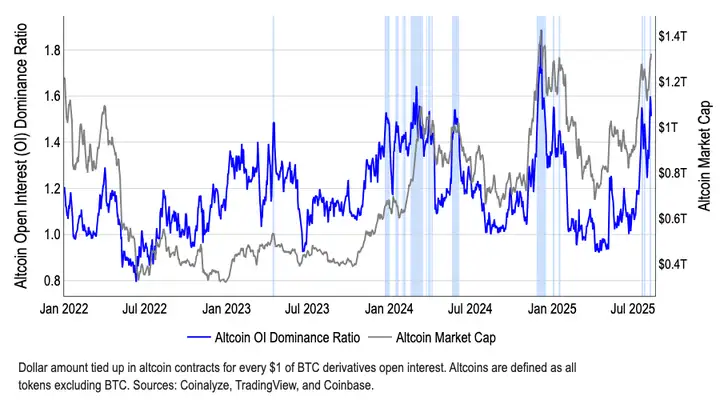

Bitcoin's market dominance has dropped from 65% in May 2025 to around 59% in August 2025, indicating that funds have begun to rotate into Altcoins. Although the total market value of Altcoins has grown by over 50% since early July (reaching $1.4 trillion as of August 12), the "Altcoin Season Index" on CoinMarketCap is currently around 40, far below the historical threshold of 75 that defines an Altcoin season. The current market conditions are beginning to suggest that as September approaches, the market may transition to a full Altcoin season.

VX: TZ7971

Changes in the global M2 money supply index often lead Bitcoin prices by 110 days, pointing to a potential new liquidity cycle in late Q3/early Q4 2025. This is crucial because for institutional funds, the narrative still seems to revolve around large cryptocurrencies, while Altcoins are primarily supported by retail investors.

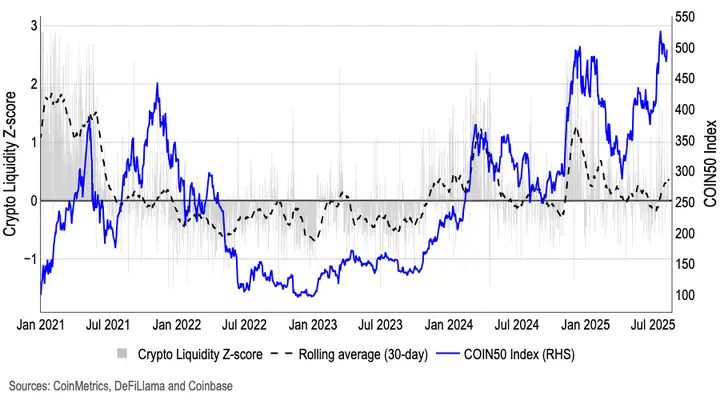

Notably, the size of US money market funds has reached a record $7.2 trillion, with cash balances decreasing by $150 billion in April, driving the strong performance of crypto and risk assets in subsequent months. Interestingly, cash balances have rebounded by over $200 billion since June, which contrasts with the cryptocurrency price increase during the same period. Typically, cryptocurrency prices and cash balances show a negative correlation.

This unprecedented cash reserve scale reflects missed opportunity costs, mainly due to:

Increased uncertainty in traditional markets (caused by issues like trade conflicts);

High market valuations;

Ongoing concerns about economic growth.

However, as the Federal Reserve is set to implement rate cuts in September and October, the attractiveness of money market funds will begin to weaken, with more funds flowing into cryptocurrencies and other high-risk asset classes.

In fact, our cryptocurrency liquidity-weighted Z-score indicator (based on stablecoin net issuance, spot and perpetual contract trading volume, order book depth, and free float) shows that liquidity has begun to recover in recent weeks after six months of decline. Stablecoin growth is partly due to a clarifying regulatory environment.

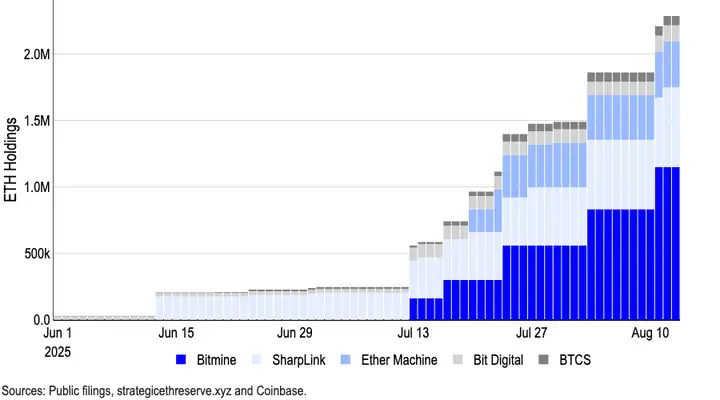

Meanwhile, the divergence between the "Altcoin Season Index" and "Altcoin Total Market Cap" primarily reflects growing institutional interest in Ethereum (ETH) - a trend supported by Digital Asset Treasury (DAT) demand and stablecoin and Real World Assets (RWA) narratives. Bitmine Immersion Technologies alone has purchased 1.15 million ETH and plans to continue accumulating through financing up to $20 billion. Another ETH DAT leader, Sharplink Gaming, currently holds approximately 598,800 ETH.

As of August 13, the latest data shows that top ETH treasury companies collectively hold about 2.95 million ETH, over 2% of the total ETH supply (12.07 million).

Among Beta options with higher yields relative to ETH, ARB, ENA, LDO, and OP are at the forefront, but only LDO seems to have significantly benefited from the recent ETH price increase (up 58% so far this month).

Maintaining a constructive outlook for Q3 2025, but with an evolving view on the Altcoin season. The recent decline in Bitcoin dominance indicates funds are initially rotating into Altcoins, but a full Altcoin season has not yet formed. However, with the rise in Altcoin total market cap and early positive signals from the "Altcoin Season Index", the market appears to be creating conditions for a more mature Altcoin season in September. This optimistic assessment is based on both macro factors and expectations of regulatory progress.

Today's fear index is 60, still in a greedy state.

The market experienced a slightly unexpected pullback, primarily triggered by a higher-than-expected PPI. The options market showed no significant changes, with no substantial variations in IV for major terms and minimal skew fluctuations. However, trading volumes indicate market enthusiasm, suggesting continued market confidence in future prospects and the continuation of the bull market.

This market trend has provided many opportunities. Despite the higher PPI, it won't change the rate cuts. As mentioned yesterday, those with spot positions should remain patient, while those without should wait for a pullback to enter. Even if the market drops, funds are still flowing in, with strong buying pressure. Clear leverage, cool down, and then push to new highs.