Typically, when Bitcoin reaches a new All-Time-High, risk warnings begin to appear. However, experts and analysts emphasize three positive Bitcoin indicators that have recently emerged in August.

These indicators act as rare signals. They suggest that Bitcoin Season may have just begun this month, even after the price surpassed $120,000.

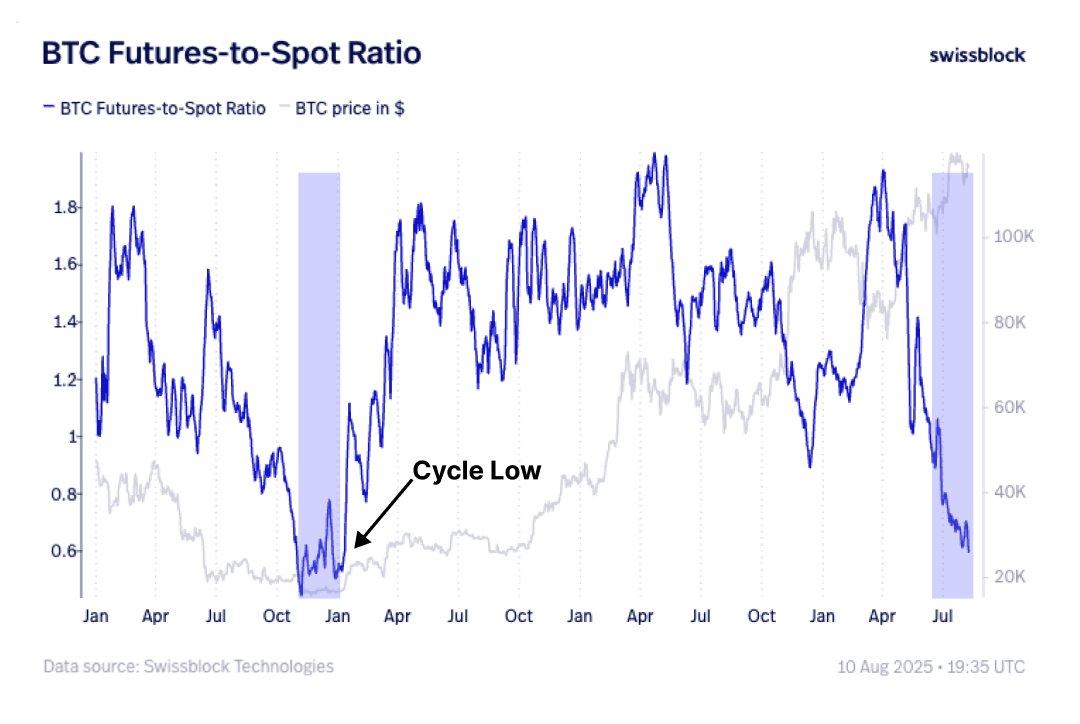

1. Bitcoin Futures-to-Spot Ratio

The first indicator is the Futures-to-Spot Ratio, which has dropped to its lowest level since October 2022. Why is this important?

According to Swissblock, this ratio measures futures trading volume compared to spot trading volume. A lower ratio indicates that large investors — often called massive allocators — are actively buying BTC in the spot market instead of speculating through futures.

Bitcoin Futures to Spot Ratio. Source: Swissblock

Bitcoin Futures to Spot Ratio. Source: Swissblock"Since the April low, this movement has been driven by spot — massive allocators are accumulating the last BTC. The futures-to-spot ratio has returned to October 2022 levels → a signal of large spot demand," Swissblock reported.

Historically, when this ratio drops significantly, it often marks the bottom of a cycle — similar to late 2022 before BTC surged above $100,000. This suggests that even with Bitcoin at six figures, the price increase may still be in its early stages.

"The 120.5K USD breakout target has been reached, now what? Price momentum is synchronized... Yes, macro volatility is predicted and downward pressure may erupt, but with exploding momentum, we will go up," Swissblock predicted.

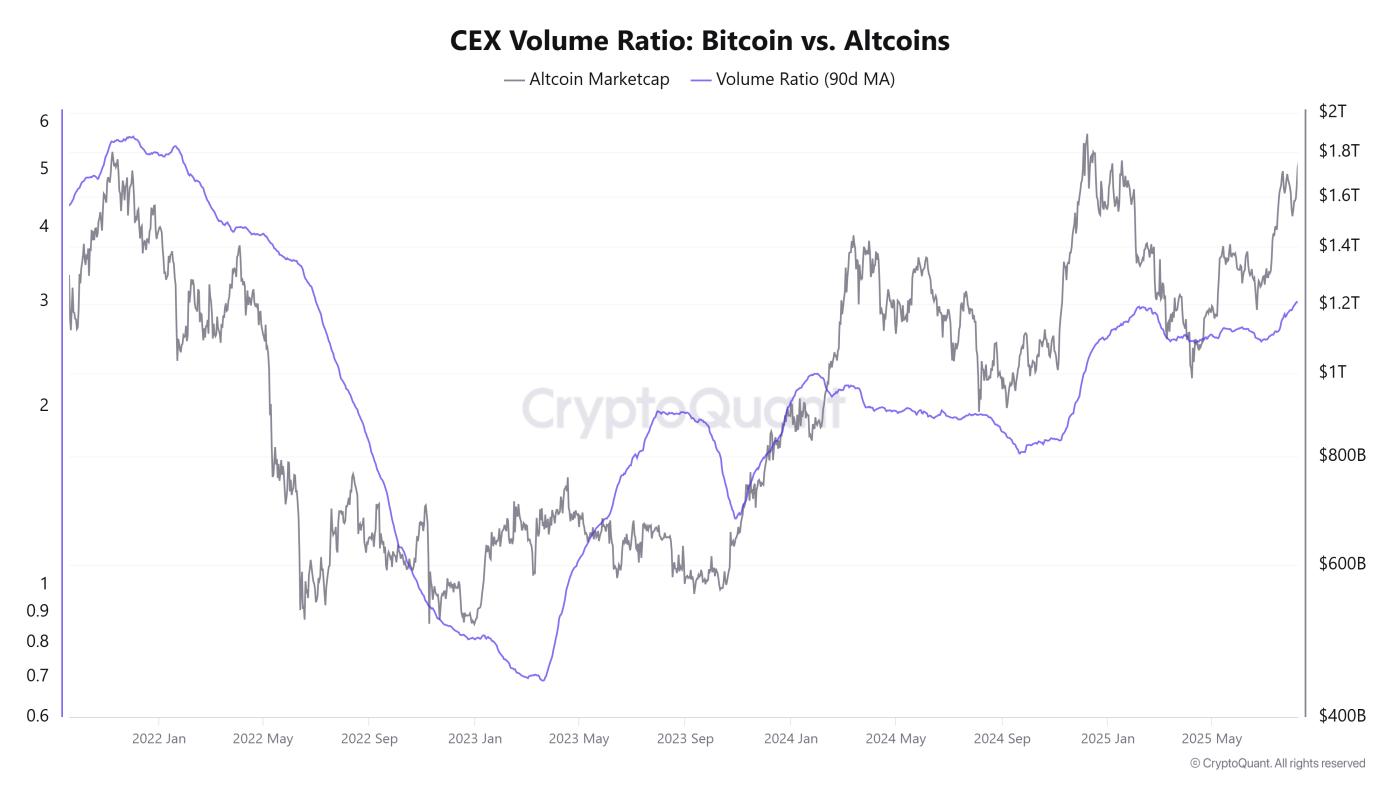

2. CEX Volume Ratio: Bitcoin vs Altcoins

The second indicator is the spot trading volume ratio between Bitcoin and altcoins.

This ratio compares the spot trading volume of BTC with altcoins on centralized exchanges (CEX). When this ratio increases, it indicates Bitcoin is attracting more capital — a classic sign of "Bitcoin Season."

CEX Volume Ratio: Bitcoin vs Altcoin. Source: CryptoQuant

CEX Volume Ratio: Bitcoin vs Altcoin. Source: CryptoQuantData from CryptoQuant reveals that this ratio tends to increase with Bitcoin's price. In August 2025, it recovered to a level of 3 — the highest since July 2022. This means Bitcoin's trading volume is currently three times that of all altcoins combined.

History shows that when this ratio exceeds 3 and moves towards 5 (as happened in late 2021), BTC typically leads strong market price increases. This suggests that current market conditions indicate Bitcoin Season has not yet reached its maximum potential.

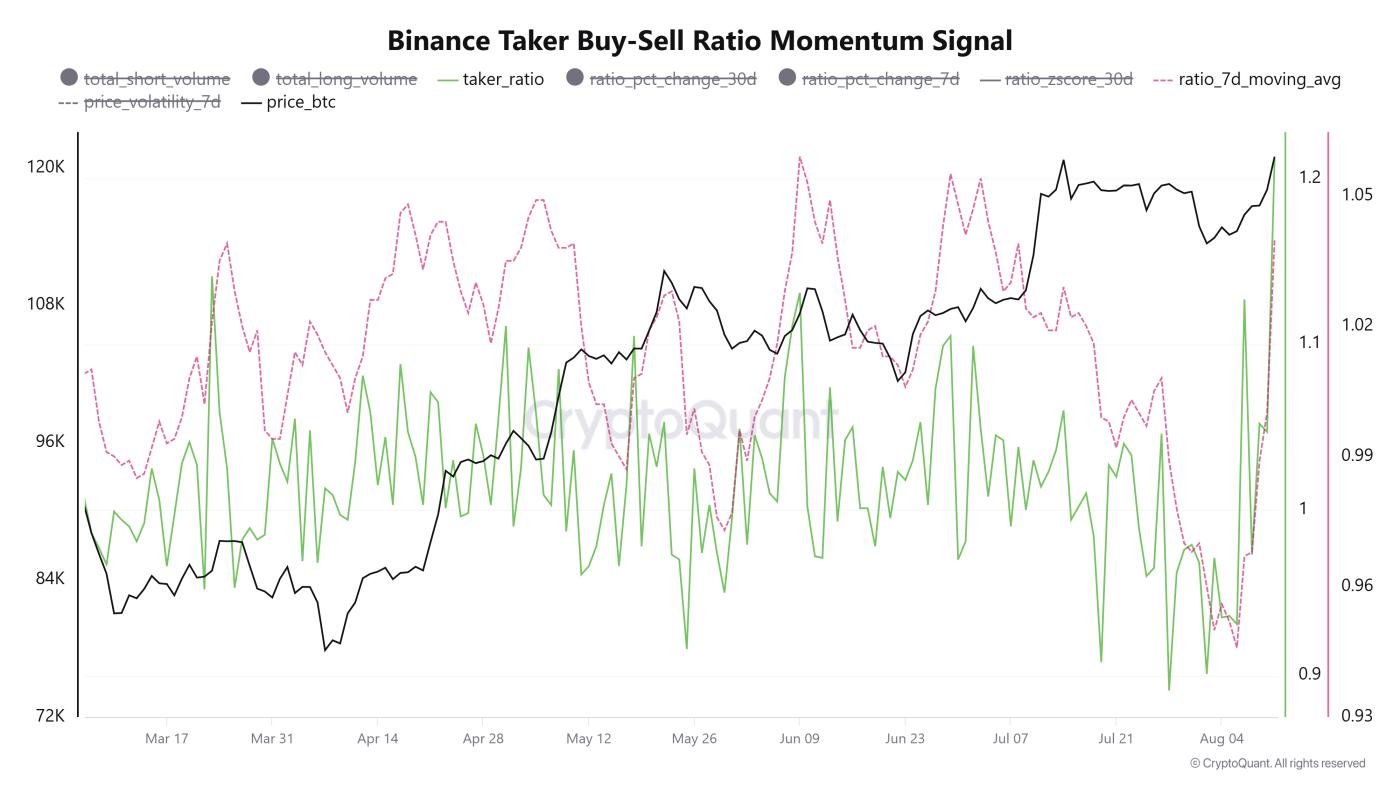

3. Bitcoin Buyer-Seller Ratio

Finally, the Taker Buy-Sell Ratio shows new buying momentum is forming strongly.

According to CryptoQuant analyst Crazzyblockk, this ratio measures buying volume divided by selling volume from takers — traders who actively place market orders.

"Takers immediately set the market tone — when they buy strongly, it often precedes price increases; when selling dominates, it can signal downside risks," Crazzyblockk explained.

A value above 1 indicates an optimistic sentiment. Crazzyblockk also noted that when this value exceeds its 7-day medium, it signals new buying momentum.

Binance Taker Buy-Sell Ratio. Source: CryptoQuant

Binance Taker Buy-Sell Ratio. Source: CryptoQuantThis signal was confirmed in August. Bitcoin's Taker Buy-Sell Ratio exceeded its 7-day medium and reached 1.21 — the highest since March.

These three indicators — record low Futures-to-Spot Ratio, recovering CEX Volume Ratio, and optimistic Taker Buy-Sell Ratio — all indicate that Bitcoin Season is beginning in August 2025.

Additionally, a recent BeInCrypto analysis suggests that Bitcoin may climb higher. However, it warns that dropping below $118,900 would invalidate the short-term upward trend.