Toncoin, which is associated with Telegram, has shown remarkable performance in the cryptocurrency market over the past two weeks. It has risen by 14% since July 24, ignoring the overall market downturn.

Currently, the altcoin is trading near $4, and on-chain and technical data suggest the possibility of further short-term growth.

TON Price Preparing for Additional Movement

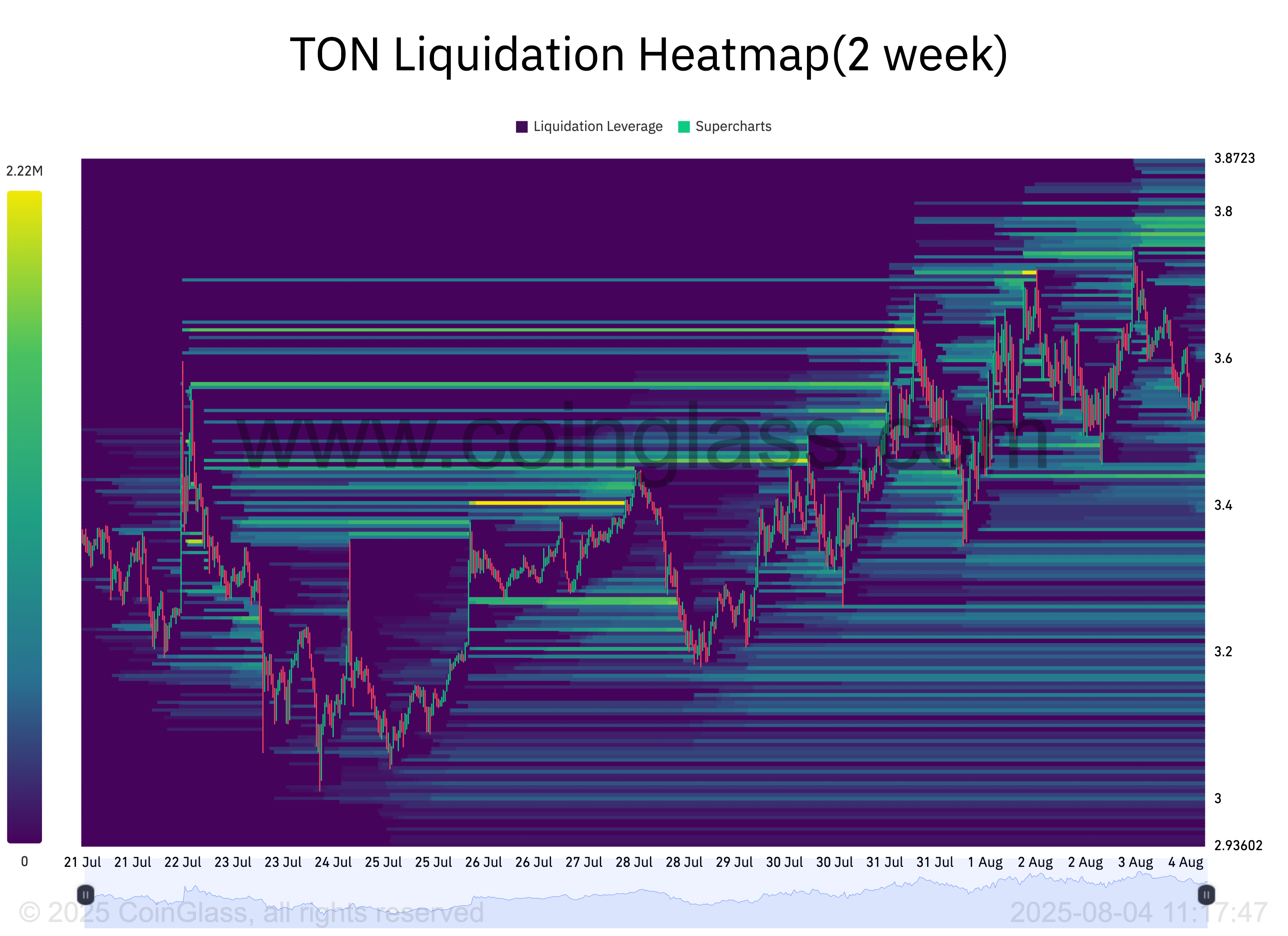

According to CoinGlass, Toncoin's liquidation heatmap shows significant liquidity concentration around the $3.77 price level.

Token Technical Analysis and Market Update: Would you like more such token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter here.

This heatmap is a visual tool that helps traders identify price levels with a high probability of liquidating leveraged positions. Bright areas indicate a higher likelihood of liquidation and highlight high liquidity.

For Toncoin, the liquidity cluster near $3.77 shows strong interest from traders looking to buy or liquidate short positions. This setup could soon trigger a new price surge.

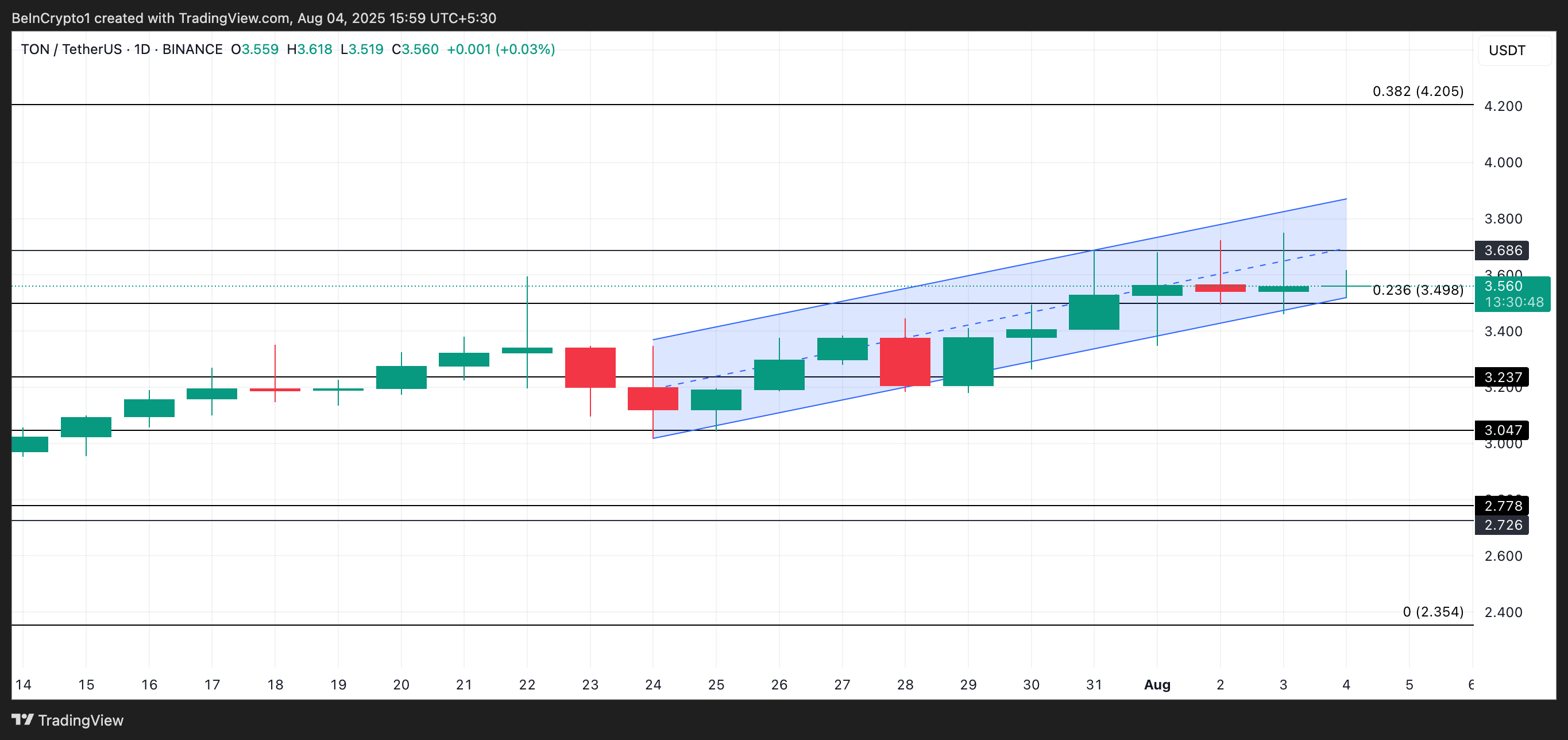

From a technical perspective, Toncoin's Relative Strength Index (RSI) remains in a healthy range, indicating potential for further growth. At the time of reporting, the momentum indicator is 67.21.

The RSI indicator measures overbought and oversold market conditions for an asset. It ranges from 0 to 100. Values above 70 indicate an overbought asset and expected price decline, while values below 30 suggest an oversold asset with potential for a rebound.

Toncoin's RSI value indicates that market participants are still showing strength, with room for further increases before buyers become exhausted.

TON Traders Betting on Rise

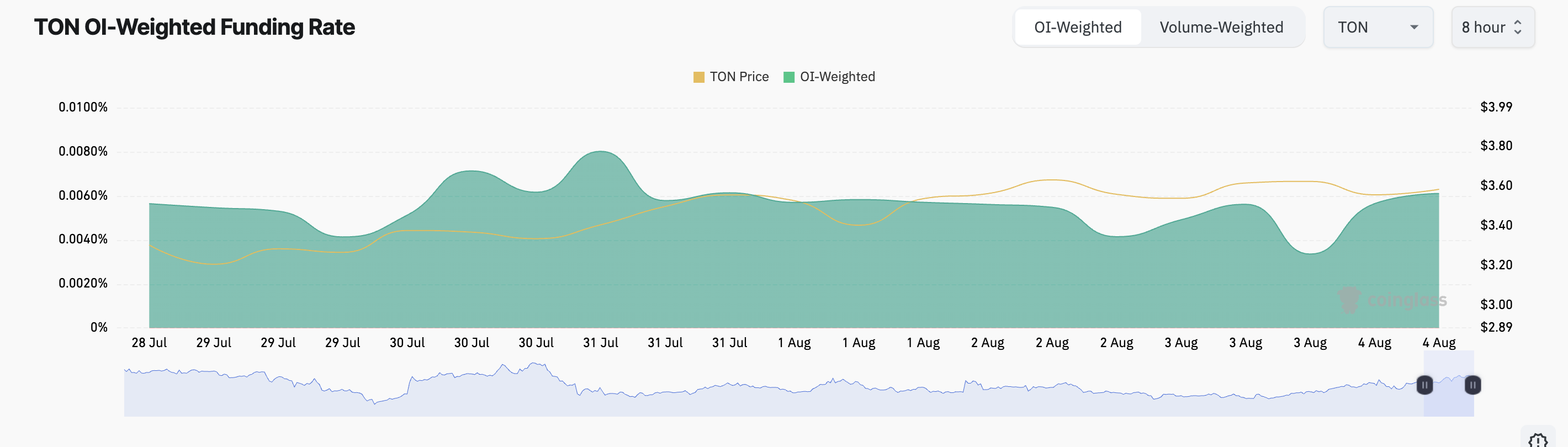

Despite continued market volatility and price decline attempts, Toncoin's funding rate remains firmly positive, confirming a bullish bias among futures traders. At the time of reporting, it is 0.0061%.

The funding rate is a mechanism used in perpetual futures contracts to align prices with the spot market. When positive, long traders (those betting on price increases) pay short traders. This indicates that market participants are generally bullish.

A consistently positive funding rate suggests strong confidence in Toncoin's upward potential, which remains positive despite market uncertainty.

Increasing Buying Pressure... Will It Break $4?

As on-chain and technical indicators confirm buying pressure, Toncoin appears ready to extend its short-term rally. In this scenario, it could break through the $3.68 resistance and rise to $4.02.

Conversely, if demand decreases and selling pressure becomes dominant, it could push the altcoin's price below $3.49.