“Stablecoin” is just Ethena’s outer layer. Let’s take it off now:

You transfer funds to a trading firm that offers a hedge fund: risk-neutral (no losses from asset price fluctuations) , offering an annualized return of up to 10%, and a large fund capacity. This fund's net asset value (NAV) at launch is $1, and returns accrue as the NAV updates. You can buy at any time, but selling through official channels requires a seven-day waiting period.

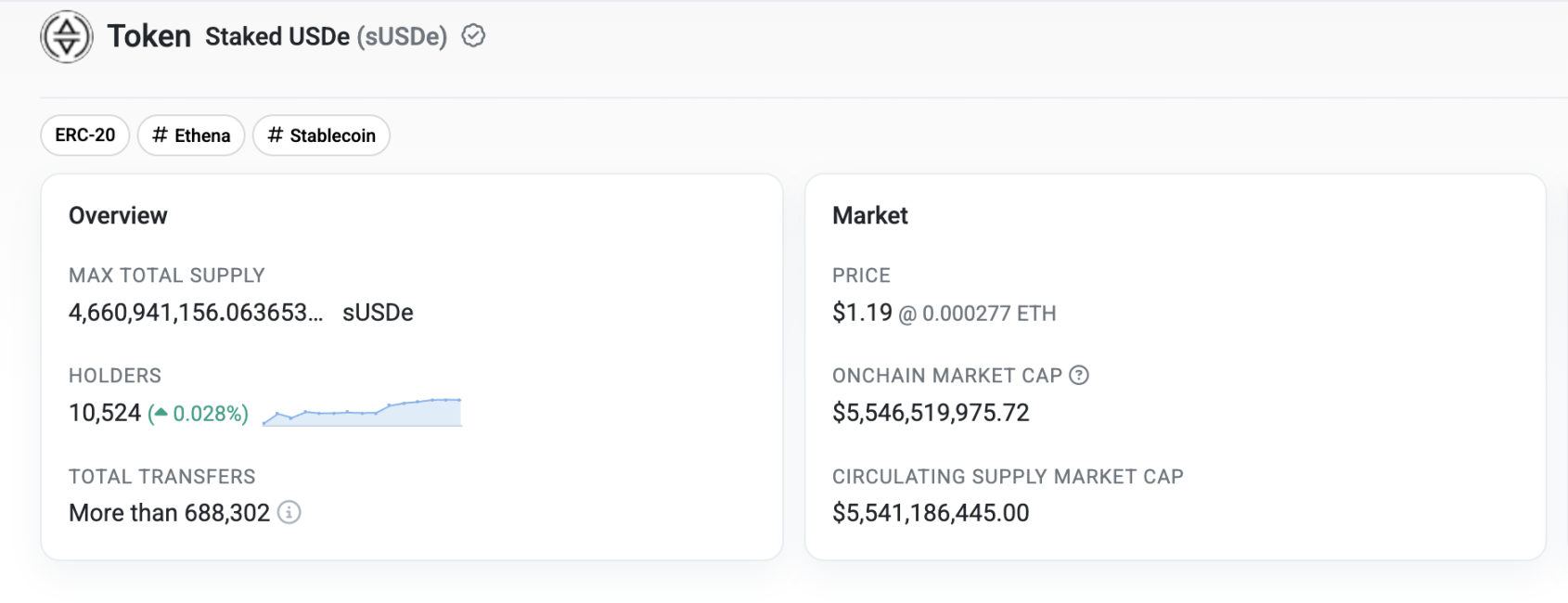

The trading company is called Ethena. For every $1 you deposit, you receive one USDe as a proof of deposit. The fund product is called sUSDe, and over 4.6 billion units have been issued. Each sUSDe unit has a net asset value of $1.19.

By sending all customers' USDe and sUSDe to on-chain wallets and registering them on the blockchain, the trading company becomes an "on-chain protocol." USDe then becomes a synthetic dollar stablecoin.

sUSDe token on the Ethereum mainnet

As the "stablecoin" narrative is hot, there are more and more companies that use stablecoins as a shell but actually run higher-risk trading strategies. Their products are often called "stablecoins backed by derivatives."

However, compared to stablecoins backed by short-term government bonds, these stablecoins carry significantly greater risks , and even their true "stability" is highly questionable. For example, Ethena's trading strategy (explained in more detail later) requires deploying funds on perpetual contract exchanges. Previously, the centralized exchange Bybit suffered a theft of over $1 billion in ETH, and Ethena holds a significant amount of funds on Bybit. If the exchange experiences a funding shortfall and halts withdrawals, the collateral behind USDe becomes insolvent.

U.S. Treasury bonds are considered the safest investment, and the market almost assumes they are "zero risk."

So why would Ethena take such a risk and use blockchain to package trading strategies into stablecoins? What are the benefits of doing so?

The first is the "crypto premium", because if we only look at Ethena from the perspective of a trading company, its valuation is "overvalued" .

Inflated valuation?

Ethena fits the “hedge fund” model in every way, including its revenue model.

Revenue Model

Ethena's primary source of revenue is funding arbitrage. For example, Ethena uses some of its users' stablecoin deposits to purchase ETH, stake it, and open an equivalent short position on an exchange. Profits and losses from spot and futures trading offset each other , achieving delta-neutral (risk-neutral, meaning profits are unrelated to asset price fluctuations).

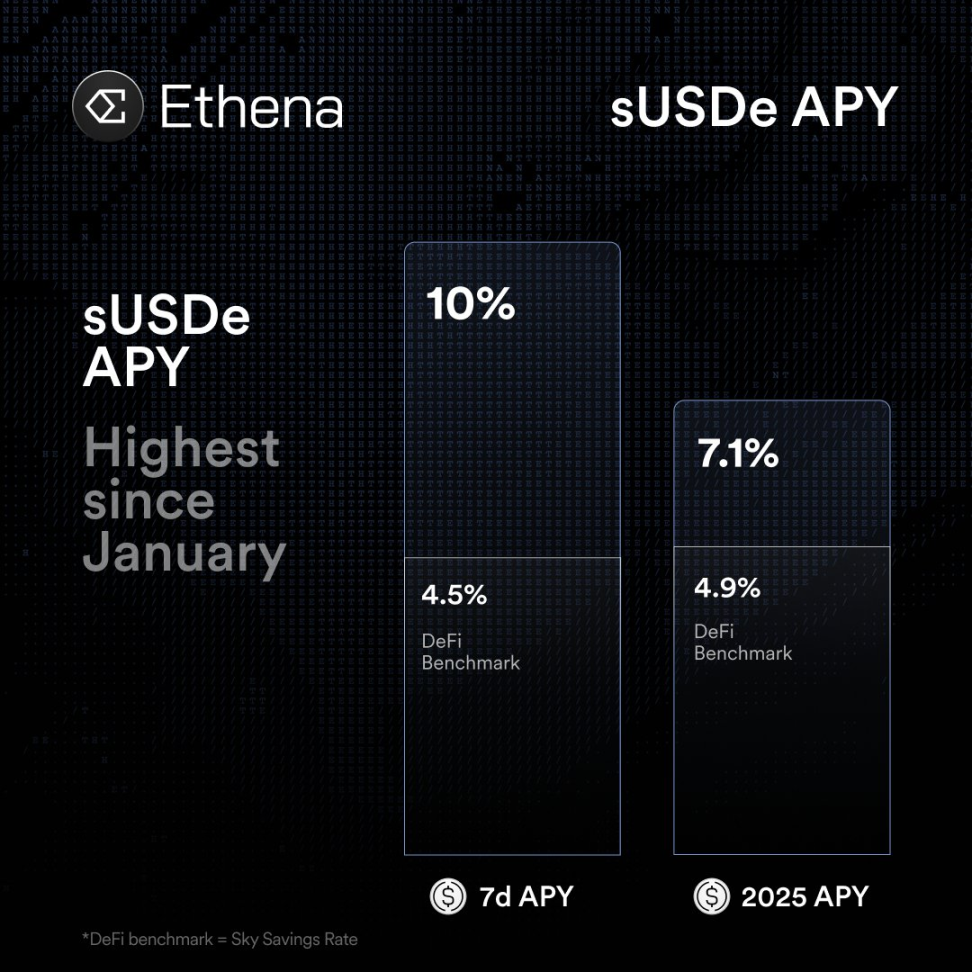

This allows spot ETH positions to earn approximately 3% annualized staking returns, while short positions, during periods of neutral or bullish sentiment, will continue to earn funding fees from long positions. Idle stablecoins can also be deployed to protocols like Sky to earn returns. These multiple benefits combine to generate an 18% annualized return in 2024. As of July 18th, Ethena's projected yield for 2025 was 7.1%.

Ethena charges 20% of strategy returns as a protocol fee , and the remaining 80% as sUSDe profit, effectively a 20% performance fee. This is a common practice among private hedge funds. So, based on this valuation model, how much is Ethena worth?

Traditional valuation models

The valuation model for private hedge funds (unlisted firms, such as Citadel and Two Sigma) typically uses 5-15 times net income as a benchmark, with the multiple varying depending on the stability of the funds and the replicability of the strategy. During the actual valuation process, investors primarily focus on several key factors:

First, capacity—whether the fund has room to expand its assets under management (AUM); second, stability—whether it can consistently deliver stable annualized returns ; and third, investor stickiness, including the lock-up period and long-term retention rate. Ethena's annualized returns are affected by market conditions and are currently volatile.

Specifically, fee-related earnings (FRE) are generally more stable and predictable, thus allowing for higher valuation multiples of 10–15x. Performance fees, however, are more volatile and generally receive lower multiples of 2–5x. The final valuation is typically calculated using a hybrid model, such as "FRE × 10 + Performance Fees × 3." Ethena's current revenue model relies solely on performance fees, with no management fee income .

Furthermore, if a fund is experiencing rapid expansion, such as doubling its AUM annually, a growth premium will be added to its valuation, further inflating the overall valuation. Ethena's recent surge in TVL is a plus. However, given the capital capacity of its underlying strategy (constrained by the market capitalization of the crypto assets and the corresponding perpetual swaps), it's not advisable to be overly optimistic about the growth potential of its hedging strategy.

Ethena's current total value locked (TVL) is $13 billion, equivalent to $13 billion in AUM. When acquiring or investing in fund management companies, valuations are often calculated based on 2%–6% of AUM. Even at 10%, the valuation would only be $1.3 billion. However, Ethena is a trading firm, not an asset management company, so this metric doesn't apply.

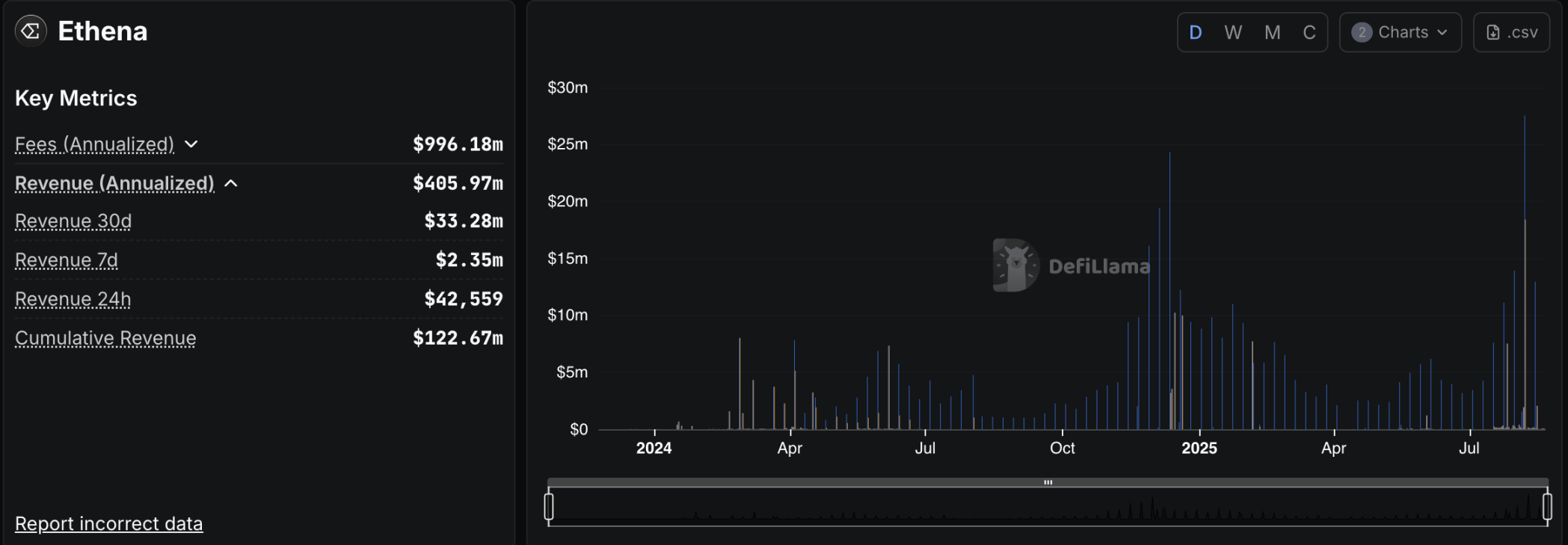

Ethena's annual revenue is approximately $400 million. Data: DeFiLlama

Based on the past 30 days of revenue, Ethena's annualized revenue is estimated to be $400 million. Using a higher multiple of 15, the valuation should be $6 billion. The data used here is not conservative, as Ethena may not be able to maintain its current annualized revenue and growth curve.

The current fully-circulated market capitalization of Ethena's token, ENA, is $9.7 billion, a 60% premium compared to the aforementioned calculation. Further contributing to its inflated valuation is the fact that the token currently offers no real capabilities.

Token value capture

Ethena has not yet turned on the "Fee Switch", which means that all current income from the Ethena protocol has nothing to do with ENA holders .

So what is the use of ENA now?

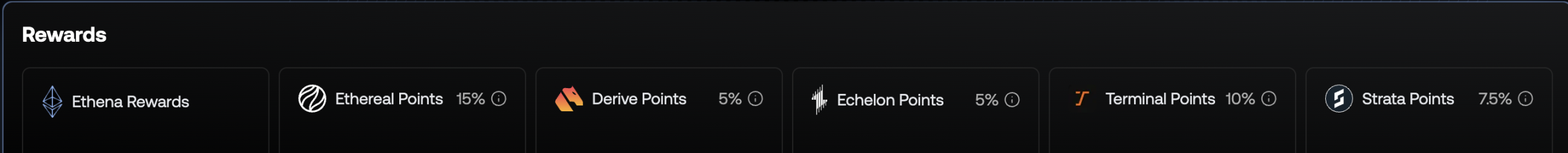

Staking ENA tokens earns sENA tokens (unstaking takes 7 days). Besides the negligible annualized interest rate of staking itself, sENA token holders can also earn points from Ethena itself and numerous ecosystem projects . These projects have pledged a certain amount of their own tokens to sENA stakers, including Ethereal (15%), Derive (5%), Echelon (5%), Terminal (10%), and Strata (7.5%). We will discuss several of these projects later.

In addition to earning Ethena points, sENA also provides a bonus to Ethena points earned by USDe. Its empowerment is primarily centered around points. Points will ultimately be redeemed for sENA tokens during the next Ethena airdrop, effectively " mining its own resources ." However, the total supply of tokens is limited, and the airdrop game cannot continue forever. The lack of underlying value support is a problem that ENA must address.

Fortunately, Ethena has considered turning on the “fee switch” to share protocol revenue with token holders, but has put forward the following conditions:

- USDe circulating supply exceeds $6 billion

- Cumulative contract revenue exceeds US$250 million

- At least four of the top five centralized exchanges by derivatives trading volume have integrated USDe into their CEX platforms.

- The reserve fund grows to 1% or more of the USDe supply

- Widening the yield gap between sUSDe APY and competing benchmarks such as Aave’s USDC

As of today, some of the above indicators have been achieved. The remaining challenges lie in increasing the size of the reserve fund and improving the relative annualized interest rate spread, thereby consolidating sUSDe's competitiveness relative to other income products.

However, the conditions for exchanges to integrate USDe are also shrouded in mystery. Currently, among the top five centralized exchanges by derivatives trading volume, only OKX and Binance have yet to integrate USDe. Binance's own BFUSD, which employs a similar hedging strategy to Ethena, is a direct competitor , reducing the likelihood of integrating USDe. Furthermore, OKX has yet to launch spot trading for the ENA token , suggesting a less-than-friendly stance towards Ethena.

It seems that ENA’s fee switch is not as “imminent” as some people expected. Even if the fee switch is turned on, how much profit can it bring to ENA stakers?

Potential yield of sENA

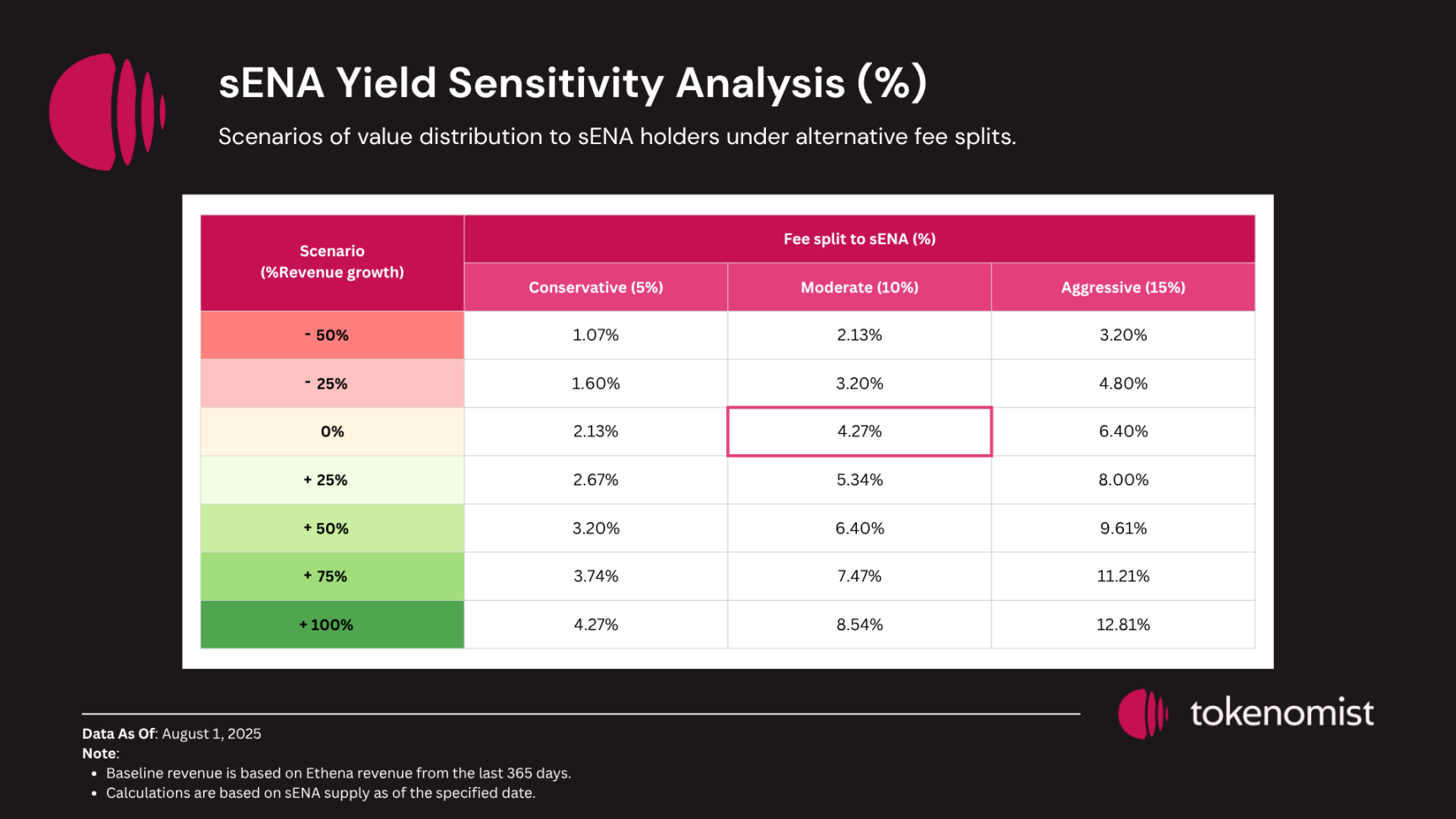

The potential rate of return of sENA is affected by the growth of Ethena's revenue and the actual share ratio. According to the calculation of tokenomist, the rate of return in the worst case scenario and the best case scenario is 1.07% and 12.81% respectively.

If we look at this 1.07% to 12.81% yield from a dividend perspective, it's actually quite satisfactory. So why is ENA's valuation inflated? Because this yield is based on a large number of ENA tokens that have yet to be unlocked and staked.

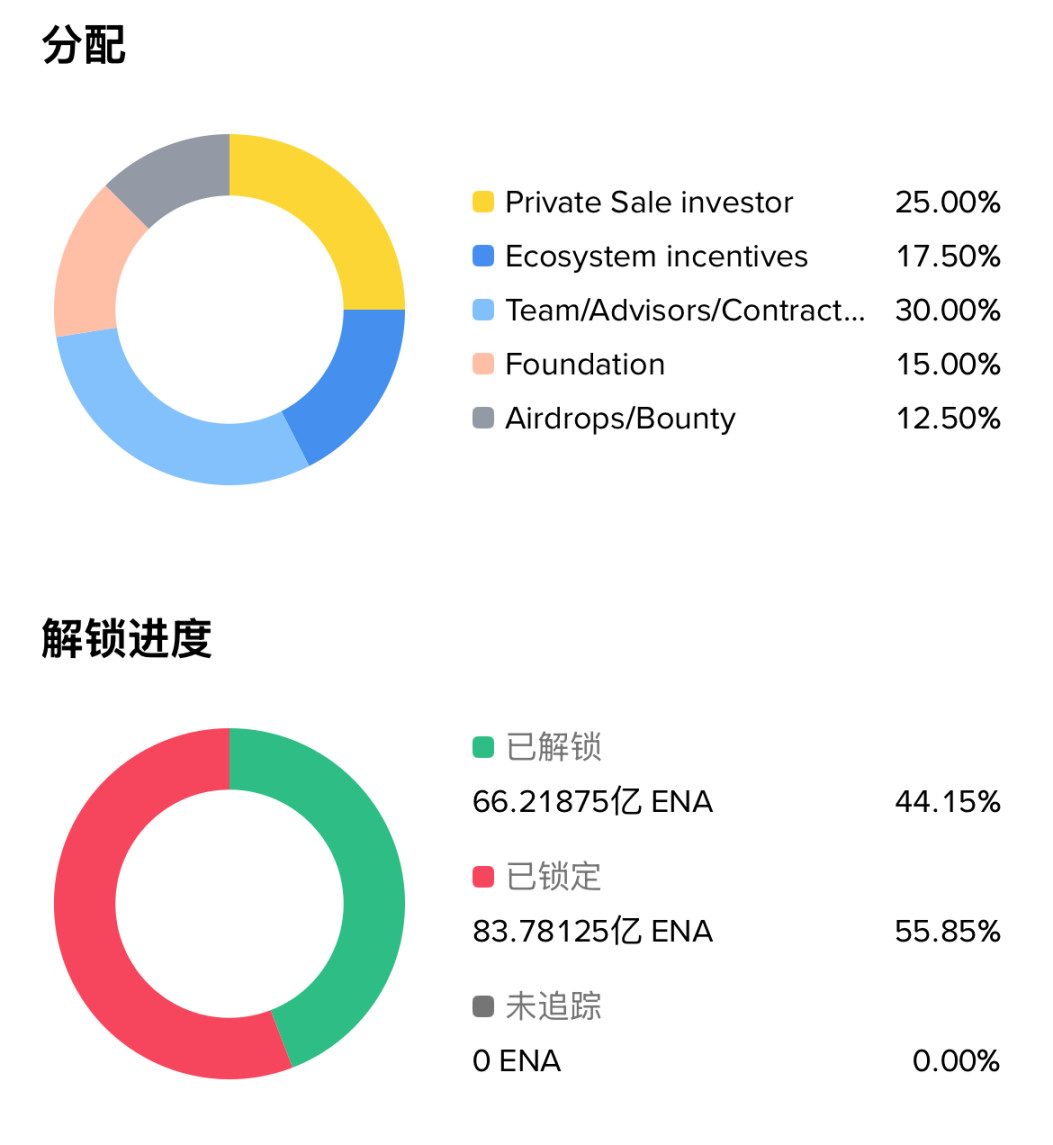

The total supply of ENA tokens is 15 billion, of which approximately 6.6 billion have been unlocked, while the current circulating supply of sENA is only 910 million . In addition to diluting potential returns, this also leads to another problem for ENA: unlocking selling pressure.

Unlocking Risk

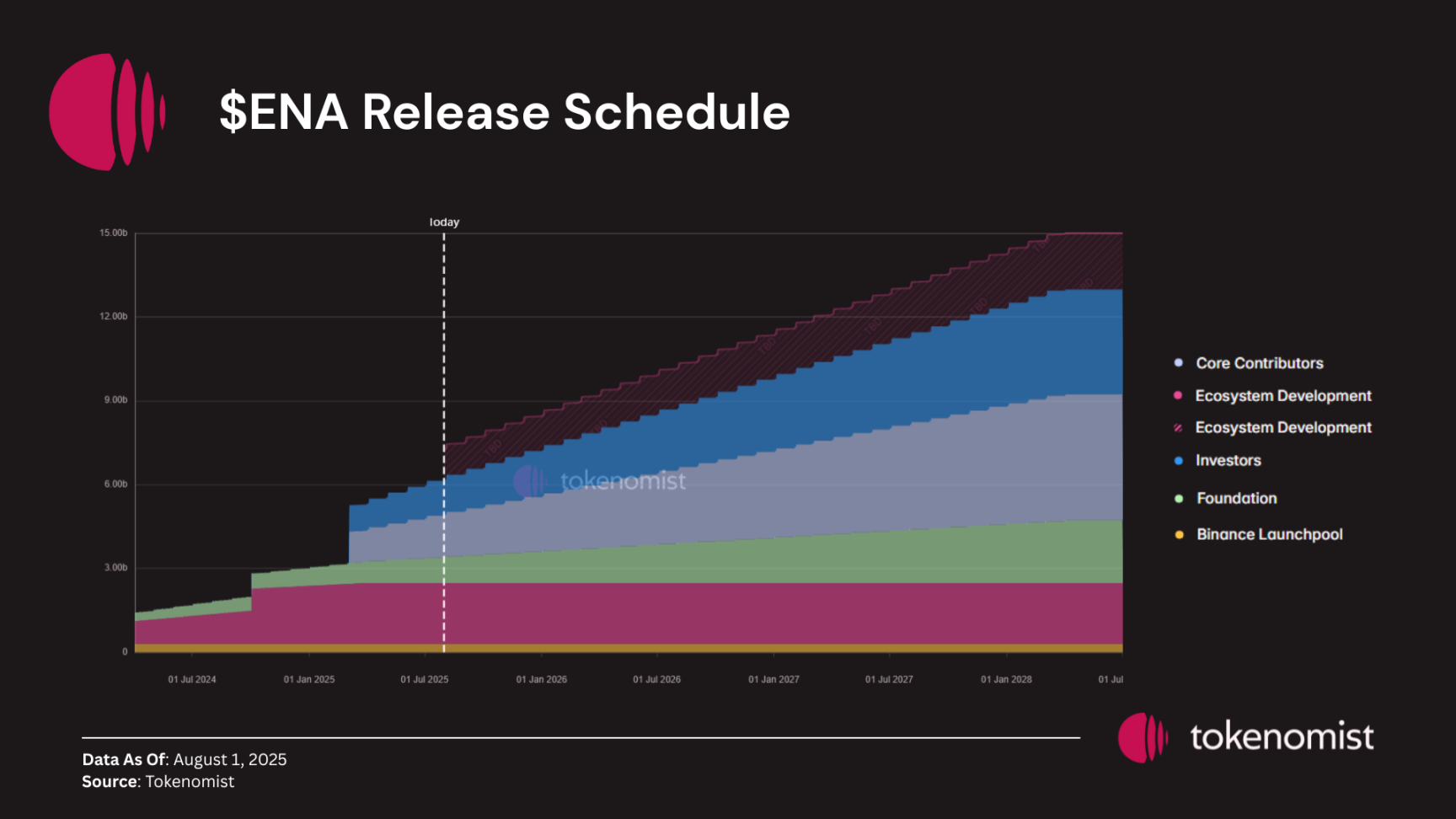

Over the next 12 months, over $500 million in tokens will be unlocked to private investors, and approximately $650 million in tokens will be distributed to the founding team and early contributors.

Meanwhile, Ethena's massive ecosystem development allocation remains largely uncertain. Currently in its fourth season of airdrops (beginning in March 2025), Ethena has distributed 2.25 billion ENA tokens over the first three seasons, 750 million per season. With Season 4 underway and 13.5% of the total supply earmarked for future ecosystem development, Ethena faces over $1 billion in distribution uncertainty .

Unlocking represents a potential dilution of the outstanding tokens. New tokens are unlocked much faster than the revenue is generated , and the impact on price could overwhelm the impact of any fee switches or buyback mechanisms.

However, the buying brought by Ethena's ENA Treasury Company may buffer the corresponding supply impact, which will not be elaborated in this article due to space reasons.

Is Ethena just a hedge fund leveraging blockchain technology to generate a valuation premium, with unclear token value capture and potential unlocking risks? Is it a bubble in the sun, poised to burst at any moment?

No. Ethena is actually aiming to build a massive CeDeFi ecosystem. (CeDeFi is the fusion of centralized and decentralized finance.)

From application to ecology

sUSDe is an application that has gained user recognition and achieved product-market fit (PMF), but it has a ceiling on its growth. Ethena, recognizing this, has chosen to build a vast ecosystem around this core application, striving to tell a bigger story.

Ethena isn't the only project to take the "application-to-ecosystem" path. Another similar example is Hyperliquid , which, after developing HyperCore , the highly successful decentralized perpetual contract trading application, launched HyperEVM , a Layer 1 public blockchain component, attracting numerous high-quality teams to build its ecosystem.

Ethena's 2025 roadmap is titled "Convergence," meaning intersection, convergence, fusion, and convergence. Converge later became the name of the public chain it launched in partnership with Securitize. Ethena's ambitions are enormous: to become CeDeFi—a bridge connecting CeFi (centralized finance) and DeFi (decentralized finance), bringing the trillion-dollar traditional finance sector onto the blockchain.

Converge is the first step in this plan.

Converge

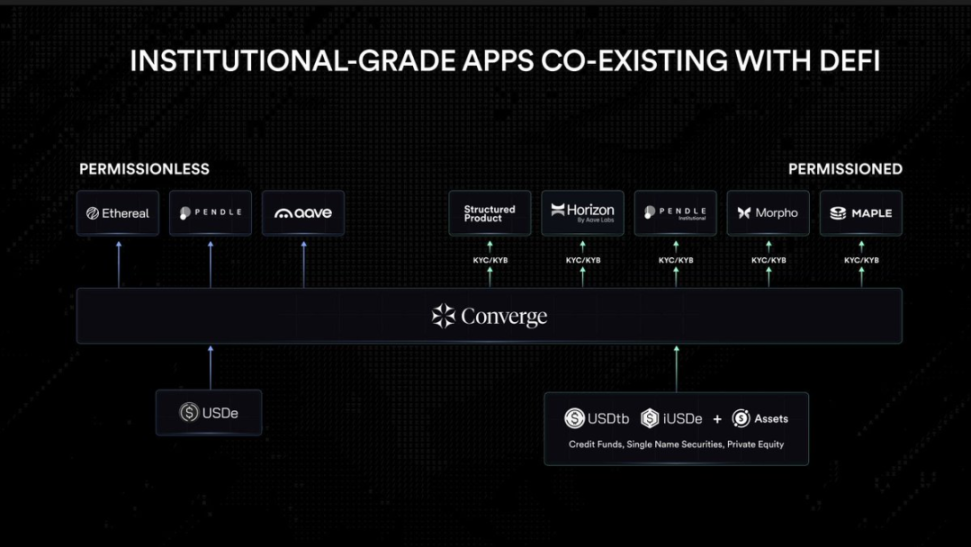

Converge is a blockchain network designed specifically for institutional investors, announced jointly by Ethena and asset tokenization platform Securitize. Positioned as a “settlement layer for traditional finance and digital dollars,” the project aims to provide traditional financial institutions with an infrastructure platform that meets strict compliance requirements without sacrificing technical performance.

Ethena plans to migrate its entire ecosystem to the new chain and issue its native stablecoin USDe, USDtb backed by BlackRock's BUIDL Fund, and iUSDe, which is designed specifically for asset management institutions, on the platform. Securitize will deploy its comprehensive tokenized securities issuance and management system on Converge, covering various asset classes such as stocks, bonds, and real estate, and actively explore new application scenarios such as on-chain stock trading.

The Converge Network will support two parallel operating models: enabling the unfettered growth of permissionless DeFi applications while also creating compliant products for traditional financial institutions. For example, tokenized securities issued by Securitize can serve as on-chain collateral in customized money markets while also providing a reliable gateway for institutional investors.

Converge has implemented stringent compliance measures, including Know Your Customer (KYC)/Know Your Business (KYB) verification, institutional-grade custodian services (provided by Anchorage, Fireblocks, and others), and permissioned validating nodes. Network validators are required to stake Ethena's governance token, ENA (to empower ENA, shifting from purely application-based to public blockchain tokens). Furthermore, USDe and USDtb will serve as the network's native gas tokens .

The public chain is just the starting point. Ethena is also planning to build its own decentralized exchange - Ethereal.

Ethereal

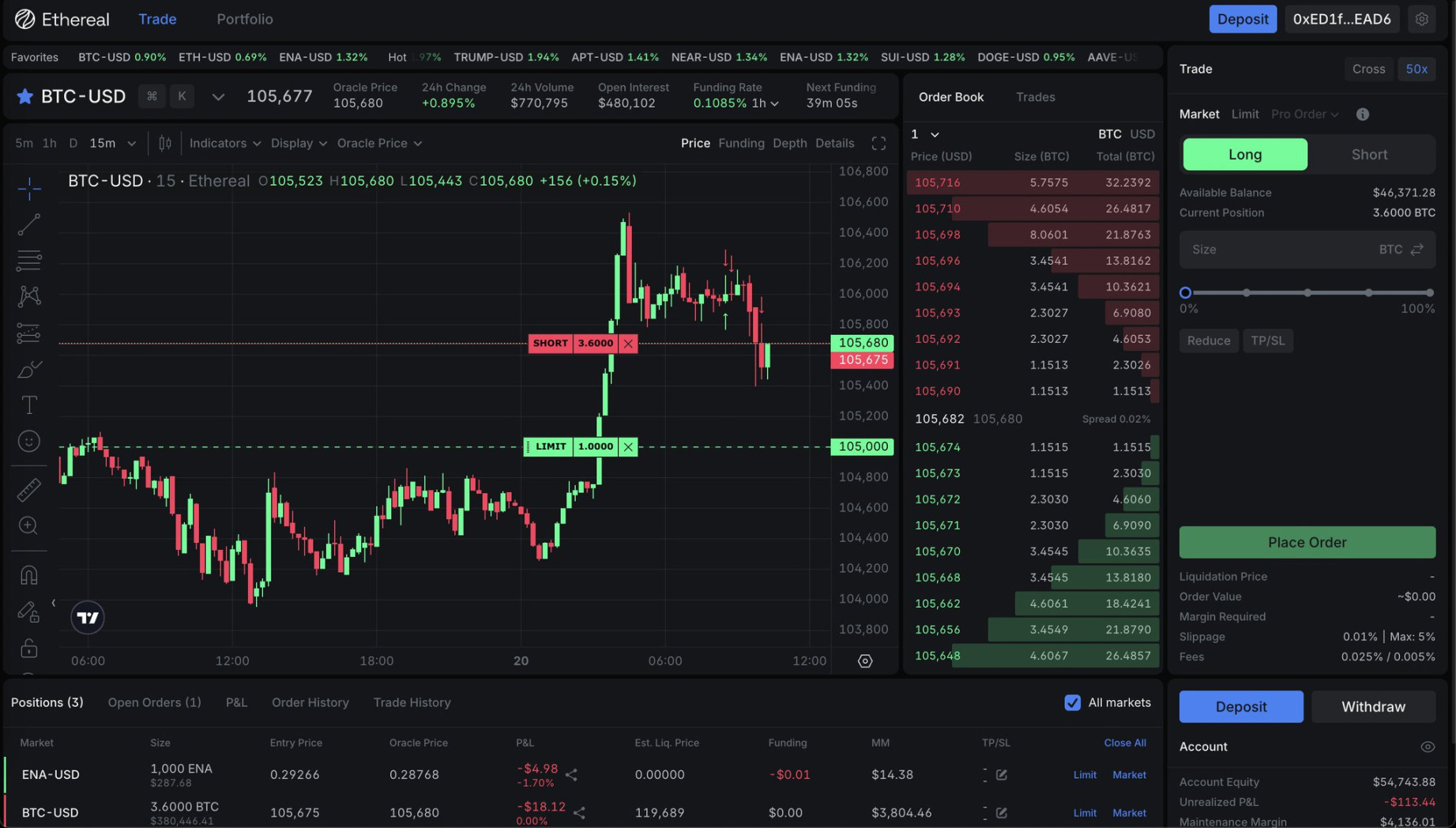

Ethereal is a decentralized exchange that uses USDe as its core asset . It will build a suite of features around it, including spot trading, perpetual swaps, lending and deposit services, and real-world asset (RWA) trading. This all-in-one super application will alleviate the fragmented DeFi experience (which requires multiple applications to implement these features). Ethereal will allow margin trading to earn returns simultaneously . Opening positions with USDe as margin expands USDe's use cases and contributes to Etheal's growth.

At the deployment level, Ethereal chose to become the L3 application chain running on Converge (although Converge is built with Arbitrum's L2 stack and chooses Celestia to provide data availability, it does not publicly promote it as L2), and said that this was not a decision to pursue technological fashion, but the product itself requires the technical solution to provide the best performance and composability as well as the exclusive block space required by the exchange .

Executing Ethena's hedging strategy on its own compliant public blockchain and using its own exchanges can, to a certain extent, mitigate the financial security risks associated with trading locations. Using USDe on Ethereal also helps Ethena improve its capital efficiency and reduce transaction losses .

Ethereal is currently in the testnet phase. It previously opened pre-deposits . Depositing USDe can obtain airdrop points from Ethereal itself and Ethena. The TVL (total locked value) once reached US$1.25 billion. Currently, it has fallen back to US$300 million due to various reasons, including the expiration of the Pendle pool, the end of Season 0 and the snapshot of points, and the start of Season 1.

However, Ethereal is not the only exchange on Converge. Another player, Terminal, is targeting another track.

Terminal

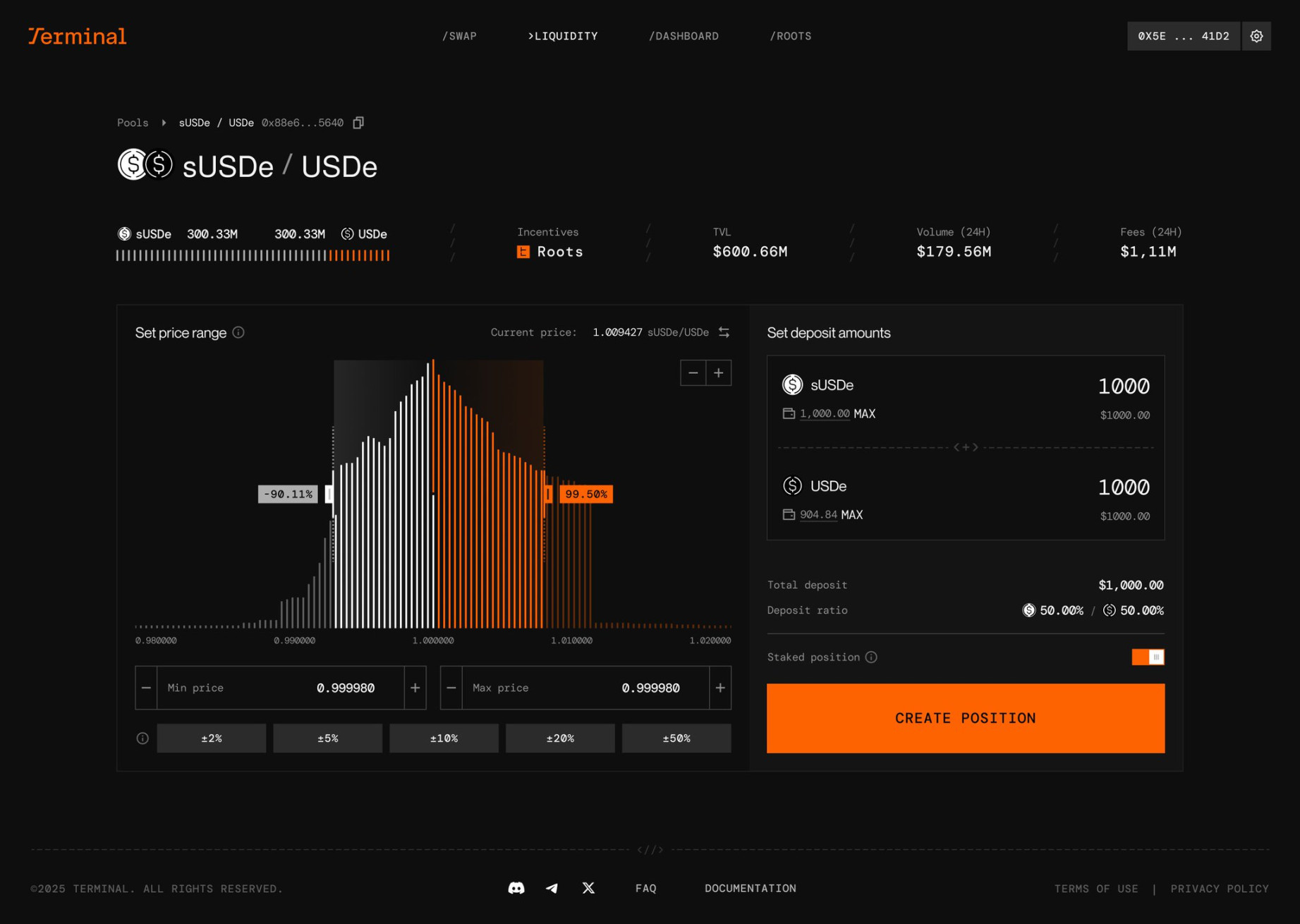

Unlike Ethereal, which focuses on building a comprehensive DeFi platform like a super-app, Terminal Finance is more focused on the institutional market. It positions itself as the liquidity hub of the Converge ecosystem, specializing in the trading of institutional assets and digital dollars .

Terminal addresses the issue of the current lack of an efficient secondary market for yield-bearing stablecoins, such as sUSDe, leading to insufficient liquidity for large-scale transactions. To address this, Terminal aims to build a spot DEX with sUSDe at its core , providing an efficient trading channel between stablecoins and institutional assets.

At the product level, Terminal will be divided into two parts:

- First, a completely open decentralized trading platform where anyone can trade and provide liquidity;

- The second is a licensed trading platform for institutions that supports compliance requirements and tokenized trading of RWA (real-world assets).

Terminal utilizes a redeemable "yield-wrapped asset" model. For example, sUSDe 's earnings are skimmed to ensure its stability against the US dollar while remaining a reliable base currency for the protocol.

Terminal's pre-deposits are also in progress. Depositing USDe can obtain airdrop points from itself and Ethena, depositing WETH can obtain points from itself and ether.fi , and depositing WBTC can obtain Terminal's own points.

Strata

Ethena's success has spawned a proliferation of imitative projects. Some, such as Resolv Labs (issuer of USR), have built upon Ethena's mechanisms and implemented "micro-innovations" to capture market share. Ethena 's mechanisms are mature and shouldn't be directly modified, but these innovations can be brought back to USDe through ecosystem projects. For example, Strata's mechanisms are similar to Resolv's.

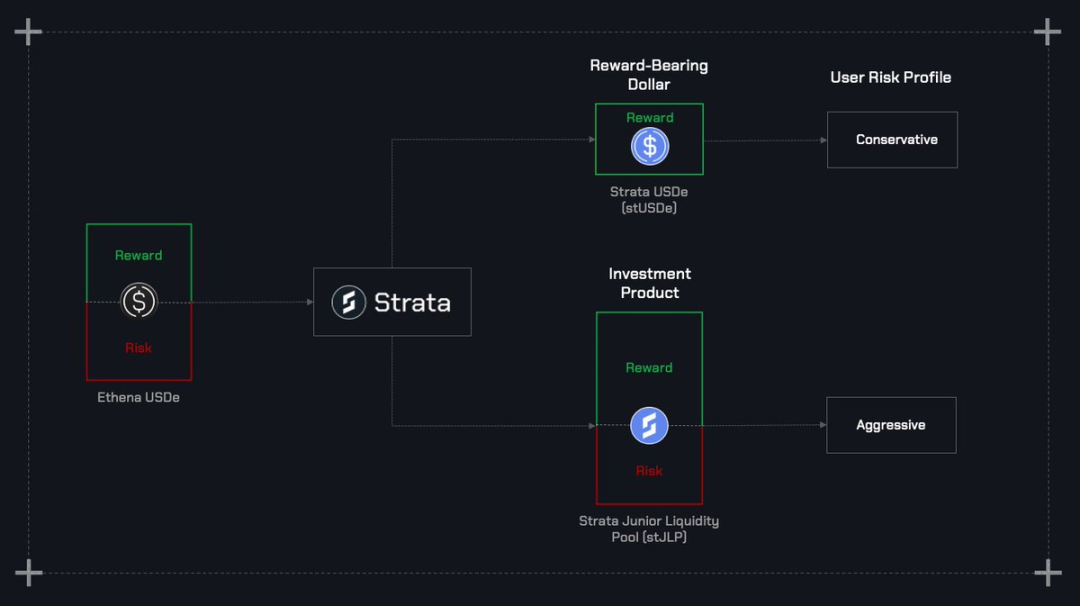

Strata is an Ethena-based risk tranching protocol designed to repackage the returns of yield-bearing stablecoins like USDe through structured products to meet the needs of investors with different risk appetites. It will also run on Converge.

Specifically, Strata splits USDe earnings into two types of tokens:

- Strata USDe (stUSDe) : As a senior product, it offers more stable returns and principal protection, suitable for conservative investors. Its income is derived from sUSDe, while guaranteeing a minimum APY and providing some upside exposure.

- Strata Junior Liquidity Pool (stJLP) : As a junior product, it bears additional risks and absorbs the volatility of sUSDe, but can obtain higher returns and is suitable for users willing to take risks.

This model is similar to structured wealth management in traditional finance, which clearly stratifies returns and risks, thereby providing institutional investors and retail investors with selectable risk exposure.

For conservative investors, Strata's stUSDe offers predictable, stable returns that are weakly correlated with traditional interest rates. For risk-averse investors, stJLP offers the potential for leveraged returns. If Ethereal and Terminal address trading and liquidity issues, Strata further complements the risk management puzzle.

Amid the convergence of DeFi and TradFi, the emergence of Strata fills a gap in institutional product design. Traditional finance's entry into DeFi often emphasizes risk-adjusted returns , and Strata addresses this need with its tokenized structured products.

Strata's airdrop season 0 is underway. Pre-depositing USDe/eUSDe (USDe pre-deposited into Ethereal) not only earns airdrop points for itself and Ethena, but also allows you to simultaneously earn Ethereal airdrop points. All three Ethena ecosystem protocols have integrated DeFi protocols like Pendle, Euler, and Morpho, offering a variety of gameplay options, including LP and YT leveraged point earning and PT revolving loans. Readers are encouraged to explore these options on their own.

Model innovation

Ethena's story is really well told. After understanding the huge ecosystem it is building, it is difficult to simply regard its behavior of putting a "crypto" shell on the trading company's business model as a scam to obtain a premium and increase its valuation. It even makes people wonder whether this kind of gameplay can really be regarded as "model innovation"?

For me personally, the answer is yes.

CeDeFi

When Ethena registered customer balances and hedge fund shares (USDe, sUSDe) on the blockchain, it truly transformed from CeFi to "CeDeFi," endowed with the inherent advantages of DeFi, such as permissionless operation. Common private hedge funds are typically open to institutions and high-net-worth individuals, with entry barriers potentially reaching millions of dollars, and may also require the provision of various identity information to meet compliance requirements. However, on-chain, there's no need for identity authentication, only gas fees—$10, $100, $1,000... any amount can be purchased through DEX without anyone's consent.

DeFi's accessibility benefits many people who were previously isolated from traditional finance. For example, citizens in the unstable country of South Africa, without even a trustworthy bank, can now enjoy the returns and appreciation provided by top hedge funds simply by accessing the internet and using a crypto wallet.

These inherent advantages of DeFi, compared to CeFi, are model innovations . For many retail investors, this represents an investment opportunity from scratch. Blockchain makes advanced finance accessible to the masses, giving retail investors more investment options.

The current role of the Ethena token, ENA, is to amplify airdrops. Isn't the "mining your own" model a bit of a downside? Actually, there's another side to this.

Token Marketing

Using token incentives (airdrops) to promote protocol growth may also be considered an innovative model for product distribution. Because it works, USDe is the fastest "dollar asset" to reach a supply of 10 billion in history, and the four quarterly ENA airdrops played an important role in this process.

It's important to note that sUSDe itself is a practical product with product-market fit (PMF). It already has a demand for returns, and with the added bonus of airdrops, it's a win-win situation. While token marketing has fueled its growth, it's unlikely that sUSDe's trajectory will be reversed once the incentives end.

For companies and products that are growing rapidly, it is normal not to distribute dividends but to use funds to prepare for future development. This is the case for many technology stocks listed on the Nasdaq.

Once a product matures, tokens will always be empowered. Even UNI, the perennially governed meme coin, is paving the way for fee facilitation. Whether through a buyback mechanism or revenue sharing, empowered tokens represent a degree of "ownership" in the underlying product, the equivalent of equity in the Web2 world. Using equity to incentivize user adoption? This is impossible in traditional finance, but blockchain makes it possible.

Giving users ownership of products is the fundamental concept of Web3 and a "model innovation" in the distribution of ownership.

Ethena is a product that amplifies blockchain model innovation and may grow into a large and ubiquitous CeDeFi ecosystem.

Disclaimer: The author of this article holds ENA tokens, the value of which meets the disclosure criteria.