Author: BlockSec

Original Title: Hong Kong's OTC Regulation Evolution: From "Crypto Street" to Comprehensive Management

In May 2025, Hong Kong police dismantled a virtual asset money laundering group worth $15 million (approximately HK$117 million), with the involved group mainly splitting and transferring funds through OTC channels located in Tsim Sha Tsui.

Earlier, in the sensational JPEX case, the Commercial Crime Bureau (CCB) disclosed that many involved funds were exchanged and transferred through OTC shops in Hong Kong, becoming a critical link in the fraud chain.

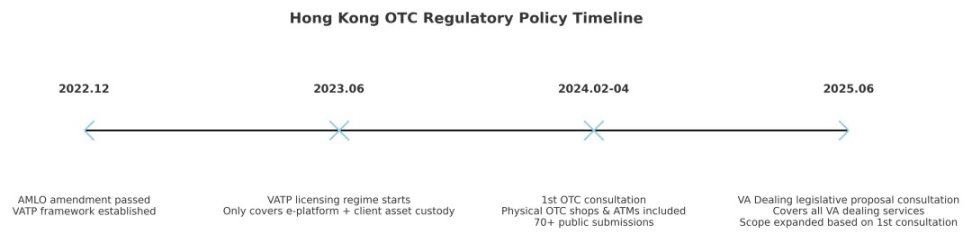

In June 2025, the Hong Kong government issued the 'Legislative Proposal to Regulate Dealing in Virtual Assets' public consultation document, suggesting incorporating all virtual asset trading services, including OTC, into a unified licensing and regulatory framework. Although the proposal is currently in the consultation stage and has not yet become a regulation, it clearly outlines the next step for Hong Kong's virtual asset regulation - from early VATP platform licensing to OTC management, and then to comprehensive VA Dealing service coverage.

In one sentence: Within three years, Hong Kong's regulation evolved from an OTC "vacuum zone" to full-chain management.

Stage One (2023): VATP Regulation, OTC Becomes a "Loophole"

In late 2022, Hong Kong passed the 'Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance', implementing a licensing system for Virtual Asset Trading Platforms (VATPs) from June 2023, regulated by the SFC.

... [rest of the text continues in the same manner]