Ethereum ETF inflows have reversed sharply since last week, with institutional investors recording a net outflow of -105,000 ETH, ending several weeks of inflows.

This sudden reversal roiled the market, suggesting that institutional confidence is waning. However, the week started positively, with +16,900 ETH flowing back into spot ETFs, indicating that demand is picking up.

VX:TZ7971

As of writing, ETH is trading around $4,611, just below key resistance. The balance between ETF inflows and overall market positioning will likely determine the Altcoin’s near-term price action.

Is the decline in on-site inventories a sign of stronger accumulation?

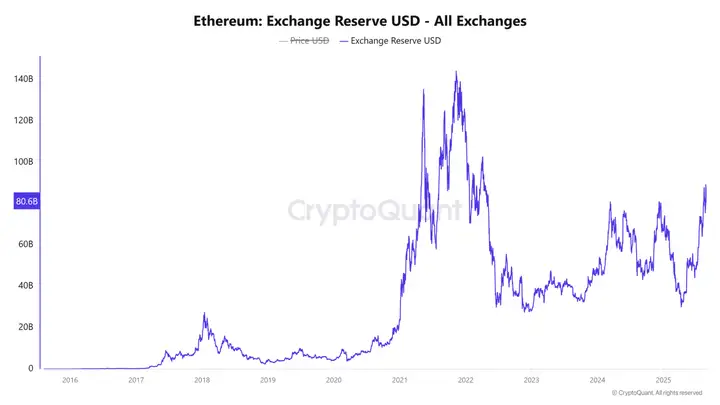

Exchange ETH reserves fell 4.41% to $80.7 billion, indicating that investors are withdrawing their balances from exchanges. This steady decline suggests a strengthening long-term holding trend, especially as the departure of tokens from exchanges will alleviate short-term selling pressure.

Historically, falling reserves have tended to coincide with periods of stable or rising prices due to reduced supply, so despite recent market volatility, this trend may reflect growing confidence among holders.

If this pattern continues, the reduction in liquidity could amplify future price fluctuations as large amounts of capital flow in or out, making Ethereum's direction more obvious.

Does the long-short ratio indicate that the market is too optimistic?

On the Binance platform, 64.44% of accounts still hold long ETH positions, while 35.56% hold short ETH positions, with a long-to-short ratio of 1.81. This imbalance suggests that most traders expect prices to recover, fueling optimism in the derivatives market.

However, excessive bias also carries risks, as when the market becomes “overcrowded with longs,” a mere price drop can trigger a chain reaction of liquidations.

However, the strong bias towards bulls also reflects, to a certain extent, confidence in Ethereum’s short-term potential.

Therefore, despite the prevailing bullish sentiment, this imbalance may force traders to remain cautious, especially if the resistance level continues to hold and leads to a sharp pullback.

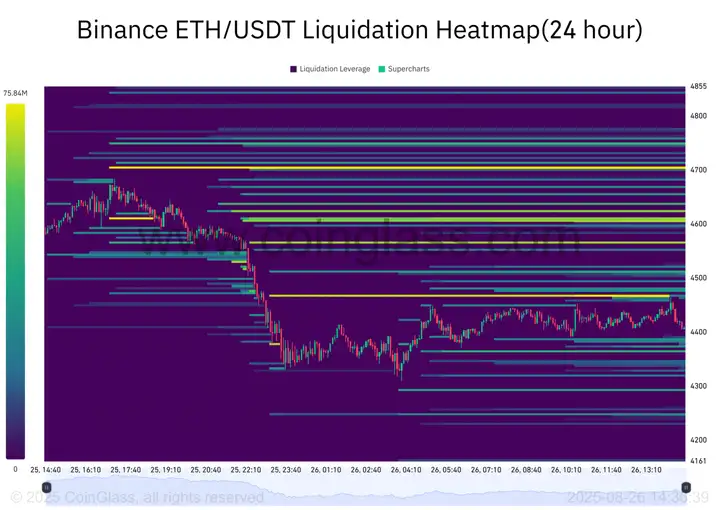

Will the $4,700 Liquidation Cluster Halt Ethereum’s Uptrend?

ETH’s liquidation chart shows that liquidations are densely concentrated around $4,700, creating both opportunities and potential risks.

A breakout above $4,700 could trigger strong buying pressure, fueling renewed upward momentum. Conversely, a failure to break through this level could trigger strong selling pressure as leveraged positions are liquidated.

These liquidation clusters highlight a key pressure point where market volatility could potentially erupt. Therefore, whether Ethereum can break through this barrier will likely determine whether bullish inflows and declining exchange reserves are enough to fuel a sustained rally.

A rebound in Ethereum ETF inflows, declining exchange reserves, and bullish trader sentiment could be signs of underlying strength.

However, a dense cluster of liquidations near $4,700 presents an insurmountable obstacle. If buying power is strong enough to overcome this barrier, ETH could extend its rally. Conversely, indecision could expose traders to a sharp pullback.

The market focus remains on Ethereum and related treasury companies. Ethereum continued its upward trend and stabilized near key moving averages, reflecting the market's bargain-hunting buying momentum in early to mid-August.

However, momentum has slowed, and the stock is expected to remain range-bound between $4,355 and $4,958, with a possible retest of the $4,355 moving average. The key to future trends lies in whether treasury companies can continue to attract capital and shape their narrative in the market.

Overall, the main line of the crypto market has not changed, and the grasp of technical aspects may become an important factor affecting profits and losses.

Today's panic index is 51, remaining neutral.

The market is still volatile. It is expected that the market will not recover some volatility until the unemployment figures and preliminary GDP data are released tomorrow. At the same time, we must also pay attention to whether Trump's dismissal of Cook will continue to ferment, because the challenge to the independence of the Federal Reserve will affect investors' confidence in the US financial system. If Trump has the final say, given his volatile personality, everyone may be deterred from the US market, and the currency market will most likely follow the pace of the US stock market in the short term, so we still need to be vigilant about this matter.

However, there are some signs of bottoming out at present. Even if it hits the bottom again, the probability of a needle will be relatively high, mainly targeting Heyue. Spot players don’t have to worry and can get on board with confidence.