Author: AB Kuai.Dong

As time has come to 2025, unknowingly, I am also in Tokyo, gradually getting used to the life of a big city. If 2023 was the beginning of the trend of industry practitioners moving to Japan, then the first half of 2025 can be described as "clustering".

This article was modified and edited by @starzqeth and @rubywxt1, focusing mainly on the basis and environment of my "Digital Nomad's Guide to Japan".

This wave of migration is mainly influenced by:

Continuous tightening of renewal and permanent residency in multiple developed regions

Continued low exchange rate of the Japanese yen (1 u = 146 yen)

Lower time and threshold for obtaining work permits and converting to permanent residency

Establishment of financial special zones (English-language administrative procedures)

➡️ The main content of this article covers:

🔹Local market structure (What can be done?)

🔹What types of visas everyone holds (12 months to apply for permanent residency?)

🔹Rapid changes at the policy level (Tax issues?)

🔹Scale of foreign companies locally (Like Binance?)

🔹Daily life and activity range of local peers

I hope the above content is helpful to you. ❤️

🎯 Japan Web3 Market

Overall, although Japan is a relatively developed country in Asia with a population of 124 million, the number of young people is gradually decreasing. Under the continuous new highs of local stocks, people's attention to crypto is not as much as before.

(The main reason is that the development needs of other industries are also booming, such as real estate, retail, tourism, and elderly care, which reduces the motivation for young people to focus on crypto).

🔹Characteristics: Middle-aged and older men are enthusiastic about stock trading, young people heavily rely on social software X to express opinions, local crypto discussions are interest-driven, and have a strong community culture.

In terms of time, in the eyes of many Chinese peers, the entire circle can be divided into: before the pandemic and after the pandemic.

Before 23, the Japanese crypto Chinese circle had only a small hundred people, mainly engaged in: local compliant business, full-time coin trading, and outsourced development.

After 23, this scale rapidly expanded. A large number of project parties, trading teams, and top-tier exchange employees, as well as industry self-employed retirees, gradually landed in Japan. This wave of people is mainly engaged in: settling and working in Japan, not doing the Japanese market, but focusing on Greater China or global business.

Currently, there are 10-20 active Chinese practitioners and bloggers in Japan. Those who have stayed locally for a long time and have influence in the Chinese world include Yishi @ohyishi (Tokyo), Suji @suji_yan (Tokyo), Guo Yu @turingou (Tokyo), Cat General @catmangox (Osaka), 𝘁𝗮𝗿𝗲𝘀𝗸𝘆 @taresky (Fukuoka). Additionally, Kay God @keyahayek recently officially moved (to Tokyo).

Therefore, later arrivals generally view Japan as a place for office, residence, and child-rearing, while maintaining communication with local financial consortiums and colleagues who come here on business trips.

The conclusion is: Being in Japan, not doing the Japanese market.

🪪 What Types of Visas Everyone Holds

Since 2023, the Japanese government has relaxed the high-level talent (J-Skip) restrictions, mainly attracting more high-asset or high-knowledge individuals to Japan for entrepreneurship, work, and investment (ultimately to collect taxes), lowering the requirements threshold.

This means that for those employed by a Japanese company or planning to start a company with significant capital, meeting the points for obtaining a high-level talent visa, they can submit a permanent residency application as early as the 12th month after landing in Japan.

So according to daily communication statistics, the new wave of Chinese practitioners in Japan are basically high-level talent visa holders. They received many bonus points due to master's degrees, high tax payments, or long work experience, thus obtaining high-level talent visas.

Many colleagues who obtained high-level talent visas in 2023 have already obtained permanent residency this year. Those interested can search for: 高度専門職 1 号, high-level talent visa. (Consult @0xdannytoma).

⁉️ Rapid Changes at the Policy Level (Taxes?)

The core reason why many crypto companies landing in Japan in recent years only use Japan as an office and R&D base, not doing the local market, is that crypto is still considered miscellaneous income in Japan, not traditional financial income.

This means that if you buy BTC worth 30 million yen through a local compliant institution and make a profit.

The next year, you'll need to pay 45% miscellaneous income tax + 10% resident tax, approximately 55%.

However, from 2025, multiple policies and trends are changing this phenomenon, for example:

MicroStrategy: Company holds tokens, investors only need to buy stocks (already implemented)

Spot ETF: Investors only need to invest normally (in progress)

Tax rate reduction: From a maximum of 55% to a unified 20% (in progress)

After these three profit, investors will ultimately only need to pay a maximum of 15.315% national tax and 5% local resident tax. Once this tax is paid, it's considered completely settled, with no further taxes required. For corporate investors: only 15.315% national tax, without local tax.

This has led to many practitioners first landing in Japan but not focusing on the Japanese market, instead watching policy changes. Some have already tested the MicroStrategy model in the Japanese stock market and have launched several companies.

However, with the head of the SBI financial group beginning to promote spot BTC and XRP ETFs.

The Japanese Financial Services Agency is also promoting related tax rate reductions. Recently, Japanese MicroStrategy stocks have started to callback based on news.

For more information interpretation: Link

🔐 Scale of Foreign Companies Locally (Like Binance?)

Currently, Chinese full-time practitioners in the crypto circle in Japan are estimated to be around a hundred, including Binance, Backpack, OSL, OK Japan, SBI Financial Group and its market makers or funds, and secondary trading teams in Tokyo, which have taken on a large number of employees.

Additionally, OneKey, Mask, Alpha (formerly KEKKAI) have also hired many colleagues interested in coming to Japan, all of which are companies in Tokyo.

Currently, only four regions are listed by Japan as financial special zones in 2024, enjoying unique channels and English administrative processes: Tokyo, Osaka Prefecture, Fukuoka Prefecture, and Hokkaido.

Currently, the head of Binance Japan is Takeshi Chino, who was previously the Japan company legal representative of Kraken exchange, worked at PwC and Tokyo Stock Exchange, and graduated from Oxford University.

However, from a management and compliance perspective, Binance Japan is limited to serving Japanese local users. Chinese demand is still handled by the global station.

🧋 Daily Life and Activity Range of Local Peers

Compared to Hong Kong, Singapore, and Shenzhen, where local gatherings are frequently held, Chinese people in Japan mainly tend to have scattered activities (each living their own life, don't disturb my Japanese life).

So Japan has become a gathering place for offline I-people and online E-people.

Currently, 90% of full-time crypto professionals live in Tokyo and its surrounding areas, with approximately 30% having their office locations in the Toranomon area of Minato Ward. This is mainly because the area is centrally located and has numerous WeWork shared offices, with individual room rental prices around 10,000 yuan.

🔹Residential Aspect

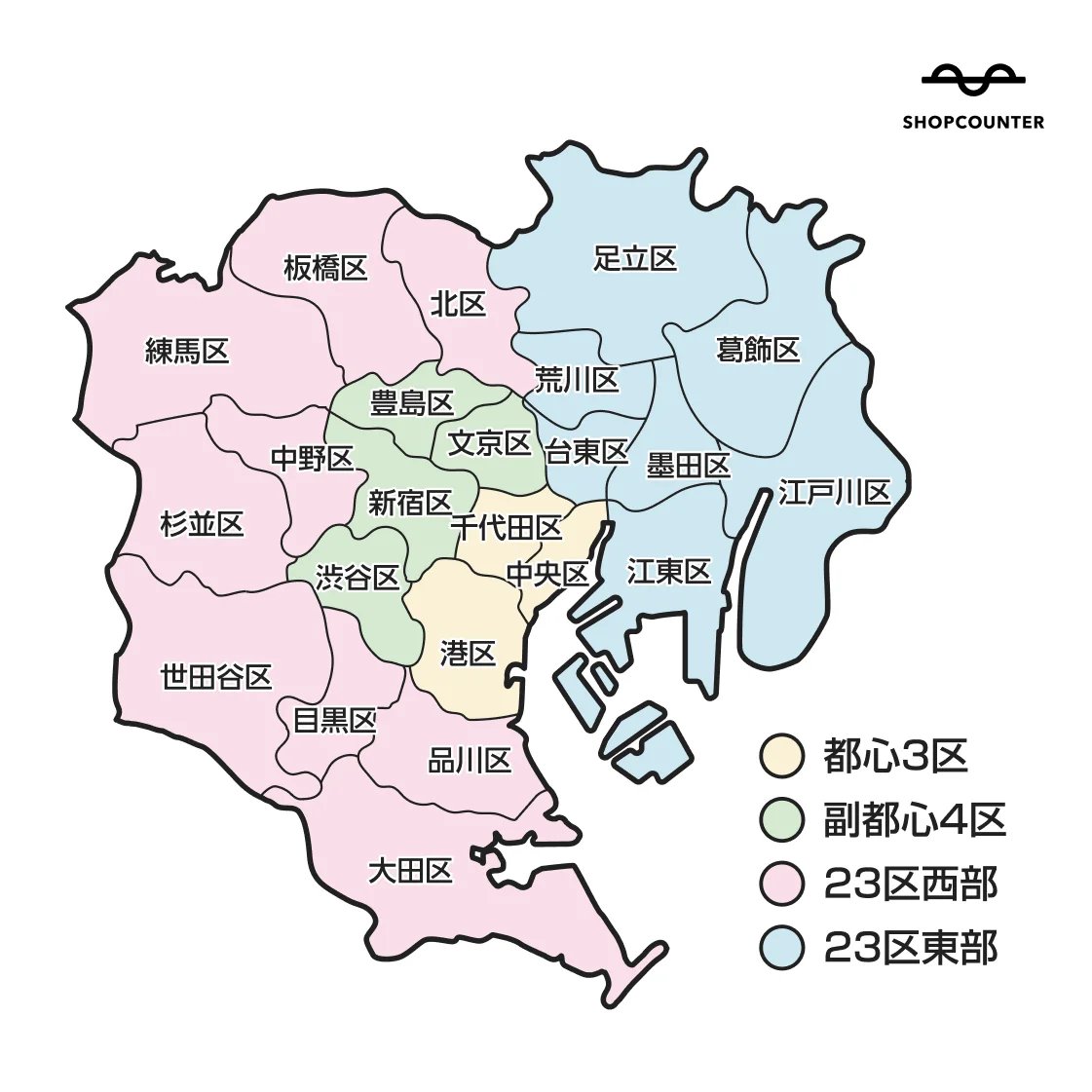

Tokyo has six core districts representing the most central areas of Japan: Chiyoda, Chuo, Minato, Shinjuku, Shibuya, and Bunkyo. For example, Minato Ward is a common workplace, while Shibuya Ward is frequently used for events.

However, most colleagues do not reside in these districts. Besides small housing spaces, expensive rent, and crowded streets, the biggest issue is that living in the central area feels like not being abroad, lacking the tranquility of anime-like small towns. Additionally, due to the surge in residents, administrative pressure is high, and document processing is relatively slow.

🔹Education

Most Tokyo professionals typically send their children to international schools. About 30% attend the British School of Tokyo (BST) in Minato Ward, with annual tuition of 2.73 million yen, which becomes approximately 110,000 yuan after national and local education subsidies.

The school uses Japanese and English, alternating teaching languages daily.

🔹Dining

Uber Eats prices are similar to Beijing and Shanghai's core areas, but delivery fees start at 1000 yen (50 yuan). Chain restaurants are numerous, with McDonald's and Domino's offering specialized delivery, typically arriving within 10 minutes.

Offline dining mainly involves local restaurants or home cooking. Wagyu beef, cabbage, bean sprouts, and tomatoes are not expensive locally, but specialty items like fruits (melons, watermelons, peaches) are costly.

🔹Hotel Aspect

Due to the recent surge in tourism and a lack of willing hotel service staff, Tokyo's hotel prices have increased 2-3 times compared to 2023.

This phenomenon has also occurred in Kyoto, Osaka, and other areas. Tokyo's central district hotel prices even exceed those in Singapore. However, rental prices have not significantly fluctuated.

🔹Residential Aspect

With a monthly rental budget of 10,000 yuan, one can only rent a 20 square meter new apartment in Ueno and Shinagawa. However, a few train stops away, one can find 50-80 square meter apartments.

Therefore, many professionals do not live in Tokyo's six core districts but in the pink and blue areas shown below.

❤️ The above is information about Web3 relocation and local life in Japan, hoping this content is helpful. Thank you.