In the past 24 hours, a large-scale position liquidation occurred in the cryptocurrency market, with long positions being particularly prominent.

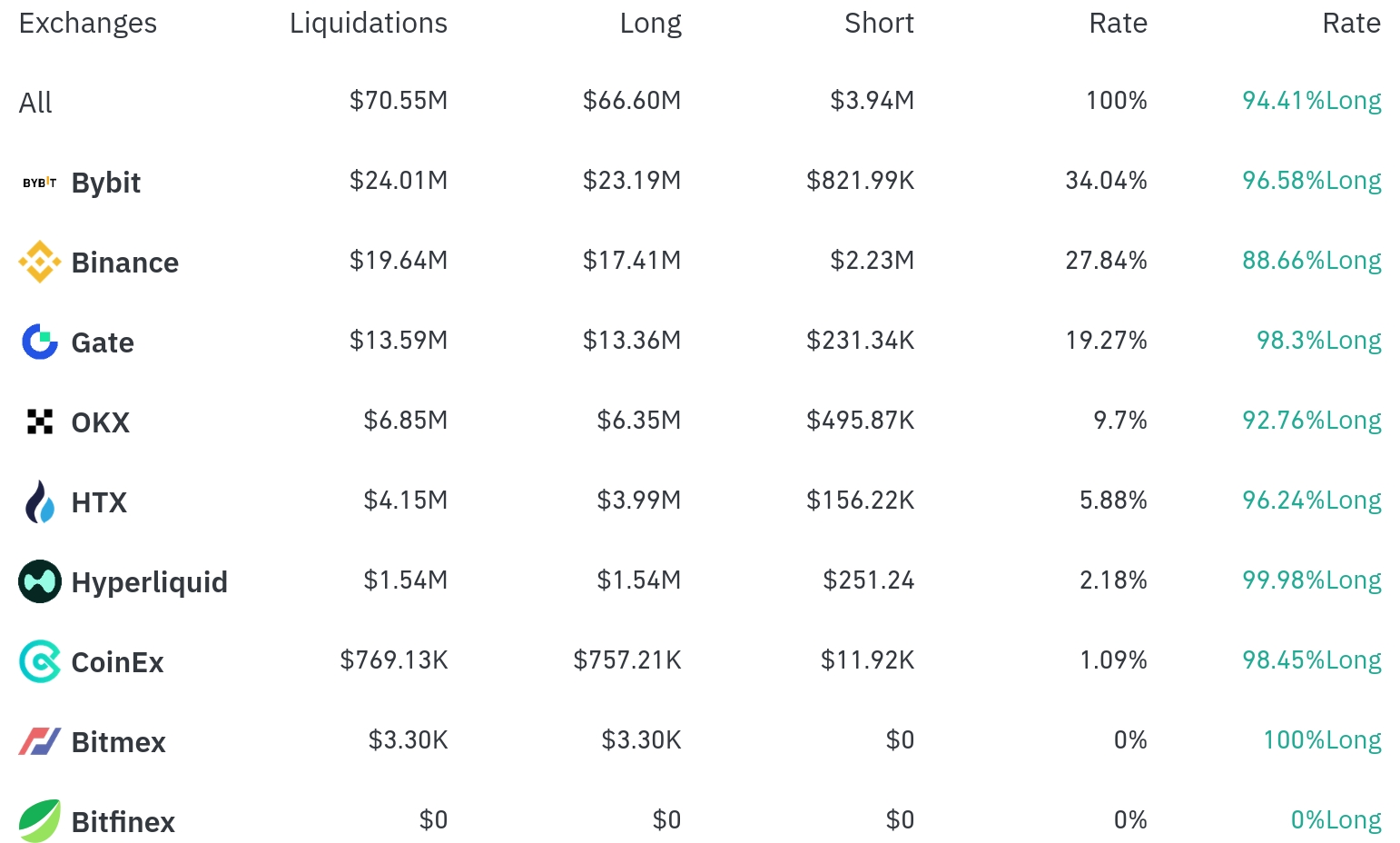

According to the aggregated data, approximately $70.55 million (about 10.32 billion won) in leverage positions were liquidated in the last 4 hours. Among these, long positions accounted for $66.6 million, representing 94.41% of the total, while short positions were only $3.94 million, or 5.59%.

Bybit saw the most position liquidations in the past 4 hours, with a total of $24.01 million (34.04%) liquidated. Of this, long positions accounted for $23.19 million, or 96.58%.

Binance was the second-highest, with $19.64 million (27.84%) of positions liquidated, of which long positions were $17.41 million (88.66%).

Gate exchange experienced $13.59 million (19.27%) in liquidations, with a very high long position ratio of 98.30%. OKX saw approximately $6.85 million (9.70%) in liquidations, with a long position ratio of 92.76%.

By coin, Ethereum (ETH) recorded the most liquidations. Approximately $91.31 million in Ethereum positions were liquidated in 24 hours, with up to $1.5 million in long position liquidations in 4 hours. The current Ethereum price is $4,462.12, up 0.74% in 24 hours.

Bitcoin (BTC) had about $21.17 million in positions liquidated in 24 hours and is currently trading at $117,547.2. It has slightly decreased (-0.05%) in 24 hours.

Solana (SOL) had approximately $10.46 million liquidated in 24 hours and is currently priced at $190.95, up 1.02%. Doge (DOGE) saw $9.42 million in liquidations and is currently trading at $0.23272.

Notably, Chainlink (LINK) recorded about $7.2 million in liquidations while its price rose 12.76% to $25.635. Cardano (ADA) also saw about $6.49 million in liquidations while trading at $0.9503, up 3.15%.

Such large-scale long position liquidations in the cryptocurrency market suggest that investors using excessive leverage were affected by sharp price adjustments amid the recent market uptrend. The high liquidation amounts for Ethereum and Bitcoin, in particular, demonstrate the concentration of leveraged investment in major cryptocurrencies.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>