1. Introduction

In mid-August, ETH surged past $4,700, reaching a four-year high. Meanwhile, Solana (SOL) spent much of the same period fluctuating between $180 and $200, far underperforming both BTC and ETH. Recalling the Solana meme frenzy that ignited on platforms like Pump.fun in 2024, it was once considered the end of ETH. On January 19, 2025, Solana reached a new all-time high near $293, before subsequently retreating, trading sideways, and experiencing fluctuating sentiment, diverging from ETH's upward trend. Beneath this surface lies a systemic difference in funding entry, value anchors, and network narratives. What are the underlying factors? Can the Solana ecosystem achieve renewed success, and can the SOL token take off again?

This article will analyze Solana's on-chain data and ecosystem performance, examining the core reasons why Solana has periodically underperformed ETH and analyzing the strengths and weaknesses of Solana's resurgence. Furthermore, it will provide a systematic perspective on Solana's potential performance in Q3–Q4 2025.

II. A Panoramic Analysis of Solana’s Ecosystem Performance in 2025

Solana's growth path is significantly different from Ethereum: it does not rely on "high gas fees + deflation" to capture value, but relies on single-chain high throughput + ultra-low fees to undertake massive long-tail and high-frequency transactions.

1. Core on-chain indicators

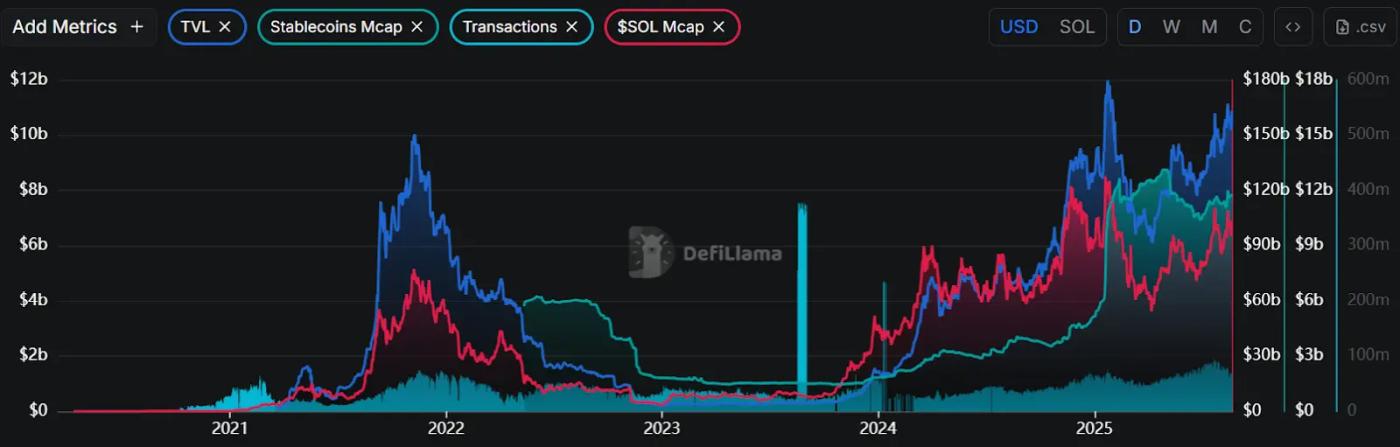

Since the beginning of this year, the Solana ecosystem has exhibited a trend of "falling from a high before fluctuating upward." TVL and stablecoin holdings have shown a step-by-step upward trend. Currently, TVL stands at approximately $10.42 billion, and the stablecoin market capitalization is approximately $11.62 billion. This indicates that the on-chain "underlying USD liquidity pool" has returned to and stabilized in the tens of billions of dollars. On-chain transaction counts remain high, maintaining active "high-frequency/long-tail" trading. $SOL's total market capitalization fell sharply in Q1, but has since shown a wave-like upward trend. From a structural perspective, the resurgence of meme popularity has marginally improved DEX/chain fees, but has not yet returned to its peak for the year.

Source: https://defillama.com/chain/solana

2. Meme Coin Section

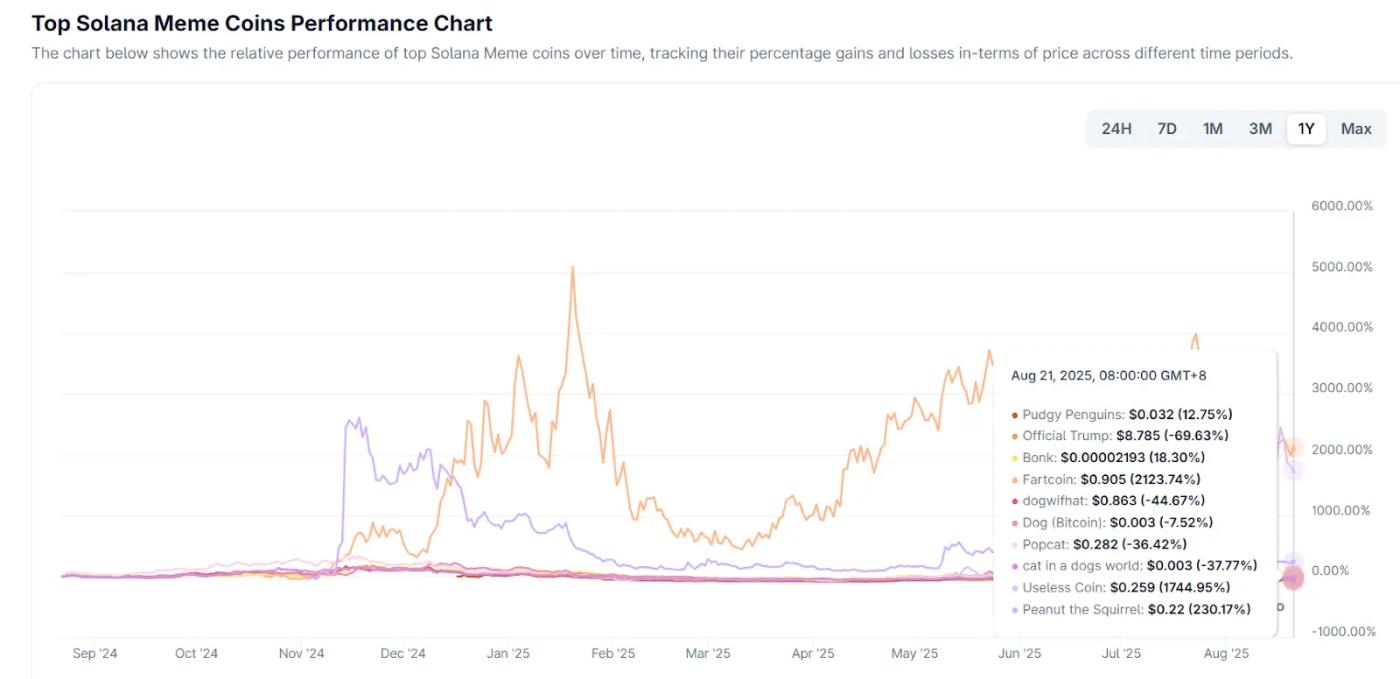

As the leading memecoin network, Solana has launched star memecoins such as BONK, WIF, POPCAT, MOODENG, PNUT, TRUMP, PENGU, FARTCOIN, and USELESS. Solana memes share the characteristics of high volatility, strong rotation, and strong event-driven growth. Currently, the total market capitalization of the Solana meme sector is approximately $11.7 billion. The five most popular memecoins since the beginning of the year are as follows:

PENGU: A "branded coin" strongly tied to popular NFT IP, with physical toy sales exceeding $10 million and covering more than 3,100 stores. Canary Capital has submitted a PENGU ETF application to the SEC. It has significantly strengthened this year and its market capitalization ranks among the top Solana Memes.

BONK : Solana’s dog-related “veteran” and community traffic portal, has also seen significant growth with the popularity of LetsBonk.fun, but is currently experiencing a significant pullback.

TRUMP: Trump Meme is an emotional coin driven by political topics. It has been fluctuating downward since its launch in January. The Trump crypto dinner in May triggered a round of recovery, but it is still in a state of decline and is sensitive to event catalysis.

FARTCOIN : Its popularity stems from humorous themes and virality: users submit fart jokes or memes to earn coins, and each transaction generates a digital fart sound. Combined with AI narratives (created by AI Truth Terminal), it is called an AI-meme hybrid that easily triggers FOMO.

USELESS : USELESS emphasizes "uselessness" as its selling point, satirizing the empty promises of other coins and becoming the most honest meme coin. The higher the price of the coin, the more useless it is, and the more likely it is to attract speculation.

Source: https://www.coingecko.com/en/categories/solana-meme-coins

3. Launchpad

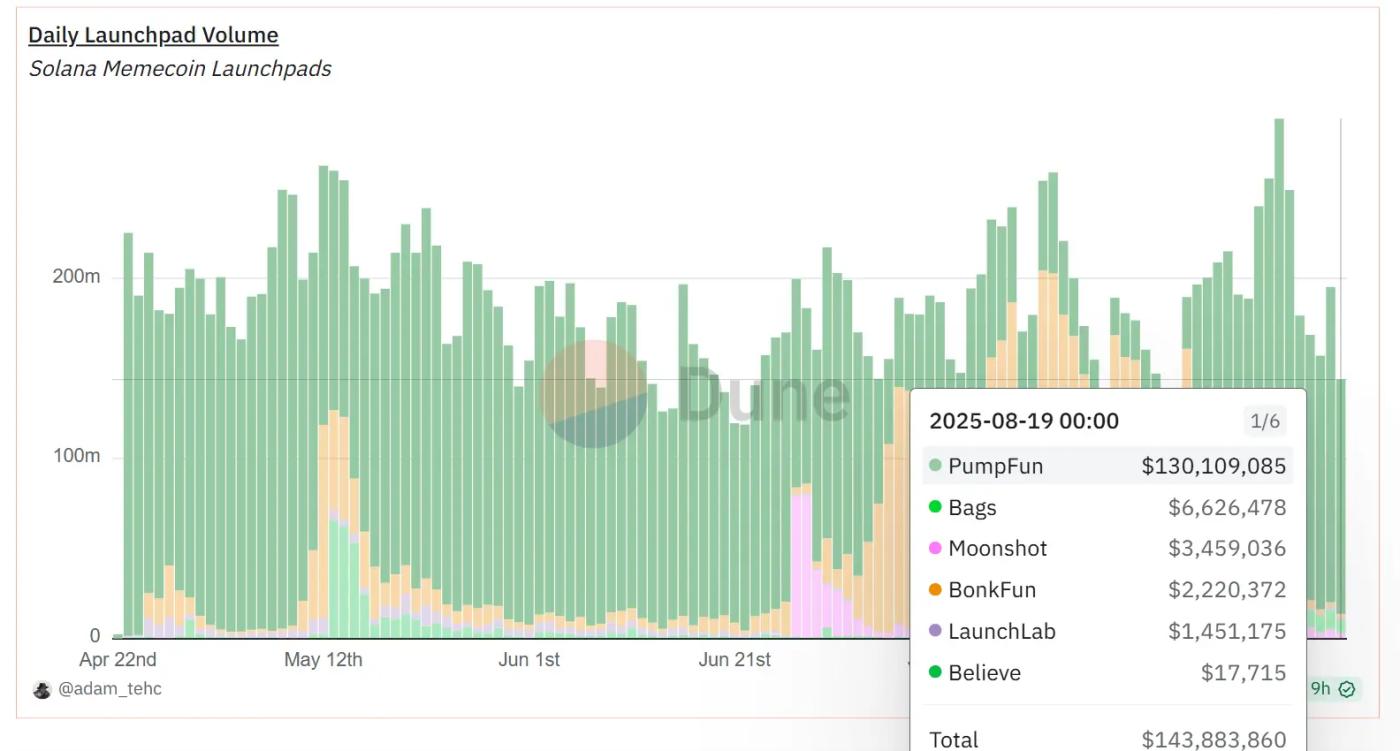

The battle for Launchpad on Solana has escalated from "who is cheaper/who can list coins faster" to a competition of "creator economy, token buybacks, and community governance."

Pump.fun: Its 1% transaction fee and "foolproof" issuance fueled the blockchain meme. In mid-August 2025, its weekly revenue reached approximately $13.48 million, returning to its peak. Cumulative revenue has now exceeded $800 million. Its dramatic recapture of market share, from 5% to ~90% in just two weeks, has garnered widespread attention online.

LetsBonk.fun: Launched in April 2025, it quickly gained market share, initially holding over 78% of the issuance in July, before subsequently declining. Its "community-based mobilization + low-threshold issuance" strategy remains a key competitor to Pump.fun.

Bags : It focuses on the "creator profit sharing/royalty" route, emphasizes creator income and continuous distribution, and enters the niche track tied to opinion leaders/creators. The transaction volume in the past 30 days has exceeded US$1 billion.

Moonshot: A fiat-entry app, supporting direct top-ups via Apple Pay and fiat deposits. It once topped the US App Store's "Free Finance Apps" chart, significantly lowering the barrier to entry for new users.

Believe : A social media portal that allows users to issue coins by replying to posts. Since June, it has caused controversy due to the suspension of some on-chain revenue sharing/switching to offline payment, and the adjustment of automatic coin listing to "manual review".

Source: https://dune.com/adam_tehc/memecoin-wars

4. DeFi sector

Solana's DeFi is more like "high-frequency/long-tail trading infrastructure." Raydium/Orca handles DEX trading and liquidity, Jupiter/Drift handles derivatives trading and routes fragmented liquidity, Kamino improves capital efficiency, and Jito/Marinade provides underlying assets with "stable interest rates and liquidity."

Raydium (AMM + Ecosystem Launch Pool): Solana's established DEX/AMM, responsible for most of the long-tail spot liquidity and launch pool functions; its fees and revenues are among the highest in the same category for a long time, showing a positive feedback loop between "platform cash flow-token value".

Jupiter (Aggregator + Trading Portal): Solana’s default router, integrating liquidity from multiple DEXs such as Raydium; the JPL pool has gathered a large amount of liquidity and announced the upcoming launch of a lending section.

Kamino (unified liquidity/lending/market making position management): Known for its "active market making treasury + lending", its TVL has long been at the forefront of Solana, becoming a "distribution center" for LPs and funds.

Jito (LST + MEV Infrastructure): MEV is made visible through the Jito client/blockchain engine/"Bundles," and a portion of MEV is distributed to stakers using jitoSOL. Jito tips already account for a significant portion of the on-chain "Real Economic Value (REV)."

3. Analysis of the reasons why SOL underperformed ETH

ETH leverages its spot ETF to create a complete closed loop of "compliant funds → secondary liquidity → market making/derivatives." Combined with its larger corporate treasury and the network narrative of an "on-chain financial hub," it forms a stronger anchor for capital absorption and valuation. Solana focuses on a trading ecosystem focused on "high-frequency/long-tail applications," and its price elasticity is more dependent on themes (such as Meme/Launchpad). It's more susceptible to "lack of anchors" when risk appetite declines or hot spots rotate.

1. ETF Fund Increment Gap

SOL : The Solana ETF (SSK) already offers staking returns in the US, but its structure is complex and it's not an SEC-registered spot ETF. Since its listing, it has only seen approximately $150 million in net inflows, far less than the ETH ETF's potential. Short-term market attention is focused on VanEck and Grayscale's SOL spot ETF applications. If approved around October, they could potentially open up a compliance model and passive funding channel similar to ETH.

ETH : Spot ETFs have surpassed $22 billion in market capitalization, becoming the primary entry point for institutional investors. Leading institutions such as BlackRock are currently pursuing applications for staking-enabled ETH ETFs. If implemented, these applications would combine staking returns with compliance channels, further solidifying long-term investment opportunities.

2. Differences in corporate holdings

SOL : Upexi, known as the "SOL Micro Strategy", currently has a NAV of approximately US$365 million, holds 1.8 million SOL, and has invited Arthur Hayes to join the advisory committee to strengthen its strategy and voice; other listed companies (such as DFDV and BTCM) are also slowly increasing their holdings, but the overall scale is still far behind the ETH treasury strategy.

ETH : BitMine Immersion (BMNR), which calls itself the "microstrategy of ETH", plans to increase its financing scale to US$20 billion. Its current NAV is approximately US$5.3 billion, second only to Bitcoin's MicroStrategy. At the same time, with the "endorsement" of globally influential opinion leaders such as Tom Lee, it has significantly strengthened the market narrative and capital appeal.

3. Differences in online narrative positioning

Solana : It is more inclined towards consumer applications and speculative hotspots (Meme, Launchpad) with "single-chain high throughput + extremely low fees". Although it has tried to enter the RWA market many times this year, most of them have ended in failure. In August, CMB International × DigiFT issued the US dollar money market fund token (CMBMINT) on Solana, which is a rare positive case of compliant RWA. On the same day, SOL stood above US$200 and was seen by the market as the starting point of a potential narrative switch.

Ethereum : Ethereum is building a compliant and sustainable on-chain financial infrastructure and clearinghouse layer, receiving institutional "structured subscriptions." Over half of all stablecoin issuance and approximately 30% of gas usage occur on Ethereum. Meanwhile, Robinhood is launching equity tokens on Ethereum's Layer 2 (L2), and Coinbase is fully committed to developing Base.

4. Different value capture mechanisms

Solana : Low fees + high throughput in exchange for ultra-high interaction density, value capture is more dependent on total transaction volume and application layer fees/MEV, etc.; when Meme/long-tail activities subside, chain fees and application fees cool down simultaneously, and the valuation anchor weakens accordingly.

Ethereum : EIP-1559 directly burns the basic fee, presenting net deflation/low inflation during busy periods, and then adds staking income to form a valuation anchor of "supply-side contraction + cash flow".

5. Historical Risk Memory and the Credibility Discount

Solana : The approximately 5-hour outage on 2024-02-06 and the subsequent decline of individual consensus nodes have been repaired, but they are still risk factors in the institutional pricing table.

Ethereum : "No downtime" and a broader developer/compliance ecosystem bring lower credibility discounts - when macro volatility rises, this discount will be magnified by the market.

Can SOL Take Off Again? Strengths and Weaknesses

SOL has the basic foundation of "high activity + low fees + MEV sharing + application layer cash flow", coupled with the catalysts of spot ETF, RWA compliance implementation, etc., it has every chance to start another wave of trend; but in the case that the ETF increment has not been implemented, the treasury size and narrative are still weaker than ETH, and the shadow of historical stability has not been completely digested, the price is still highly "event-driven".

1. SOL's advantages and bullish logic

Single-chain throughput + low fees = a natural breeding ground for active and long-tail assets

Solana handles tens of millions of interactions per day on a single chain, and trading and market making are naturally active with extremely low fees, which is conducive to the continuous trial and error and spread of Meme, long-tail assets and high-frequency DeFi.Compliant RWA is being proofed

China Merchants Bank International (CMBI) and DigiFT are tokenizing a US dollar money market fund and deploying it simultaneously on multiple chains, including Solana and Ethereum. Claiming to be the first publicly compliant MMF on Solana, CMBI offers a "cash-like asset that can be interpreted by institutions" and access to fiat currencies and stablecoins. This represents a potential "long-term funding narrative."The inflation curve is predictable

Solana's established inflation model: 8% initially, decreasing by 15% every "year" (~180 epochs), and 1.5% long-term. The actual annualized rate in 2025 is expected to be between 4.3% and 4.6%, with community-driven proposals to accelerate inflation. This predictable downward trend in inflation is beneficial for medium- and long-term valuations.If spot ETFs are approved, the funding gate will open.

VanEck and several other institutions have submitted or updated the S-1 filings for the SOL spot ETF to the SEC; once approved, they will replicate ETH's "compliant funds → passive allocation → market making/derivatives" path and attract more corporate treasuries to join.

2. SOL’s Disadvantages and Short-Selling Logic

ETF real growth is still on the way

ETH's spot ETF has a market capitalization exceeding $22 billion, establishing a closed loop of institutional capital. Meanwhile, SOL is still in the application/communication phase. Currently, "collateralized" products listed in the US are not standard SEC spot ETFs, and their ability to attract capital is far weaker. The difference between realized and anticipated returns is directly reflected in relative returns.The gap between the size of treasury strategy and its spokesperson

The ETH camp's "treasury companies" (such as BMNR) are significantly larger than those in the SOL camp (such as Upexi), and are backed by top opinion leaders like Tom Lee. Meanwhile, the SOL treasury is still in its "catch-up" phase. This means who will have more ammunition in times of turmoil.The "Financial Hub vs. Consumption/Speculation Chain" of Online Narratives

ETH firmly holds the narrative commanding heights of stablecoins/liquidation/compliant finance; Solana relies more on Meme/Launchpad/long tail to drive activity and fees. Theme rotation will directly affect on-chain fees and cash flow, and the price anchor is more "floating".“Fee reduction competition” from ETH itself

The reduction in Ethereum mainnet fees and competition from networks such as BSC, Base, and Sui have made "low fees" no longer Solana's only selling point, and have had a diversion effect on new developers and funds.

5. Q3–Q4 SOL Trend Outlook and Summary

Solana's essence remains a consumer-grade, high-frequency blockchain offering high activity, low fees, and application monetization. Whether it can take off again in Q3–Q4 depends crucially on whether the ETF can drive incremental compliance growth, whether RWA can successfully implement a scalable closed-loop system, and whether network stability continues to improve.

Baseline Scenario : Q3 enters a period of volatile upward movement characterized by "trading recovery and narrative waiting." On-chain activity and DEX/perpetual swaps trading remain high, while the meme market exhibits a cycle of pulsating activity, withdrawals, and renewed activity. At the price level, SOL is generally trading between an upward shift in valuation driven by improving fundamentals and a contraction in the risk premium associated with event expectations, with a volatile upward trend.

Bullish scenario : If spot ETFs are approved or enter a clear effective window around Q4, coupled with the regular issuance of RWA (not just individual MMFs, but more government bonds/notes/fund products), the three elements of SOL, namely "capital gateway, sustainable cash flow, and network resilience", will be strengthened at the same time, and prices are expected to trend upward and break through previous highs.

Short-selling scenario : ETF is delayed or rejected again, Meme/Launchpad obviously declines, and other main chains have innovative functions or hot topics, which may trigger the loosening of valuation anchor and collapse of transaction beta; if combined with macro tightening or Ethereum mainnet/L2 significantly reduces fees and diverts traffic again, SOL will enter a "high volatility decline-weak rebound" structure.

Conclusion

Solana experienced a rollercoaster of popularity in 2025. From its dazzling brilliance at the beginning of the year amidst the meme frenzy to relative eclipse mid-year amidst the mounting pressure from Ethereum, the market's perception of Solana has fluctuated several times. However, what is certain is that the unique value of Solana's high-performance public chain remains outstanding, and its ecosystem has not stagnated due to a temporary lull. In the long run, whether Solana can regain its lead depends on its ability to convert its high-speed network advantages into sustained user value: retaining users after the speculative wave subsides and expanding its application scope; and earning the trust of mainstream capital and gaining a share of the regulatory compliance process. Fortunately, we are seeing signs that Solana is gaining momentum, whether through institutional investment, technological upgrades, or a shift in its ecosystem narrative. Perhaps the current pullback is more like a buildup of momentum, awaiting the opportunity for another takeoff.

about Us

As the core investment research arm of Hotcoin Exchange, Hotcoin Research is committed to transforming professional analysis into a practical tool. We analyze market trends through our "Weekly Insights" and "In-Depth Research Reports." Our exclusive "Hotcoin Selection" column (using AI and expert screening) helps you identify promising assets and reduce the cost of trial and error. Our researchers also meet with you weekly via livestreams to analyze hot topics and predict trends. We believe that this caring support and professional guidance will help more investors navigate the market cycle and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries inherent risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.