[Performance by Period]

Pendle (PENDLE/KRW) rose by +38.56% in a week, emerging as the top short-term performer. Etena (ENA/KRW) increased by +35.34%, and Layer Zero (ZRO/KRW) recorded a +29.99% short-term return, confirming strong mid-to-short-term momentum. Chainlink (LINK/KRW) also rose by +26.84%, and Stargate Finance (STG/KRW) by +22.33%, with major DeFi tokens showing strength and forming a sector rally.

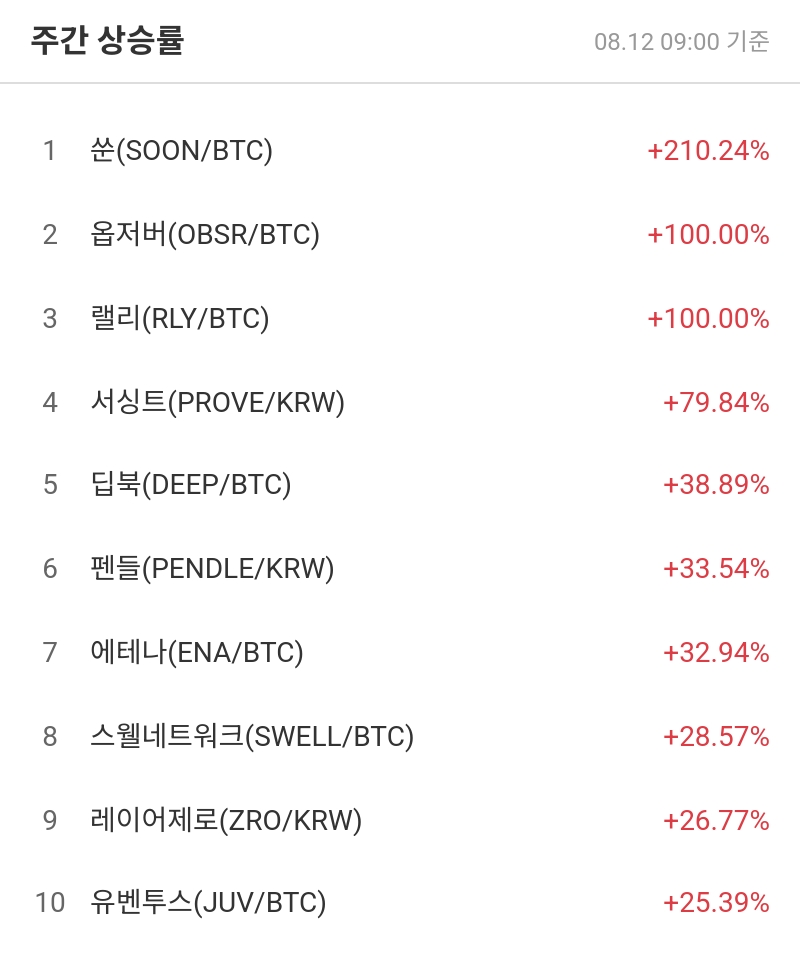

[Weekly Performance TOP 10]

1st Soon (SOON/BTC) +210.24%

2nd Observer (OBSR/BTC) +100.00%

3rd Rally (RLY/BTC) +100.00%

4th Sursint (PROVE/KRW) +79.84%

5th DeepBook (DEEP/BTC) +38.89%

6th Pendle (PENDLE/KRW) +33.54%

7th Etena (ENA/BTC) +32.94%

8th Swell Network (SWELL/BTC) +28.57%

9th Layer Zero (ZRO/KRW) +26.77%

10th Juventus (JUV/BTC) +25.39%

This week's top weekly performer was Soon (SOON/BTC), recording +210.24% and representing BTC market strength. Rally (RLY/BTC) and Observer (OBSR/BTC) also rose by +100% each, joining the theme surge. In the domestic KRW market, Sursint (PROVE/KRW), Pendle (PENDLE/KRW), and Etena (ENA/BTC) stood out.

[Daily Purchase Settlement Intensity TOP 5]

1st Wallace (WAL/KRW) 500.00%

2nd VeChain (VET/KRW) 500.00%

3rd Render Token (RENDER/KRW) 500.00%

4th Tether (USDT/KRW) 500.00%

5th Groestlcoin (GRS/KRW) 500.00%

In the purchase settlement intensity category, five tokens simultaneously recorded 500%. Wallace (WAL), VeChain (VET), and Render Token (RENDER) led the short-term breakthrough with explosive buying pressure. USDT and GRS also showed an unusual strong trend.

[Daily Selling Settlement Intensity TOP 5]

1st Power Ledger (POWR/KRW) 0.00%

2nd IOST (IOST/KRW) 0.00%

3rd Ontology Gas (ONG/KRW) 0.00%

4th Chain Bounty (BOUNTY/KRW) 0.00%

5th Orbs (ORBS/KRW) 0.00%

In contrast, POWR, IOST, ONG, BOUNTY, and ORBS recorded 0% at the bottom of selling settlement intensity, showing an extreme selling advantage. This means continuous selling settlement in price analysis, indicating a phase where investors need to transition to a wait-and-see approach.

This week's market observed both supply concentration due to short-term surges in specific tokens and a theme rally centered on the BTC market. However, given the possibility of technical adjustments and profit-taking, a divided approach and risk management are required rather than excessive chasing.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>