PancakeSwap officially enters the tokenized stock field by launching perpetual contracts for three major US stocks.

The rise of platforms providing tokenized stocks demonstrates the true potential of this field.

PancakeSwap enters the stock tokenization space

In the latest announcement, PancakeSwap — one of the top DeFi protocols on BNB Chain — has officially launched perpetual contracts for three iconic US stocks: Apple (AAPL), Amazon (AMZN), and Tesla (TSLA). These contracts are deployed on PancakeSwap V3 and support leverage up to 25x.

"PancakeSwap Perpetuals are perpetual contracts that allow you to speculate on an asset's price, including cryptocurrencies and now stocks, without owning the underlying asset. You can go long or short, trade with leverage, and access the market 24/7," the announcement stated.

This is the first time a DEX has expanded into the stock derivatives field. It is an important step for DeFi in integrating traditional assets, a trend often called RWA (Real World Assets).

According to data from RWA.xyz, the tokenized stock market has reached a market capitalization of 374 million USD, increasing 220% since June. Monthly transfer volume is around 330 million USD. Algorand holds 66% of the tokenized stock market share, mainly driven by EXOD stocks from Exodus.

Tokenized stock market capitalization. Source: RWA.xyz

Tokenized stock market capitalization. Source: RWA.xyz"If only 1% of global stocks are tokenized, the market could exceed 1.3 trillion USD, driving significant growth in on-chain assets and DeFi infrastructure towards widespread adoption," a Binance Research report emphasized.

The Binance Research report also noted that the number of active on-chain addresses increased from 1,600 to 90,000. However, centralized exchanges are far superior to on-chain platforms, with tokenized stock trading volume over 70 times higher.

From a positive perspective, this gap also shows the growth potential for DEX platforms in this emerging field.

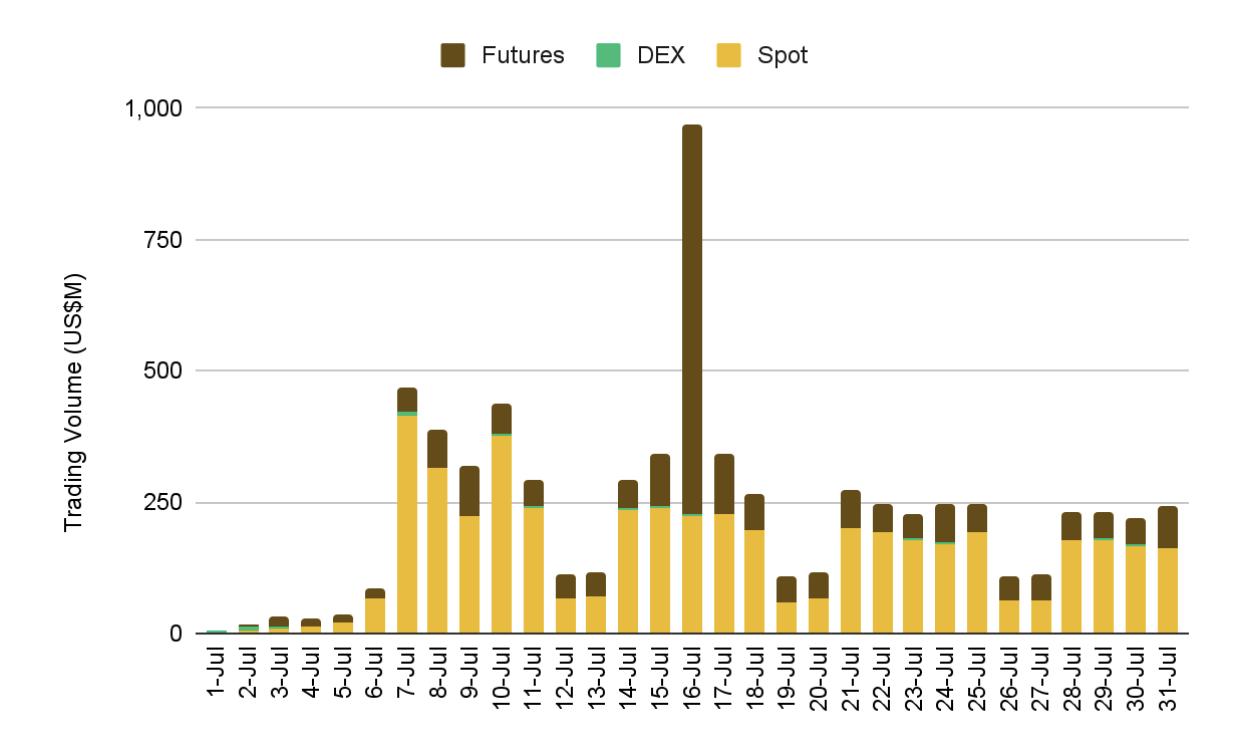

Centralized exchanges are currently outpacing on-chain trading activity in July. Source: Binance Research

Centralized exchanges are currently outpacing on-chain trading activity in July. Source: Binance ResearchA protocol specializing in US stock tokenization, xStocks, has exceeded 2 billion USD in total trading volume just three months after launch. This growth shows the explosive and promising demand for trading stocks in tokenized form. However, competing with predecessors is a major challenge for PancakeSwap.

Data shared on X shows PancakeSwap recorded a positive increase in user numbers and trading volume in July. The platform generated over 188 billion USD in spot trading volume, capturing 43% of the DEX trading volume market.

The launch of perpetual stock contracts could continue to be a primary growth driver for PancakeSwap in the coming months.