The altcoin market entered a downward trend in the third week of August. The market capitalization (TOTAL3) decreased by 7%, from $1.1 trillion to $1.03 trillion. This adjustment fueled short-selling sentiment among derivatives traders.

How much liquidation risk will this create? The liquidation heatmap highlights several altcoins with high exposure.

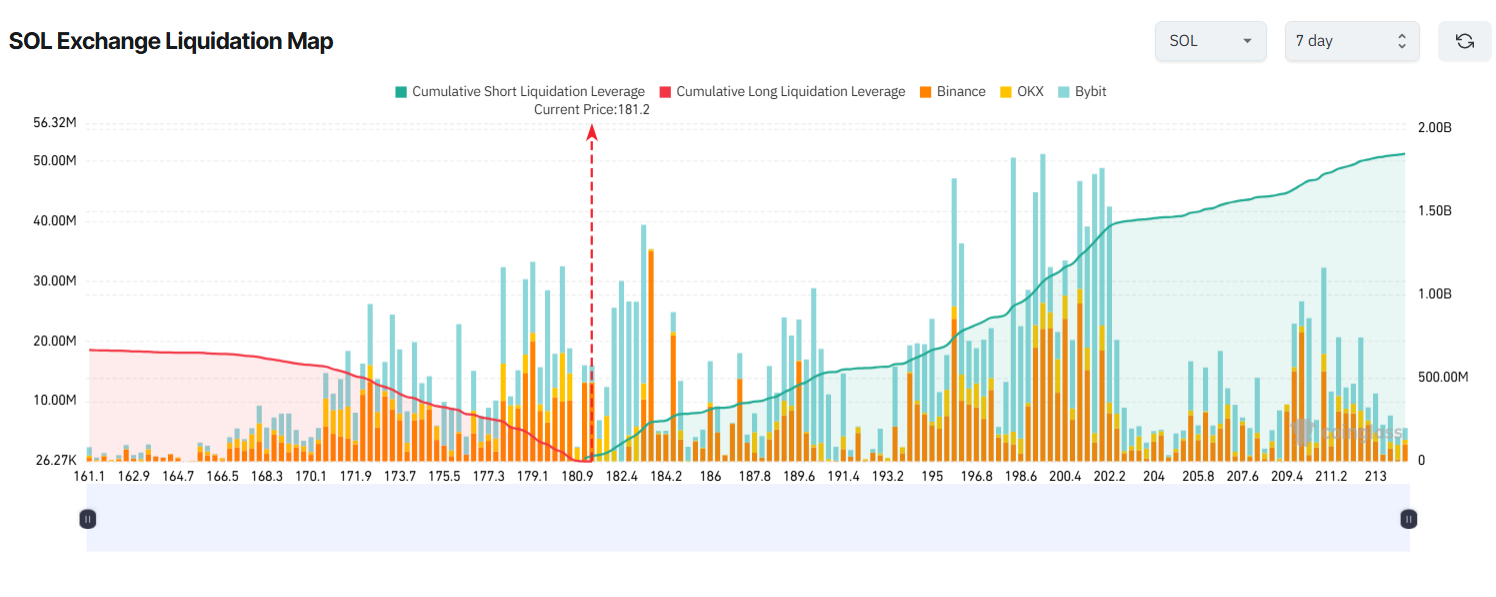

1. Solana (SOL)

Solana's 7-day liquidation map shows that short-selling liquidations (green on the right) have been dominating long positions since the third week of August. However, Solana may face risks to short positions due to several positive developments.

In particular, Solana is reviewing a new governance proposal SIMD-0326, which introduces the Alpenglow consensus protocol to accelerate block finalization.

Additionally, Solana has announced a new record. The network processed over 104,000 transactions per second.

If SOL recovers to $200 this week, over $1.1 billion in short positions could be liquidated. Conversely, if SOL drops to $161, approximately $646 million in long positions could be at risk of liquidation.

Analysts warn of an even more concerning scenario. They predict that SOL might drop below $170 and then rebound above $200 in the same week, meaning both long and short traders could face liquidation risks.

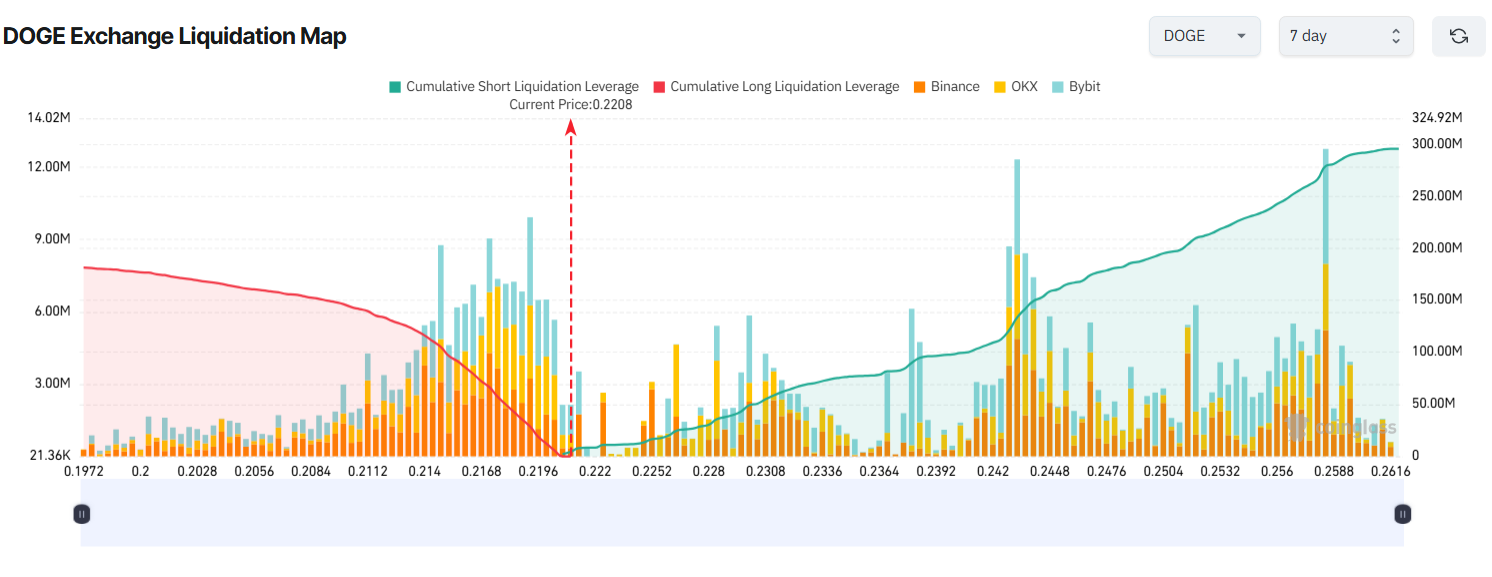

2. Dogecoin (DOGE)

Dogecoin (DOGE) has been gaining attention as whales and investors have been accumulating in large quantities in August.

Moreover, Grayscale has submitted an application to the US SEC to convert a $250 million Dogecoin trust into a spot ETF. Meanwhile, cryptocurrency bettors on Polymarket are estimating over 70% probability that US regulators will approve a DOGE ETF by the end of the year.

Despite these positive news, DOGE's liquidation map shows short positions dominating accumulated liquidations. Traders seem to be anticipating a correction. DOGE has already risen more than 30% this month, from $0.188 to $0.255.

If DOGE falls below $0.20 this week, accumulated long liquidations could exceed $176 million. Conversely, if DOGE rises back to $0.26, approximately $290 million in short positions will be liquidated.

Trader TadiGrade argued that now is not the time to maintain a bearish stance on DOGE. He predicted that the coin might be on the verge of a strong rally.

"Dogecoin's rising triangle sets a medium-term target of $1.8." – Trader TadiGrade

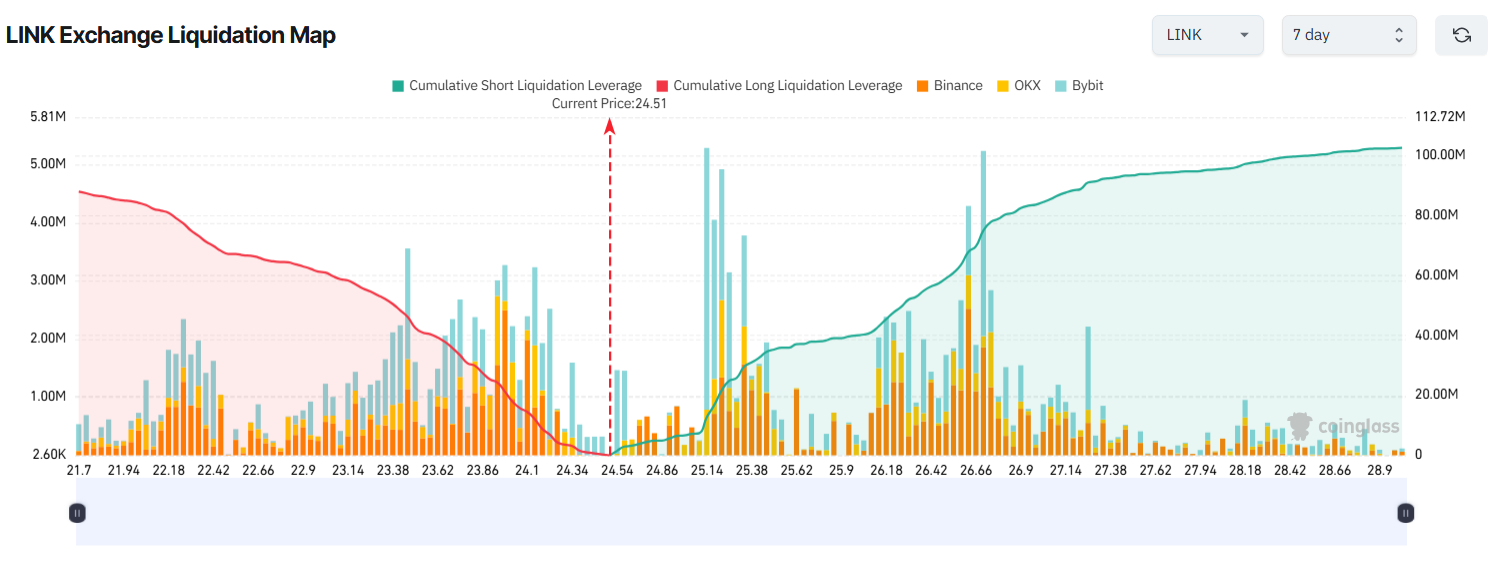

3. Chainlink (LINK)

Chainlink (LINK) has been raising its profile in August. Investors are excited about the Chainlink Reserve initiative announced earlier this month.

According to a recent BeInCrypto report, whale wallets have added over 1.1 million LINK in the past seven days.

However, the same report revealed that LINK exchange deposits are increasing again, suggesting that investors are starting to take profits after LINK rose more than 50% since the beginning of the month.

LINK's liquidation map is relatively balanced, as both bullish and bearish sides have strong incentives.

If LINK falls below $22, approximately $85 million in long positions could be liquidated. If LINK rises to $27, about $85 million in short positions will be liquidated. The price range is the same, and the liquidation amounts are nearly identical.

Meanwhile, market sentiment at the time of writing is greedy, and the altcoin season index is 51 points.