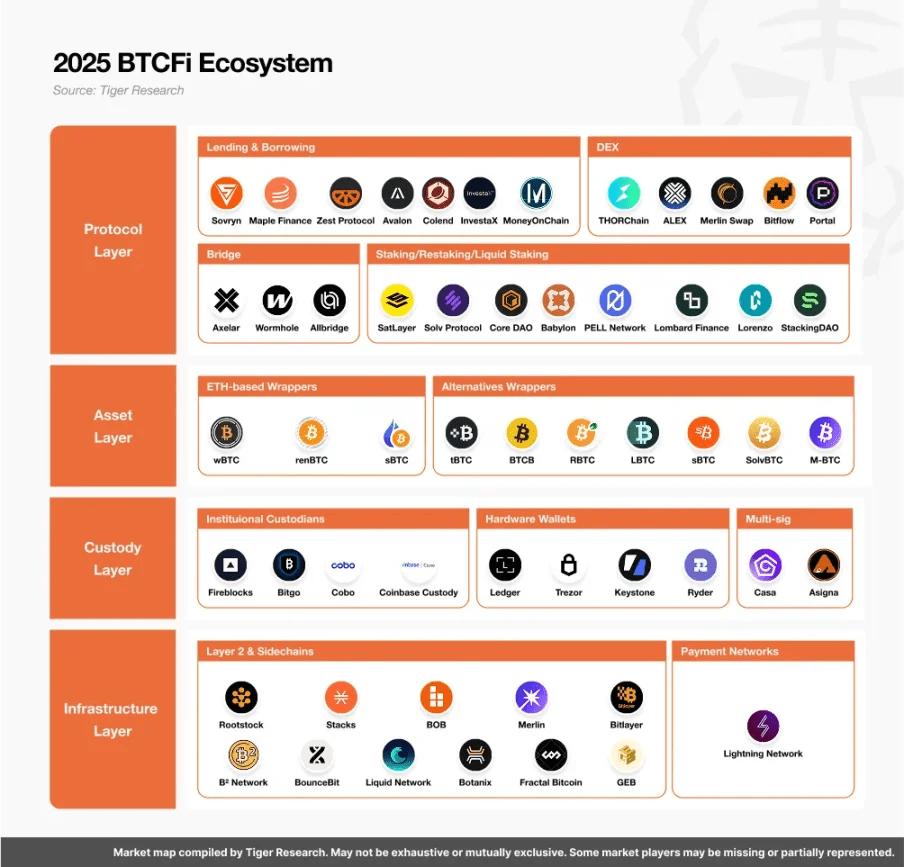

This report, written by Tiger Research, analyzes the BTCFi argument and examines why decentralized finance on Bitcoin is becoming an inevitable trend by investigating capital efficiency improvements, institutional adoption drivers, and technological infrastructure development.

Key Summary

Bitcoin's capital base is massive but underutilized, and BTCFi will change this status quo:Currently, over 14 million BTC are in an idle state, with Bitcoin lacking the capital efficiency of Ethereum's DeFi ecosystem. BTCFi will transform BTC into interest-bearing assets, release liquidity, and enable its use in lending, staking, insurance, and other decentralized financial applications built on Bitcoin's security.

Institutional demand for native BTC returns is growing, and infrastructure is ready:From compliant custody solutions to real-world yield protocols, the BTCFi ecosystem now covers ETFs, permissioned lending, insurance models, and staking protocols that meet institutional standards.

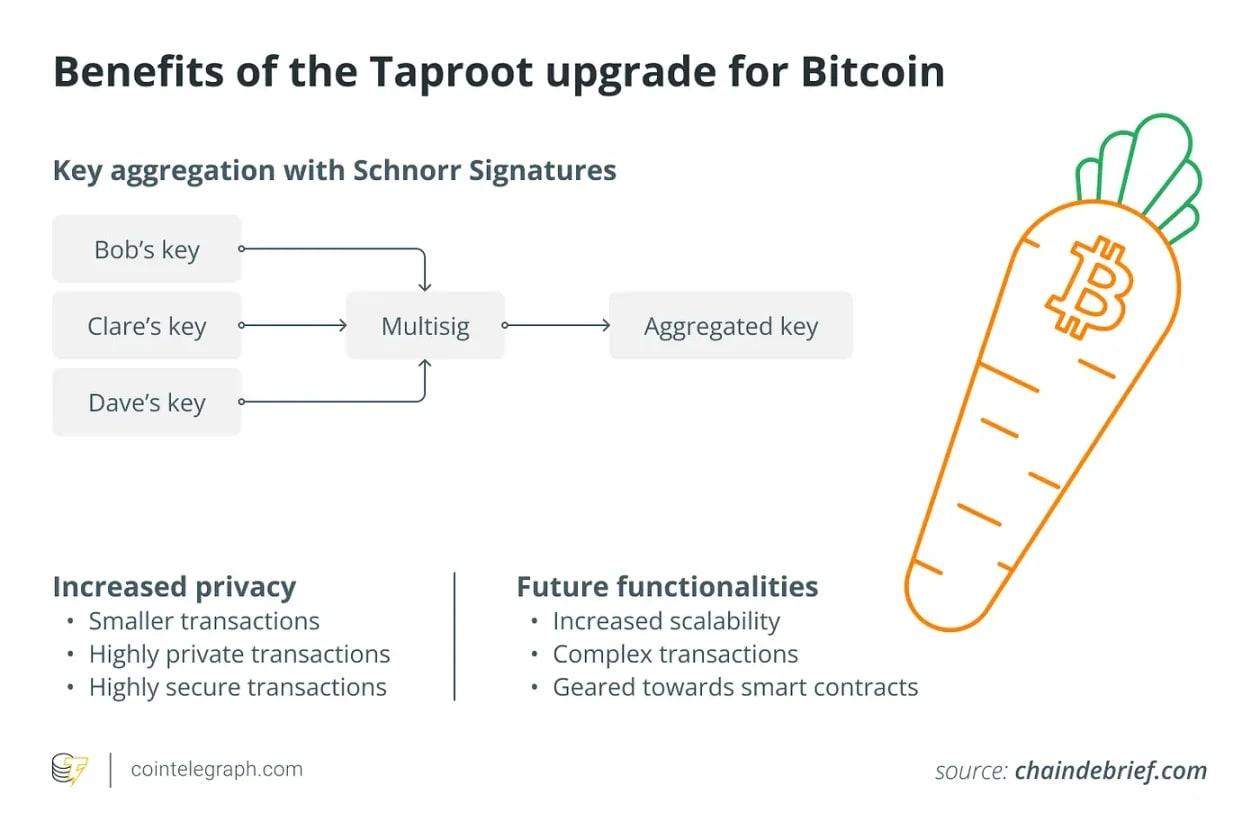

Technical breakthroughs and Layer-2 innovations provide BTCFi with scalability and programmability.

Upgrades like Taproot and emerging Layer-2 platforms now support smart contracts, token issuance, and composable DeFi applications on Bitcoin.

1. Capital Liquidity Bottleneck: The Significance of BTCFi

Bitcoin is now an asset base worth over $1 trillion, but most of these assets are in an idle state.Analysts estimate that 99% of BTC's market value is "idle", meaning almost all bitcoins are stored in wallets or cold storage, generating no on-chain yields. On-chain data confirms this: over 14 million BTC have remained unused for a long time.

This is in stark contrast to Ethereum, where a large amount of ETH is actively deployed in DeFi and staking.For example, liquid staking protocols on Ethereum have locked over 14.37 million ETH (approximately $56 billion), transforming ETH into interest-bearing assets and driving a vibrant on-chain economy.

Ethereum's DeFi "summer" demonstrated how capital efficiency through staking rewards, lending interest, and liquidity provision could unlock enormous value for smart contract platforms. In comparison, Bitcoin has remained underutilized; its vast liquidity yields 0% and cannot be further composed into financial products at the base layer.

BTCFi (Bitcoin DeFi) aims to release these dormant capitals. As CoinGecko's guide states, Bitcoin DeFi will "transform Bitcoin from a passive asset to a productive asset", enabling holders to earn yields or use BTC in DeFi applications.

Essentially, BTCFi's goal is to achieve for Bitcoin the transformation DeFi brought to Ethereum: converting static assets into yield sources and becoming a foundation for further innovation.

(Translation continues in the same manner for the rest of the text)Another example is SatLayer, which launched a decentralized insurance tool backed by interest-bearing BTC. SatLayer, often referred to as the "Berkshire Hathaway of Bitcoin," allows any BTC holder to restake their assets into an on-chain insurance pool and earn a portion of premium income. SatLayer is collaborating with crypto-native and traditional underwriting institutions like Nexus Mutual and Relm to build a new class of decentralized BTC insurance products.

3.3 Protocol Maturity and Institutional Trust

BTCFi protocols like Babylon and Lombard have surpassed billions of dollars in total locked value (TVL), passed security audits, and are advancing SOC2 compliance. Many protocols have also hired Wall Street veterans as advisors and prioritize risk management by design. These initiatives have established credibility for global large-scale capital allocators.

All of this points to a future where BTC yields will become the cornerstone of institutional portfolios, just like U.S. Treasury bonds in traditional markets.This transformation will also create a chain reaction: institutional funds flowing into BTCFi will not only benefit Bitcoin holders but also enhance cross-chain liquidity, drive more DeFi standards, and provide a trustworthy, productive capital base layer for the entire crypto economy.

In short, BTCFi offers institutions the best of both worlds: the reliability of Bitcoin as a premium asset and the opportunity to earn yields.

4. Why Now? The Technology Stack Driving BTCFi Explosion

BTCFi is no longer just a theoretical concept—it is becoming a reality, thanks to breakthroughs in three aspects: technical upgrades in the Bitcoin ecosystem, market demand growth from infrastructure improvements, and institutional interest driven by regulatory clarity.

4.1 From Taproot to BitVM

The latest upgrades to the Bitcoin protocol and ecosystem have laid the foundation for more complex financial applications. For example, the 2021 Taproot upgrade improved Bitcoin's privacy, scalability, and programmability, even "encouraging the use of smart contracts on Bitcoin" by enhancing efficiency. Taproot also supported new protocols like Taro (now Taproot Assets) for issuing tokens and stablecoins on the Bitcoin ledger.

Similarly, concepts like BitVM (a proposed Bitcoin "virtual machine") promise to enable Ethereum-like smart contracts on Bitcoin, with a testnet planned for 2025.Equally important, a batch of Bitcoin-native Layer-2 networks and sidechains have emerged.

Platforms like Stacks, Rootstock (RSK), Merlin Chain, and the new BOB Rollup are introducing smart contracts to the Bitcoin ecosystem.

Stacks supports smart contracts through Bitcoin's computing power, enables cross-chain tokenization through sBTC, and provides native BTC yields through proof of transfer (PoX) staking, making Bitcoin more programmable and productive for developers and institutions.

BOB (Build on Bitcoin) is an EVM-compatible Layer-2 using Bitcoin as its finality anchor. It even plans to leverage BitVM to implement Turing-complete contracts based on Bitcoin's security.

Meanwhile, the Babylon protocol introduced Bitcoin staking to secure other chains and has attracted tens of thousands of BTCs. As of the end of 2024, Babylon has staked over 57,000 BTC (approximately $6 billion), making it one of the top-ranked DeFi protocols by TVL. Merlin, as the BTCFi Layer-2 with the highest TVL, reached about $3.9 billion in TVL within 50 days of its launch, greatly expanding the BTCFi landscape.

The combination of these upgrades and new layers addresses many early obstacles, and Bitcoin can now support tokens, smart contracts, and cross-chain interactions in a modular way.

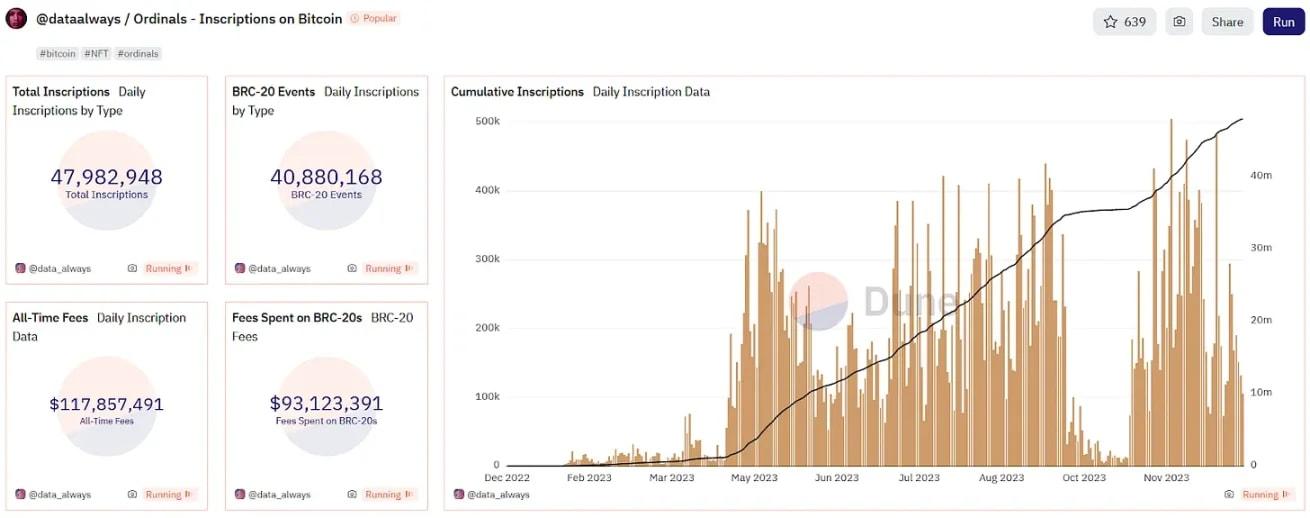

4.2 From Ordinals to BRC-20

Over the past two years, market demand for more expressive uses of Bitcoin has grown significantly. A typical example is the explosion of Ordinals and BRC-20 tokens in 2023.Users began inscribing assets and Non-Fungible Tokens on satoshis, driving a surge in on-chain activity.

By the end of 2023, over 52.8 million Ordinals inscriptions had been created, growing to approximately 69.7 million by the end of 2024. Meanwhile, miners collected hundreds of millions of dollars in fees, exceeding 6,900 BTC (approximately $405 million) by the third quarter of 2024.

This trend proves that users are willing to do more with Bitcoin block space than simply holding or paying, and the demand for Bitcoin Non-Fungible Tokens, tokens, and DeFi applications has become apparent.

The emergence of the Ordinals protocol fundamentally enabled Bitcoin to carry these new types of assets, and the BRC-20 standard provided a framework for tokenization. Although technically different from Ethereum's ERC-20, its role in expanding Bitcoin's utility is similar.

All these advancements constitute a technology stack that did not exist a few years ago.The Bitcoin ecosystem is now ready to build a complete DeFi infrastructure around its core asset.

In summary, these catalysts work together to make BTCFi mature,and this trend may accelerate in the coming years.

5. BTCFi Ecosystem Scenarios

The goal of BTCFi is to transform Bitcoin from a passive store of value to an actively deployed financial asset in decentralized finance.

5.1 Bringing Bitcoin into DeFi

The BTCFi lifecycle typically begins with BTC holders transferring their assets to bridges or custodians. The original BTC is locked, and a 1:1 tokenized version is issued. This wrapped BTC enters the ecosystem's asset layer, enabling integration with smart contracts and DeFi protocols.

5.2 Exploring the BTCFi Technology Stack

After tokenization, BTC flows through a structured hierarchy in the BTCFi technology stack. At the asset layer, Solv Protocol enables BTC to serve as a cross-chain interest-bearing collateral through SolvBTC and the Staking Abstraction Layer (SAL), supporting structured products and capital-efficient use cases.

Institutional adoption is supported by products like lstBTC. lstBTC, launched by Maple Finance in collaboration with CoreDAO, leverages Core's dual staking mechanism. BitLayer provides a trust-minimized, Bitcoin-native Layer-2 environment where Peg-BTC can support smart contract activities.

In terms of compliance, IXS offers real-world yields based on BTC through compliant financial structures. Meanwhile, infrastructure projects like Botanix expand Bitcoin's programmability by introducing EVM compatibility, enabling BTC to support smart contracts as gas.

5.3 Using BTC as Collateral and Staking Assets

As infrastructure improves, BTC can be used as collateral. For example, on bitSmiley, BTC can be used to mint stablecoins, thereby generating income or implementing stablecoin strategies. Emerging staking models are also expanding BTC's utility: protocols like Babylon allow native BTC to participate in protecting Proof of Stake (PoS) networks and earn rewards for doing so.

5.4 Risk Management and Position Exits

Throughout the process, BTC holders retain economic exposure to Bitcoin price fluctuations while earning yields from DeFi protocols. These positions are reversible: users can exit at any time by closing positions, redeeming wrapped BTC, and retrieving the original Bitcoin (minus fees or earnings).

5.5 Protocol Incentives and Income Models

Supporting these flows are diverse profit models. Lending platforms earn income through origination and utilization fees, capturing the spread between borrowers and lenders. DEXs collect liquidity fees for each transaction, typically sharing these with liquidity providers and protocol treasuries. Staking and bridging services extract commissions from earned rewards, incentivizing maintenance of uptime and network security.

Some protocols use native tokens to subsidize usage, guide activities, or manage treasuries. Custody products typically adopt traditional asset management models, charging annual fees (such as 0.4%-0.5%) for assets under custody or management.

Additionally, spread capture provides a less conspicuous but important income source: protocols can profit from interest rate differences and basis trading through cross-chain arbitrage or structured yield strategies.

These models collectively demonstrate how BTCFi protocols activate idle Bitcoin while establishing a sustainable income foundation. As more BTC enters this layered system, it not only circulates but also compounds, generating yields and supporting a Bitcoin-centric parallel economy.