Welcome to Asia Pacific Morning Brief—a newsletter summarizing overnight cryptocurrency developments affecting regional markets and global sentiment. Enjoy a cup of green tea and follow this information.

Vietnam launches an international financial center with a pilot cryptocurrency exchange program by the end of the year. Bakkt enters Japan by renaming to bitcoin.jp. Chainlink launches US stock data. Nomura receives a derivative license in Dubai.

Vietnam to Test Cryptoasset Exchange at International Financial Center

Vietnam moves towards cryptocurrency regulation as Prime Minister Pham Minh Chinh announces the International Financial Center will operate by the end of 2025, with digital asset trading platforms. Deputy Governor Pham Tien Dung revealed Vietnam has established comprehensive legal foundations for digital assets at the GM Vietnam 2025 conference.

The Digital Technology Law, passed in June 2025, officially recognizes cryptoassets as distinct from virtual assets, effective from January 2026. The Ministry of Finance has submitted a pilot resolution for cryptoasset exchanges using blockchain as core infrastructure.

Vietnam ranks second globally in cryptocurrency ownership with 21.2%, with over 21 million citizens holding digital assets worth over $100 billion annually. The regulatory sandbox will operate in Ho Chi Minh City and Da Nang, potentially attracting major exchanges. South Korea's Upbit has explored entering the Vietnamese market, indicating international confidence in the emerging legal framework.

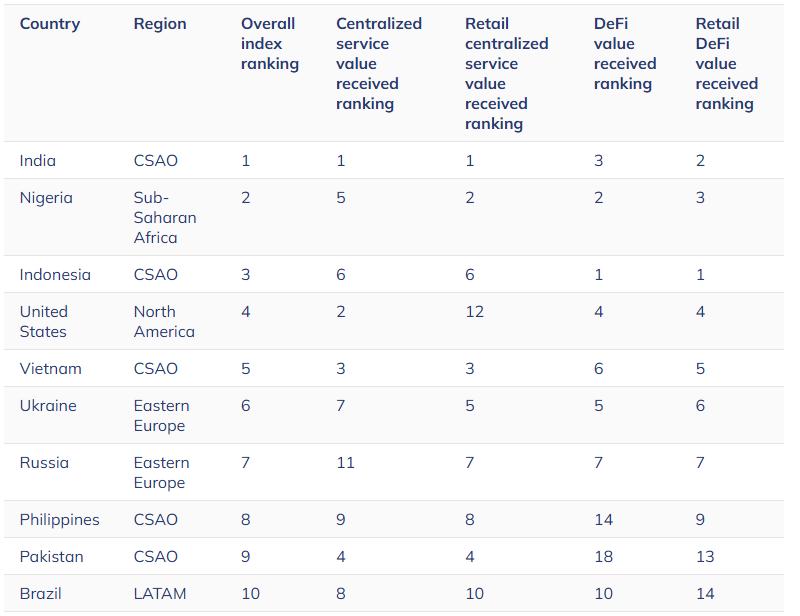

Vietnam ranks 5th in Chainalysis's 2024 Global Crypto Adoption Index, dropping from the top position in the 2022 survey. Source: Chainalysis

Vietnam ranks 5th in Chainalysis's 2024 Global Crypto Adoption Index, dropping from the top position in the 2022 survey. Source: ChainalysisBakkt Launches Bitcoin Treasury Strategy in Japan through "bitcoin.jp" Rebranding

Bakkt Holdings has acquired 30% of Tokyo-listed Marusho Hotta, becoming the largest shareholder in a $235 million deal. The Japanese company will be renamed "bitcoin.jp" after shareholder approval, with Bakkt securing the corresponding web domain. Phillip Lord, Bakkt International Chairman, will assume CEO role and integrate Bitcoin into the company's treasury strategy.

Bakkt's Co-CEO Akshay Naheta noted Japan's legal environment creates "an ideal platform for a Bitcoin-focused enterprise". This move follows Bakkt raising $75 million in equity capital and issuing $1 billion to purchase Bitcoin, marking a shift from cryptocurrency infrastructure to direct Bitcoin treasury operations.

Chainlink Launches Real-Time US Equity Data Streams for DeFi

Chainlink has launched Data Streams for US stocks and ETFs, providing institutional-grade pricing for blockchain networks. The service offers real-time data for assets like SPY, NVIDIA, Apple, and Microsoft across 37 blockchains. DeFi protocols like GMX, Kamino, and others have integrated these data streams.

The infrastructure includes trading hour execution, latency detection, and circuit breaker logic with sub-second latency. This addresses a critical gap in crypto equity infrastructure, despite the $275 billion crypto asset market. Use cases include perpetual futures, on-chain lending with stock collateral, and synthetic ETFs.

Business Director Johann Eid said the launch enables "crypto financial products ready for production directly linked to US equities" on-chain. The move aligns with increasing regulatory acceptance, including the recent GENIUS Act supporting crypto financial instruments.

Nomura's Laser Digital Obtains Dubai License for Crypto OTC Derivatives

Laser Digital, Nomura's cryptocurrency subsidiary, has received its first regulated over-the-counter cryptocurrency options license under Dubai Virtual Asset Regulatory Authority's pilot framework. The company becomes the first VARA-regulated entity to provide direct OTC crypto options to clients in the emirate.

Dubai's crypto-friendly legal environment continues to attract major companies, with Coinbase-owned Deribit also planning operations here. Product Director Johannes Woolard praised VARA's detailed explanation process and flexible implementation. Laser Digital will initially focus on major cryptocurrency tokens through medium-term options under ISDA agreements, maintaining a simple structure before expanding to enhanced profit and lending services.

Contributions by Shigeki Mori and Shota Oba.