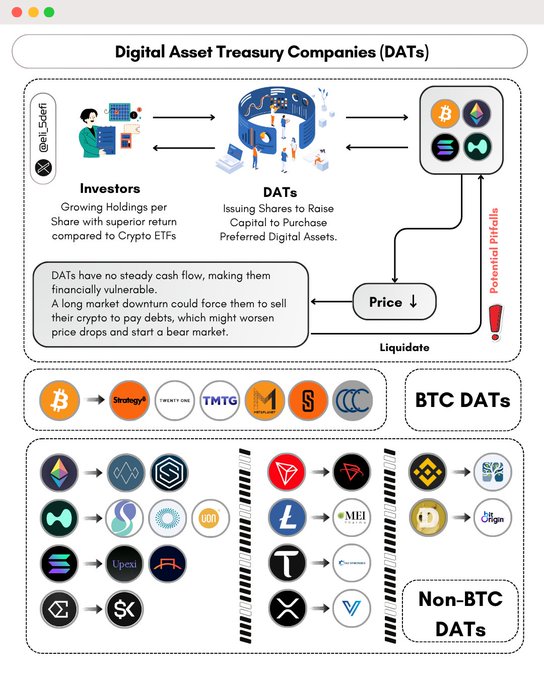

DAT companies are multiplying rapidly.

They raise capital → Buy crypto → Watch asset values drive stock prices higher → Then issue more shares to buy more crypto

It's a flywheel that's attracting massive attention.

➠ Pension funds, sovereign wealth funds & insurance companies can't buy crypto directly due to regulations

➠ But they can buy shares of companies that hold crypto treasuries

➠ This creates legitimate channels for trillions in institutional capital to flow into crypto markets

But the cycle feeds on itself as long as crypto prices rise.

Yes current DATs have some stability (lower leverage, diversified crypto strategies, regulatory reporting requirements)

But modified versions will emerge soon. Companies who’re struggling will acquire public firms & convert them purely into crypto holding.

> When the crypto prices decline, the flywheel will reverse its direction

> Weakest DATs will start selling to defend stock prices

> This will create downward pressure that accelerates across the sector

Remember DAT’s solve institutional access problems + create new sources of market volatility.

Dan Smith

@smyyguy

08-14

The DAT Daily

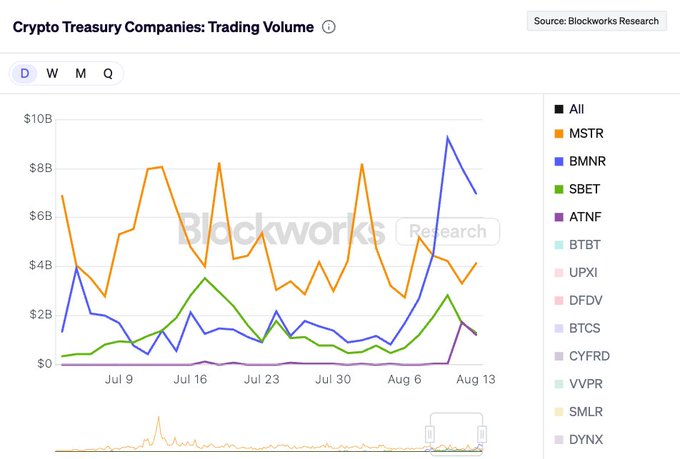

Yesterday saw $14.2 billion of sector trading volume, with 68% driven by Ethereum DATs and 30% by Bitcoin DATs

The top 4 names by volume

- BMNR (ETH) $6.9b

- MSTR (BTC) $4.2b

- SBET (ETH) $1.3b

- ATNF (ETH) $1.2b

These are quickly becoming "the big 4"

DAT stands for digital asset treasury.

It is a structure that continuously increases EPS (earnings per share) through asset management by simply holding tokens.

Eli5DeFi

@eli5_defi

07-25

➥ The New Kids On The Block - Digital Asset Treasury Companies

In recent months, several Digital Asset Treasury (DAT) companies have burst onto the scene, with some pivoting from their original ventures.

What are these companies, and how they works?

Let's dive in and find out

Damn so DAT is actually tredning rn

Thanks Yashas!

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content