Author: 0xjacobzhao and ChatGPT 4o

Thanks to Lex Sokolin (Generative Ventures), Stepan Gershuni (cyber.fund), and Advait Jayant (Aivos Labs) for their valuable suggestions. Opinions were also sought from project teams such as Giza, Theoriq, Olas, HeyElsa, Almanak, and Brahma.fi during the writing process. The article strives for objectivity and accuracy, but due to some subjective judgments, there may be inevitable biases. Readers are kindly requested to read critically and with understanding.

In the current crypto industry,stablecoin payments and DeFi applicationsare among the few tracks that have been verified to havereal demand and long-term value. Meanwhile, the flourishingAgents are gradually becoming the actual user interface implementation in the AI industry, becoming the key intermediate layer connecting AI capabilities with user needs.

In the convergence of Crypto and AI, especially in the direction of AI technology feeding back to Crypto applications, current explorations are mainly focused on three typical scenarios:

Conversational Interaction Agents: Primarily focused on chat, companionship, and assistant types. Although most are still shell-like general large models, they have low development barriers, natural interactions, and token incentives, making them the earliest form to enter the market and attract user attention.

Information Integration Agents: Focusing on intelligent integration of online and on-chain information. Kaito, AIXBT, and others have succeeded in online information search and integration, while on-chain data integration is still in the exploration stage with no prominent projects.

Strategy Execution Agents: Centered on stablecoin payments and DeFi strategy execution, expanding into two major directions of Agent Payment and DeFAI. Such Agents are more deeply embedded in on-chain trading and asset management logic, potentially breaking through hype bottlenecks to form an intelligent execution infrastructure with financial efficiency and sustainable returns.

This article will focus on the convergence and evolution path of DeFi and AI, tracing its development stages from automation to intelligence, and analyzing the infrastructure, scenario space, and key challenges of strategy execution Agents.

Exploratory Directions for Medium to Long-Term Layout:

Pendle Revenue Rights Trading: Clear time dimension and yield curve, suitable for Agent management of maturity rotation and inter-pool arbitrage;

Funding Rate Arbitrage: Theoretically promising returns, needs to solve cross-market execution and off-chain interaction challenges with high engineering complexity;

LRT Dynamic Portfolio Structure: Static staking is not adaptive, can try strategies like LRT + LP + Lending for automatic adjustment.

RWA Multi-Asset Portfolio Management: Difficult to implement in the short term, Agents can provide auxiliary support in portfolio optimization and maturity strategies;

Project Introduction of DeFi Scenario Intelligentization:

1. Automation Infrastructure: Rule Triggering and Conditional Execution

Gelato is one of the earliest infrastructures for DeFi automation, previously providing condition-triggered task execution support for protocols like Aave and Reflexer, but now has transformed into a Rollup as a Service provider. The main battlefield of on-chain automation has shifted to DeFi asset management platforms (DeFi Saver, Instadapp). These platforms integrate standardized auto-execution modules including Limit Order settings, liquidation protection, automatic portfolio rebalancing, DCA, grid strategies, etc. Additionally, we see some more complex DeFi automation tool platform projects:

(The translation continues in the same manner for the rest of the text, maintaining the specified translation rules for technical terms)Theoriq

Theoriq Alpha Protocol is a multi-agent collaborative protocol focusing on DeFi scenarios, with its core product Alpha Swarm dedicated to liquidity management. It aims to build a full-chain automated closed loop of "perception-decision-making-execution". Composed of three types of Agents: Portal (on-chain signal perception), Knowledge (data analysis and strategy selection), and LP Assistant (strategy execution), it can achieve dynamic asset allocation and yield optimization without human intervention. The underlying Alpha Protocol provides Agent registration, communication, parameter configuration, and development tool support, serving as the operational foundation of the entire Swarm collaborative system and is considered the "intelligent agent operating system" of DeFi. Through AlphaStudio, users can browse, call, and combine various Agents to build a modular and scalable automated trading strategy network.

As one of the first projects on Kaito Capital Launchpad, Theoriq recently completed a community fundraising of $84 million and is about to have its Token Generation Event. Theoriq has recently launched the AlphaSwarm Community Beta testnet, with the mainnet version also set to be officially released soon.

Reference research report: Theoriq Research Report: AgentFi Evolution of Liquidity Mining Yields

[The rest of the translation follows the same professional and precise approach, maintaining the technical terminology and context.]AgentFi's Realistic Path and High-Level Vision

Undoubtedly, lending and yield farming are the most valuable and easily implementable business scenarios for AgentFi in the DeFi world, with inherent characteristics naturally suitable for introducing intelligent agents:

-

Broad strategy space with multiple optimization dimensions Lending involves strategies beyond chasing the highest yields, such as interest rate arbitrage, leveraged cycling, debt refinancing, and liquidation protection; Yield farming encompasses rich strategic arrangement spaces including APR tracking, LP rebalancing, compound reinvestment, and strategy portfolios.

-

Highly dynamic, suitable for intelligent agents to perceive and respond in real-time: Interest rate changes, TVL fluctuations, reward structure modifications, new pool launches, and emerging protocols all affect the optimal strategy path, requiring dynamic adjustments.

-

Execution window opportunity costs with significant automation value: Funds not allocated to the optimal pool will lower returns and need automatic migration.

2. Fusion Structure of RWA and DeFi (RWA-as-Collateral & Custody Reuse): Some protocols are exploring the use of tokenized T-bills as collateral assets in DeFi lending systems. In this structure, Agents can help users automatically complete deposit operations, interest rate comparisons, and collateral portfolio adjustments, forming a dual-income path. Assuming RWA assets achieve widespread circulation on platforms like Pendle and Uniswap, Agents can track Token premium/discount and implied yield changes across different platforms, constructing automated arbitrage and rolling deployment strategies. As the market matures, this may become an important breakthrough for AgentFi in the RWA field.

Swap Trading Combinations, Upgrading from Intent Infrastructure to AgentFi Strategy Engine

In the current DeFi intelligent ecosystem, Swap transactions introduce account abstraction and Intent mode, hiding complex DEX multi-chain path selections, driving user transactions with concise inputs, and significantly lowering interaction barriers. However, such systems remain at the "atomic action automation" level, lacking real-time perception and response to environmental changes, and have not introduced goal-oriented strategy execution mechanisms, thus lacking the intelligent agent characteristics of AgentFi.

In the AgentFi framework, Swap operations are no longer a single action, but part of a larger-scale combined strategy. For example, when a user expresses "wanting to combine stETH and USDC to obtain the highest yield", the Agent can automatically complete multiple Swaps (such as USDC → ETH → stETH), perform Restaking, split Pendle PT/YT, configure arbitrage strategies, and recover yields.

Looking further, Swap plays a key role in the following three AgentFi scenarios:

Component of Yield Combination Strategy: As a fund dispatch relay station, Swap supports Agents in automatically completing asset allocation paths, improving strategy execution efficiency.

Cross-Market Arbitrage / Delta Neutral Strategy: By comparing different on-chain price sources, Agents can dynamically adjust positions and build hedging portfolios.

Trading Behavior Risk Defense: When detecting large transactions, Agents can automatically assess slippage, execute in batches, and avoid potential MEV attacks.

Therefore, a Swap Agent truly possessing AgentFi characteristics must have the following capabilities: dynamic strategy perception, cross-protocol scheduling, fund path optimization, trading timing judgment, and risk prevention. Future Swap Agents should serve multi-strategy combinations, dynamic position adjustments, and cross-protocol value capture, with a long road ahead.

DeFi Intelligent Evolution Roadmap: From Automation Tools to Intelligent Agent Network

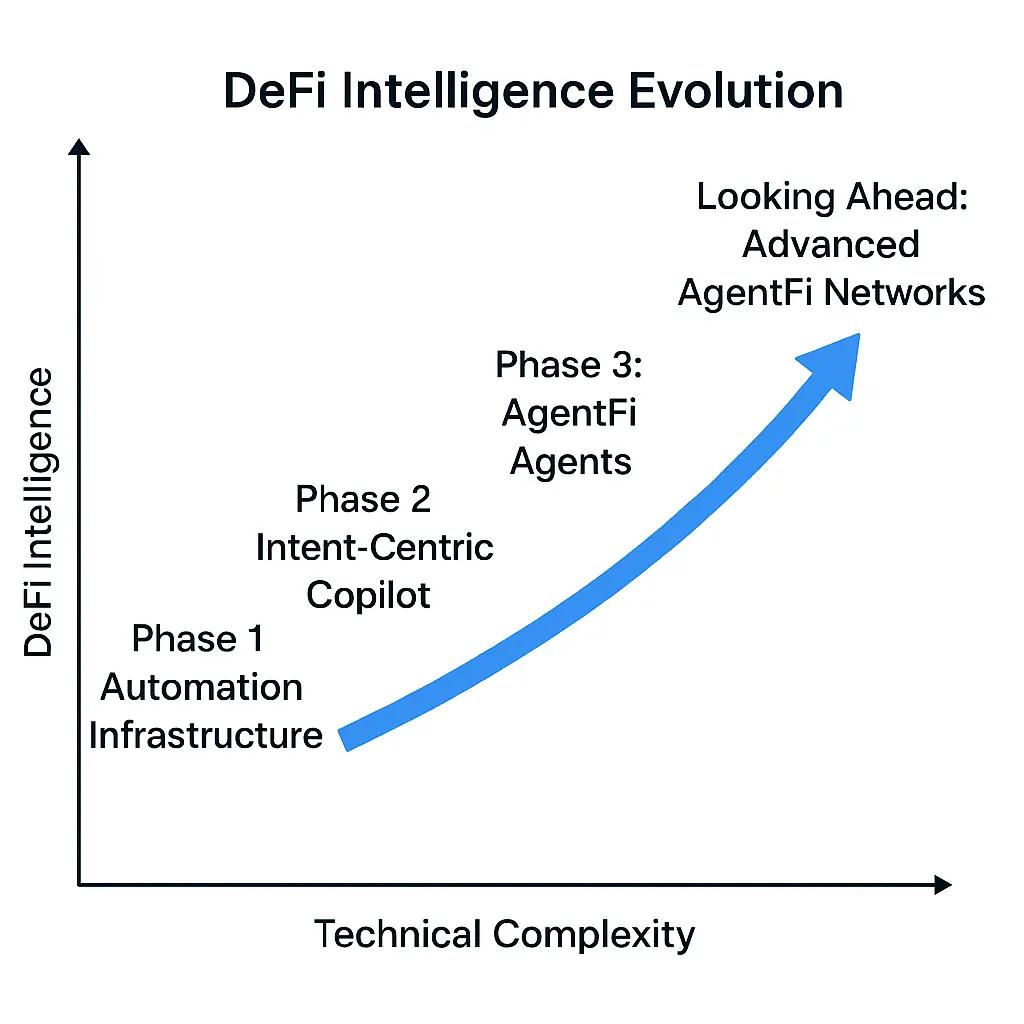

In summary, we witness the evolution path of DeFi intelligence from automation tools to intent assistants to intelligent agents

The first stage is "Automation Infrastructure", characterized by rule triggering and condition execution to achieve basic on-chain operation automation. For example, triggering trades or rebalancing tasks based on preset conditions like time or price, with systems primarily being underlying execution frameworks, typical projects including Gelato and Mimic.

The second stage is "Intent-Centric Copilot", emphasizing user intent expression and execution suggestion generation. Systems at this stage are no longer limited to "what to do", but attempt to understand "what users want" and provide the best execution path suggestions. Representative projects like Bankr and HeyElsa mainly improve DeFi accessibility through intent recognition and interaction experience.

The third stage is "AgentFi Intelligent Agent", marking the formation of strategy closed loop and on-chain autonomous execution. Agents can automatically complete perception, decision-making, and execution based on real-time market conditions, user preferences, and strategy logic, truly achieving 24/7 non-custodial on-chain fund management. Simultaneously, AgentFi can autonomously manage user funds without requiring user authorization for each operation, which has sparked significant discussions about security and trust mechanisms, becoming an unavoidable core issue in AgentFi design. Representative projects include Giza ARMA, Theoriq AlphaSwarm, Almanak, Brahma, etc., which have certain deployment capabilities in strategy deployment, security architecture, and product modules, forming the backbone of the current DeFi agent direction.

We look forward to the emergence of "Advanced AgentFi Agents" that not only achieve autonomous execution but can also cover complex cross-protocol and cross-asset business scenarios, representing our vision for the advanced form of DeFi intelligence:

Pendle Yield Rights Trading: Future intelligent agents will comprehensively take over maturity rotation and strategy orchestration, ultimately releasing fund efficiency.

Funding Rate Arbitrage: Cross-chain arbitrage agents are expected to precisely capture every opportunity in funding rate differences.

Swap Strategy Combinations: Swap is a key node in the multi-strategy yield path of intelligent agents, achieving combinatorial value transformation.

Staking and Restaking: Agents will continuously optimize staking portfolio strategies, dynamically balancing yields and risks.

RWA Asset Management: As the on-chain world welcomes diversified physical assets, agents will configure globally stable income assets.

Click to learn about ChainCatcher's job openings

Recommended Reading:

From Advertising Professional to Crypto "Price Hunter": Peter Brandt's Half-Century Trading Legend

BitMine Stock Soars: Silicon Valley Venture Capital Godfather Peter Thiel Bets Big on Ethereum