xStocks tokenizes US stocks and ETFs and introduces them to the Solana blockchain. Each token is backed 1:1 by real stocks held by a regulated custodian. Non-US traders can enjoy 24/7 market access, on-chain instant settlement, fractional stock ownership, and use stock exposure for DeFi applications (such as lending, AMMs, collateral). Within 6 weeks of launch, xStocks' on-chain cumulative trading volume has approached $500 million.

Highlights

- US Stocks and ETF Tokenization: xStocks tokenizes US stocks and ETFs, with each token backed 1:1 by real stocks held by a regulated custodian, providing 24/7 trading, T+0 settlement, and fractional ownership convenience.

- Launch Time and Coverage: Since launching on June 30, 2025, it offers over 60 tokenized stocks and ETFs, including major US companies and index funds (such as Apple, NVIDIA, S&P 500). Non-US users can buy and hold them like any SPL token.

- Distribution and Composability: Supported multi-platform trading from day one, listed on Kraken and Bybit, tradable through Raydium and Jupiter, usable as collateral on Kamino, and natively supported by Phantom and Solflare wallets.

- Programmable Compliance: Implementing programmable compliance features through Solana Token Extensions (such as corporate action handling, pause/transfer control) while maintaining DeFi compatibility.

- Early Market Performance: Cumulative trading volume of approximately $2.1 billion in 6 weeks, with on-chain trading volume around $500 million. As of August 11, 2025, xStocks holds about 58% market share in tokenized stock trading, with Solana holding most of the market value.

Simple Problem

Many people globally face issues of slowness, high costs, or inconvenience when buying US stocks. Traditional equity market trading has limited hours, and investors must go through intermediaries and handle complex paperwork, with settlement typically taking days. This friction not only makes investing complicated but also keeps potential investors out.

But what if a stock could be as liquid as a token? What if it could be stored in a wallet, instantly transferred, and used for other financial applications? This is exactly what xStocks promises on Solana.

Tokenized stocks provide financial exposure to stocks for non-US traders and support usage as collateral, participation in automated market maker (AMM) liquidity pools, or cross-platform 24/7 transfers. This not only brings new investment strategies but also creates entirely new forms of liquidity.

xStocks was officially launched on Solana on June 30, 2025, by Backed (one of the most experienced real-world asset issuers), opening a new chapter of US stock trading for global investors.

Original Video Link: Click Here

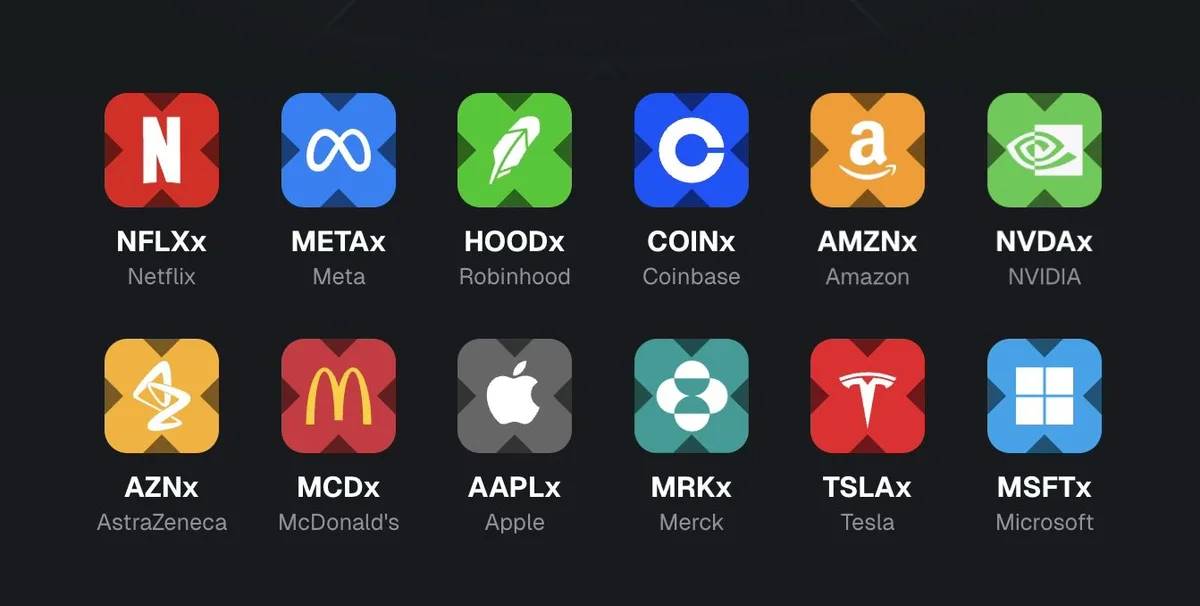

The first batch of xStocks includes over 55 tokenized stocks and ETFs, covering well-known companies like Apple, Microsoft, NVIDIA, Tesla, and Meta. Users can now trade stocks of these famous enterprises on Solana.

xStocks' stock codes end with an "x", such as NVDAx (NVIDIA) and AMZNx (Amazon), bringing a new identifier for tokenized stocks.

Image Source: xStocks

As of August 2025, the complete list of 60+ xStocks launched on Solana is as follows: