In the context of the Solana ecosystem growing strongly with many DeFi projects emerging, the need for a sustainable and efficient liquidation layer is becoming increasingly urgent. Among a series of traditional AMM protocols that still have many limitations in terms of Capital efficiency and user experience, Saros emerges as a breakthrough solution with the Dynamic Liquidity Market Maker mechanism. So what is Saros? Let's join Coin68 to learn about the most prominent DLMM DEX exchange on Solana through the article below!

What is Saros? Learn about the most prominent DLMM DEX currently on Solana

What is Saros?

Saros is a DeFi platform on Solana that aims to build a seamless, low-cost, and high-speed trading experience. The most prominent feature of this platform is Saros DLMM (Dynamic Liquidity Market Maker). This is a mechanism with a dynamic market making model that allows LP to flexibly deploy, manage, and rebalance their Capital according to different liquidation models (Spot, Curve, Bid-Ask).

Saros Home

Through this, Saros not only helps optimize Capital efficiency and reduce slippage, but also creates opportunities for both basic and advanced users to exploit many market-making strategies. With the ability to integrate SDKs, Concentrated Incentives, and swap mechanisms, creating friendly pools, Saros aims to become one of the core infrastructures of DeFi on Solana.

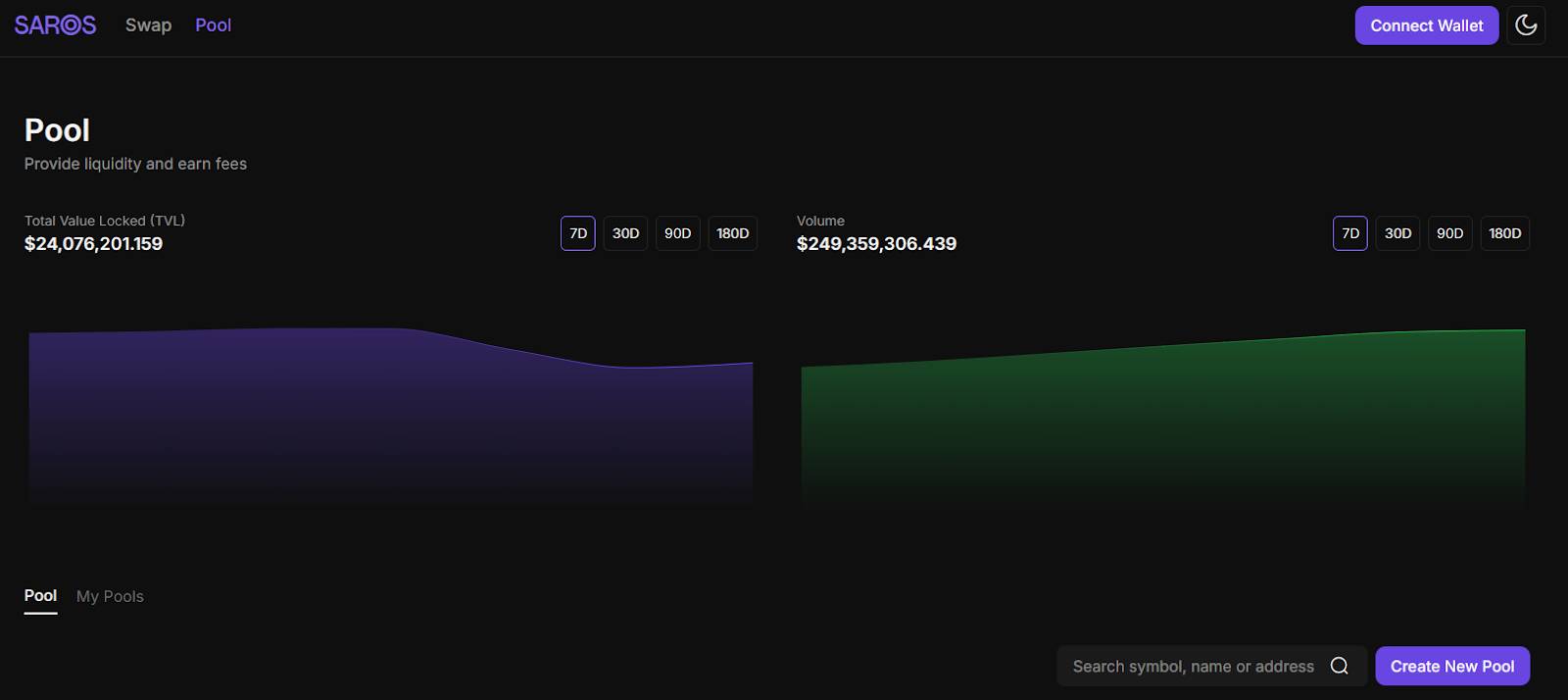

Saros AMM

Saros AMM (Automated market maker) is the first liquidation engine of Saros DEX on Solana, providing a simple, transparent and permissionless way for anyone to Swap SPL Token on Solana instantly through user-provided liquidation pools, instead of having to rely on intermediaries or complex Order Book .

Saros AMM

With the liquidation maintenance formula x*y=k that is the foundation of every DEX, Saros AMM maintains continuous liquidation and a 50/50 balance between the two assets, suitable for new Token listings, providing liquidation on a "sell it and forget it" basis and creating a smooth, always-on DeFi experience.

However, similar to other traditional AMMs, Saros AMM can experience slippage when large volume change the asset ratio in the pool.

In practice, Saros AMM serves many important use cases such as creating spot markets for SPL Token , preparing liquidation for newly listed projects, yield farming with SarosFarm, and Staking via Saros Garden. For developers, integration is easy thanks to the Saros Javascript SDK.

Saros DLMM

The unique feature of Saros lies in the DLMM (Dynamic Liquidity Market Maker) mechanism. This is a major step forward compared to liquidation AMM models. Instead of allocating liquidity in a scattered and inefficient manner, the DLMM mechanism allows LP (LPs) to concentrate Capital in target price ranges and automatically adapt to market fluctuations. This mechanism operates based on the Liquidity Book (dynamic liquidation book) with Bin Architecture ( liquidation cell or liquidation bin), in which each bin represents a fixed price.

As a result, transactions are executed using the Zero-Slippage Swap mechanism. This means that the listed price is the matching price. In addition, the Dynamic Fee Model and Surge Pricing help LPs to be better compensated during periods of strong market volatility, minimizing the risk of Impermanent Impermanent Loss .

In particular, DLMM supports many Liquidity Shapes such as Spot, Curve, Bid-Ask, suitable for each strategy, along with the Concentrated Incentives mechanism that immediately rewards LPs when placing Capital in the right trading liquidation zone. Thanks to these factors, Saros DLMM brings high Capital efficiency, attractive profits and a more stable trading experience for both LPs and traders.

Key Features of Saros DLMM

Among the products in the Saros ecosystem, Saros DLMM is the core product of Saros, built as a new generation liquidation layer on Solana.

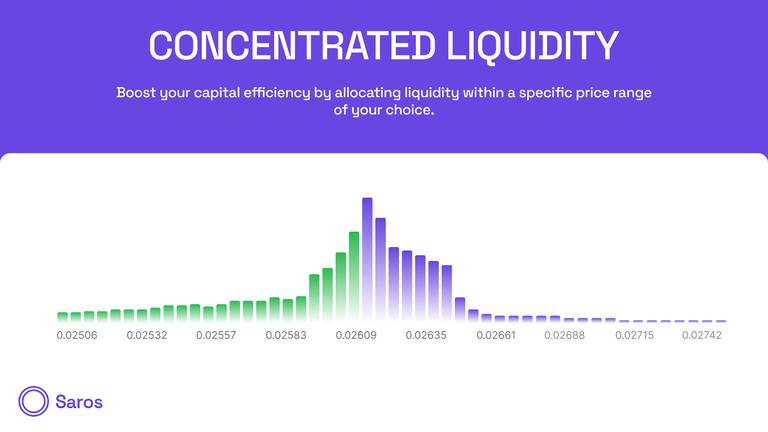

Concentrated Liquidity Feature

- Concentrated Liquidity : Instead of distributing liquidation across the entire price range like traditional AMMs, Saros DLMM allows LP (LPs) to concentrate Capital in specific price ranges. This approach makes Capital more efficient, allows for large trades to be processed with low slippage, and also provides higher trading fee returns for LPs.

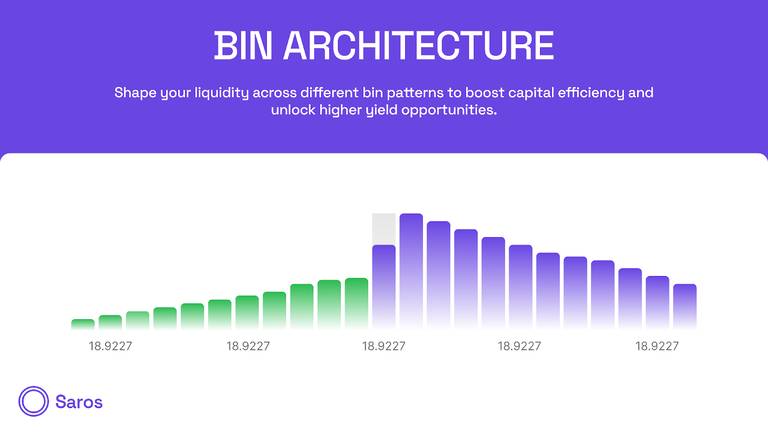

Bin Architecture

- Bin Architecture : Liquidation in DLMM is Chia into multiple “bins” and each bin represents a fixed price. Bins combined together form a complete liquidation pool. As a result, LPs can allocate Capital precisely according to their strategies, while traders benefit from reduced Price Impact in each transaction.

- Zero-Slippage Swaps : With bin architecture, swaps occur at fixed prices instead of being affected by pool depth like traditional AMMs. This ensures “the price you see is the price you get”, providing a more accurate, predictable and stable trading experience for users.

- Dynamic Fee Model : Saros DLMM uses a flexible fee mechanism consisting of 3 components: Base Fee (basic fee) fixed for all transactions, Variable Fee (variable fee) adjusted based on fluctuations and liquidation imbalances and Protocol Fee (protocol fee) usually accounts for 20% to maintain and develop the protocol. This model helps LPs to be protected from adverse arbitrage and have a more stable source of income.

Surge Pricing Feature

- Surge Pricing : When the market is volatile, the transaction fee will automatically increase slightly to limit excessive trading and reduce risks for the pool. This mechanism both encourages LPs to provide deeper liquidation and helps them receive higher profits to compensate for risks such as Impermanent Loss .

- Liquidity Shapes : Saros DLMM allows LPs to choose how to allocate Capital in many shapes: Spot Shape (even distribution), Curve Shape (concentrated in the middle, gradually thinning out on both sides) and Bid-Ask Shape (putting liquidation at both ends, leaving the middle empty). In addition, LPs can also provide Single-Sided Liquidity (with just one Token). Thanks to that, the liquidation provision strategy becomes flexible and suitable for many different market contexts.

- Advanced Strategies : DLMM supports a wide range of custom strategies, from Tiered Limit Placement (Chia Capital across multiple key price levels), Peg Divergence Opportunities (profit when stablecoins deviate from peg), DCA-Integrated Liquidity (combine price Medium and fee generation), to Smart Entry/Exit and Liquidity Walls. These tools allow LPs to deploy sophisticated strategies similar to professional market makers.

- Concentrated Incentives : This is a direct on-chain reward mechanism for LPs when they put Capital into the price range where trading is most active. The “reward range” is usually between 1–11 bins around the active bin. Thanks to CI, LPs are incentivized to allocate liquidation in the right place, helping to increase market depth and improve the trading experience.

SAROS Token Details

SAROS Token Specifications

Token name | Saros |

Ticker | SAROS |

Blockchain | Solana, Viction |

Contract | Solana: SarosY6Vscao718M4A778z4CGtvcwcGef5M9MEH1LGL Viction: 0xb786d9c8120d311b948cf1e5aa48d8fbacf477e2 |

Total supply | 10,000,000,000 SAROS |

Supply circulation | 2,624,999,826 SAROS |

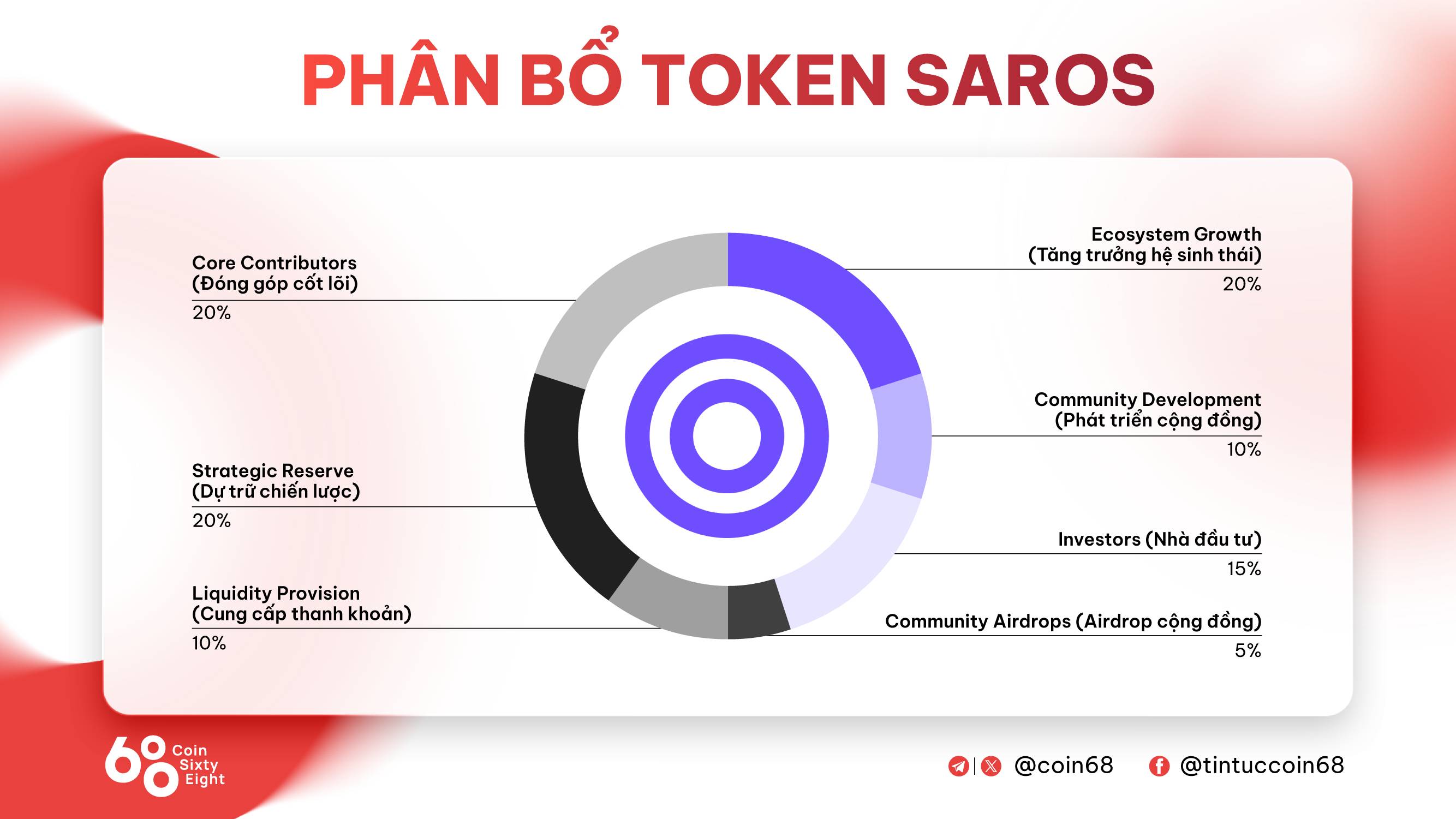

SAROS Token Allocation

Saros Allocation

Ecosystem Growth : 20%

Community Development : 10%

Investors: 15%

Community Airdrop : 5%

Liquidity Liquidation: 10%

Strategic Reserve: 20%

Core Contributors : 20%

Uses of SAROS Token

- Governance : SAROS Token holders have the right to participate in voting and shape the long-term development direction of the protocol.

- Premium Features : Stake SAROS Token to unlock advanced features, privileges not available to the public.

- Incentives : Used to create and maintain liquidation, while rewarding the community and contributors in the ecosystem.

- Ecosystem Utility : Used in Saros products such as SarosSwap, SarosFarm, Saros Garden and other integrated DeFi programs.

Where to buy and Token Sale ?

Currently, users can trade SAROS Token Sale on exchanges such as:

CEX : Gate , Bybit , MEXC , Ourbit, Bitget , BingX , Kucoin, Bitunix

DEX : Saros Swap , Saros AMM , Saros DLMM ,...

Saros project development roadmap

Currently, the development roadmap of the Saros project has not been announced in detail. Coin68 will update immediately if there is information.

Saros project development team

- Lynn Nguyen : CEO

- Thanh Le : Co-Founder

- Dieu Bui : Core Contributor

- Ken Nguyen : Core Contributor

- Tom Cheng : Core Contributor

Investors in the Saros project

Investors in the Saros project

Saros has successfully raised $3.78 million from many large investment funds in the blockchain and DeFi fields. Notable among them is Solana Ventures, along with names such as Hashed, Spartan Capital, GBV Capital, Arche Fund (Coin98 Ventures) and many other funds such as Genblock Capital, Impossible Finance, K300 Ventures, Asymm Ventures, Cryptomind, Kyros Ventures and Evernew Capital.

Saros recent situation

Saros (SAROS) recorded a sharp decline of 70% on August 24, 2025, falling to $0.109, its lowest level since April 2025. This plunge wiped out the gains of the previous months and caused concern among investors. Some compared SAROS's performance to that of MANTRA (OM), which fell by 90% and has yet to fully recover.

Market data shows that the main reason is that highly leveraged traders on Centralized Exchange have been shrinking their positions. Open interest has dropped sharply from around 90 million to 20 million SAROS. After the shock, the price quickly recovered, currently trading around $0.32, down about 6% on the day.

Saros Chart on Bybit on August 26, 2025

In response to concerns from the community, Thanh Le (Co-Founder of Saros) affirmed: “We believe this is just a market-driven correction, possibly related to a large highly leveraged position on a CEX. According to the data, open interest has dropped from 90 million SAROS to around 20 million. There has been no sell-off from the team or long-term investors. Our focus remains unchanged: building Saros into Solana ’s primary liquidation .”

Update on$SAROS Market Activity

— Thanh Le (@imlethanh98) August 24, 2025

We are monitoring the recent price movements in$SAROS and would love to provide clarity.

Based on our ongoing investigations and available data, we believe this is a market-driven adjustment, potentially involving a large, highly-leveraged…

Summary

Above is all the information about the Saros project, Coin68 hopes that readers will grasp the basic information to better understand the project and products. Wish you have more useful knowledge!

Note: The information in the article is not XEM investment advice, Coin68 is not responsible for any of your decisions.