance" Staking game truly enter retirement funds and 401(k)s.

If truly approved, it would not just be Solana's victory, but a milestone for PoS narrative moving from on-chain to exchanges, from geeks to institutions.