In the altcoin market, a clear polarization trend is emerging between rising and falling themes. Even amid an overall market recovery, there are significant temperature differences among individual stocks and themes.

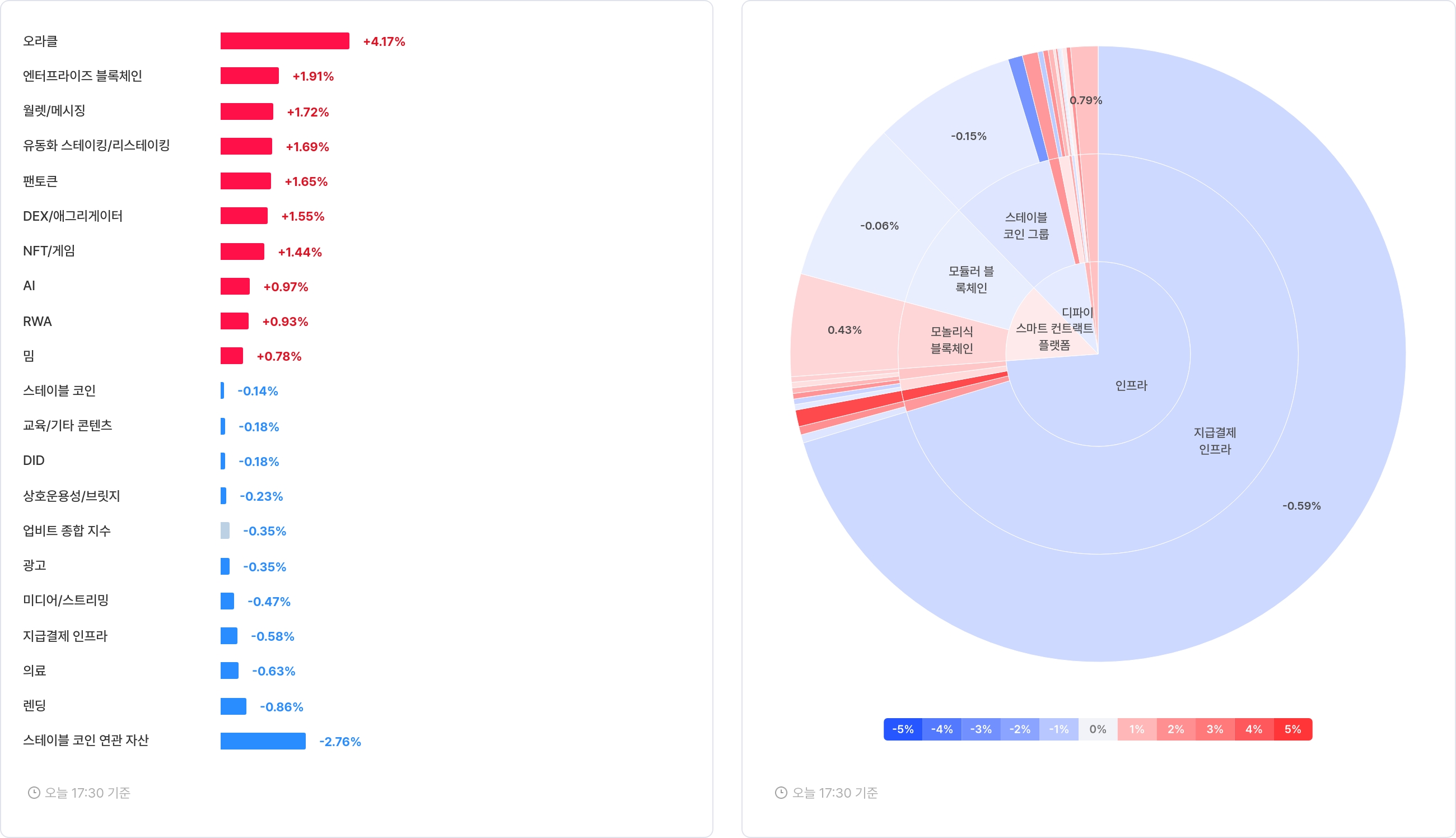

According to Upbit DataLab as of 5:08 PM on August 8th, 11 out of 24 total sectors showed a limited rebound, while 13 sectors recorded a decline, further emphasizing differentiation among market stocks.

The sector with the highest rise was Oracle (+4.17%), led by Chainlink (LINK, +4.40%) and Pyth Network (PYTH, +0.59%). In the Enterprise Blockchain (+1.91%) sector, Hedera (HBAR, +1.95%) and Altair (ALT, +0.80%) rose.

The third-highest sector was Wallet/Messaging (+1.72%), with Safe (SAFE, +3.58%) and Wallet Connect (WCT, +0.23%) showing strength. In the Liquid Staking/Restaking (+1.69%) sector, multiple tokens like Pendle (PENDLE, +3.61%), Origin Protocol (OGN, +1.20%), and Kernel DAO (KERNEL, +0.92%) increased.

The Fan Token (+1.65%) sector also joined the upward trend. Sports-related tokens like Atletico Madrid (ATM, +18.04%), Paris Saint-Germain (PSG, +5.33%), and Napoli (NAP, +3.28%) were particularly prominent. In the DEX/Aggregator (+1.55%) sector, tokens like Orca (ORCA, +9.58%) and Uniswap (UNI, +2.09%) reinforced the upward momentum.

In contrast, the sector with the largest decline was 'Stablecoin Related Assets' (–2.70%), with Ethena (ENA, –3.18%) and Sky Protocol (SKY, –2.13%) recording significant drops. In the Lending (–0.94%) sector, Maple Finance (SYRUP, –3.19%), Strike (STRIKE, –2.60%), and Aave (AAVE, –0.63%) declined.

In the Payment Infrastructure (–0.59%) sector, Bitcoin (BTC, –0.73%), BCH (–0.62%), and BSV (–0.54%) also fell. Medical (–0.48%) and Media/Streaming (–0.47%) sectors also showed weakness.

Major sectors like Infrastructure, DeFi, Smart Contract Platforms, and Stablecoin groups showed different trends. DeFi displayed mixed performance with Liquid Staking (+1.69%) and Lending (–0.94%), while Payment Infrastructure declined by –0.59%. Some Smart Contract Platforms rose, and the Stablecoin group fell by –2.70%.

While the market shows a gradual recovery with rising sectors outperforming falling sectors, the polarization trend between sectors continues to spread.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>