The popular altcoin Solana has been struggling to maintain its upward momentum since reaching a cycle high of $206 on July 22. In the past week alone, this asset has dropped 14%, reflecting a decline in short-term investor confidence.

However, on-chain data suggests that the coin may experience a short-term recovery. Early indicators point to a sentiment shift that could promote a rebound in future sessions.

Long-term holders focus on Solana

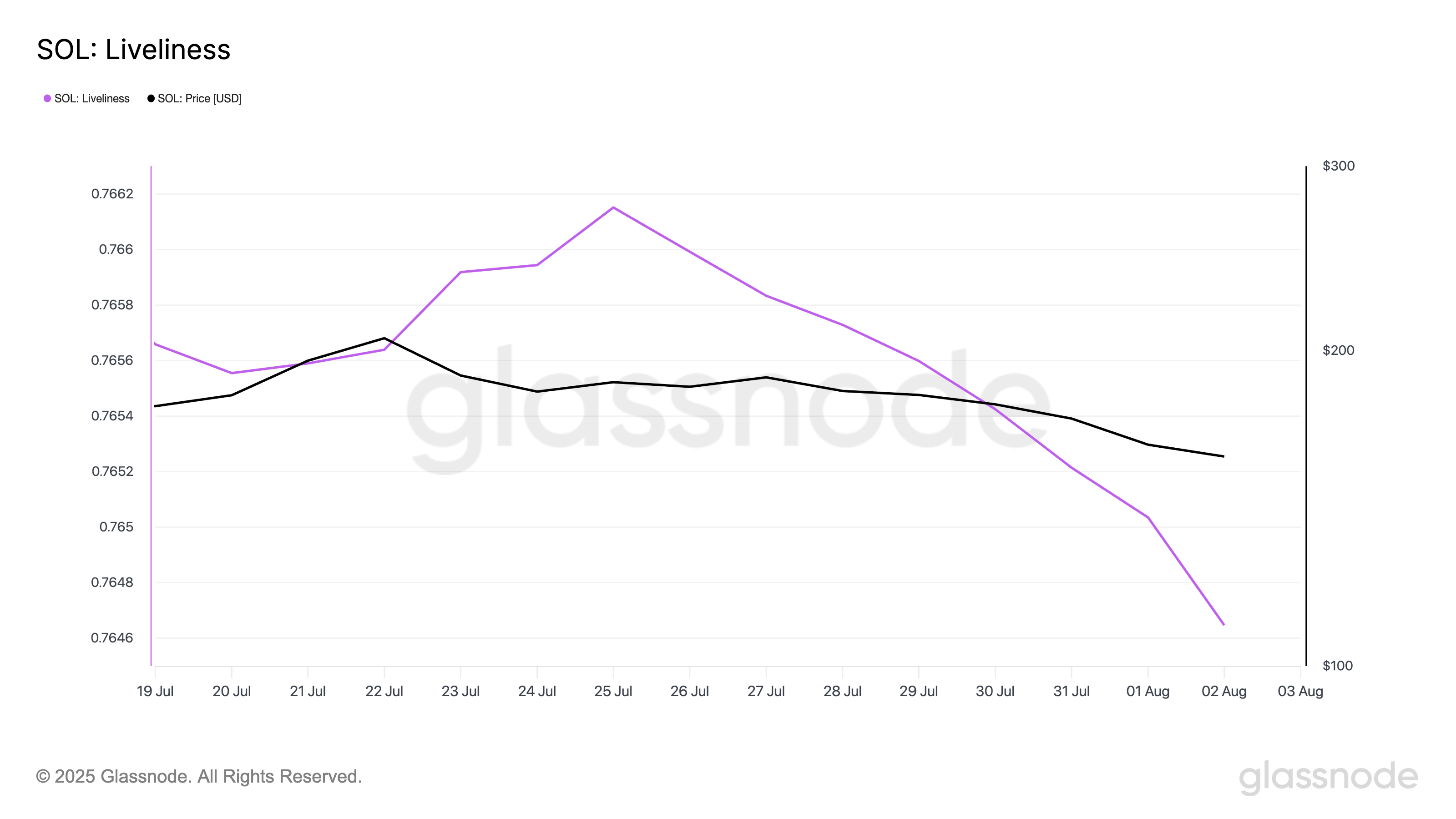

While short-term traders are selling their holdings, long-term holders (LTH) are entering a re-accumulation mode. This behavioral change is clearly evident in Solana's liveliness, which has been steadily decreasing since July 25.

According to Glassnode, this indicator that tracks the movement of previously inactive tokens plummeted to a weekly low of 0.76 yesterday, confirming a decrease in selling among SOL's long-term holders.

Want more token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter here.

Liveliness calculates the ratio of coin days destroyed to total coin days accumulated, tracking the movement of long-held tokens. When this indicator rises, it indicates more inactive tokens are being moved or sold, often signaling profit-taking by long-term holders.

Conversely, when this indicator falls, as with SOL, it suggests these investors are moving assets away from exchanges and holding.

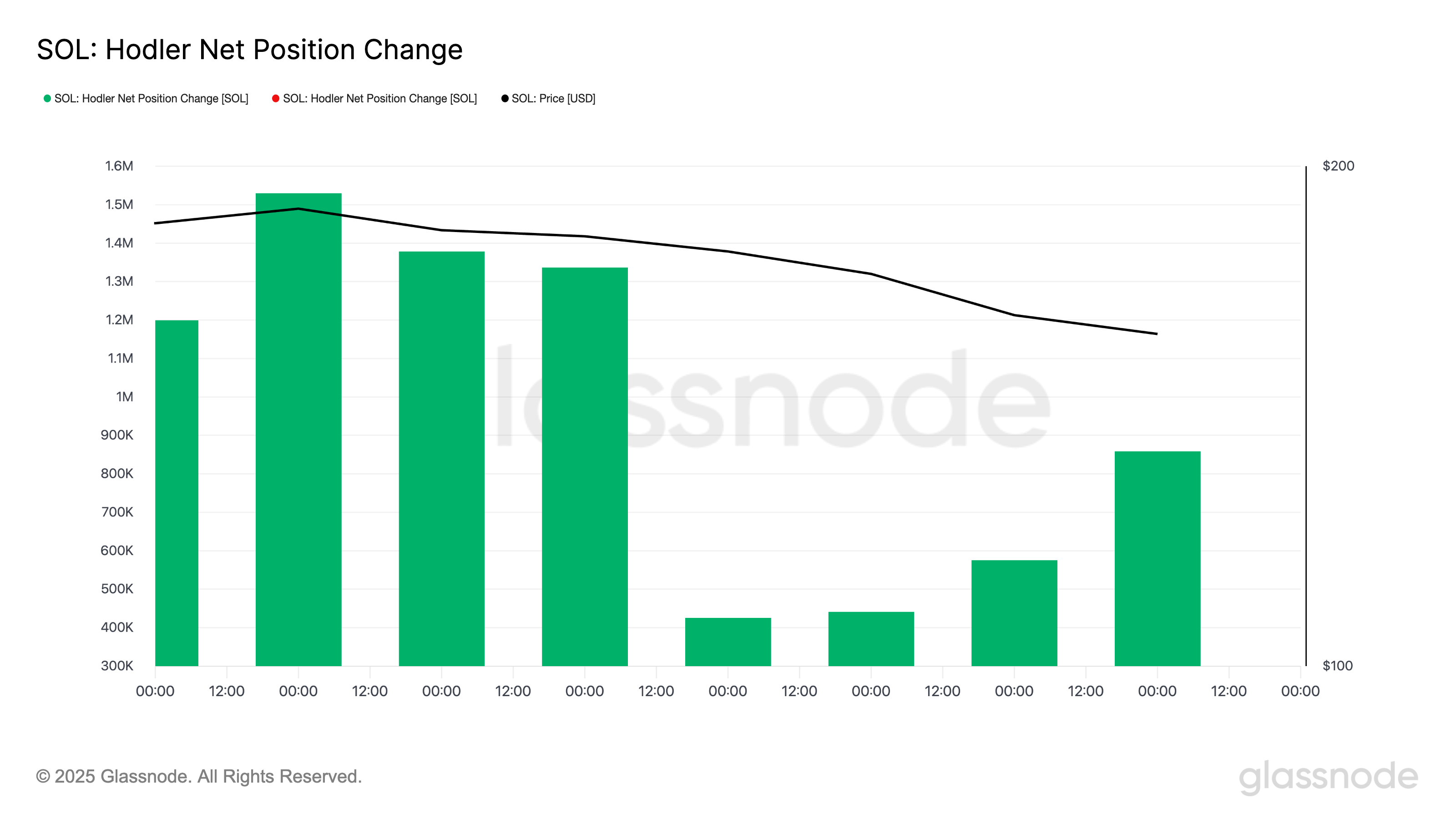

Moreover, SOL's holder net position change has recorded a steady increase since July 30. This confirms that more coins are moving to long-term storage despite the asset's sluggish price movement.

According to Glassnode data, this indicator, which measures the 30-day change in supply held by long-term holders, has risen 102% over the past four days. Such a rise indicates that LTHs are accumulating more rather than selling coins.

Solana Traders Selling at a Loss... Bottom Forming?

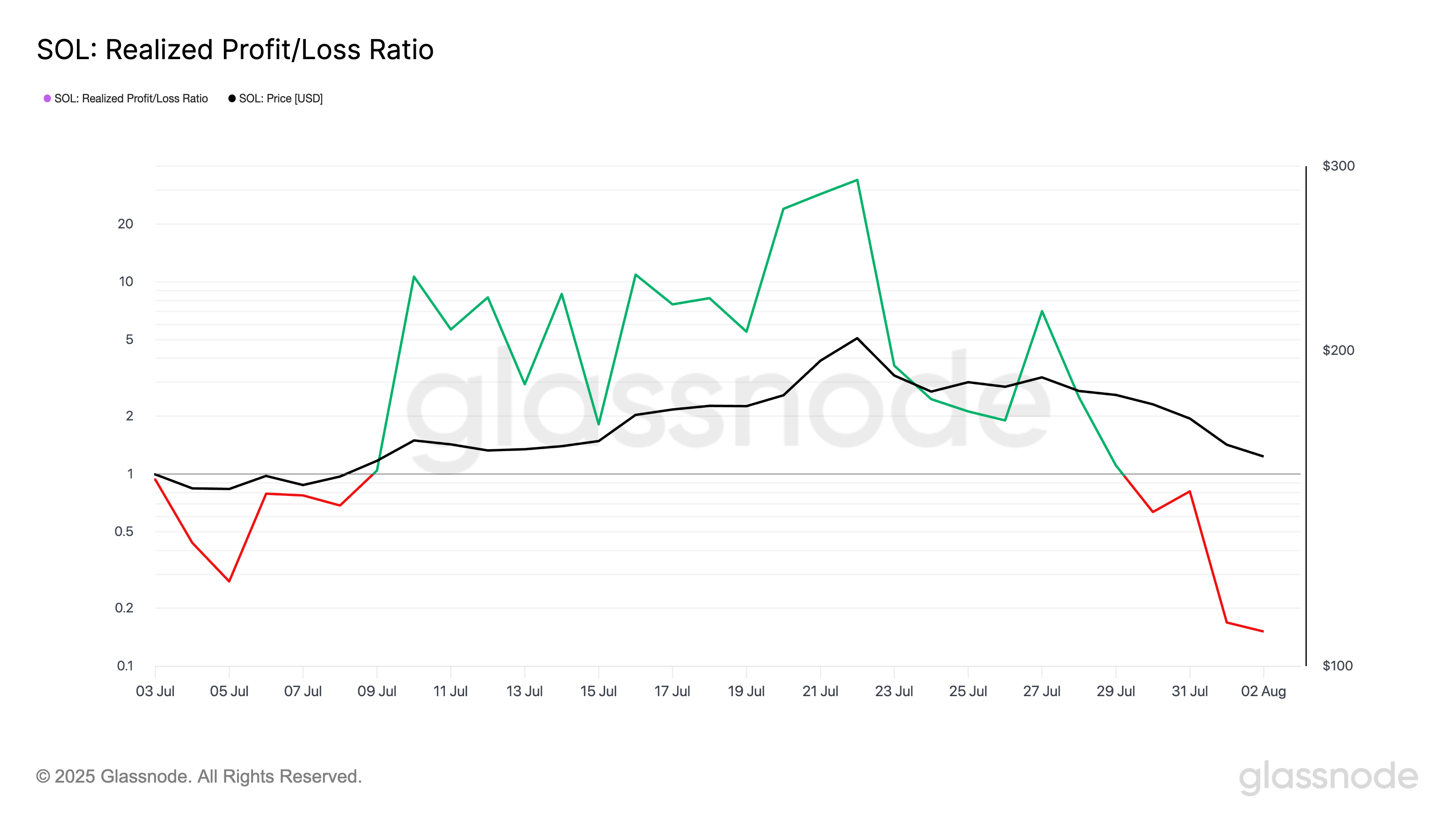

The continuous decline in SOL's realized profit/loss ratio supports the above positive outlook. On-chain data shows this indicator closed at a 30-day low of 0.15 on August 2, indicating many traders are still closing positions at a loss.

Historically, markets tend to stabilize when most participants sell below their cost basis.

As holders willing to sell at a loss decrease, selling pressure may reduce. This could pave the way for SOL to find a local bottom before a potential catalyst triggers a rebound.

Solana Seriously Testing $158 Support

SOL is currently trading at $160.55, above the key support level of $158.80. If buying pressure increases, SOL could initiate a bullish reversal and move towards $176.33.

However, if selling continues and the support weakens, SOL's price could drop to $145.90.