Hi, I’m kx~

A digital nomad who has been traveling around the world for 10 years .

Amid tightening global crypto regulations, Singapore is quietly emerging as Asia's most competitive crypto financial hub. As Southeast Asia's leading fintech hub, the Monetary Authority of Singapore (MAS) has officially issued 33 Digital Payment Token Service (DTSP) licenses. The issuance of these licenses signals a higher compliance threshold, signaling the emergence of true crypto giants.

Today, we will take you to the bottom of these 33 institutions to see which players have obtained the "entry ticket" and who stands out in this regulatory reshuffle.

What does the Singapore DTSP license mean?

DTSP is one of the highest-level crypto licenses granted by Singapore under the Payment Services Act. Licensed businesses can legally conduct crypto-related businesses, including trading, custody, payment, and wallet services, while also gaining greater trust and partnership opportunities with financial institutions.

To sum it up in one sentence: without this license, you are basically not considered a compliant player; only if you get it, you are eligible to enter the "regular army" track.

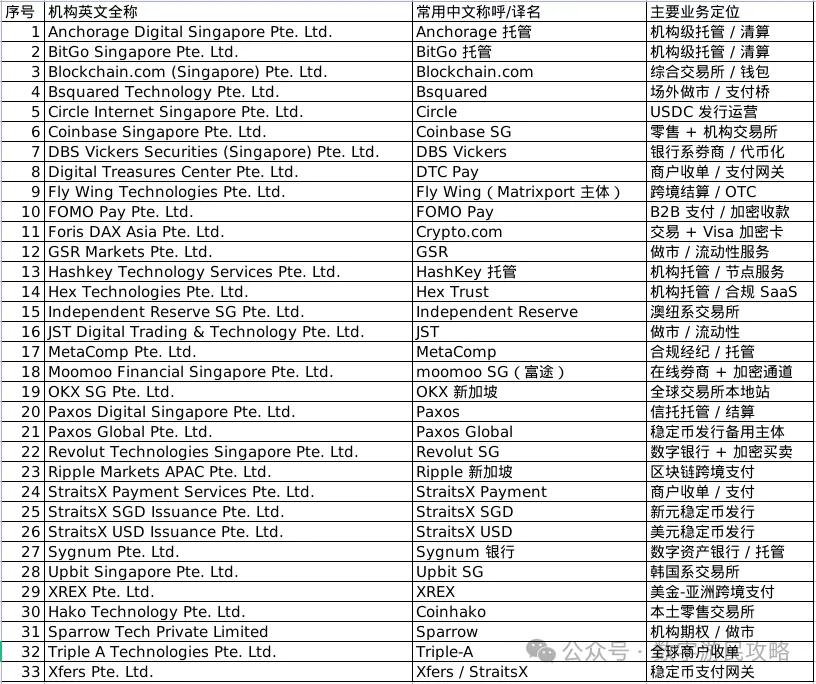

Full list of 33 licensed institutions

1. Global leading institutions are entering Asia. American crypto giants such as Coinbase, Circle, Crypto.com, Ripple, and Anchorage have all settled in Singapore, not only to expand the market, but also to bet on "Singapore becoming a bridgehead for compliance in Asia."

2. The rapid rise of local institutions. Singapore-based companies such as Coinhako, DTC Pay, StraitsX, and FOMO Pay have gradually grown into important players in Southeast Asia. Some even have central bank support and deep ties with local banks.

3. Crypto regulation is moving from the gray to the sunshine. The issuance of these 33 licenses not only establishes Singapore’s position as a compliance benchmark, but also sends a clear signal to other countries: Web3 is not unregulatable; the key lies in methods and determination.

It can be divided into 5 tracks in total: exchanges, market making, custody, payment, and stablecoins

It can be divided into 5 tracks in total: exchanges, market making, custody, payment, and stablecoins

Analyzing each institution in alphabetical order:

1) Anchorage Digital Singapore Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Anchorage Digital is the first digital asset bank to obtain a U.S. national banking charter (OCC), and its services focus on compliant, secure, institutional-grade digital asset solutions.

Main business directions:

Custody Service : Provides high-security cryptocurrency custody services such as multi-signature and hardware isolation, designed specifically for institutions.

Trading and Settlement : Conduct on-chain transactions and settlements directly within the custodial account, without transferring assets. Staking : Provides regulated staking income services for supported blockchains.

Governance participation : Assist customers to participate in DeFi, DAO governance, etc. Core advantages: Regulatory compliance : Operates under dual regulation in the United States and Singapore, and is strictly supervised by OCC and MAS.

High security : The security architecture is based on hardware modules (HSM) and on-chain signatures to prevent hot wallet attacks.

Designed specifically for institutions : Clients include banks, funds, family offices, government funds, etc.

2) BitGo Singapore Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

BitGo Singapore Pte. Ltd., a subsidiary in Singapore, is an important landing point for BitGo in Asia.

Main business directions:

1. Institutional-grade crypto custody services Multi-signature wallet (Multisig) / MPC wallet support / Support for over 600 digital assets / Hierarchical access control and compliance auditing capabilities tailored for institutions

2. Transaction settlement and liquidity services support internal transaction settlement of on-chain custody accounts/connect to multiple exchanges and market makers, and provide OTC payment counterparty clearing

3. API wallet and Wallet as a Service (WaaS) developers can access its API interface to build wallet functions / benchmark Fireblocks, Anchorage wallet infrastructure market

4. Compliance reporting support Supports FATF Travel Rule requirements/provides on-chain transaction transparency, audit reports and KYT (Know Your Transaction) services Core advantages: High security : multi-signature + MPC architecture, with no major attack record Designed for institutions: Service clients include banks, funds, family offices, government funds, etc.

3) Blockchain.com (Singapore) Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Blockchain.com is one of the earliest brands in the crypto industry, founded in 2011. Initially offering block explorer and lightweight wallet services, it is one of the few integrated crypto platforms that offers consumer wallets, institutional trading, derivatives services, and lending.

Main business directions:

1. Wallet service (mainly non-custodial) provides a non-custodial light wallet app (similar to MetaMask experience) / supports mainstream currencies such as BTC, ETH, USDT, USDC / integrates DEX SWAP function

2. Blockchain.com Exchange offers global spot trading for both crypto and fiat currencies. It features a simple UI that emphasizes compliance and security. It also offers trading tools like limit orders and stop-loss orders.

3. Institutional services include OTC block trading, lending (crypto collateral), and options products/with compliant KYC/KYB processes and on-chain tracking tools

4. Users of income products can earn interest by staking BTC, ETH, etc. / Similar to the Coinbase Earn model . Core advantage: Blockchain.com is unique in that it is a compliant upgrade of the "old crypto brand" in the Web1 era, taking into account wallet, platform, OTC and institutional trading functions.

4) Bsquared Technology Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Bsquared's business focuses on serving as a bridge between on-chain assets and traditional finance (TradFi), and its services combine technical and liquidity capabilities.

Main business directions:

1. OTC Market Making: Providing market-making quotes for crypto assets to exchanges and institutional clients; Maintaining bilateral liquidity in multiple currencies, including stablecoins, BTC, ETH, and other mainstream currencies; Providing bulk order matching and structured trading strategies.

2. Crypto Payment Bridge provides crypto payment withdrawal channels for cross-border e-commerce, wallet apps, trading platforms, etc. / converts stablecoins such as USDT and USDC into local fiat currencies (such as SGD, USD, PHP, etc.) / connects to local payment networks (such as FAST, PayNow) or overseas settlement systems

3. API and Integration Services: API interfaces are provided to support connection with wallets, DApps, and payment platforms, allowing platforms to integrate their market making and withdrawal capabilities in a "white label" model . Core advantage: Bsquared is characterized by combining traditional "market making" capabilities with "payment channel" capabilities, which is suitable for customers who want to solve the legal tender and stable currency conversion problem.

5) Circle Internet Singapore Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Circle is the issuer of USDC, the world's second-largest dollar-denominated stablecoin (after Tether's USDT). Its operations are subject to regulatory compliance scrutiny by multiple regulators, including the U.S. Treasury's FinCEN, the SEC, and Singapore's MAS. Circle's mission is to become the "underlying infrastructure for the digital dollar" in the Web3 world.

Main business directions:

1. The Asian Stablecoin Clearinghouse will introduce USDC to exchanges, payment platforms, and DeFi projects in Southeast Asia and promote “regulated stablecoins” as an alternative to USDT in line with the MAS compliance framework.

2. Support local Web3 companies in Singapore to collaborate with institutions such as Xfers/StraitsX, Triple-A, and FOMO Pay to promote the inclusion of USDC in local payment systems or cross-border e-commerce settlement networks.

3. Fiat Currency Channel and Reserve Compliance Register USDC's local reserve management structure with Circle Singapore / access local banking systems such as DBS, UOB, and Standard Chartered for fund custody Core Advantages: Circle is one of the most compliant, transparent, and ecosystem-supporting stablecoin issuers.

6) Coinbase Singapore Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Coinbase is one of the earliest compliant trading platforms in the United States. Founded in 2012 and listed in 2021, it is the first pure-play crypto exchange listed on the US stock market. It is considered a "bridge company" between traditional capital and crypto finance. Coinbase sees Singapore as a key node in its Asian expansion, especially in the context of high-pressure US regulation and compliance-friendly Asia-Pacific environments. Coinbase Singapore plays a particularly important role.

Main business directions:

1. Localized fiat currency deposit and withdrawal channels will support PayNow FAST SGD deposits starting in 2023 / connect to Singapore's local banking system to enable USDC SGD exchange / provide SGD-denominated purchases of BTC, ETH, USDC and other assets

2. The retail investor platform has launched a MAS-compliant interface and risk warnings for local users, providing a simplified "buy-sell UX" experience.

3. Localized Institutional Services: Coinbase Prime launched in Singapore, providing custody, liquidity, and transaction settlement services to family offices, crypto funds, and financial institutions, as well as OTC and API access solutions.

4. Web3 wallet and developer access: Coinbase Wallet supports user access to DApps, NFTs, Developer API, and Wallet-as-a-Service modules, opening up to Asian developers. Core advantages: Coinbase's strengths lie in its "high compliance + global connectivity + local institutional services," making it particularly suitable for retail investors with low risk appetite and institutions requiring regulatory endorsement.

7) DBS Vickers Securities (Singapore) Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

DBS is one of the first traditional banks in the world to launch cryptocurrency services, using its subsidiary DBS Vickers to undertake trading and brokerage services, while providing a tokenized asset platform and on-chain custody services through DBS Digital Exchange (DDEx).

Main business directions:

1. Digital asset trading supports mainstream currencies such as BTC, ETH, XRP, and BCH. It is open to institutions and qualified investors. Transaction matching and settlement are completed within a closed platform (avoiding on-chain risks).

2. Digital asset custody is integrated with DBS Bank's existing private key custody architecture / Multi-signature + hot and cold isolation + bank-level audit system / Storage and settlement are completed within the internal bank account structure

3. Tokenization Asset Services: We have issued multiple on-chain tokens for bond-like assets (e.g., private bonds, PE fund shares) and provide high-net-worth clients with an "asset securitization + on-chain circulation" solution. 4. On-chain clearing and settlement: We support clients in completing on-chain atomic swaps between digital assets and fiat currencies on the DDEx platform and can access DBS's proprietary payment system (similar to SWIFT/FAST). Core Advantages: DBS is one of the few compliance models that has achieved dual regulatory collaboration between a "bank + crypto platform." DBS's competitive advantage lies not in the number of currencies or liquidity, but rather in: its exceptional compliance and adaptability to traditional financial operational processes , as well as its robust internal funding, audit, and settlement structures .

8) Digital Treasures Center Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

DTC Pay is a local Singaporean company specializing in compliant crypto payment solutions. It is committed to bringing the Web3 payment experience into mainstream business scenarios, with a particular emphasis on "merchant-side implementation."

Main business directions:

1. Digital currency acquiring merchants can accept payments in USDT, USDC, ETH, etc., and automatically convert them into SGD/USD for deposit

2. Payment gateway API access to e-commerce, SaaS, and POS systems to achieve on-chain payment capabilities

3. Customers paying at offline POS terminals can scan the code or transfer funds on the chain to make encrypted payments, and the system will automatically complete the exchange and settlement.

4. Deposit and withdrawal services provide services for exchanging crypto assets for fiat currencies (such as SGD, USD) or reverse recharging stablecoins. Core advantage: Compared with large institutions that only serve C-end wallets or market making transactions, DTC Pay is more like a localized infrastructure that "integrates Web3 into life". As an MPI+DPT licensed institution, DTC Pay is one of the few institutions in Singapore that can legally provide crypto payment services to third-party merchants . The company supports the entire process of crypto collection + local settlement + regulatory audit and has been connected to Singapore's local payment networks, such as FAST and PayNow.

9) Fly Wing Technologies Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Matrixport is a crypto-finance platform founded by Bitmain co-founder Jihan Wu. It was spun off from its mining machine business in 2019 and is headquartered in Singapore, positioning itself as a "crypto bank." Fly Wing Technologies Pte. Ltd. is Matrixport's compliant implementation vehicle in Singapore.

Main business directions:

1. DPT services fiat-to-cryptocurrency exchanges (especially stablecoins such as USDT/USDC/DAI)

2. OTC market making provides block trade quotes, mainly for exchanges and institutions

3. Cross-border settlement supports Asian funds to be cleared through stablecoins

4. High-net-worth customer service Customized management of customer funds, configuration of crypto-wealth management products, and response to leverage and lending needs Core advantages: High liquidity of stablecoins Direct connection with multiple exchanges and wallet platforms, strong OTC liquidity, support for large-value product diversification Providing innovative financial management options such as structured income products, BTC/ETH lending, and automatic staking Core customers are professional users , not retail investors, but more focused on institutions, market makers, funding parties, and wallet operators

10) FOMO Pay Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

FOMO Pay began as an aggregator payment platform, similar to an enterprise version of WeChat or Alipay, initially serving local merchants (particularly retailers catering to Chinese tourists). With business expansion and loosening regulations, FOMO Pay has gradually transformed into a compliant digital payment bridge, integrating settlement and clearing solutions for fiat currencies, cryptocurrencies, and central bank digital currencies (CBDCs).

Main business directions:

1. Cryptocurrency collection / B2B payment supports merchants using USDT, USDC, BTC, ETH, etc. / Provides automatic fiat currency conversion and bank account deposit services / Suitable for e-commerce platforms, overseas companies, travel payments, etc.

2. Cross-border settlement and clearing bridges support the conversion of fiat currencies into stablecoins (such as USDC) and cross-border transfers, or vice versa. Integrates with RippleNet, SWIFT, PayNow, FAST, and other networks. Settlement channel partners are available in Southeast Asia, Africa, and the Middle East.

3. Central Bank Digital Currency (CBDC) docking Participate in MAS-promoted eSGD projects such as Project Orchid / Provide technical infrastructure for future CBDC reception and payment

4. Multi-currency acquiring gateway (fiat + crypto) with a set of APIs, supporting payment methods such as Visa, Alipay, WeChat, USDC, ETH, etc. / providing unified reconciliation, invoicing, compliance audit, and AML reporting

Core advantages:

FOMO Pay is more inclined towards bank-level/B2B/cross-border corporate customers and does not serve as a retail wallet.

11) Foris DAX Asia Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Main business directions:

Digital Payment Token (DPT) Services: Provides local compliant cryptocurrency trading, payment, exchange, and custody services in Singapore.

Crypto.com's operational vehicle in the Asia-Pacific region : Serving as Crypto.com's legal and compliant entity for the Southeast Asian and Australian markets, supporting the brand's global expansion.

Fintech service integration : Supports the launch of Crypto.com’s core products, such as the exchange, DeFi wallet, and Crypto.com Visa card, in Singapore.

Core advantages:

Regulatory Compliance : We hold an MPI license issued by MAS and are one of the few approved crypto institutions in Singapore to legally provide crypto services.

Rich product ecosystem: supports exchanges, NFT platforms, payment cards, Web3 wallets and other services, with complete on-chain and off-chain integration capabilities.

Technology and Security : We have a global standard KYC/AML system, smart contract auditing, and risk control capabilities, focusing on user asset security and transparent supervision.

12) GSR Markets Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Main business directions:

Institutional-grade liquidity provision and market making: GSR provides deep liquidity and price support to trading platforms, token issuers and large institutions, covering a wide range of digital assets.

Over-the-counter (OTC) and programmatic execution services: support for block trades, cross-currency/cross-fiat OTC, and efficient programmatic trading through API, with flexible services

Risk management and quantitative trading strategy support: Utilize quantitative models and risk control systems to develop strategies and manage asset risks for institutional clients.

Fintech service expansion: In addition to trading functions, GSR has expanded into investment and consulting, DeFi architecture consulting , asset management, etc.

Core advantages:

Global network and accumulated experience: GSR was founded in 2013 and has more than ten years of experience in the digital asset market, serving global token issuers and exchanges, with a strong reputation and customer relationships.

Professional liquidity and execution capabilities: Provides high-quality execution and price transparency across 200+ digital assets and 25 fiat currencies, and supports API and UI access

Strategic diversification and innovation: Expanding services such as Katana DeFi network, investment and consulting services to strengthen its role as a bridge between DeFi and traditional finance

13) Hashkey Technology Services Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Main business directions:

Institutional-grade OTC crypto trading services: We provide bulk spot trading services for institutions and qualified investors, covering mainstream crypto assets and fiat currency pairs, and support one-on-one negotiated quotes or API execution.

Digital Payment Token (DPT) Services: As a licensed entity, we provide services such as the sending, receiving, and exchange of digital payment tokens, complying with the Singapore Payment Services Act. Fiat Currency Solutions: We offer fast conversion channels between fiat currencies such as the Singapore Dollar (SGD) and the US Dollar (USD) and crypto assets, enabling institutions to quickly enter and exit the market.

HashKey Group's compliance portal in Singapore: As a key node in the Asia-Pacific region, it provides local compliance access for the group's services such as exchanges, asset management, and Web3 infrastructure.

Core advantages:

Institutional service capabilities: It has high liquidity, T+0 settlement, customized quotation and other service capabilities, and is suitable for scenarios such as large-scale transactions and fund allocation between compliant exchanges.

Group Ecosystem Synergy: Backed by HashKey Group, resource integration covers exchanges, asset management, tokenization and infrastructure services, with integrated advantages.

Strategic geographical advantage: With Singapore as the bridgehead, it connects the Southeast Asian market with the Hong Kong regulatory framework, forming a dual-center structure in the Asia-Pacific region.

14) Hex Technologies Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Main business directions:

Institutional-grade digital asset custody (Custody): Provides compliant and secure custody services to institutions, parties to agreements, and financial institutions, including cold wallets and multi-signature mechanisms.

OTC Trading and Market Services (Markets/OTC): Provide professional OTC trading matching, financing, fiat currency access and other services, and provide integrated support for institutional asset allocation.

Staking Services: Supports institutional-grade staking solutions including node verification, secure staking, and Validator-as-a-Service. Fiat On-Off Ramps: Provides local and cross-border fiat deposit, withdrawal, and exchange services within the MAS regulatory framework.

Core advantages:

Strong custody security: With a bank-level asset protection system, multi-signature mechanism and insurance support, it is particularly suitable for institutions and parties to the agreement.

Integrated services: From custody to OTC to settlement, we offer a comprehensive, integrated service process, providing institutions with a closed loop of efficiency and compliance assurance.

Institutional Market Reputation: Recommended and supported by well-known projects and institutions including Aave, Algorand Foundation, Animoca Brands, and Hedera .

15) Independent Reserve SG Pte. Ltd.

1. Company Overview

II. Business Positioning and Advantages : Key Business Directions: Digital Asset Trading Platform (Spot Exchange): Providing spot crypto asset trading services, supporting deposits and trading in fiat currencies such as SGD, USD, AUD, and NZD. Institutional OTC Trading Services: Targeting institutional clients and high-net-worth individuals, we offer OTC desktop services, with transaction sizes typically ranging from SGD 50,000 to tens of millions. API Trading & Advanced Tools: Supporting institutional features such as API access, AutoTrader, Fireblocks integration, and USD arbitrage. Fiat Currency Gateway Services: Offering deposit channels such as PayNow, FAST (SGD), and SWIFT (USD), enabling instant or fast fund transfers. Compliance and Security: MAS licensed, ISO 27001 certified, annual external audits, client asset segregation, and a 1:1 reserve commitment.

II. Business Positioning and Advantages : Key Business Directions: Digital Asset Trading Platform (Spot Exchange): Providing spot crypto asset trading services, supporting deposits and trading in fiat currencies such as SGD, USD, AUD, and NZD. Institutional OTC Trading Services: Targeting institutional clients and high-net-worth individuals, we offer OTC desktop services, with transaction sizes typically ranging from SGD 50,000 to tens of millions. API Trading & Advanced Tools: Supporting institutional features such as API access, AutoTrader, Fireblocks integration, and USD arbitrage. Fiat Currency Gateway Services: Offering deposit channels such as PayNow, FAST (SGD), and SWIFT (USD), enabling instant or fast fund transfers. Compliance and Security: MAS licensed, ISO 27001 certified, annual external audits, client asset segregation, and a 1:1 reserve commitment.

Core Advantages: Leading Regulation: Independent Reserve is the first cryptocurrency exchange in Singapore to receive official MAS approval. Its license includes services such as Debit Payment (DPT) and remittances. Asset Security: Client funds are fully segregated and not lent or re-hypothecated. The platform maintains a 1:1 reserve ratio, with its primary crypto assets stored in underground cold storage in Australia. ISO 27001 certification ensures system security.

16) JST Digital Trading & Technology Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Main business directions : Institutional market making and liquidity support: Provide market making services for the crypto asset market, and provide quotes and liquidity support for trading platforms and token issuers. Customized trading and execution solutions: Provide OTC block trading, algorithmic execution and structured trading services for institutional clients. Digital Payment Token Service (DPT): Holds MAS MPI approval and can legally provide exchange and trading of digital payment tokens, and crypto-fiat currency channel services. Risk management and quantitative trading strategies: Leverage traditional finance and quantitative trading experience to provide value-added services such as asset management, risk control, and stable currency solutions. Core advantages: Financial professional experience: The founding team comes from traditional financial institutions and has many years of market making and trading experience. They integrate mature established processes with crypto asset services to implement quantitative and structuring capabilities: Provide programmatic execution, customized OTC and quantitative strategy support, suitable for the complex operational needs of high-net-worth and institutional clients.

17) MetaComp Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Main business directions: OTC and digital asset trading services: Provide over-the-counter transactions and stablecoin redemptions for enterprises, financial institutions and payment platforms, support large-scale one-to-one quotes and API access Cross-border fiat currency payments and FX infrastructure: Its StableX platform supports stablecoin-driven cross-border FX liquidity aggregation, multi-fiat currency exchange and fast settlement Digital asset custody and prime brokerage services: Through the CAMP platform, OTC, payment, custody and prime brokerage functions are integrated to provide partners and platforms with end-to-end asset management solutions Compliance and FinTech service support: Leveraging the MAS license, we provide compliant chain-linking and crypto asset infrastructure access for FinTech, payment institutions and traditional finance Core advantages: Platform integration capabilities: The CAMP platform integrates trading, payment, custody, compliance screening and prime brokerage to provide partners with an end-to-end service experience Stablecoin and FX architecture support: StableX provides cross-border FX and clearing capabilities with stablecoins as the core, supporting multi-currency conversion and liquidity optimization Institutional and enterprise orientation: The model is P2B2C, focusing on enterprises, platforms and institutional clients rather than retail, connecting with high-end asset management and payment process needs.

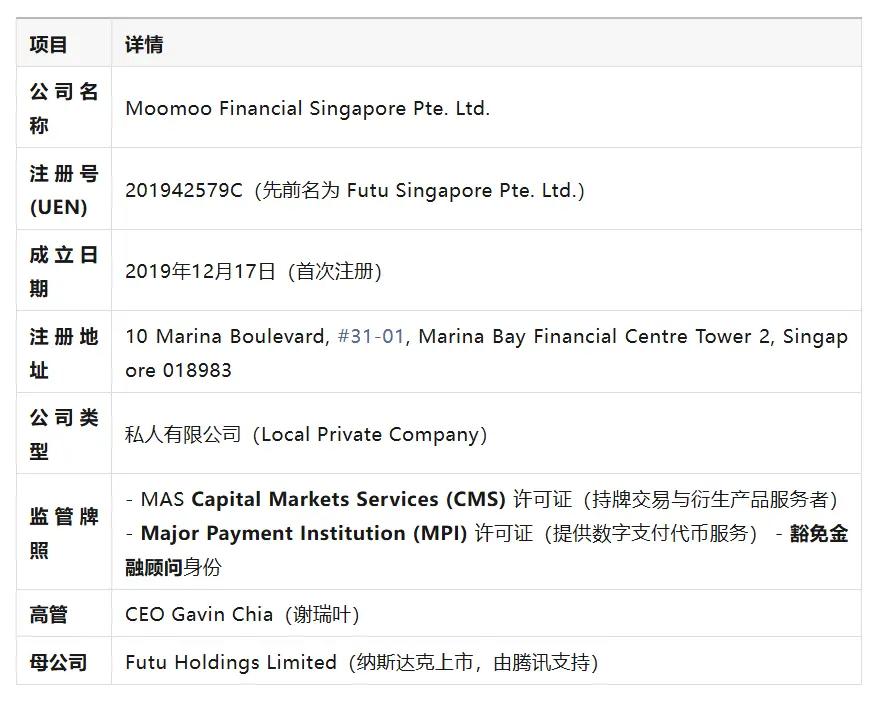

18) Moomoo Financial Singapore Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Key Business Areas: Securities and Derivatives Brokerage Services: Holds a MAS CMS license and provides brokerage services covering securities, collective investment products, exchange-traded derivatives, OTC derivatives, and leveraged Forex contracts. Wealth Management and Digital Brokerage Platform: Offers cross-border stock, ETF, bond, and option trading through the moomoo super‑app, integrating real-time quotes, analytical tools, and community features. DPT Services under the Major Payment Institution: Provides digital payment token-related services, including crypto asset top-up and trading support . Exempt Financial Advisory Services: Provides investment product advice and report generation services, with legal advisory status for securities and derivatives. Client Access and Trading Infrastructure: Becomes a trading and clearing member of CDP, SGX-ST, and SGX-DT, allowing users to directly participate in Singapore's local securities market. Core Advantages: Backed by a listed group. Strength: Affiliated with Futu Holdings (backed by Tencent), it has strong capital, technical background, and global operational experience. Technology-driven Platform Experience: The moomoo platform supports 24/7 US stock trading, stock screeners, social communities, and financial education content, with an integrated user experience that highlights its rich product offerings and educational attributes. Combine the platform's investment courses, news information and community interaction to enhance user investment confidence and stickiness

19) OKX SG Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Key Business Directions: Crypto Spot Trading Services (Spot Trading): Local users can legally buy and sell crypto assets in compliance with MAS's regulatory compliance requirements for digital payment token transactions; Digital Payment Tokens (DPT) and Cross-Border Remittance Services: SGD and other fiat currencies are provided for exchange, transfer, and capital circulation services with crypto assets through licensed entities; SGD deposit and withdrawal channel integration: DBS's PayNow and FAST instant SGD channels have been integrated to provide a local deposit and withdrawal experience ; Localized Operations Team Management: Former Grab, MAS, and GIC executive Gracie Lin has been appointed CEO to enhance strategic and compliance operations capabilities; Core Advantages: Global Brand Backing: Affiliated with OKX, the world's fourth largest cryptocurrency exchange, supporting over 50 million users and possessing international market and product strengths; Smooth Local Funding Channels: Cooperation with DBS enables PayNow/FAST instant deposits and withdrawals, improving user convenience and trust; Platform Technology and Ecosystem Advantages: OKX's parent company possesses mature exchange technology, Web3 wallets, and DeFi/NFT ecosystems, enabling local platforms to have global connectivity.

20) Paxos Digital Singapore Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages Main Business Directions: Stablecoin Issuance Services: Paxos Digital Singapore carries the issuance of the MAS-approved USDG stablecoin (Global Dollar), which complies with the MAS stablecoin regulatory framework that will soon take effect. Digital Payment Token (DPT) Services: Provides fiat currency and crypto asset exchange, payment and transfer services to corporate clients, and is supervised by MAS (MPI approved). Bank Custody Cooperation: Cooperates with DBS Bank, DBS is responsible for the custody and cash management of stablecoin reserve funds, and enhances the transparency and security of the mechanism. Financial Institutions and Enterprise Solutions: Provides MAS-regulated stablecoin technology access and custody issuance capabilities, serving global corporate clients' issuance business and on-chain payment integration. Core Strengths: Strong stablecoin governance capabilities: Paxos has global experience issuing assets such as PayPal USD (PYUSD) and Pax Dollar (USDP); USDG launched by the Singapore entity is the first local compliant issuer that complies with the MAS stablecoin regulatory framework. Top bank cooperation: Collaboration with DBS Bank, which provides institutional credit and regulatory compliance support for reserve asset custody. Transparency and compliance: Stablecoin assets are backed by 1:1 reserves, with regular disclosure of reserve reports and third-party audits, in line with global regulatory standards and consumer protection requirements.

2. Business Positioning and Advantages Main Business Directions: Stablecoin Issuance Services: Paxos Digital Singapore carries the issuance of the MAS-approved USDG stablecoin (Global Dollar), which complies with the MAS stablecoin regulatory framework that will soon take effect. Digital Payment Token (DPT) Services: Provides fiat currency and crypto asset exchange, payment and transfer services to corporate clients, and is supervised by MAS (MPI approved). Bank Custody Cooperation: Cooperates with DBS Bank, DBS is responsible for the custody and cash management of stablecoin reserve funds, and enhances the transparency and security of the mechanism. Financial Institutions and Enterprise Solutions: Provides MAS-regulated stablecoin technology access and custody issuance capabilities, serving global corporate clients' issuance business and on-chain payment integration. Core Strengths: Strong stablecoin governance capabilities: Paxos has global experience issuing assets such as PayPal USD (PYUSD) and Pax Dollar (USDP); USDG launched by the Singapore entity is the first local compliant issuer that complies with the MAS stablecoin regulatory framework. Top bank cooperation: Collaboration with DBS Bank, which provides institutional credit and regulatory compliance support for reserve asset custody. Transparency and compliance: Stablecoin assets are backed by 1:1 reserves, with regular disclosure of reserve reports and third-party audits, in line with global regulatory standards and consumer protection requirements.

21) Paxos Global Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Key Business Areas: Stablecoin Issuance Support: Providing technical and custody support for stablecoins such as PayPal USD (PYUSD) and Pax Dollar (USDP). Cryptocurrency Custody and Transaction Settlement: Providing institutional-grade digital asset custody and clearing services through the Paxos Settlement Service. Blockchain Infrastructure: Providing back-end blockchain solutions for major financial institutions (such as PayPal, Mastercard, and MercadoLibre). Compliant Tokenization: Compliant on-chain tokenization services for assets such as precious metals and securities (e.g., Pax Gold, PAXG). Core Strengths: Strong Regulatory Qualifications: Holding an MPI license from the MAS in Singapore; Paxos Trust Company, a regulated trust company in the United States, is regulated by the New York Department of Financial Services (NYDFS). Global Institutional Partnership Network: Partnering with financial giants such as PayPal, Revolut, Mastercard, and Interactive Brokers.

22) Revolut Technologies Singapore Pte. Ltd.

1. Company Overview

II. Business Positioning and Advantages : Key Business Directions: Digital Payments and Multi-Currency Accounts: RTSPL provides multi-currency accounts, e-money transfers, currency exchange, and international remittance services for individual and corporate customers. Digital Payment Token Services (Cryptocurrency): As a DPT service provider, it supports the purchase and sale of cryptocurrencies (regulated under Singapore's PS Act) . Card Solution Management and Acquiring Services: Supports the issuance of prepaid Mastercard or Visa cards, merchant acquiring, and account issuance. Insurance Product Agency: Provides value-added services such as travel insurance through MAS-registered agency status. Core Advantages: Global Brand Support and Local Implementation: RTSPL is Revolut's local operating entity in Singapore, backed by the brand, technical expertise, and global user network of its UK headquarters, while also enjoying a legal basis for local business operations in Singapore. Diversified Service Capabilities: Beyond traditional payment and remittance services, it also offers crypto services, merchant acquiring, virtual/physical card issuance, and insurance agency capabilities, providing users with an integrated financial experience. Flexible business models encompass both B2C and B2B models: It provides financial services such as consumption, transfers, and investments to individual customers, while also providing financial infrastructure such as merchant acquiring and cross-border payments to corporate customers, resulting in strong market coverage. 23) Ripple Markets APAC Pte. Ltd. I. Company Overview

II. Business Positioning and Advantages : Key Business Directions: Digital Payments and Multi-Currency Accounts: RTSPL provides multi-currency accounts, e-money transfers, currency exchange, and international remittance services for individual and corporate customers. Digital Payment Token Services (Cryptocurrency): As a DPT service provider, it supports the purchase and sale of cryptocurrencies (regulated under Singapore's PS Act) . Card Solution Management and Acquiring Services: Supports the issuance of prepaid Mastercard or Visa cards, merchant acquiring, and account issuance. Insurance Product Agency: Provides value-added services such as travel insurance through MAS-registered agency status. Core Advantages: Global Brand Support and Local Implementation: RTSPL is Revolut's local operating entity in Singapore, backed by the brand, technical expertise, and global user network of its UK headquarters, while also enjoying a legal basis for local business operations in Singapore. Diversified Service Capabilities: Beyond traditional payment and remittance services, it also offers crypto services, merchant acquiring, virtual/physical card issuance, and insurance agency capabilities, providing users with an integrated financial experience. Flexible business models encompass both B2C and B2B models: It provides financial services such as consumption, transfers, and investments to individual customers, while also providing financial infrastructure such as merchant acquiring and cross-border payments to corporate customers, resulting in strong market coverage. 23) Ripple Markets APAC Pte. Ltd. I. Company Overview II. Business Positioning and Advantages : Key Business Directions: Digital Payment Token Services (DPT): Officially authorized by MAS, we provide regulated digital token services such as crypto asset trading, deposits, and withdrawals . Enterprise-Level Cross-Border Payments and Settlements: Leveraging RippleNet's blockchain technology, we provide financial institutions, payment platforms, and corporate clients with cross-border payment solutions powered by stablecoins and XRP. Blockchain Payment Infrastructure Development: Integrating Ripple's global architecture and bringing technology to the Asia-Pacific market, including software development and integration services (SSIC 62011). APAC Regional Strategic Hub: Serving as Ripple's primary business center in the Asia-Pacific region, we support local business expansion, customer service, and regional compliance communications. Core Advantages: Backed by the global Ripple brand and technology ecosystem: Parent company Ripple maintains a cross-border payment network covering over 300 clients in over 40 countries, with over 90% of its business occurring outside the United States. Integrated Payments and Cryptocurrencies: We offer a multi-tiered service offering, including stablecoin payments, XRP liquidity support, and on-chain clearing. Research-focused clients are particularly reliant on this integrated capability.

II. Business Positioning and Advantages : Key Business Directions: Digital Payment Token Services (DPT): Officially authorized by MAS, we provide regulated digital token services such as crypto asset trading, deposits, and withdrawals . Enterprise-Level Cross-Border Payments and Settlements: Leveraging RippleNet's blockchain technology, we provide financial institutions, payment platforms, and corporate clients with cross-border payment solutions powered by stablecoins and XRP. Blockchain Payment Infrastructure Development: Integrating Ripple's global architecture and bringing technology to the Asia-Pacific market, including software development and integration services (SSIC 62011). APAC Regional Strategic Hub: Serving as Ripple's primary business center in the Asia-Pacific region, we support local business expansion, customer service, and regional compliance communications. Core Advantages: Backed by the global Ripple brand and technology ecosystem: Parent company Ripple maintains a cross-border payment network covering over 300 clients in over 40 countries, with over 90% of its business occurring outside the United States. Integrated Payments and Cryptocurrencies: We offer a multi-tiered service offering, including stablecoin payments, XRP liquidity support, and on-chain clearing. Research-focused clients are particularly reliant on this integrated capability.

24) StraitsX Payment Services Pte. Ltd. / StraitsX SGD Issuance Pte. Ltd. / StraitsX USD Issuance Pte. Ltd. / Xfers Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Main business directions: Stablecoin platform services: As the issuing and distribution entity of MAS-compliant single-currency stablecoins such as XSGD, XUSD, and XIDR, it provides institutions and enterprises with stablecoin minting, redemption, exchange and cross-border payment channels. Payment infrastructure output: Provides API-supported enterprise-level payment Rails, including merchant acquiring, cross-border transfers, local payments, account and card issuance, etc. Wallet and OTC services: Support users and institutions to buy and sell stablecoins in real time, provide Swap exchange, OTC block trading, e-wallet functions, and connect crypto platforms and financial customers Cross-border QR code payment: Cooperate with partners such as Alipay+ and GrabPay to achieve instant payment experience for inbound tourists at merchants in Singapore, use XSGD for instant settlement of merchants, and enhance the overall user experience and compliance transparency. Core advantages: Multi-currency stablecoin ecosystem: Issues stablecoins such as XSGD (Singapore Dollar), XUSD (US Dollar), XIDR (Indonesian Rupiah), supports cross-chain issuance and on-chain payment swaps, and is highly compatible with MAS's new framework . Strong cooperation network and market layout: Cooperate with DBS Cooperate with banks to custody reserve assets; cooperate with Alipay+ and GrabPay to build a cross-border payment network;

25) Sygnum Pte. Ltd.

1. Company Overview II. Business Positioning and Advantages Main Business Directions: Digital Asset Banking: Providing institutional-grade digital asset trading, custody, lending, staking, asset management, and tokenization platform services Brokerage Trading Platform Services (DPT Brokerage): Leveraging the MPI license, Sygnum provides regulated crypto asset trading, fast settlement, and quotation services to Accredited and Institutional Investors, supporting Fiat ↔ Crypto trading channels Compliant Custody and Asset Services: Providing custody services, capital market product trading, fund management, corporate financial advisory, and security token custody through the MAS and CMS regulatory structures Global Operations Network: As the Asia-Pacific digital asset center, Sygnum collaborates with entities in Switzerland, Abu Dhabi, Luxembourg, and other locations, and supports customer service capabilities in more than 65 countries and regions Core Advantages: Comprehensive Compliance License System: Since its inception, Sygnum has positioned itself as a fully compliant digital asset bank, integrating the high-standard regulatory systems of Switzerland's FINMA and Singapore's MAS Institutional-grade service capabilities and deep liquidity: The platform offers professional investors a competitive spread, deep liquidity, and a fast settlement trading experience. It also provides one-on-one support from account managers and supports a broad product portfolio and technology integration: including various institutional-grade digital asset functions such as custody, lending, staking, asset management, tokenization, and corporate banking services, building a one-stop service platform. 26) Upbit Singapore Pte. Ltd. I. Company Overview

II. Business Positioning and Advantages Main Business Directions: Digital Asset Banking: Providing institutional-grade digital asset trading, custody, lending, staking, asset management, and tokenization platform services Brokerage Trading Platform Services (DPT Brokerage): Leveraging the MPI license, Sygnum provides regulated crypto asset trading, fast settlement, and quotation services to Accredited and Institutional Investors, supporting Fiat ↔ Crypto trading channels Compliant Custody and Asset Services: Providing custody services, capital market product trading, fund management, corporate financial advisory, and security token custody through the MAS and CMS regulatory structures Global Operations Network: As the Asia-Pacific digital asset center, Sygnum collaborates with entities in Switzerland, Abu Dhabi, Luxembourg, and other locations, and supports customer service capabilities in more than 65 countries and regions Core Advantages: Comprehensive Compliance License System: Since its inception, Sygnum has positioned itself as a fully compliant digital asset bank, integrating the high-standard regulatory systems of Switzerland's FINMA and Singapore's MAS Institutional-grade service capabilities and deep liquidity: The platform offers professional investors a competitive spread, deep liquidity, and a fast settlement trading experience. It also provides one-on-one support from account managers and supports a broad product portfolio and technology integration: including various institutional-grade digital asset functions such as custody, lending, staking, asset management, tokenization, and corporate banking services, building a one-stop service platform. 26) Upbit Singapore Pte. Ltd. I. Company Overview

2. Business Positioning and Advantages

Key Business Directions: Cryptocurrency trading platform for institutional and retail markets: As part of the Upbit APAC network, it supports the Singapore, Indonesia, and Thailand markets, providing localized trading channels and services for diverse customer groups. Compliance-focused infrastructure operations: Adhering to the Payment Services Act 2019, we implement compliance processes, KYC/AML, customer asset segregation systems, and prudent management mechanisms. Connecting to global and regional networks: Leveraging the strengths of parent company Upbit APAC, we support integrated capabilities such as Travel Rule services (VerifyVASP), regional exchange operations, and institutional integration . Core Advantages: Upstream and downstream ecosystem synergy: Connecting to the platform resources of parent company Upbit APAC, we leverage VerifyVASP, exchanges in Southeast Asia, and institutional projects to provide integrated compliant trading and infrastructure services. Covering both institutional and retail markets: Supporting both retail and institutional clients, with flexible product positioning to meet multi-tiered market needs such as deposits, trading, and settlements. Strong brand and technical foundation: Leveraging the technology, trading depth, stability, and security of Upbit's headquarters in South Korea, along with the collaboration of a local compliance team in Singapore.

27) XREX Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Main business directions: Cross-border B2B payment and remittance solutions: Provide XREX Pay, a cross-border payment platform for SMEs in emerging markets, supporting SGD, USD, and stablecoin channels (such as USDT, USDC) to achieve fast and low-fee settlement. Blockchain-driven custody/guarantee services (BitCheck): Use digital escrow contracts, combine traditional payments and crypto assets, to achieve fund release for both parties in the business. Based on a consensus mechanism, improve security and transparency. Comprehensive payment service functions: MPI license covers six payment services including account issuance, local and cross-border remittances, merchant acquiring, electronic currency issuance, and digital token services . Stablecoin and fiat currency interoperability: Supports instant exchange and settlement of fiat ⇄ stablecoins to meet the funding needs of different companies for US dollars and on-chain assets. Core advantages: Innovative payment model: BitCheck and blockchain escrow: BitCheck provides a digital escrow contract mechanism, which is compatible with fiat currencies and stablecoins, improves transaction transparency and flexibility, and is particularly suitable for cross-border B2B scenarios . USD liquidity support for SMEs in emerging markets: Helps companies solve the problem of obtaining US dollars and provides a simple and efficient on/off-ramp for fiat currency and stablecoin, which is particularly suitable for markets such as Southeast Asia and Central Asia.

28) Hako Technology Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Main business directions: Retail user crypto asset platform: Coinhako is a cryptocurrency wallet and trading platform for ordinary users, supporting the purchase, sale, management and storage of a variety of digital assets, focusing on providing fiat currency ↔ crypto asset on/off ramp services for Singapore and Asian markets Digital payment token services and cross-border transfers: After holding the MAS MPI license, it can provide digital payment token (DPT) services and cross-border transfer functions in compliance with regulations, including SGD ↔ Crypto, Crypto ↔ SGD exchange and asset custody High net worth and institutional services: Launched Coinhako Privé (for high net worth clients and institutions), providing dedicated account managers, zero transaction fees, customized custody and trading strategy services; also provides Coinhako Earn (income product) Infrastructure and ecological cooperation: Establish cooperation with AWS, GrabPay, etc. to optimize technical stability, user experience, and expand payment access channels; participate in digital cultural activities such as NFT and e-sports to enhance brand influence Core advantages: Strong retail user base and brand awareness: As of the end of 2021, it has approximately 400,000 in Singapore Registered users, transaction volume in 2021 increased by 1200%. Coinhako was once rated as one of Singapore's top financial applications. Multi-layered product lines covering terminal and institutional clients: not only serving ordinary retail investors, but also expanding into the high-net-worth and institutional markets through the Coinhako Privé and Earn product lines, achieving B2C and B2B dual-wheel drive . Local innovation and financing endorsement: With a local start-up background, it has obtained strategic financing support from companies including SBI Holdings and Sygnum Bank; and won the Financial Services category award at the 2022 SBR National Business Awards, recognizing its innovative influence.

2. Business Positioning and Advantages

Key Business Directions: Institutional-Grade Digital Asset Platform and System Solutions: Providing customized services for financial institutions and family offices, including digital asset trading, options products, fund management, and compliant custody. Self-custody Technical Support: Received a MAS FSTI Innovation grant and partnered with RigSec to deploy an HSM‑based enterprise self-custody solution, enabling integrated hardware-encrypted cold wallet management. Brand and Regional Integration: After integration into the Amber Group, the platform's functionality, regulatory compliance, and service experience will be integrated, while leveraging a stronger regional presence. Core Advantages: Professionally Targeted at Institutional and Accredited Investors: Focusing on family offices, high-net-worth individuals, and institutional clients, the company provides customized digital asset products that are distinct from traditional trading platforms. Technology and Security Innovation: Introducing military-grade hardware security modules (HSMs) to implement self-custody solutions, meeting MAS regulatory requirements for cold wallet security. Global Brand Integration and Expansion Strategy Support: Affiliated with Amber International (NASDAQ-listed AMBR), the company leverages its global ecosystem resources to expand its reach into Asian and global markets.

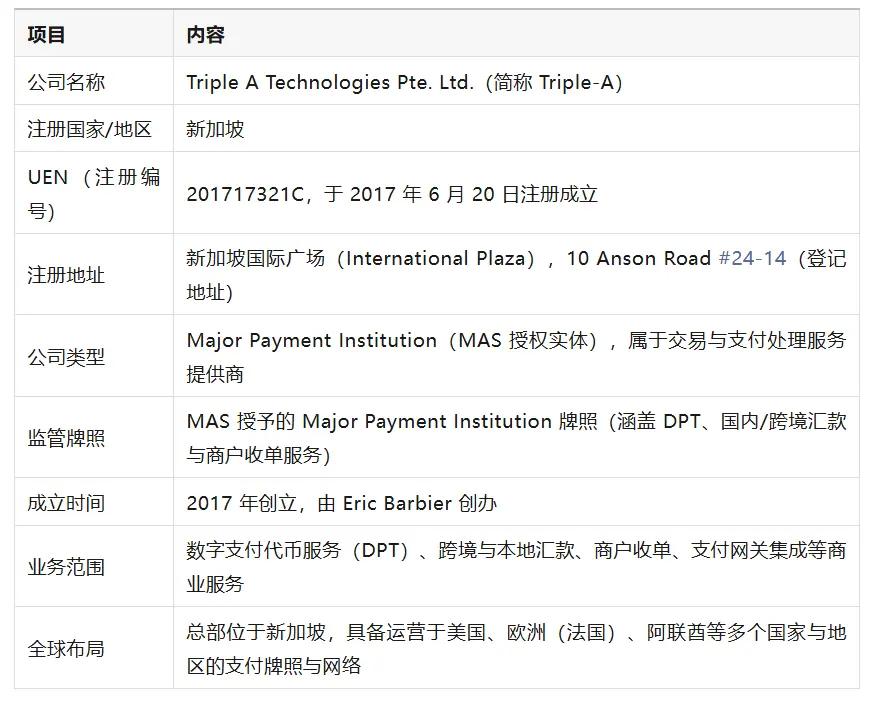

30) Triple A Technologies Pte. Ltd.

1. Company Overview

2. Business Positioning and Advantages

Main business directions:

Enterprise-level digital currency payment services: Triple‑A provides enterprise payment solutions for e-commerce platforms, digital banks, e-commerce, luxury goods, beauty, aviation, travel, gaming, creator economy, and other industries. We support digital currency (including stablecoins) collection, remittance, settlement, and instant fiat currency conversion.

Web-Based API and White Label Solutions: Offers multi-channel access options (including API and no-code integration), supporting Pay-by-Link, wallet top-ups, invoice payments, cryptocurrency spending routes, and a white-label trading system. Global Cross-Border Payment Network Support: Operating in over 120 countries, serving over 20,000 merchants worldwide and reaching over 300 million cryptocurrency holders.

Stablecoin and Fiat Interoperability: Enables instant fiat-to-stablecoin conversion, eliminating price volatility risk for consumers while eliminating the need for merchants to hold crypto assets. Cross-chain and platform support: Supports on-chain USDT and USDC channels, such as Arbitrum, providing merchants with low-fee, high-speed stablecoin payment options.

Core advantages:

Strong global B2B merchant network: covering multiple industries such as e-commerce, luxury goods, e-travel, gaming platforms, etc., and working with well-known brands such as Coinbase, Farfetch, Alternative Airlines, Crypto.com, etc.

Fluctuation-free payment experience: Instantly convert cryptocurrency payments into fiat currency, eliminating the risk of price fluctuations for merchants while supporting efficient settlement and customs clearance processes.

Ecosystem integration and multi-channel support: Supports API, no-code, white-label platforms, multi-currency stablecoins and fiat payment channels, flexibly adapting to different customer and industry needs.