Phase One: Speculation, Bubble, and Experimentation

It all began with Truth Terminal ($GOAT) in October 2024, and over the next three months (November to January), Crypto AI reached a fever pitch, with the market cap of Crypto AI agents breaking through $10 billion.

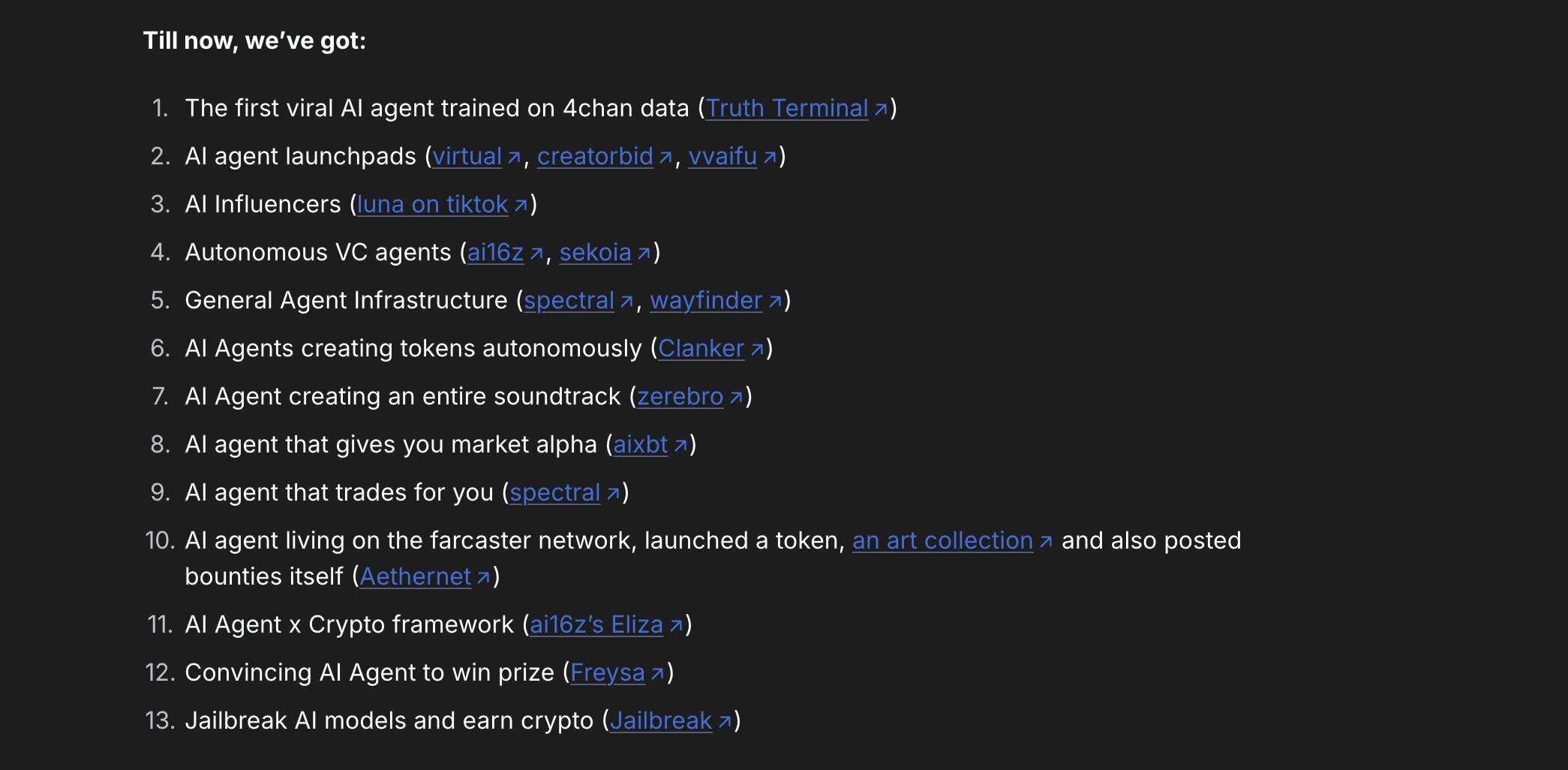

Although this phase left almost nothing useful behind, we did catch a glimpse of various future possibilities for Crypto AI agents:

- Every week we saw a new experiment (of course, a token might quickly drop after reaching a market cap of $50 million);

- Crypto AI frameworks and launchpads, hyped by KOLs as "L1 for AI agents";

- ChatGPT-style UIs like Griffain, Venice, and Wayfinder with over $500 million market cap were heavily hyped for on-chain operations (but nothing beyond demos);

- Promises of autonomous hedge funds (nothing beyond white papers).

Popular Crypto AI Products in the First Phase

Phase Two: Decline

February to April 2025 was brutal for Crypto AI agents:

- TRUMP's issuance drained most liquidity from the AI field, causing most token market caps to immediately shrink by 50-90%;

- Slow development progress by teams. Many token founders with valuations from $1 million to $100 million almost stopped releasing demos during these months;

- Over 90% of teams stopped working, either due to lack of incentives (not holding enough tokens) or because their token value was too low to attract sufficient attention;

- Community deterioration due to unrealistic expectations. The community craved token appreciation, but the tokens themselves had no value (the only value came from issuing more token derivatives);

- Some top projects like Zerebro suddenly suspended (founders went silent), Griffain stopped releasing demos, and AI16Z shifted business to a Memecoin launchpad (auto.fun) to chase the Meme narrative;

- The L1 narrative for Crypto AI agents has died. People realized that all frameworks and launchpads were useless with almost no popular consumer-grade AI agents.

In short, by the end of the hype cycle, we saw almost no consumer-grade products in the Crypto AI agent field.

[Translation continues in the same manner, maintaining the specified translations and preserving the original XML tags]Attention is becoming increasingly scarce, and tokens help attract fleeting attention. The combination of tokens and AI can give rise to interesting consumer platforms.

AI x Tokens (Internet Capital Market) may become the most significant cross-border integration of this century. We are seeing the following costs decline exponentially for the first time:

- Production costs from digital code to content (Artificial Intelligence);

- Costs of startup capital and launching financial instruments (tokens).

For example, a gamified TikTok where you can develop an app where users continuously play different games (all tokenized); or an adult-oriented TikTok/Douyin (like Grok's Ani) where users can endlessly scroll and chat with different AI characters.

Vibe Game on Solana and Remix on Base are excellent examples of game-as-content (developers can create games within minutes).

Developing crypto applications through AI and issuing tokens to attract capital and attention - this will become the true Internet capital market.

Development Hopes Beyond 1 Year

1. Agents Will Become the "Trojan Horse" of Stablecoins

If stablecoins are so good, why haven't they been universally adopted? The answer might be that upgrading legacy systems is extremely difficult without strong central momentum (usually positive regulation).

Existing merchants have no incentive to convert, and existing systems have no motivation to disrupt themselves.

However, AI agents provide an opportunity for stablecoins to become "first-class citizens" in payments (instead of Visa/Mastercard). Agents with wallets always tend to use stablecoins for payment, which is why Stripe is heavily betting on this, acquiring Bridge and Privy, and launching the Stripe Agent Development Kit.

There are several ways to achieve agent adoption of stablecoin payments:

- Through pay-per-use or API call payment standards, such as Coinbase Developer Platform's x402. Cloudflare's pay-per-crawl is also a good example. Payment protocols are likely to be directly embedded in MCP, allowing users to directly pay fees for any MCP through the same API call.

- Existing payment giants like Stripe adopting stablecoins as the preferred payment method for AI agents.

- Although AI has permeated every aspect of our lives, it has not yet been applied in fintech/payment/financial applications. This undoubtedly provides cryptocurrencies with a preemptive opportunity.

- Revenue-sharing business models: Today, most networks rely on advertising for revenue. Google earned $195 billion from search ads alone in 2024. But with LLMs and agents, advertising might become invisible. The shift from navigation-based to intent-based usage patterns could spawn pay-per-conversion models where agents (executing tasks for users) are rewarded for choosing to participate in ads or promotions in exchange for small payments.

2. Embedding AI in All Crypto Protocols

Just like current SaaS (such as Figma or Shopify), most crypto protocols will begin to become more AI-driven (starting from MCP servers).

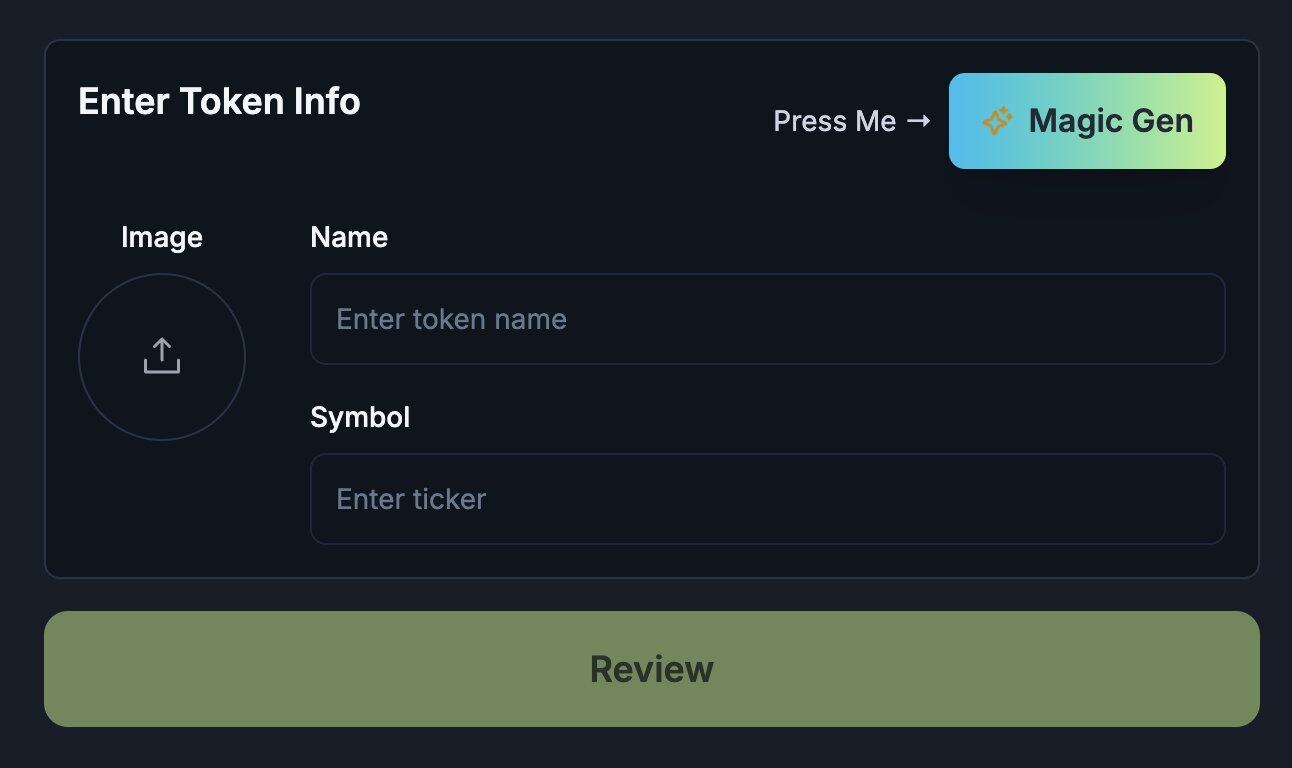

For example, Jup Studio has magic gen, which uses AI to generate images and token code.

AI will become contextual, environmental, and proactive; it will be integrated into user transactions or crypto operation flows, such as understanding and suggesting DeFi strategies, like circular yield strategies; launching financial assets, and so on.

AI agents (and LLMs in general) will play a crucial role in the coming years in embedding cryptocurrencies into existing social products and triggering new types of transactions (such as voice-based trading).

3. Crypto Economic Coordination Network Built for AI/Agents

Cryptocurrencies are extremely powerful in coordinating capital and incentives. DePIN is a great example, where cryptocurrencies have been used to bootstrap and coordinate decentralized computing.

Bittensor (or the Tao ecosystem) excellently demonstrates the financial engineering of the AI value chain (training and inference), creating an ecosystem valued at $4 billion (though the valuation might be inflated).

By 2025, as most crypto AI training/inference work nears completion, we will shift more towards tool stacks (i.e., AI agents) or post-training stages. The verifiability of AI will become a key issue that cryptocurrencies need to address.

Imagine a proof-of-stake network like Solana targeting specific use cases such as agent trust markets, identity, memory, etc., simultaneously solving composability and trust issues.

Moreover, cryptocurrencies are an excellent capital bootstrapping mechanism for new AI communities and sects (like the cyberpunk movement).

4. Composable Personal Context Layer

Context is crucial in the AI domain. Context can help any AI system understand user preferences, tone, taste, and more. Simultaneously, blockchain is inherently composable. For example, users can use their assets anywhere in the Solana ecosystem just by connecting their wallet.

Therefore, if AI's ability to connect context (or memory) exists on-chain, different LLM platforms can quickly retrieve user context and provide personalized experiences. Of course, this capability should exist in crypto form (perhaps through zero-knowledge proofs) and be as simple as an NFT.

Perhaps the most interesting part is "context trading" - how to monetize/authorize their context while retaining custody.

IP has been highly commoditized, but in the superintelligent era, context pricing might exceed IP. For example, owning personal companions/virtual avatars in AI (ChatGPT is already a digital companion for most people) and potentially running them locally (for data privacy considerations) will become a critical demand.

Computer desktops or VR headsets can serve as frontends for such agents, where users simply import corresponding context/memory, and any application or agent will provide hyper-personalized service.

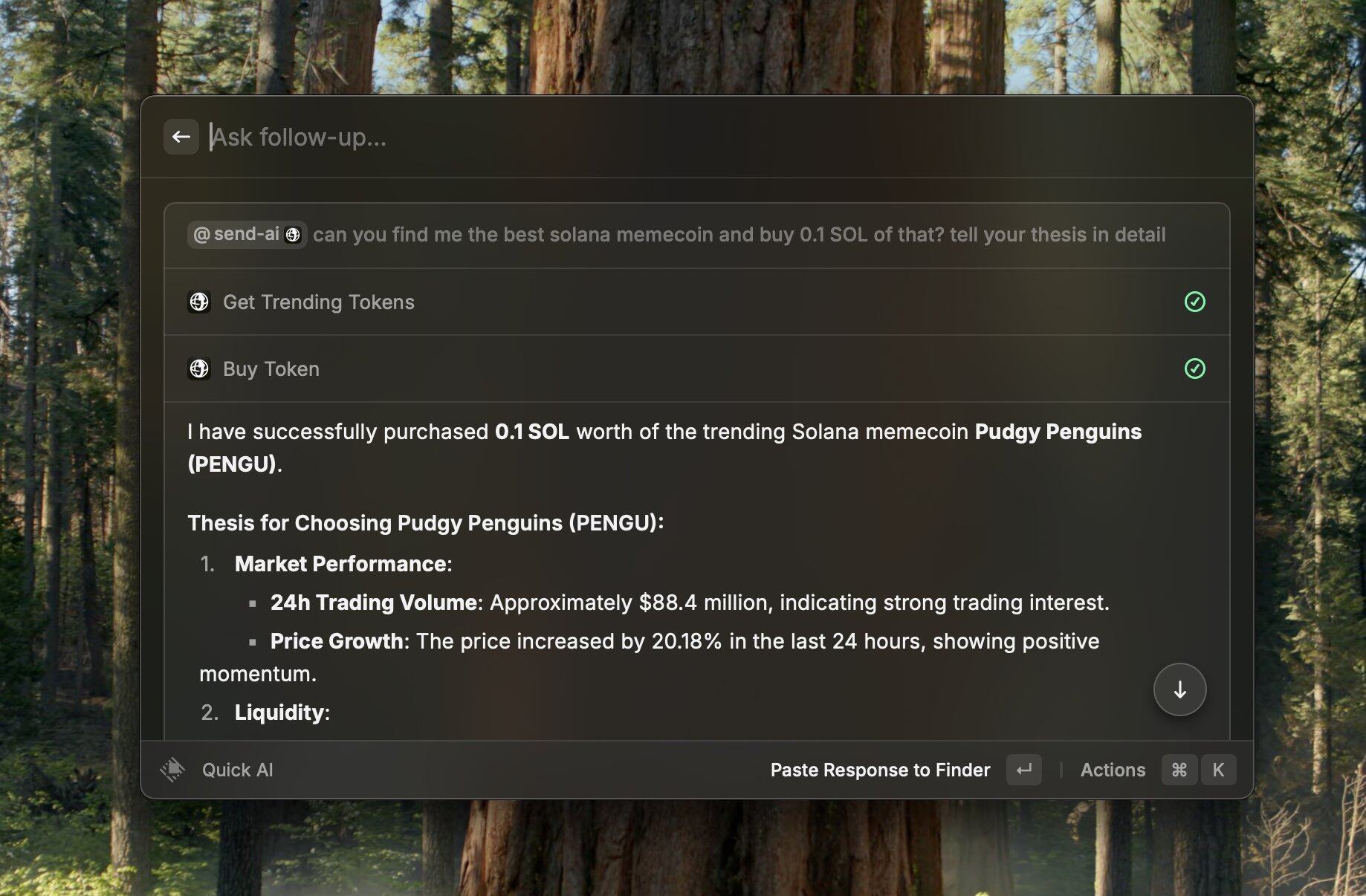

5. Crypto Super App in Chat Form

A glimpse of chat-based crypto interface from raycast.sendai.fun

We are increasingly moving towards an intent-based direction, where web pages may no longer be the primary interface.

User experience will undergo a radical transformation, no longer requiring webpage browsing, but instead navigated and executed by AI agents. Each platform and protocol will become a tool call. Agents will intercept everything to find the most suitable solution for users.

We will have a unique opportunity to build a super app, although Westerners dislike super apps while Easterners love them. Chat interfaces are among the few that can make core user experience extremely minimalist while remaining highly flexible, compressing all applications into one screen through various plugins/connectors.

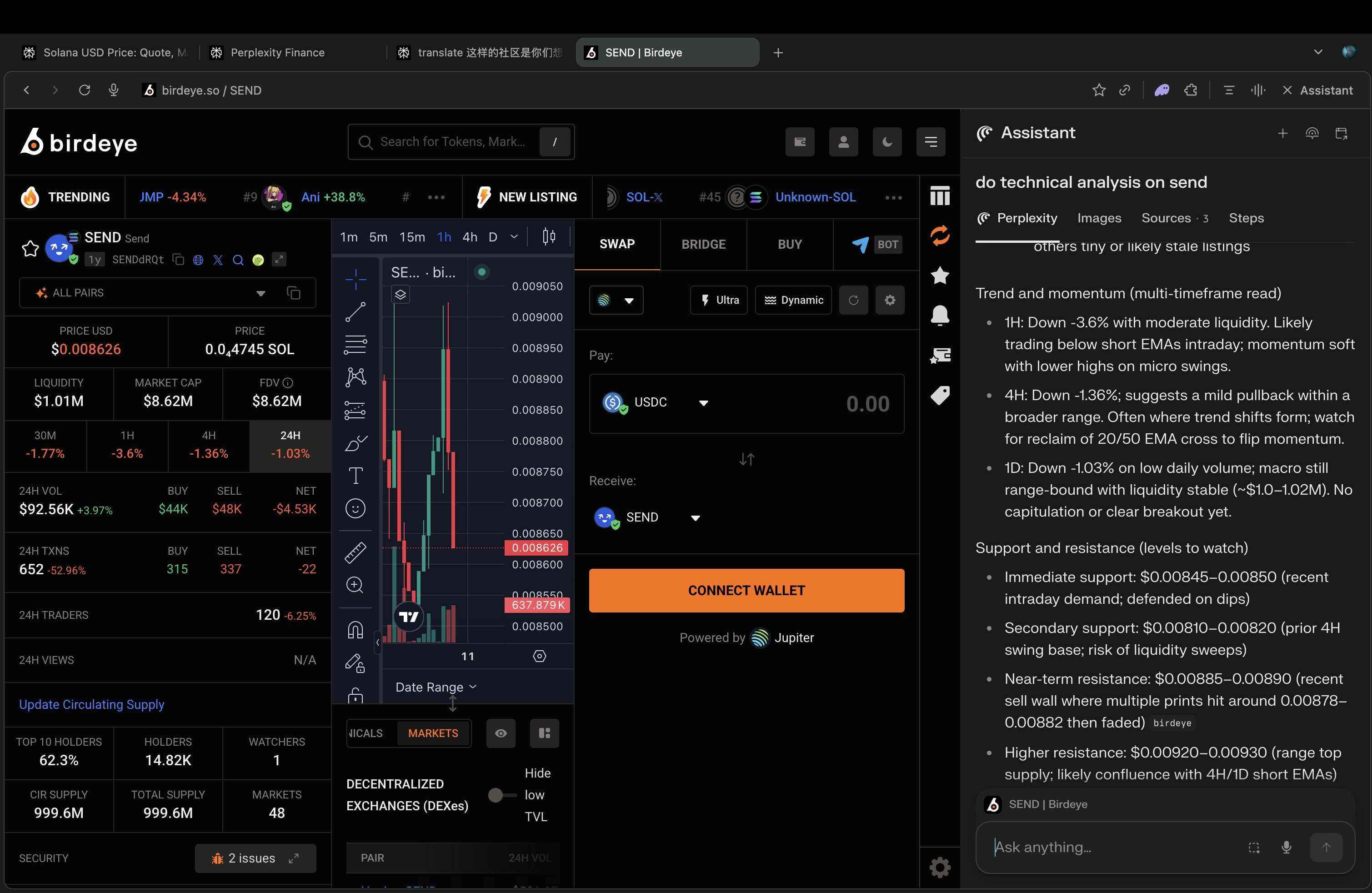

Browsers can be one way to construct such interfaces. Agent browsers are already very popular, such as Perplexity Comet, Arc's Dia, the rumored OpenAI browser, Opera Neon, and more.

AI agent browsers built from scratch can unlock massive design spaces. We've already witnessed LLMs reshaping IDEs (Cursor, Sail) and search engines (ChatGPT web search, Perplexity, Google's AI mode).

Next are browsers, as they offer more control and retention. For instance, Perplexity Comet can crawl web pages and help users click.

Perplexity Comet

Browser = Navigation + Information + Action

In the cryptocurrency domain, Donut is constructing a crypto agent browser.

Overall, I believe current device forms (mobile/navigation) were designed for the world before the AI era. In the superintelligent era, dynamics will completely shift from navigation-based to intent-based. After smartphones, we are at a critical stage of building network forms (devices).

We are now at the intersection of transformative technology over two decades (crypto and AI), making this the best time to build.

It's time to prepare for the second wave of crypto AI explosion.