The meme coin market slowdown has pulled Shiba Inu (SHIB) down 11% over the past week. At the time of writing, this top meme coin is trading at $0.00001234.

However, despite the price drop, two important on-chain indicators are showing a price divergence, increasing the likelihood of a short-term reversal.

Traders remain optimistic about SHIB despite price decline

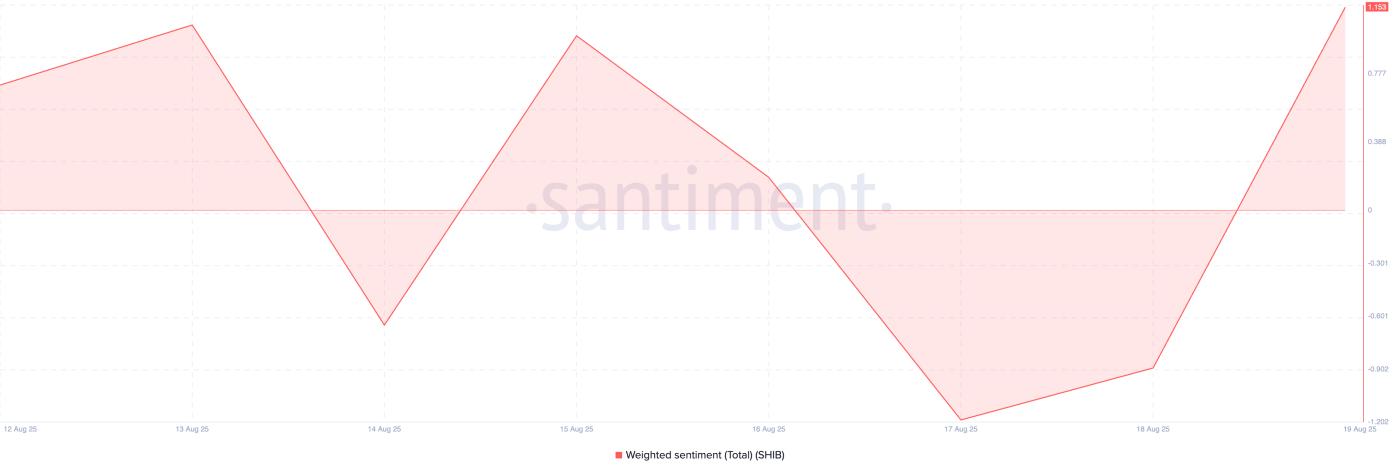

Despite recent unimpressive performance, SHIB has seen its weighted sentiment rise, indicating that traders are becoming increasingly optimistic about this meme coin. According to Santiment, this indicator is at its seven-day high of 1.153 at the time of writing.

For TA and token market updates: Want more information about such tokens? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

SHIB Weighted Sentiment. Source: Santiment

SHIB Weighted Sentiment. Source: SantimentAn asset's weighted sentiment measures its overall positive or negative bias by combining social network mention volume with the tone of those discussions.

When an asset's weighted sentiment is positive, it signals increasing confidence and new interest in the asset, even when the price is under pressure.

Conversely, a negative weighted sentiment reflects declining conditions. This means investors have become skeptical about the token's short-term prospects, which could lead to reduced trading.

SHIB's price drop, coupled with rising weighted sentiment, creates a price divergence, indicating growing market confidence despite the price decline. This divergence is typically understood as a potential reversal signal, suggesting traders may be quietly positioning for a recovery.

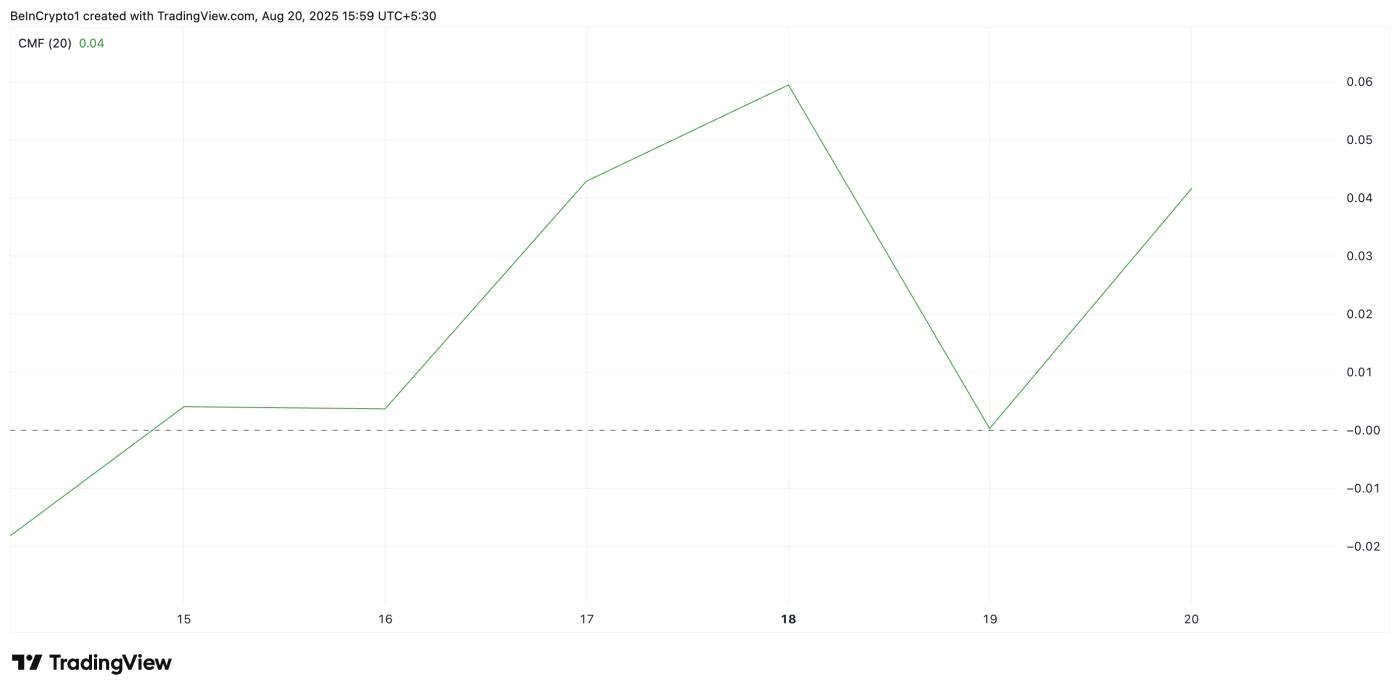

Furthermore, the altcoin's Chaikin Money Flow (CMF) setup supports this price appreciation prospect. Indicators from the meme coin's daily chart show CMF steadily increasing, even as SHIB's price drops, creating another price divergence.

At the time of writing, CMF is at 0.04, signaling that money is beginning to flow back into the asset.

SHIB CMF. Source: TradingView

SHIB CMF. Source: TradingViewCMF measures buying and selling pressure based on price and trading volume. A positive CMF indicator, as SHIB currently has, suggests more capital is entering the market than leaving it.

When this occurs alongside a price drop, traders are quietly accumulating tokens at lower prices, a sign of potential strength.

Can Shiba Inu turn losses into a breakout?

When such price divergences form, they often indicate a potential trend reversal. For SHIB, this means buyers have enough momentum to challenge selling pressure and trigger a recovery to $0.00001295.

SHIB Price Analysis. Source: TradingView

SHIB Price Analysis. Source: TradingViewConversely, if the selloff continues, SHIB risks dropping to $0.00001167.