The market seems to have entered an unpredictable phase recently. Blue-chip cryptocurrencies remain volatile at high levels, and the general direction remains undecided. The altcoin market has not ushered in the expected full-scale bull market, while DAT assets or coin stocks are leading the traditional financial market.

VX:TZ7971

Prior to this, many voices on social media characterized this bull market as driven by traditional funds. This type of funds has several different characteristics compared to previous market cycles, such as decision-making being heavily influenced by macroeconomic factors, lower risk appetite, more concentrated funds, weaker wealth spillovers, and less pronounced sector rotation.

Therefore, when the macroeconomic environment undergoes significant changes, re-examining these changes will help us make accurate judgments. As Powell adjusts the Fed's decision-making logic, the performance of the US job market will determine the market's confidence in the September rate cut in the short term, which in turn will affect the prices of risky asset markets.

Why is Trump in a rush to cut interest rates?

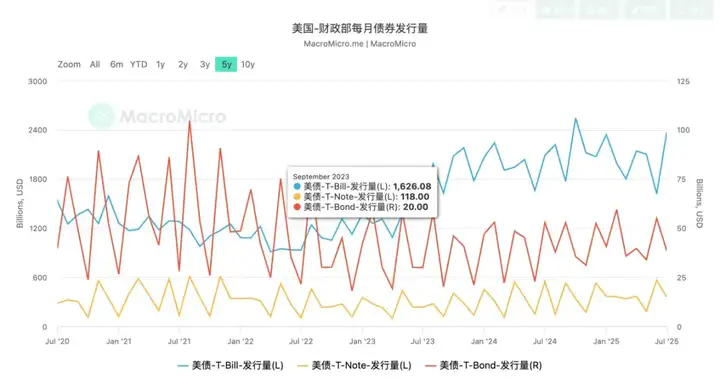

There are two main points. The first is to ease debt pressure. We know that during the term of the previous Treasury Secretary Yellen, the U.S. Treasury has increased the issuance of short-term bonds in its bond issuance structure, and Bensant retained this decision. The advantage of doing so is that short-term bond interest rates are regulated by the Federal Reserve, reducing the drag of long-term bonds on the fiscal situation. From the current situation, the market demand for short-term U.S. bonds is strong, which is conducive to reducing financing costs. However, the problem is also obvious, that is, the debt duration is shortened, and the repayment pressure in the short term increases. This is why the recent negotiations on the debt ceiling have become more vocal.

Lowering interest rates means less pressure on short-term debt payments. Secondly, it will lower financing costs for small and medium-sized enterprises, facilitating the development of industrial chains. We know that compared to large enterprises, small and medium-sized enterprises (SMEs) typically rely more heavily on bank debt financing for their operations. Therefore, in a high-interest environment, their willingness to expand financing will be dampened. Furthermore, after tariffs have altered the competitive structure of the domestic market, it is imperative to incentivize SMEs to expand production and help them quickly fill supply gaps in the market to prevent inflation. This is a pressing need. Therefore, Trump will spare no effort in pressuring the Federal Reserve to cut interest rates, rather than resorting to smokescreens.

Cryptocurrencies all saw a surge after Bao's speech was released last week, and the subsequent pullback shows that the market had already priced in an interest rate cut this year to a certain extent. After determining the new trading logic, the market shifted from the initial emotional expectations to rational expectations. Therefore, sufficient evidence is needed to evaluate the extent of the interest rate cut.

As for how deep the pullback will be, I think the trend of ETH, which has been the hottest in the past period of time, is worth paying attention to. As long as the price does not fall below this rising channel in the short term, it proves that there has been no obvious reversal in investor sentiment, so the risk is controllable.

Today's panic index is 50, remaining neutral.

Yesterday, two pieces of data from the US showed that the US economy is still in good shape, which may have reduced the basis for interest rate cuts, causing the cryptocurrency market to fluctuate. BTC fared slightly better, stabilizing at $112,000, while ETH is still hovering around $4,500.

The US will release GDP and core PCE data tonight. Core PCE is one of the important indicators used by the Federal Reserve to assess interest rate adjustments. It is a price index that measures personal consumption expenditures. In other words, it is an indicator of inflation. Therefore, it is expected that the market will pay attention to this data tonight. If it is higher than expected, the market trend will be hit, because economic data that is unfavorable to interest rate cuts has appeared for two consecutive days.