Author: Simon Taylor

Translated by: TechFlow

According to Fortune, Stripe and Paradigm may be collaborating on developing a blockchain centered on payments, though not officially confirmed, assuming the information is true. Additionally, Circle announced similar plans in its financial report. What do these developments mean?

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating into English.]When Stripe acquired Bridge, I suggested that Stripe was transforming into a software company. They are not competing in low-cost processing, but creating value by solving workflow issues such as refunds, retries, and cyclic logic. This is because payment infrastructure has gaps that are not obvious to those outside the industry.

Imagine if payment infrastructure were no longer fragmented.

What if you had a commoditized infrastructure that could enable instant processing, operate 24/7, and be specifically designed for payment companies and their clients with ultra-high transaction volumes and throughput? This is clearly something existing blockchains cannot do.

However, the problem with incentive mechanisms is that they always tend to lead to the "dark side" - creating a closed ecosystem to capture more economic benefits at the expense of becoming a truly open network. I agree that this is indeed a huge risk.

It's No Coincidence That Circle Launched Arc in the Same Week

This proves that stablecoin industry leaders see the same trends as Stripe. Circle has likely been researching and developing Arc for years.

After experiencing stellar public market performance, Circle is now facing pressure from declining interest rates and needs to find new revenue sources (the vast majority of Circle's revenue comes from Treasury yields, with 80% allocated to its issuing partners).

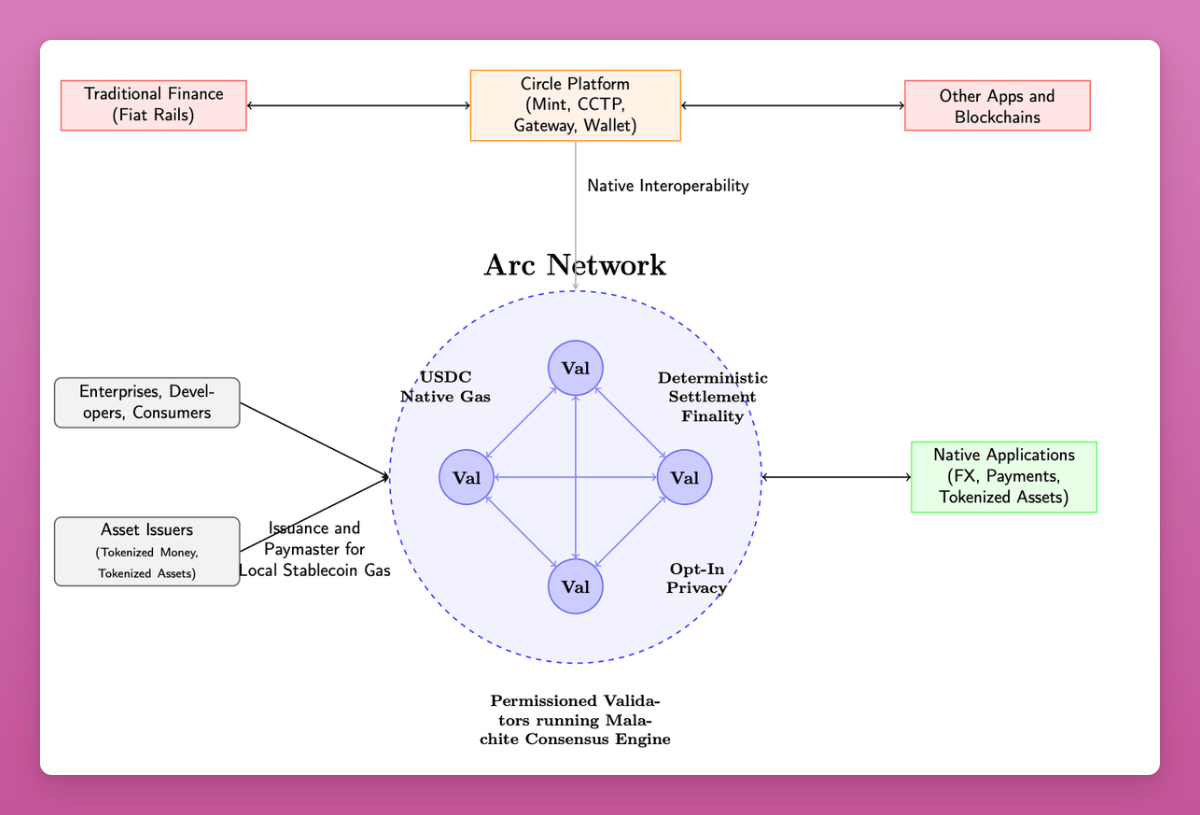

Compared to networks like Base, ETH, or Solana, Circle's new network has multiple features friendly to financial institutions and the payment industry.

Here is the list of features from its whitepaper, though most will not be launched on the first day, it clearly shows Circle's strategic direction:

Using USDC to pay transaction fees (Gas)

Validator nodes run by regulated entities

Faster throughput (3,000 to 10,000 TPS)

Optional privacy features: Payment amounts are hidden, addresses are visible but not identifiable in public

Optional disclosure features: Regulators can access transaction information through a "view key"

Will launch USYC (Treasury token): Providing on-chain collateral and margin functions

Bridge functionality using Circle's proprietary Gateway and CCTP: Circle has already supported USDC circulation on many chains, and they will reuse this foundation

Roadmap includes institutional-level forex functions

Payment features: Such as invoice attachments, on-chain refunds, and dispute resolution mechanisms

This whitepaper is clearly more of a feature vision list than a currently available product, but it clearly shows Circle's intentions and the industry's development direction.

My observations:

Many of these features are targeted at capital market participants, such as collateral, margin, and regulators.

There are many terms aimed at the risk management community, like "institutional level" and "consumer protection".

Circle sacrifices issuance profits for distribution: They share most of their revenue with Coinbase and Binance. The new product will help improve this situation.

But can Circle meet everyone's needs? They indeed have first-mover advantage and market awareness, but do we need more clear functional divisions?

Dragonfly's Rob Hadik offered a pessimistic view:

So, to win now, must Circle compete with Stripe in the merchant or SME space, or battle Kinexys in the large enterprise domain and win the final customer relationship? It's hard to imagine how they could win this battle.

—— Rob Hadik

(Although Hadik has invested in Circle's competitors, his analysis is usually very accurate.)

My view is: The future of on-chain finance still holds opportunities. Circle has every reason to make bold attempts with its first-mover advantage.

Winners will be few, and all enterprises are wisely trying to expand their market. Fortunately, we have moved beyond the stage of sacrificing infrastructure that can truly support global market scale for the sake of "decentralization performance".

If you pursue decentralization, Bitcoin exists for that purpose.

If Every Company Creates Its Own Blockchain, Are We Going Back to Square One?

If every company builds its own chain, are we just recreating today's reconciliation chaos with new technology?

The answer is no.

The value of tokenization does not depend on a single chain, but on scale and programmability.

Distribution is crucial.

Circle is willing to give up 80% of its revenue for distribution channels. If Binance and Coinbase can continue to dominate and successfully pivot to new revenue sources, this would be reasonable. But other market participants also have their own distribution methods.

The result is rarely black and white.

Looking back at 2017 and 2021, I often felt the "yet another blockchain" phenomenon. There were indeed many such examples (does anyone remember EOS?)

But wasn't Solana once "just another blockchain"?

Our innovation is not over, and we are facing the most revolutionary technological transformation in human history - the rise of artificial intelligence.

Building Payment Infrastructure for AI Explosive Growth

With the rise of AI tools, subscriptions as a default payment mechanism are facing challenges.

High-frequency users break traditional models: For example, companies like Anthropic have started setting usage limits because a few high-frequency users can generate huge costs, leading to resource allocation imbalances.

AI tool costs are difficult to track: Behind the subscription model are inference costs (GPU fees), cloud platform fees, and token usage costs of AI models. Tracking these costs is very complex (companies like Lava Payments and Polar are solving this problem).

Profitability challenges intensify: Many AI tools face huge losses, with reports indicating that programming tools like Cursor and Windsurf are in severe loss states.

AI model costs will decrease over time, but frontier models are not. Subscription models cannot cover costs for high-frequency users. If we want to drive the AI revolution, we need more AI usage, not less.

This means we indeed need to understand underlying transaction costs, but more importantly, we need an ultra-fast, ultra-low-cost, and programmable payment infrastructure.

The rise of AI will increase payment transaction volume by an order of magnitude.

AI labs, venture capitalists, and payment companies are preparing for a whole new world where the speed of fund flow far exceeds human comprehension. When AI agents pay each other for computational resources, tokens, and service fees, they need a payment system closer to commoditization to support such high-frequency transactions.

The Ultimate Battle to Capture AI Native Payment Tracks

Stablecoins enter the stage.

Today's stablecoins are often more cost-effective for international remittances, but in domestic payments, traditional payment methods are usually faster, cheaper, or better. Most existing blockchains are designed to meet multiple needs and perform well in this regard.

The problem is that the processing capacity of chains like Ethereum at 15 to 30 transactions per second (TPS) or Solana at 3000 transactions per second is insufficient to handle today's payment peak loads. If agent-to-agent payments become widespread, total payment volume (TPV) could increase 10 or even 100 times.

These payment-focused blockchains are far more than "just another blockchain" - they may become important components of future market structures after payments enter the AI native era.

The goal of AI native financial infrastructure is not just to pursue complete decentralization or extreme speed, but to build a system that is both fast enough and decentralized enough to meet upcoming challenges. To think that this task is already completed would be a grave mistake.

The attention to stablecoins is reaching a white-hot stage. Undoubtedly, like AI, we may be in a bubble phase in the short term. But looking long-term, it's worth considering how the infrastructure and partner ecosystem will evolve in the next 2 to 3 years.

Deposits will be tokenized: This means traditional "off-ramp" channels will no longer be needed, as they will natively exist on-chain.

Stablecoin competitiveness will be further enhanced: This means many current disadvantages regarding speed and cost will gradually disappear.

Every digital bank, service provider, and traditional bank will achieve integration: This means our performance requirements for stablecoins will significantly increase.

AI will require 10 to 100 times payment capacity: This means today's settlement infrastructure will not meet future demands.

We need to build entirely new infrastructure for this new era.

This means that if you haven't yet adopted stablecoins in your daily workflow,

or haven't clearly planned their position in your future roadmap,

if you still view stablecoins as a speculative tool, you're essentially ignoring the monetary value brought by the operating system upgrade itself.