This article is machine translated

Show original

REDSTONE HST IS EXPANDING + RED POTENTIAL

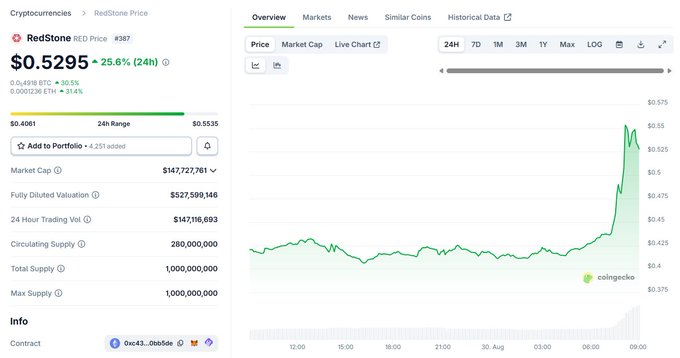

The valuation of $RED is really attractive!

I myself am still betting on the Oracle RedStone platform being able to challenge the position of Pyth Network or further Chainlink in the Crypto market for the following reasons:

1⃣ RedStone is always looking for potential niches

As one of the next generation Oracles competing with the big guys on their own strengths is suicidal.

With the emergence of new protocols, finding niche markets to increase Market Share is the most optimal strategy. Some of the markets that RedStone is implementing quite successfully are:

- LSD

- LSDfi

- BTCfi

- RWA

- ...

2⃣ Continuously launch new products

One of the best ways to demonstrate the team’s positivity is to diligently launch new products that are relevant to the general market. Since TGE, RedStone has launched many new products such as:

- RedStone Bolt: RedStone Bolt is a real-time Oracle platform built to serve Blockchains aiming for real-time transaction completion first, namely MegaETH and Solana.

- RedStone ATOM: RedStone Bolt is an Oracle platform dedicated to DeFi Lending with the goal of optimizing the efficiency of liquidation and redistribution of OEV back to the protocol.

Why do you say these are 2 products suitable for the market?

First, the goal of Web3 is to bring the user experience back to the same as Web2, one of the main factors is the transaction completion time. So Blockchains towards Realtime will definitely be the story of the future so this is a step of RedStone to prepare for the upcoming wave.

Next, the intersection between DeFi & CeFi is getting stronger and the Lending segment will be the strongest development Shard to build Use Case for RWAs so helping DeFi Lending platforms optimize liquidation will help RedStone capture more market share.

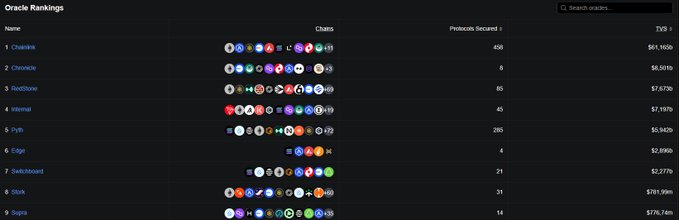

=> Remembering the above strategy, RedStone has now officially surpassed Pyth Network to become the TOP 3 largest Oracle in the market!

3⃣ Standard Tokenomics

Hitting the weak points of your competitors is also one of the best ways to increase Market Share. Obviously, compared to competitors like Chainlink or Pyth Network, RedStone has built a relatively interesting Tokenomics from the beginning such as:

- Buy Back program available

- There is a revenue Chia program using $BTC $ETH Stablecoin for Stakers

- Have regular Airdrop programs to the community

4⃣ Valuation is still relatively low

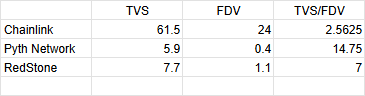

If we evaluate Oracles primarily based on TVS/FDV, we get numbers like:

- Chainlink: 2.5

- Python Network: 7

- RedStone: 14.75

According to the above parameters, the higher the index of an Oracle, the greater its potential. Here we have RedStone, if we simply compare it with Pyth Ntwork, we see:

- RedStone has a higher TVS ($7.7 billion vs. Pyth's $5.9 billion).

- $RED's valuation is lower at $400 million compared to Pyth Network's $1.1 billion.

RedStone

@redstone_defi

08-19

RedStone is securing over $10B in TVL across 170+ clients.

Demand for reliable oracle infrastructure is accelerating as onchain finance expands.

And this is only the beginning.

Explore the RedStone adoption map ↓

👀👀👀

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content