Welcome to the US Cryptocurrency Morning Briefing—an essential summary of today's critical cryptocurrency developments.

Prepare your coffee. As cryptocurrency giants compete for influence, Tether showed a bold move that could redefine its role in the US market and beyond.

Bo Hines Joins Tether's US Stablecoin Push

Tether, the world's largest stablecoin issuer, made a decisive move towards the United States. The company hired Bo Hines, the former executive director of the White House Crypto Council.

Tether Appoints Former White House Crypto Council Executive Director Bo Hines as Strategic Advisor for Digital Assets and U.S. Strategy

— Tether (@Tether_to) August 19, 2025

Read more: https://t.co/N4ZXMU5181

This appointment reflects the company's intention to build political capital and a regulatory base in the global competitive stablecoin market. This was mentioned in recent [US cryptocurrency news] publications.

The company confirmed that Hines recently stepped down from his position on the cryptocurrency council and will serve as a strategic advisor for Tether's digital assets and US strategy.

In his new role, Hines' mission is to help Tether navigate Washington, coordinate expansion, and position the company at the center of US digital asset policy debates.

"Bo demonstrated remarkable leadership within the US administration and played a crucial role in driving initiatives to promote digital asset innovation... On behalf of the company, we are all excited about his decision... Welcome Bo," Tether CEO Paolo Ardoino shared on X.

According to Tether's management, Hines' deep understanding of the legislative process will be an asset in entering the US market.

From White House Policy to Private Strategy

Meanwhile, Bo Hines offers a rare combination of government experience, legal education, and industry credibility.

Thank you @BoHines for doing an amazing job with the first ever Crypto Council. Huge accomplishments with the Crypto Summit, Genius Act, and Digital Assets Report. As you pursue your next chapter, I look forward to being able to draw on your expertise and advice. https://t.co/Sxw8lD5tWL

— David Sacks (@davidsacks47) August 9, 2025

In Washington, he worked with Trump's AI & Cryptocurrency Czar David Sacks to create stablecoin guardrails and drive blockchain financial innovation initiatives.

He also led interagency working groups focused on consumer protection and integrating emerging technologies into the US financial system.

"During my public service, I directly witnessed the transformative potential of stablecoins to modernize payments and increase financial inclusion. I am pleased to join Tether and will contribute to providing a product ecosystem that sets standards of stability, compliance, and innovation in the US market," a quote from Hines in Tether's announcement.

This move comes at a time when Tether has strengthened its domestic credibility after reinvesting nearly $5 billion in US infrastructure and technology ecosystems while doubling its presence in the country.

The company's hiring of Hines goes beyond accelerating momentum. It signals to legislators Tether's intention to operate with transparency and long-term commitment.

While Tether strengthens its US strategy through heavyweight talent and investment, the European story is less clear. The European Union's new MiCA (Markets in Crypto-Assets) framework raised questions about how global stablecoin giants will comply.

Ardoino publicly took a hard stance on MiCA, warning that some provisions could hinder innovation. He also reaffirmed that Tether will not compromise its operating principles.

When MiCA becomes safer for consumers and stablecoin issuers, then we might reconsider.

— Paolo Ardoino 🤖 (@paoloardoino) July 23, 2025

Europe remains a red line for Tether, unlike the US, suggesting Tether will not abandon its US market ambitions.

Hines' hiring indicates that Tether is no longer satisfied with operating on the periphery of US policy debates. By directly inserting itself into the nation's political machinery, the company is betting that its scale and influence will provide advantages over competitors like Circle.

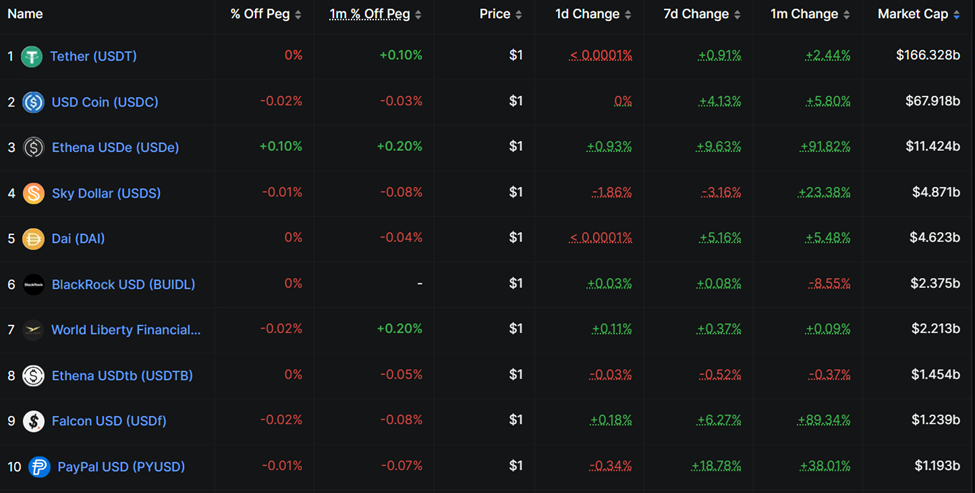

Today's Charts

US Cryptocurrency News

Here's a summary of today's notable US cryptocurrency news:

- Robinhood Introduces AI Market Insights to the UK — Is This the Dawn of Crypto Innovation?

- Backlash Erupts as MicroStrategy Heightens Bitcoin Volatility Exposure.

- Terawulf Stock Soars as Google Stake Increases to 14%.

- Sei Prepares for Takeoff: Monaco Launch and ETF Application Stimulate Investor Optimism.

- SEC Delays Decision on 7 Crypto ETFs to October 2025.

- Bitcoin Displays Signs of Bottoming Before Next Rally.

- Pi Network's Challenges Cast Shadow on 2025 Pi Hackathon.

- What Impact Does $950 Million XRP Moving Off Exchanges Have on Ripple Price?

- Why Is Bitcoin Treasury Gaining Popularity in Asia?

Cryptocurrency Stock Overview

| Company | Closing on August 18th | Pre-Market Overview |

| MicroStrategy (MSTR) | $363.60 | $361.17 (-0.67%) |

| Coinbase Global (COIN) | $320.73 | $321.00 (+0.084%) |

| Galaxy Digital Holdings (GLXY) | $26.79 | $26.65 (-0.52%) |

| Marathon Holdings (MARA) | $16.09 | $16.06 (-0.19%) |

| Riot Platform (RIOT) | $12.32 | $12.34 (+0.16%) |

| Core Scientific (CORZ) | $14.53 | $14.54 (+0.069%) |