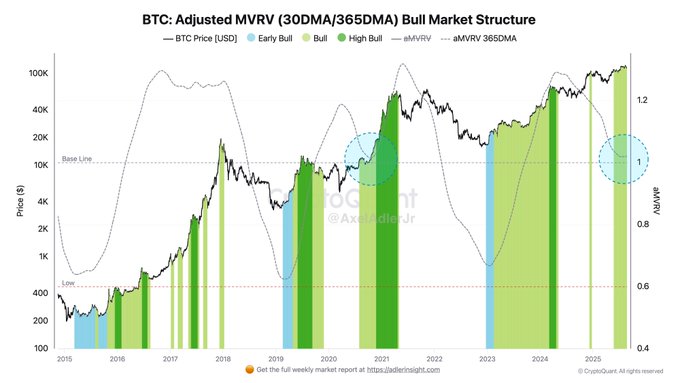

Currently, the annual Adjusted MVRV has pressed against the 1.0 zone - this means that the short-term average (30-day) is practically equal to the annual average (365-day). The annual basis remains positive, and its curve looks horizontal because two forces are currently mutually compensating: after a strong impulse, the 30-day metric has cooled down along with volatility and profit-taking velocity, while the heavy 365-day average still retains the past months of growth within it. As a result, the numerator and denominator move almost synchronously, the difference between them compresses, and the basis line neither slides down nor accelerates upward - the market is literally digesting the previous rally. Such a position at 1.0 is more of a pause within a bullish structure than the finale of a cycle. As long as the annual basis doesn't reverse downward, we're talking about balancing rather than a trend break: the network is redistributing risk from hot hands to more patient ones without signs of capitulation. Over the next couple of weeks, we'll see the reaction at 1.0. For now, the picture is more about time than about reversal.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content