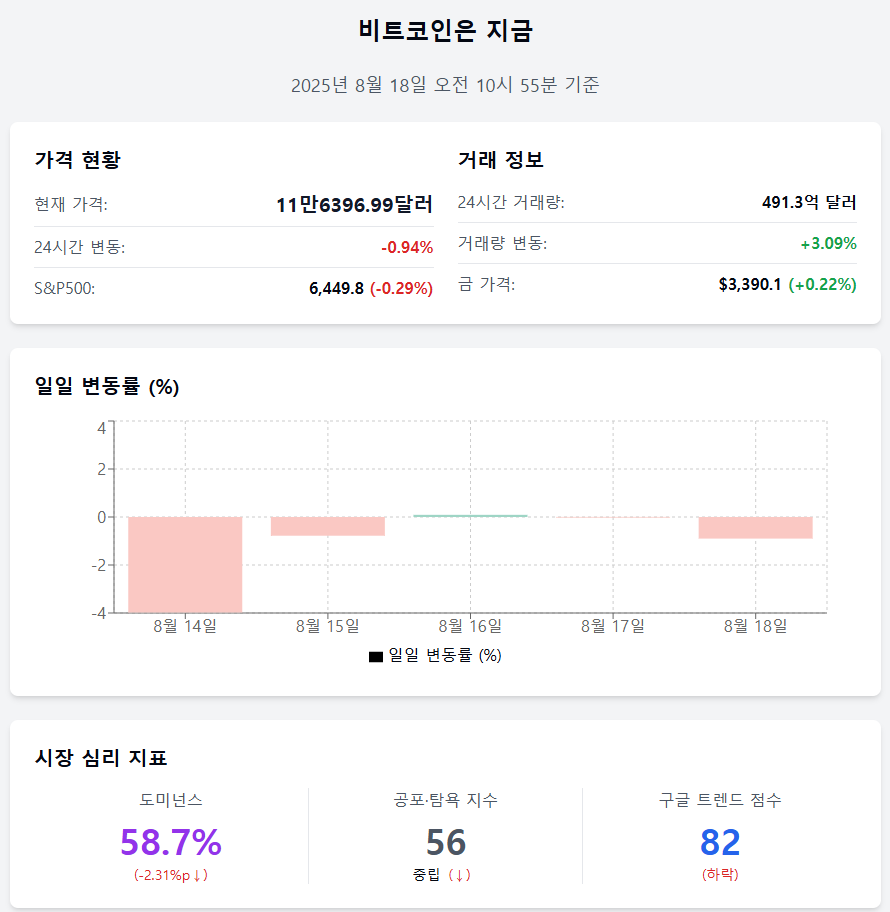

As of 10:55 AM on August 18, 2025

Bitcoin is maintaining the level around $116,000 amid a short-term adjustment, but is showing relative weakness compared to altcoins due to a decline in dominance and a slowdown in investment sentiment.

📈 Price now

Price $116,396.99 (–0.94%) Bitcoin is trading at $116,396.99, down 0.94% from the previous day. The rebound has been cut off, and the short-term adjustment trend continues.

Trading volume $49.13 billion (+3.09%) The 24-hour trading volume increased by 3.09% to $49.13 billion, with short-term buying and selling becoming more active.

Daily fluctuation –0.90% The daily fluctuation over the past 5 trading days is ▲14th –3.98% ▲15th –0.78% ▲16th +0.09% ▲17th –0.03% ▲18th –0.90%, showing a limited rebound amid a downward trend.

Asset comparison S&P500↓ · Gold↑ As of last Friday the 15th, the S&P 500 index was 6,449.8, down 0.29% from the previous day, and gold prices rose 0.22% to $3,390.1. Risk assets adjusted, while safe-haven assets showed strength.

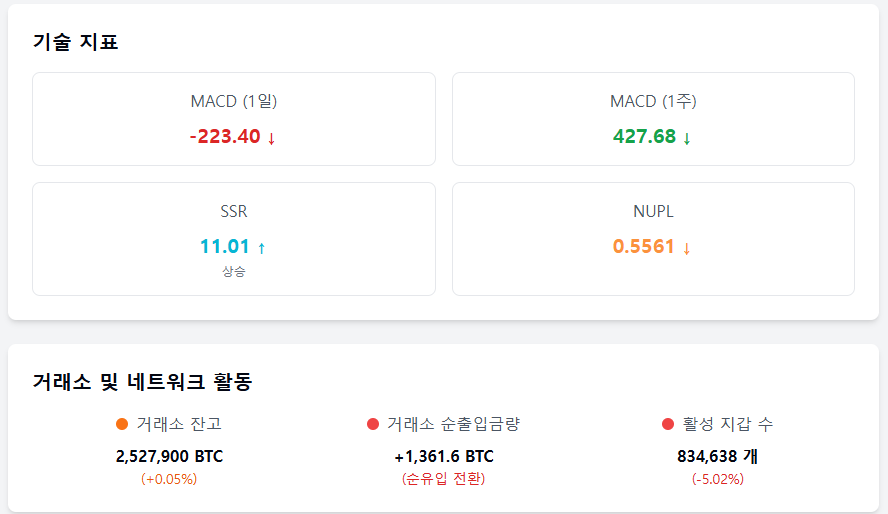

MACD –223.40 The short-term MACD is –223.40, indicating increased downward pressure, while the 1-week MACD is 427.68, maintaining a medium-term bullish trend.

❤️ Investor sentiment now

Dominance 58.7% (–2.31%p) Bitcoin dominance dropped 2.31 percentage points from the previous day, continuing the flow of funds into altcoins.

Fear & Greed Index 56 (neutral) Slightly decreased from the previous day (57, neutral) and remained in the neutral zone. Investor sentiment has somewhat contracted compared to last week (62, greed).

Google Trend 82 Bitcoin-related search scores rose from 78 on the 17th to 82 on the 18th, gradually expanding interest.

🧭 Market now

SSR 11.0080 (+0.0198) The Stablecoin Supply Ratio (SSR) is 11.0080, slightly up from 10.9883 the previous day, showing limited relative buying capacity.

NUPL 0.5561 (+0.0001) The Unrealized Profit Ratio is 0.5561, slightly increased from the previous day. The proportion of investors in the profit zone remains largely unchanged.

Exchange balance 2.5279 million BTC (+0.05%) The Bitcoin balance on exchanges increased by 0.05% to 2.5279 million BTC, with a slight increase in sell-side liquidity.

Exchange net inflow +1,361.6 BTC (–0.17%) The net exchange inflow is 1,361.6 BTC, decreased by 0.17% from the previous day, showing a slight net inflow.

Active wallets 834,638 (–5.02%) The number of active wallets decreased by 5.02% from the previous day (878,740) to 834,638, indicating a slowdown in on-chain activity.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>