As of the morning of August 18th, the major cryptocurrency prices are showing a mixed trend, with differentiated movements across individual stocks in the market. Bitcoin, the top market capitalization cryptocurrency, is currently trading at $116,400.40, with a 24-hour change of -0.95%, showing a slight decline. Over the recent 7 days, it has adjusted by -3.02%, and over 30 days by -1.46%, while maintaining a moderate upward trend with approximately 11.27% growth over 60 days and 9.31% over 90 days. Bitcoin continues to dominate the overall cryptocurrency market with a 58.72% market share.

In contrast, ETH is at the center of a technical rebound, leading the market. Its current price is $4,401.69, with a 24-hour change of only -0.14%, but showing strong growth of 2.23% over 7 days and 24.04% over 30 days. Particularly, its surge of 75.02% over 60 days and 73.19% over 90 days is interpreted as reflecting active demand from institutional and individual investors. This upward trend has lifted ETH's market capitalization to over $53.15 billion, accounting for 13.46% of the total cryptocurrency market. Ripple, which has been relatively weak in recent months, is currently showing a somewhat mixed trend. Its price is $3.05, with a 24-hour change of -1.97%, declining 5.56% over 7 days and 11.61% over 30 days. However, with a solid growth of 40.85% over 60 days and 26.75% over 90 days, investors are maintaining a cautious strategy, leaving room for potential short-term adjustments. The overall cryptocurrency market is generating complex investment signals, with altcoins like ETH maintaining strength despite Bitcoin's weak pressure.

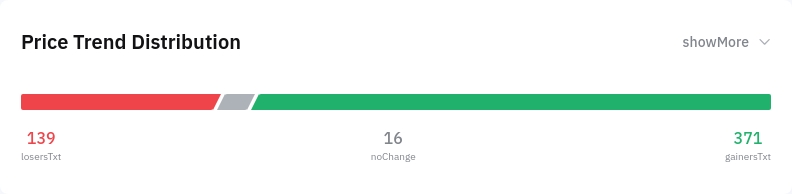

Meanwhile, the distribution of profit and loss zones among derivatives market participants provides insights into investment sentiment and expectations. According to Bybit's position profit distribution, 371 accounts are in profit, 139 accounts are in loss, and only 16 accounts remain unchanged. The profit zone being 2.67 times larger than the loss zone suggests that long positions have been more successful than short positions during the recent technical rebound. This can be interpreted as an indicator of a somewhat optimistic short-term market sentiment in the derivatives market.

Particularly, ETH's upward trend sustained for over 30 days appears to have driven active long position inflows in derivatives trading, becoming a key driver for expanding profit zones. Technical analysis investors' rising expectations for ETH, which has crossed the $4,000 mark, induced leverage position expansion, likely leading to an increase in profit-realizing accounts. In contrast, stocks like Ripple have been underperforming over the past week, potentially realizing profits from short positions, but overall showing a mid-term wait-and-see attitude. For Bitcoin, even with moderate fluctuations, trading patterns seem more defensive than aggressive, maintaining price movements within a certain range.

As such, the position profit structure in the derivatives market is adjusting following the price trends of major stocks, and the price elasticity concentrated on certain stocks is increasingly influencing investment strategies. In the future, market direction may serve as a short-term sentiment shift signal based on the trend of actual positions and profit zone ratios...

In this context, ETH is reorganizing its upward trend based on solid fundamentals despite recent short-term adjustments. Particularly after a 25% surge in early August and a slight correction near $4,700, it is currently consolidating prices around $4,400. However, on-chain signals still suggest strength. The exchange reserve has decreased to a 9-year low of 14.88 million ETH, indicating reduced selling pressure from long-term holders, which supports potential upside. Additionally, capital inflows from major institutional investors like BlackRock are acting as a core foundation for stabilizing mid to long-term market trends. Experts diagnose that ETH is targeting $4,543-$4,876 in the short term, with the possibility of breaking $5,000 on the weekly chart.

Overall, the crypto market is maintaining a technical upward trend centered on ETH, while simultaneously maintaining a cautious sentiment towards adjustment risks. In terms of Q3 cumulative returns, ETH has recorded an explosive 80% growth, significantly ahead of Bitcoin's 10%. However, it's worth noting that ETH's recent surge is amplifying the volatility of DeFi and ERC20-based altcoins. Particularly, if ETH breaks below $4,100, it could expand short positions and increase overall market instability. Therefore, the current market requires a conservative risk management strategy focused on position size adjustment, split buying, and checking key support lines, rather than chasing purchases, while paying attention to the possibility of breaking technical resistance and adjustment zones amid a medium-term upward trend.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>