Dolomite is the largest lending protocol in the Berachain ecosystem, occupying 90% of the ecosystem's lending TVL.

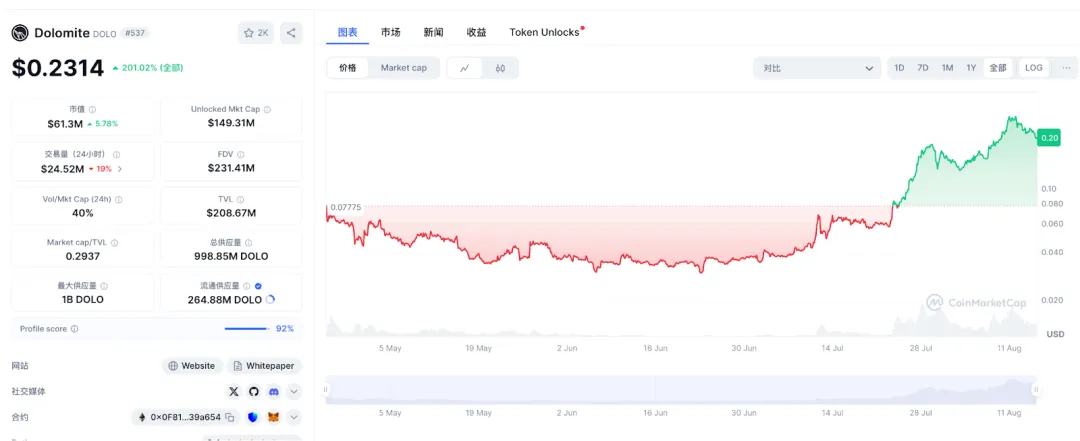

Recently, Dolomite has become one of the most notable projects on Berachain. Its native token DOLO has surged from a low of around $0.03 in June to a high of $0.3, with an increase of nearly 10 times in two months, becoming one of the most eye-catching assets in the Berachain ecosystem.

Focusing on Dolomite, it is a native lending protocol on Berachain, characterized by a highly modular architectural design, including an immutable core layer and a variable module layer. This allows it to flexibly adapt to the rapid development of DeFi while maintaining the stability of its core functions.

Unlike lending products such as Aave or Morpho, Dolomite has introduced a series of unique innovations that have attracted significant attention from DeFi users. These include a virtual liquidity system (allowing users to simultaneously earn lending yields and use them for leveraged trading, earning multiple returns and significantly improving capital efficiency), a dynamic collateralization mechanism (supporting users in borrowing non-standard assets while retaining ecosystem rights), and the ability to support over 1,000 unique assets.

With Dolomite's migration to the Berachain mainnet in February this year, it has deeply integrated Berachain's Proof of Liquidity (PoL) consensus mechanism, providing higher rewards and liquidity incentives, ensuring that users retain governance rights, earnings, and staking rewards during the lending process.

In fact, the surge of DOLO is driven by a series of positive developments from the protocol itself and benefits from the overall expansion of the Berachain ecosystem. Especially after the Berachain mainnet launch, DOLO's TVL growth rate was 83% above the chain's average. As Berachain's infrastructure continues to improve, Dolomite is expected to achieve a new round of growth in the next stage, making DOLO a focus for investors. Similarly, the market generally believes that DOLO's strong rise may be an important signal of an imminent new breakthrough in the Berachain ecosystem.

Positive Factors Behind Dolomite's Surge

In fact, the most direct catalyst driving Dolomite's surge is the potential deep cooperation with World Liberty Financial (WLFI), a project associated with the Trump family.

This cooperation not only covers a long-term strategic partnership with the WLFI Treasury-linked vault but also involves the expected integration of the stablecoin USD1 into the Dolomite protocol. Additionally, Dolomite co-founder Corey Caplan also serves as a technical advisor to WLFI, further strengthening the signal of cooperation between the two.

In this context, the market's expectations for Dolomite have rapidly heated up.

On one hand, the political capital and resource mobilization capabilities behind the WLFI project are undeniable, potentially opening up possibilities for Dolomite to connect with broader mainstream audiences, policy institutions, and even traditional capital markets. On the other hand, USD1 is expected to enter the Dolomite lending system and play an important asset role, which will introduce new liquidity to the protocol.

Meanwhile, the DOLO token itself has been sought after due to narrative amplification. Leveraging WLFI's heat and the associated political narrative, DOLO is expected to gain further exposure on platforms like Binance Alpha and achieve higher-dimensional cognitive penetration and capital injection among top-tier communities and institutional users.

Beyond external benefits and market sentiment, the Berachain ecosystem's deep support for Dolomite is also an unavoidable core factor in its surge.

In fact, since the Berachain mainnet launched in February this year, Dolomite's TVL has achieved nearly 20 times growth and become the most representative lending protocol in the ecosystem. As a key infrastructure on Berachain, Dolomite has gained tremendous liquidity and market attention by leveraging Berachain's technological innovations and economic model.

Berachain's BECTRA upgrade has made it the first L1 to achieve atomic batch trading after ETH, significantly improving transaction efficiency and system throughput, providing stronger underlying performance support for Dolomite.

Similarly, Berachain's unique PoL (Proof of Liquidity) mechanism further amplifies Dolomite's protocol benefits. Users can participate in mining while lending assets, obtaining very considerable multi-layered incentive returns, greatly enhancing Dolomite's user stickiness and capital sedimentation ability.

We see that the launch of native DEXs like KodiakFi, the active "bribery mechanism" between protocols, and the overall TVL rise across the ecosystem (covering DEX, lending, LSD, and other directions) further constitute market demand for $DOLO.

Under the PoL incentive mechanism, assets are long-term locked in the protocol, not only reducing selling pressure but also amplifying participants' long-term holding expectations, providing a strong basis for growth for core protocols including Dolomite. Therefore, Dolomite's strong performance can be considered a natural result of multiple effects after the Berachain mainnet launch.

DOLO's Surge May Signal a New Breakthrough in the Berachain Ecosystem

In fact, Dolomite and the Berachain ecosystem have formed a mutually reinforcing collaborative relationship.

Since Dolomite migrated to the Berachain mainnet in February this year, not only has the protocol's TVL achieved rapid growth, but it has also significantly driven overall capital inflow into the Berachain ecosystem, particularly releasing more abundant on-chain liquidity in the lending sector.

It is reported that Dolomite has cumulatively attracted over $3.3 billion in stablecoin borrowing and promoted Berachain's TVL to jump from $1 billion to $2.5 billion within three months after the mainnet launch. This liquidity growth directly acts on Berachain's underlying mechanism optimization.

Especially after the PoL v2 launch, the positive relationship between asset lock-up and incentive models has been further strengthened, effectively alleviating market selling pressure on native tokens (such as $BERA). By improving reward levels, it has stimulated more user participation, thereby constructing a positive cycle of increased liquidity, enhanced incentives, and rising user engagement, accelerating the PoL flywheel effect.

As a native protocol, Dolomite also provides critical support for other protocols on Berachain. For example, DEX protocols KodiakFi and InfraredFinance connect liquidity pools and bribery mechanisms through its lending infrastructure, achieving fund circulation and incentive efficiency, driving rapid growth of ecosystem projects like Puffpaw and Oogabooga. Dolomite's collaboration with Berachain's underlying BECTRA upgrade (supporting atomic batch trading) further improves on-chain transaction efficiency, reduces gas costs, and enhances the ecosystem's execution capability and user experience.

In terms of governance, Dolomite has directly improved Berachain's community participation and governance activity through dBERA, dHONEY reward vaults, and veDOLO lock-up airdrop strategies. Currently, developer submissions in the Berachain ecosystem have increased by 14% compared to the average level, with daily BGT redemption reaching 19,900, while maintaining a low inflation rate of 1.44% across the ecosystem.

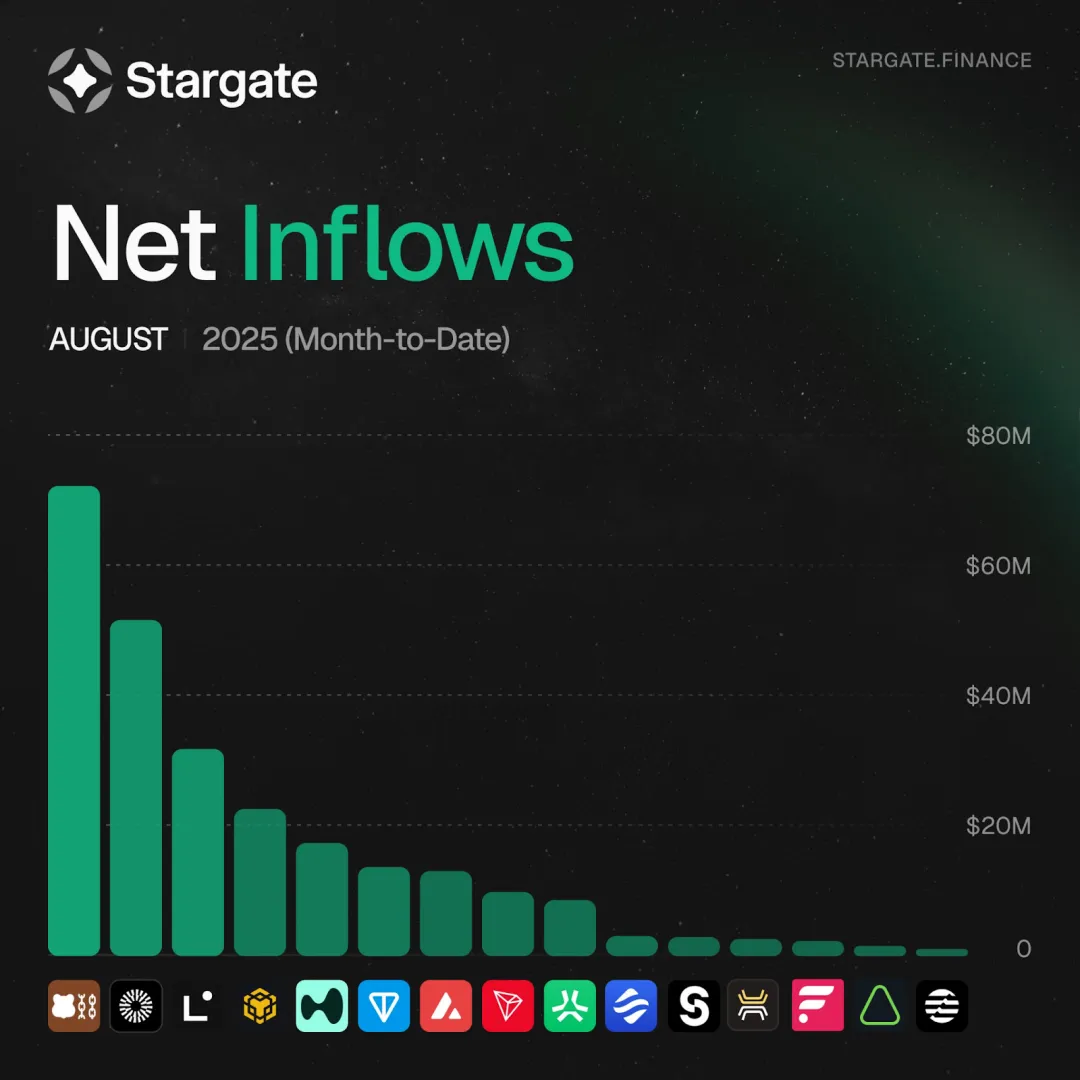

Therefore, Dolomite's strong rise is expected to further bring capital inflow, promoting both Berachain's TVL and user numbers, nourishing ecosystem project prosperity and systemic growth, ultimately forming a self-consistent positive closed loop within the ecosystem. It is worth mentioning that according to Stargate's cross-chain bridge net inflow data published in August 2025, Berachain has topped the net inflow list, far exceeding other mainstream chains, further verifying its strong gold-absorbing ability and capital preference in the current market cycle.

So Dolomite's price performance and market progress actually mark Berachain's transition from a "quiet construction period" to an "explosive growth" phase, similar to the early DeFi explosion of Solana or Ethereum. Therefore, after DOLO, the market still maintains strong expectations for $BERA.

From a more macro perspective, with the collaboration between Dolomite and WLFI, it is expected to help Berachain expand to broader user layers and institutional circles.

As a native project on Berachain, the potential Treasury-linked cooperation between Dolomite and WLFI, and the expected integration of USD1 stablecoin, are likely to become an important entry point for Berachain to attract traditional capital and compliant funds, while bringing significant user growth. Currently, the number of independent wallets in the Berachain ecosystem has grown by over 5.6 times since the mainnet launch.

At the same time, it further helps the Berachain ecosystem spread beyond the industry.

We see that Berachain has already collaborated with entity sports resources such as SSC Napoli and the Canadian national basketball project, which has for the first time expanded Berachain's application boundaries beyond the crypto circle to more mainstream and brand-influential application scenarios, becoming one of the key examples driving Web3 mass adoption. This represents Berachain gradually transitioning from a technology-driven public chain to an open ecosystem with real social connectivity and financial accessibility.

It is worth noting that Berachain is currently in the early stage of ecosystem construction, with many projects yet to have their Token Generation Event. The strong performance of DOLO undoubtedly brings a positive market signal to the ecosystem, a good start. As more native protocols gradually mature, the potential market performance of other Berachain ecosystem projects is worth continuous attention.