After surging to $117,000 over the weekend, Bitcoin's upward trend has abruptly stalled, and it has since fallen back to hover around $112,000. Market analysts generally believe that "big money" has recently quietly withdrawn from Bitcoin and shifted its bets to Ethereum, a surge that is reshaping the capital landscape in the cryptocurrency market.

VX:TZ7971

According to Coingecko, Bitcoin is currently trading at $112,763, a 2.4% drop in a single day. This is a dramatic reversal compared to the strong trend that soared above $117,000 on Saturday morning.

Powell's speech set the stage for a September rate cut, sparking a brief surge in Bitcoin, but it failed to sustain the subsequent rally. The surge following Powell's remarks was more a short-term pullback driven by thin liquidity than by long-term market confidence. With leverage liquidated and a lack of new themes to fuel the rally, the market naturally stalled.

More crucial is the movement of whale. One whale wallet sold over 24,000 bitcoins between August 16 and 24, becoming a market focus.

Once the whale dump their stocks, the panic effect is immediately amplified, and the subsequent follow-up selling makes the decline even faster.

What is even more striking is that the selling funds did not withdraw from the market, but instead poured into Ethereum: more than $2 billion was used to buy spot, of which $1.3 billion was directly invested in staking.

Another whale that originally held more than 100,000 bitcoins recently sold part of its holdings, purchased 62,900 ethers, and established a long position of more than 135,000 ethers in the derivatives market.

ETF flows also reflect this trend. Bitcoin spot ETFs performed poorly in August, with some funds even experiencing net outflows. In contrast, Ethereum ETFs saw significant growth in inflows, a clear shift in institutional investor preferences.

If the Ethereum ETF is approved to open the staking function, it will surely ignite the staking craze again, and Ethereum is likely to become the protagonist of the second half of the bull market.

High-net-worth investors have begun selling Bitcoin and increasing their holdings of Ethereum, betting that the latter has greater potential for growth thanks to corporate buying.

Data shows that Bitcoin's market share has dropped from 61% at the beginning of the month to 57.94%, and market funds have clearly shifted to competing currencies.

According to market data, Bitcoin's market share (BTC.D) fell 2.52% in the past week and is now at 57.9%.

During the same period, the total market value of cryptocurrencies fell 1.05% in the past week, the total market value excluding Bitcoin (TOTAL 2) rose 2.64%, and the total market value excluding Bitcoin and Ethereum (TOTAL 3) rose 0.59%.

ETH is currently attempting a weekly close above $4,600. Success would be a crucial confirmation that this isn't a bull trap. A weekly close above $4,600 would mark ETH's highest weekly close ever. This would also pave the way for the next leg of its upward trajectory, targeting $5,200–5,500 next week.

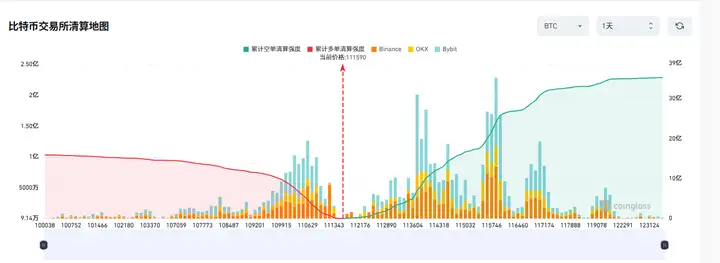

According to Coinglass data, if Bitcoin falls below $110,000, the cumulative long order liquidation intensity on mainstream CEXs will reach 1.128 billion. Conversely, if Bitcoin breaks through $115,000, the cumulative short order liquidation intensity on mainstream CEXs will reach 1.332 billion.

Will the market be higher by the end of the year? I think it will. If you're not leveraging, don't worry. There might be further drops this week, but if you have some spare cash, this would be a good opportunity to buy the dips. I believe money will be printed before the end of the year. Bitcoin could reach $150,000, and ETH could exceed $6,000. But before then, the fall is likely to be volatile.

Today's panic index is 47, remaining neutral.

In the early morning, ETH approached $5,000 and set a new record high. Then it flash crashed, taking BTC and a copycat with it. In fact, there are only two situations. One is the whale selling after the new high, and the other is the targeted explosion of high leverage. In fact, there is no need to panic. Many coins have not even fallen below our entry position. Short-term corrections will not block the long-term trend.

The events that will have the greatest impact on interest rate cuts this week are the US GDP and core PCE data released on Friday. Core PCE has actually been climbing over the past six months, indirectly indicating rising inflation. If the data released on Friday is not good, there will likely be another major setback. Heyue players should pay attention to risk control.