Chainlink continues to achieve strategic milestones and shows signs of entering a new upward cycle while attracting inflows from whale and institutional wallets.

The official launch of the Chainlink Reserve represents a strategic preparatory fund aimed at supporting ecosystem development through long-term LINK accumulation.

Chainlink Reserve Launch

According to the official announcement, the Chainlink Reserve is a decentralized accumulation mechanism for Chainlink (LINK).

LINK tokens allocated to the reserve are not expected to be withdrawn for several years. This delivers a strong message about the project's long-term strategy and reflects a commitment to maintaining a stable resource pool for incentive programs, development, and integration efforts.

"No withdrawals are expected from the reserve for several years, which means the strategic $LINK reserve will become an accumulation machine driven by adoption," a user on X mentioned.

The lack of short-term withdrawal plans for LINK in the Chainlink Reserve could help alleviate selling pressure in the market. It acts as a "black hole" absorbing liquidity, preparing for the next upward cycle.

Whale and Institutional Accumulation

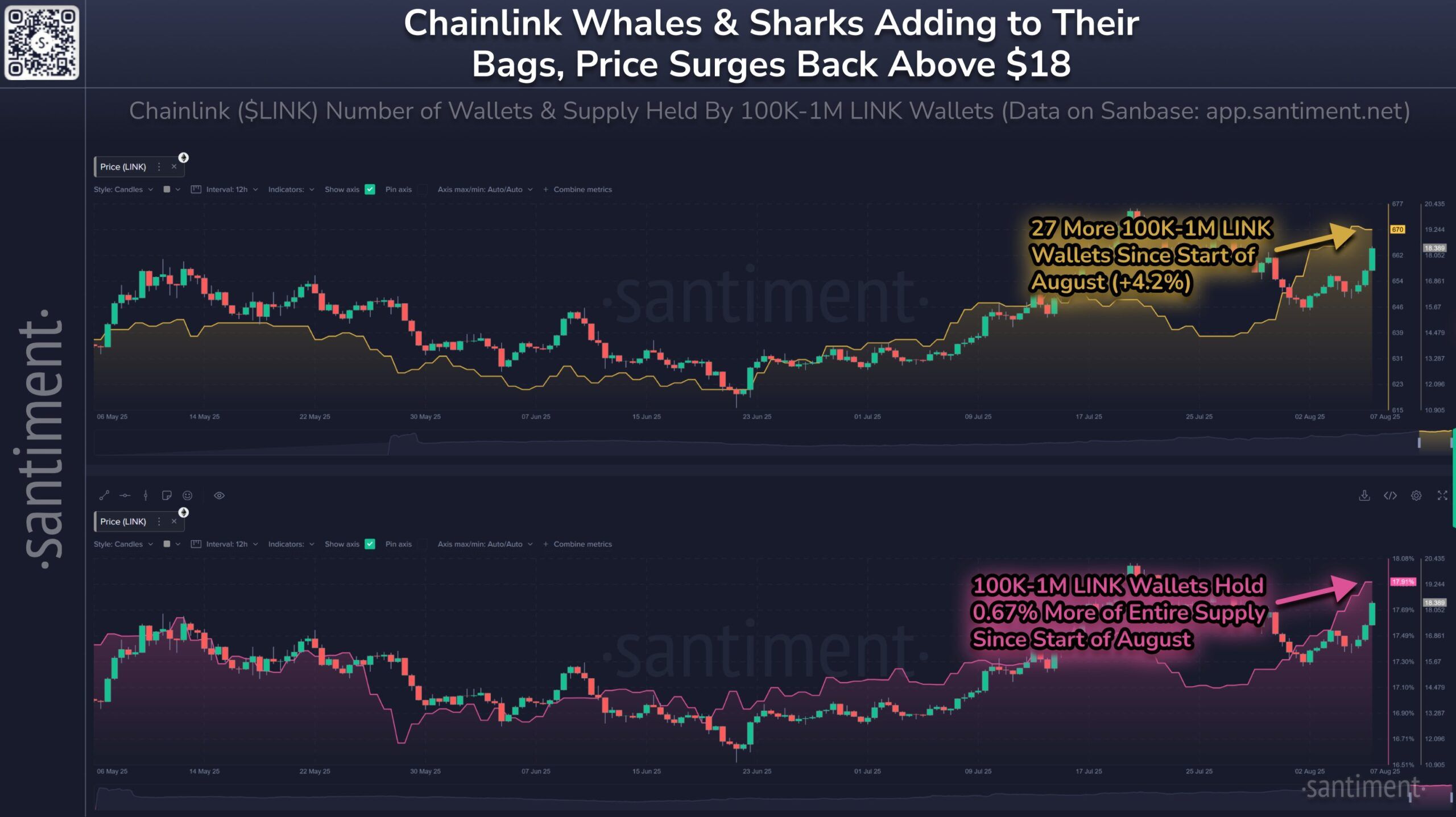

According to data from cryptocurrency online data platform Santiment, the number of wallets holding 100,000-1 million LINK increased by 4.2% in August. Additionally, 0.67% of LINK's total supply was accumulated in just a few days.

This indicates that whales and institutions are accelerating accumulation even though the market has not entered an upward phase.

Generally, accumulation behavior of large wallets occurs during periods of uncertainty or low liquidity. If this trend continues, LINK's price could receive strong fundamental support at the deep buying levels of major investors.

Additionally, according to an analyst on X, the key support level of $13 is firmly maintained. If the upward scenario continues, LINK could move to the $46 target zone. However, this needs to be confirmed by actual price movements and trading volume in the coming weeks.

Some technical analysts have noted that LINK is repeating patterns seen during its growth cycles in 2023 and 2024. Specifically, the formation of a "Higher Low" and price breakout are typical precursors to major upward movements.

While it is too early to confirm, the similarity in chart patterns and on-chain behavior is raising investors' expectations for a new upward movement.

At the time of reporting, LINK is trading at $19.35, up 15.3% in the last 24 hours. LINK's strong recovery is part of today's overall market recovery.