Key Points:

- Cycle Network adopts a three-layer architecture design: using Ethereum as a security anchor, connecting cross-source networks, and integrating transaction activities through zkEVM rollup, thereby eliminating dependence on traditional cross-chain bridges.

- The infrastructure already supports cross-chain stablecoin settlement and chain abstraction GameFi applications. Projects like Golden Goose demonstrate how Cycle simplifies operational complexity while providing yield strategies.

- Since the Alpha mainnet launch, Cycle has secured over $400 million in assets and processed more than 2.7 million transactions.

- The CYC token issuance aims to reward early users, promote ecosystem development, and maintain network security. 20% is allocated for community airdrops, 10% for staking security mechanisms, with its tokenomics design achieving synergy between long-term participation and decentralization.

Introduction

Cycle Network is building a multi-chain settlement layer that simplifies the complexity of multi-chain environments without relying on cross-chain bridges. This infrastructure has secured over $400 million in assets, processed more than 3 million mainnet transactions, and integrated over 20 networks including Monad, Berachain, Sonic Labs, BSC, and Base.

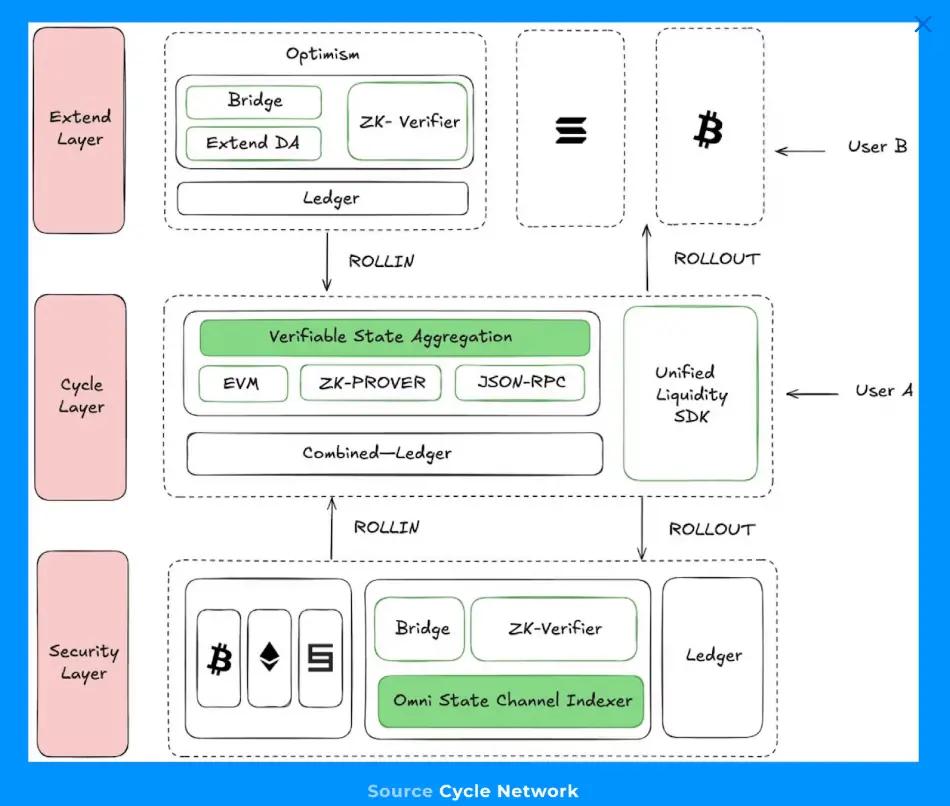

Its architecture contains three levels: the security layer ensures state integrity through Ethereum and zero-knowledge proofs (ZKP); the expansion layer connects all source and target networks through decentralized endpoints and Expanded Data Availability (EDA); the Cycle layer serves as a zkEVM rollup aggregating cross-network activities. These three layers work collaboratively to maintain global state synchronization, allowing applications and users to operate as if in a single network.

The infrastructure supports cross-chain stablecoin settlement and simplified multi-chain interfaces, enabling bilateral reconciliation with traditional banks in real-world assets (RWA) and stablecoins, enhancing transaction verifiability and transparency.

Cycle Network Overview

Cycle Network's technical architecture aims to integrate multi-chain networks into a unified bridge-less settlement layer through three core components: security layer, expansion layer, and Cycle layer.

The security layer is the cornerstone of Cycle Network's integrity and security. This layer relies on Ethereum's decentralized programmable infrastructure, anchoring the global state on Ethereum to inherit its robust security guarantees. By combining Ethereum endpoints with zero-knowledge proof (ZKP) technology, Cycle achieves trustless on-chain verification of network activities. These ZKP proofs submitted to Ethereum allow anyone to independently verify Cycle's state updates, thereby inheriting Ethereum's consensus mechanism security.

The expansion layer covers all source and target networks storing transaction data, including Layer1, Layer2, and dedicated application chains. Cycle deploys endpoints in various expansion layers, ensuring complete message retrieval through Expanded Data Availability (EDA) mechanisms. These endpoints achieve cross-network state synchronization through decentralized indexing.

The core Cycle layer serves as an advanced rollup layer, aggregating transactions from the security and expansion layers. It uses decentralized sequencers and zkEVM provers to maintain a consistent global state across diverse networks. This architecture enables users to safely perform multi-chain interactions without manually cross-chaining or adapting to specific chain interfaces.

Stablecoin Liquidity and Multi-Chain Settlement

Cycle Network enables stablecoins to flow seamlessly between different networks as if within a single system, significantly enhancing multi-chain liquidity and settlement efficiency. Its multi-chain settlement capabilities fundamentally transform stablecoin reconciliation, verification, and confirmation mechanisms across chains, allowing users to access unified liquidity without complex cross-chain operations.

For stablecoin issuers, Cycle provides verifiable proof ensuring on-chain token activities perfectly match off-chain bank reserves or real-world assets. By aggregating all transactions into an auditable ledger, every token flow between integrated networks can be transparently recorded and verified. This architecture meets compliance requirements while enhancing regulatory and market trust through asset anchoring mechanisms.

Developers also benefit from simplified multi-chain deployment processes. Traditional models require separate contract deployments across networks, whereas Cycle SDK supports one-click synchronized deployment across networks, significantly shortening development cycles and accelerating product market entry, with convenience comparable to cloud infrastructure's virtualization revolution of deployment environments.

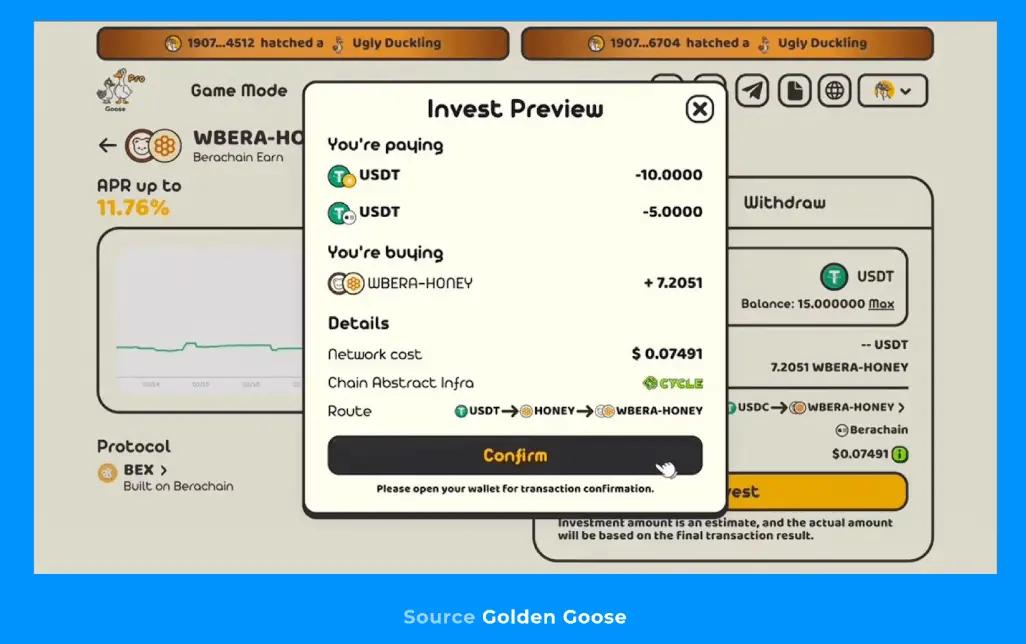

Golden Goose: Chain Abstraction GameFi Practical Case

Golden Goose is a GameFi platform built on Cycle Network, simplifying multi-chain strategies into a gamified experience. Users can "incubate" virtual geese by staking assets like USDT, earning VEGOOSE token rewards and CYC token airdrops by completing yield tasks. The platform's underlying infrastructure by Cycle enables automatic cross-chain, exchange, gas payment, liquidity provision, and staking functions. Users simply select strategies and click "stake" through a unified dashboard, with the system implementing multi-chain asset scheduling via Rollin/Rollout infrastructure and unified liquidity system.

Golden Goose significantly lowers entry barriers for crypto-native and mainstream users. Players can start earning by logging in with social accounts without wallet configuration. The application's marketing activities have attracted over 800,000 addresses, including 100,000 users from TikTok. By August 2025, the mainnet had attracted 20,000 paid addresses with a total locked value of $15 million, performing exceptionally well in markets like Latin America, Brazil, Japan, and Turkey.

Cycle Network Token Issuance

Cycle Network's Alpha mainnet officially launched on February 10, 2025, marking the start of the pre-Token Generation Event (pre-TGE) phase. The mainnet launch coincided with the introduction of testnet rewards, developer bounty programs, and early user competitions to promote network activity.

The key milestone of the pre-TGE stage is the launch of the Cycle Liquidity Hub in mid-June 2025. As the core infrastructure before token generation, this hub is essentially Cycle's multi-chain stablecoin and asset clearing center. User-deposited assets will form cross-network liquidity reserve pools, available for Rollin/Rollout processes. Participants can earn transaction fees and token reward eligibility. The launch of the liquidity hub simultaneously initiates a series of airdrop plans aimed at rewarding network supporters during this phase.

Airdrop Mechanism and Participation Method

Cycle Network has reserved 20% of its total token supply as a community airdrop reward pool, specifically to incentivize early supporters (such as liquidity providers and active users). The airdrop plan adopts an inclusive design principle, setting a participation cap of approximately $1000 contribution value per address, effectively preventing whales from monopolizing allocation quotas through a contribution capping mechanism. Excess deposits or multi-wallet strategies cannot significantly enhance airdrop points, ensuring fairness in the ranking.

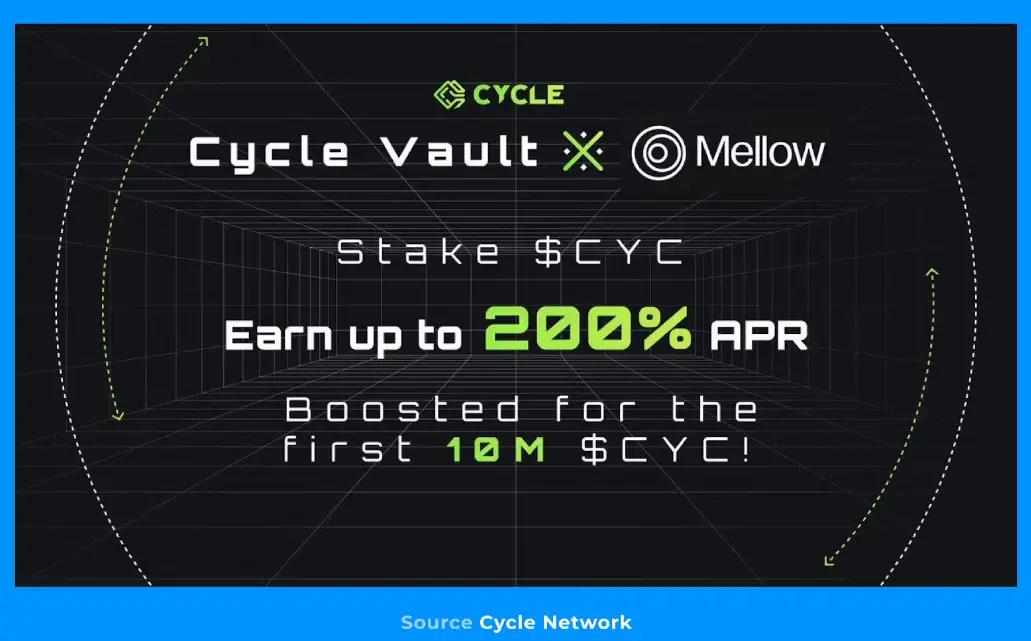

To enhance participant returns, the platform simultaneously launches the Mellow CYC staking rewards program, where users can earn up to 200% annual yield by staking CYC. This mechanism continues to motivate community members to participate in ecosystem development during the airdrop reward waiting period.

Token Economic Model

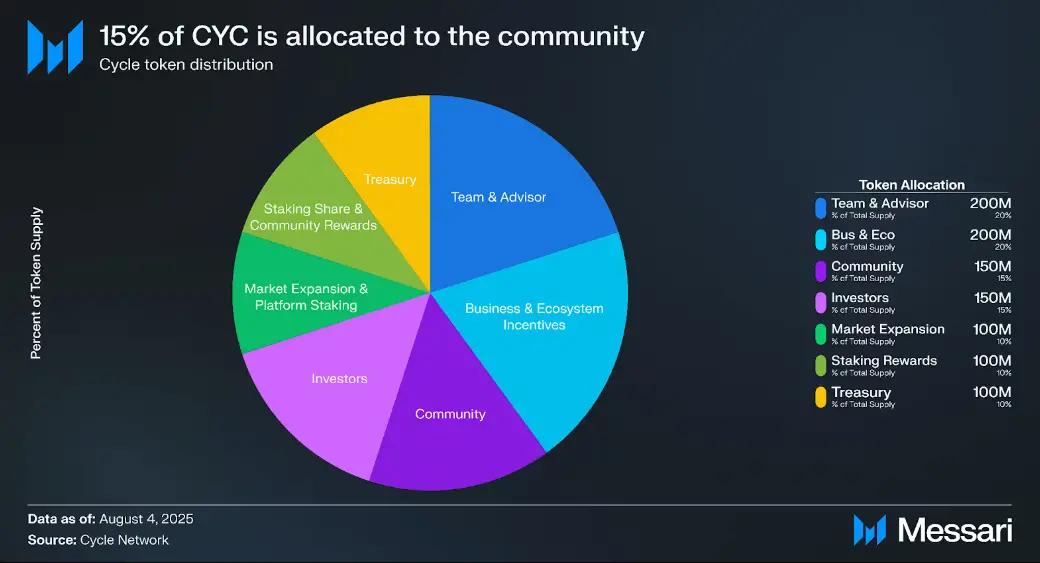

Cycle Network's token economic model uses CYC as a fixed-supply network utility and governance token, with a total supply of 1 billion tokens that will never be increased. CYC allocation covers multiple categories, aimed at simultaneously promoting project development and community incentives:

- Team and Advisors (20%): Token allocation has a 12-month lock-up period (no release in the first year after TGE), followed by linear unlocking over 48 months.

- Business and Ecosystem Incentives (20%): These tokens serve as a dedicated ecosystem development fund, initially distributed based on quantifiable contributions (such as rewarding projects bringing traffic to Cycle or funding network infrastructure development teams). Once on-chain governance is launched, the community will vote on specific allocation plans.

- Community Incentives (15%): Specifically for community programs (including airdrops and user incentive measures implemented in the pre-TGE phase and continuous reward mechanisms after TGE), distributed every six months, fully released within three years.

- Investor Share (15%): For early investors and strategic partners (including incubation funds), with a 1-year lock-up period, subsequently unlocked gradually over 24 to 36 months according to agreement terms.

- Treasury Reserve (10%): Locked for 6 months after TGE, then gradually released over 48 months.

- Market Expansion and Platform Staking (10%): These tokens are used for market expansion, ecosystem growth, and staking incentives. Some may be activated during TGE (such as initial liquidity or exchange listing), with the remainder used for growth plans and liquidity enhancement as needed.

- Staking and Shared Security Rewards (10%): Specifically to incentivize participants maintaining network security through staking (including Symbiotic restaking and Cycle native validator node staking). Tokens will be distributed as rewards to stakers providing security for Cycle Network and its multi-chain transactions, with a release cycle set for long-term linear unlocking (60 months or 5 years). This slow release mechanism ensures continuous incentives for security maintainers and aligns with the Symbiotic restaking model—stakers provide security for multiple networks (including Cycle) by long-term asset locking and earn rewards.

CYC Token Functions and Incentive Mechanisms

CYC tokens have multiple functions in the Cycle Network ecosystem, with demand directly linked to network usage. Core functions and incentive roles include:

- SDK Usage Fee: Developers building applications on Cycle need to pay CYC as a service fee when using multi-chain APIs (such as invoking Rollin/Rollout functions).

- Network Gas Fees: CYC is the native fuel token for all transactions and smart contract executions within Cycle Network.

- Security Staking (Symbiotic Restaking): As members of the Symbiotic shared security protocol, CYC holders can participate in staking to maintain network validation security (such as aggregating sequencer nodes). Stakers earn rewards from the 10% staking rewards pool. New networks accessing Cycle's liquidity layer also need to stake CYC (for example, Layer1 integration requires locking a certain number of tokens), with stakers simultaneously gaining future governance rights.

- Liquidity Mining Incentives: To launch multi-chain asset pools, Cycle uses CYC to reward liquidity providers. Users depositing mainstream assets like ETH into the liquidity hub or cross-chain asset pools will receive CYC rewards. The innovative aspect is that unlike traditional single-chain AMMs, liquidity providers support a multi-chain liquidity system empowering the entire ecosystem, with CYC rewards used to compensate for Impermanent Loss and opportunity costs, thus attracting more capital inflow.

Beyond these core functions, CYC will also serve as Cycle Network's governance token. Although governance functions will be introduced soon, token holders will ultimately be able to vote on protocol upgrades, parameter adjustments, and proposals for specific token pool allocations (such as ecosystem incentives or treasury reserves). This both grants CYC holders decision-making power in network development and aligns with the project's decentralization philosophy.

Conclusion

Cycle Network has built a unified liquidity multi-chain settlement infrastructure supporting practical applications like stablecoin settlements. This architecture currently safeguards assets exceeding $400 million and handles transaction volumes in the millions. Platforms like Golden Goose have validated that its infrastructure can support user-friendly multi-chain applications while shielding technical complexity for developers and users.

After TGE, Cycle is shifting from infrastructure construction to ecological expansion. Liquidity hub and airdrop plans and other pre-TGE measures aim to achieve distributed ownership allocation and initiate network participation. CYC tokens will serve as a universal functional asset across the network, used for paying transaction fees, obtaining liquidity rewards, participating in secure staking, and governance. Cycle establishes a foundation for long-term project development through a structured token economic model and clear distribution incentive strategy, committed to becoming a base layer in multi-chain settlement and unified liquidity.