Author: BUBBLE

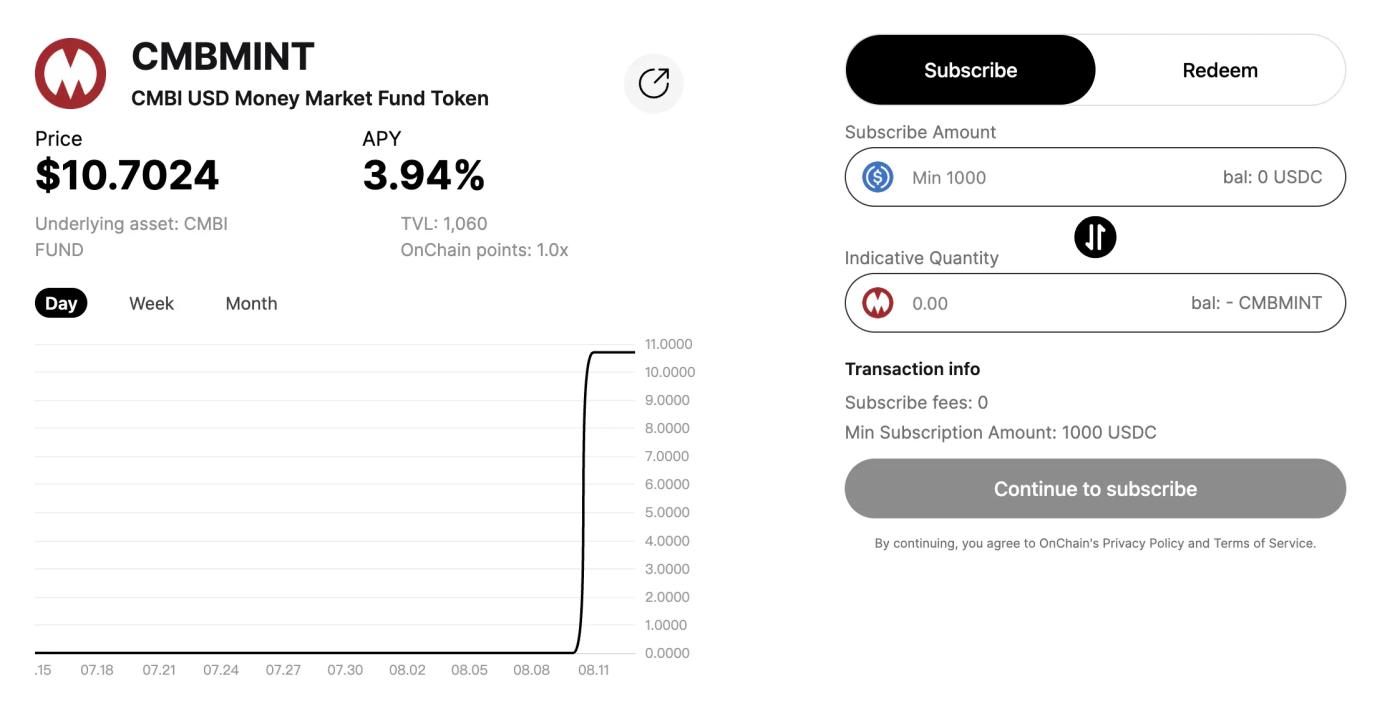

On August 8, 2025, CMB International, a subsidiary of China Merchants Bank, announced a collaboration with DigiFT, a digital exchange in Singapore, and OnChain, a Solana blockchain service provider, to tokenize a US dollar money market fund recognized in Hong Kong and Singapore. The fund will issue a token called CMBMINT. Notably, this is the first tokenized fund across multiple jurisdictions, and being led by an Asian financial giant will provide an excellent compliant sample for future multi-regional Real World Asset (RWA) collaborations.

On August 13, Solana officially confirmed that it would be the first blockchain for this fund's tokenization, marking Solana's first publicly offered tokenized fund product. The market responded optimistically. Solana's price rose 15% in the past 24 hours, and within three hours of the announcement, it further increased by 5%, breaking the $200 mark.

This article will explore the institutional network behind this collaboration, CMB International's blockchain layout and ambitions, and the investment content of the CMBMINT on-chain fund.

(The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms.)In addition to public chain ecosystems, China Merchants International continues to focus on alliance chains and enterprise services. In July 2022, blockchain infrastructure provider "Rivtower" completed a Pre-B round of financing worth tens of millions of yuan, with China Merchants International continuing to increase its investment as an existing shareholder. Rivtower, formed by a domestic open-source alliance chain technical team, developed the world's first cloud-native blockchain framework CITA-Cloud, providing underlying technical support for industrial internet and government-enterprise markets. China Merchants International's consecutive investments in its A+ and Pre-B rounds demonstrate its long-term optimism about the blockchain infrastructure track and further consolidate its influence in the domestic alliance chain/Web3 infrastructure circle.

Virtual Asset Service Exploration (2022-2025)

As blockchain and financial applications gradually integrate, China Merchants International has begun to expand into new fields of digital assets and financial technology convergence in recent years. Between 2022 and 2023, China Merchants International served multiple times as the exclusive placement agent for Hong Kong-listed company Arta TechFin (279.HK), helping it complete stock issuance and convertible bond offerings. Arta TechFin, established by New World Group's executive vice-chairman Cheng Chi-kong, is positioned to connect Web2 and Web3 using new technologies like blockchain, providing high-end financial services that integrate virtual and traditional assets. Its product lineup includes the Arta Wallet, a wallet and custody platform using world-leading security technologies, and the Arta STO, a blockchain-based regulated digital securities issuance platform.

These forward-looking investments have also earned recognition from regulatory authorities. On July 14, 2025, China Merchants International Securities Limited was officially approved by the Hong Kong Securities and Futures Commission, becoming the first Chinese bank-affiliated securities firm to obtain a virtual asset trading service license in Hong Kong. This means China Merchants International can legally provide trading services for cryptocurrencies including Bitcoin and Ethereum to qualified investors, expanding its business scope from traditional stocks to the digital asset domain.

American Public Chain Collaborates with Chinese Institutions: Who is Driving this "Century Cooperation"?

Behind the successful cross-border on-chain fund, two key institutions, DigiFT and OnChain, are worth noting - one "connecting" through regulatory compliance, the other focusing on public chain technology issuance support to "link" Solana and other public chains. Who are they exactly?

DigiFT: Pioneer of Compliant On-Chain Trading Platform

DigiFT is a Singapore-based fintech company established in 2021, dedicated to creating a parallel compliant and decentralized on-chain digital asset exchange. Its founder, Henry Zhang, has a deep banking background, which made DigiFT prioritize regulatory compliance from the beginning.

Henry Zhang has nearly 13 years of senior management experience in the Chinese-speaking region of foreign banks, source: Linkedin

DigiFT is the world's first on-chain trading platform recognized by the Monetary Authority of Singapore as a Recognized Market Operator (RMO) with a Capital Markets Services (CMS) license. With these dual licenses, DigiFT can legally provide on-chain security token issuance and trading services to qualified investors. In terms of technological innovation, DigiFT was the first to launch a globally compliant on-chain Automated Market Maker (AMM) mechanism, combining decentralized trading efficiency with traditional regulatory requirements. Additionally, the platform has issued the world's first tokenized US Treasury deposit receipts, proving the feasibility of introducing real financial assets into the DeFi realm.

In 2025, DigiFT obtained a digital asset custody license from the Monetary Authority of Singapore, extending its business scope to compliant custody services and further improving its end-to-end Real World Assets (RWA) solution capabilities. In this CMBMINT project, DigiFT plays the role of issuer and exchange: issuing tokens pegged to fund net asset value and providing subscription, trading, and redemption channels to qualified investors through its own platform.

In fact, before this collaboration, DigiFT had already completed multiple RWA tokenization partnerships. In February 2025, DigiFT collaborated with Invesco to launch a $630 million tokenized private credit fund (iSNR), deployed on the Arbitrum chain, supporting USDC/USDT subscriptions and expanding to the Plume network. In March 2025, it launched two tokenized index funds tracking AI stocks (such as Apple, Tesla) and major crypto assets. As a UBS on-chain tokenization distribution partner, DigiFT supports products like uMINT (US dollar money market fund) and collaborated with Kucoin in August to use uMINT as collateral on the platform. They have also collaborated to varying degrees with HashKey Capital, FundBridge, Wellington Management, Libeara, Chainlink, IOST, WSPN, GSR, and other institutions and projects in the real-world asset tokenization field.

It is precisely because DigiFT possesses mature compliance operational experience and innovative on-chain trading technology that China Merchants International can confidently entrust the fund token issuance and circulation to its management. Traditional institutions are responsible for asset and compliance oversight, while innovative platforms handle technical implementation and market liquidity, each playing to their strengths.

OnChain: RWA Technical Supporter

OnChain is a financial technology company focused on global asset on-chain allocation. Its core team members come from both traditional finance and blockchain backgrounds, including NASDAQ-listed company founders, trillion-dollar asset management institution executives, and former top 5 exchange senior executives. The core team graduated from renowned universities like Peking University and Columbia University, and have worked at institutions such as Goldman Sachs, ByteDance, and Tencent, possessing deep experience in blockchain, smart contracts, and digital asset management.

Supported by top institutions like China Merchants Bank International (CMBI), UBS, and Invesco, they provide on-chain investment solutions covering money market funds, bond funds, and non-standard fixed-income products, with plans to support global ETFs and mainstream stock market investments in the future, promoting deep integration of traditional finance and on-chain ecosystems.

The RWA Era of Large Institutions

The increasing collaboration between institutions and on-chain projects reflects a trend: RWA projects can only truly be implemented and succeed when regulatory, asset, and technological forces converge. From a broader perspective, Asian financial institutions (Hong Kong's new policies, Singapore's sandbox) are building stages for such cross-border blockchain innovations. In the future, as more traditional giants "build bridges" with blockchain innovative enterprises, we have reason to expect more cross-market and cross-technological field collaborations that will mature real-world asset on-chain processes and bring new possibilities to global financial markets.